Updated March 21, 2024

A Maine LLC operating agreement is a required document that outlines a company’s ownership and day-to-day activities. All matters related to the business should be included in the agreement and signed by all the members. State law requires the document to be completed and kept by the company. However, it is not filed with any government authority.

Is an Operating Agreement REQUIRED in Maine?

Yes. Executing an operating agreement is mandatory for LLCs in Maine.

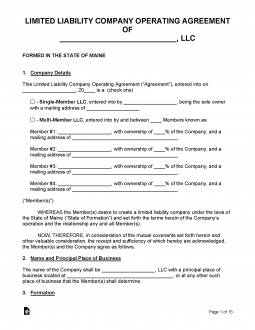

By Type (2)

Single-Member LLC Operating Agreement – For use by a sole proprietor to properly establish all requirements by the state and to ensure that all of the benefits of the implementation of the document will also be in the best interest of the owner and the business.

Single-Member LLC Operating Agreement – For use by a sole proprietor to properly establish all requirements by the state and to ensure that all of the benefits of the implementation of the document will also be in the best interest of the owner and the business.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by companies that will have more than one (1) member managing the company. The document would ensure that all of the appropriate information is provided to the State of Maine for proper implementation.

Multi-Member LLC Operating Agreement – For use by companies that will have more than one (1) member managing the company. The document would ensure that all of the appropriate information is provided to the State of Maine for proper implementation.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

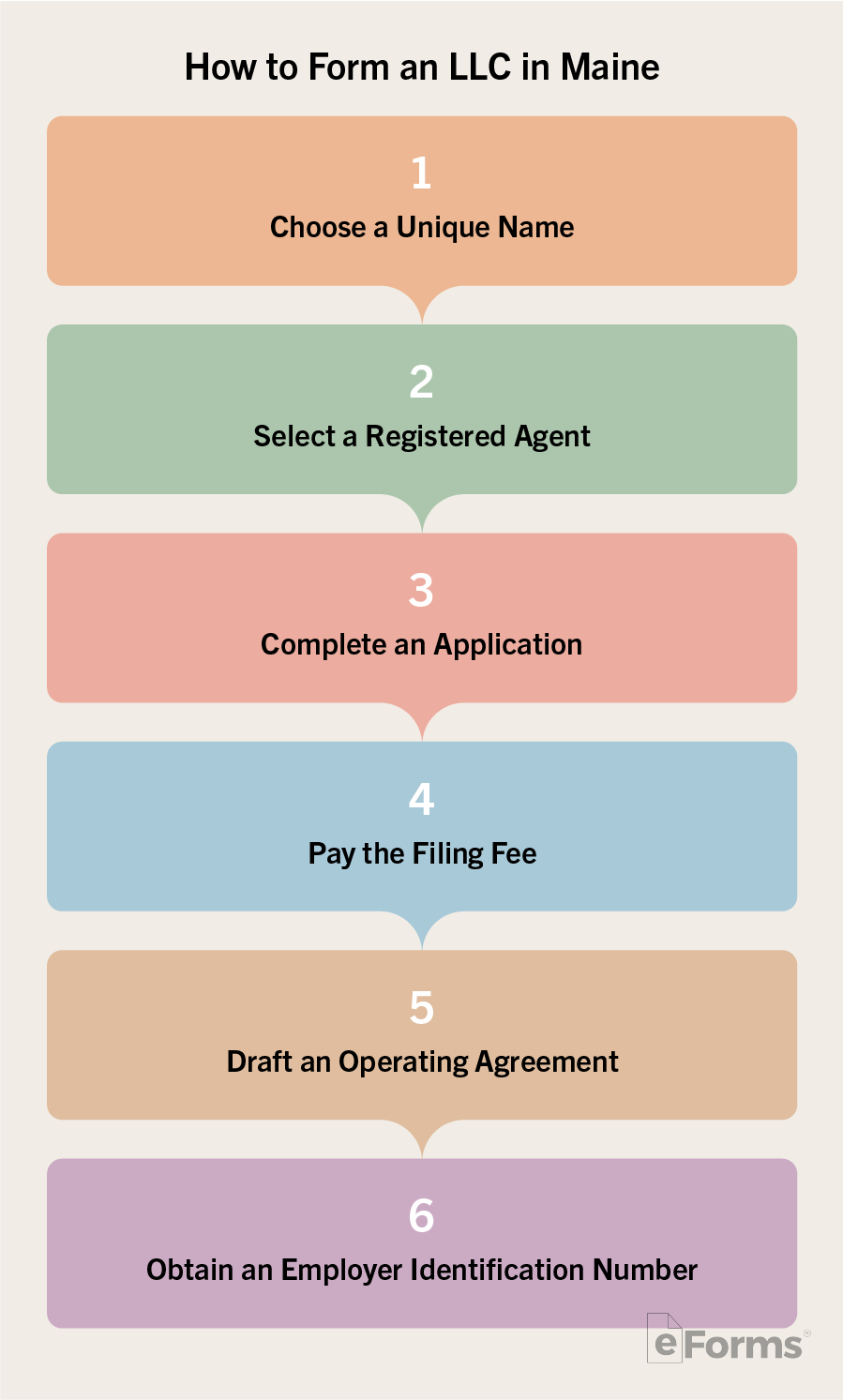

How to Form an LLC in Maine (5 steps)

- Choose a Registered Agent

- LLC Type

- Supply the Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

Begin by conducting a Preliminary Search of the Maine Secretary of State’s records to confirm that the name you’ve selected for your business is available and not similar to the name of another registered entity. You may proceed onto the LLC filing process after confirming the availability of the name.

1. Choose a Registered Agent

The Registered Agent may be an:

The Registered Agent may be an:

- Individual resident of the State

- Commercial entity legally transacting business in the State

A Registered Agent is a representative of the entity that is authorized to receive annual state filings, service of process notices, or any other legal demand served on the LLC.

2. LLC Type

If you are creating a new LLC, formed within the State, it is considered a Domestic entity. Alternatively, an LLC formed outside the State is labeled as a Foreign Entity. Download and complete the following PDF application specific to your entity type:

If you are creating a new LLC, formed within the State, it is considered a Domestic entity. Alternatively, an LLC formed outside the State is labeled as a Foreign Entity. Download and complete the following PDF application specific to your entity type:

- Domestic – Certificate of Formation

- *Foreign – Application for Authority to Do Business

*Foreign applications must include a Certificate of Existence, or similar document, to prove the validity of the LLC.

3. Supply the Filing Fee

- Domestic – $175

- Foreign – $250

Once you have attached the filing fee, deliver your filing package to the following address:

Secretary of State, Division of Corporations, UCC, and Commissions, 101 State House Station, Augusta, ME 04333-0101

4. Operating Agreement

LLC managing members are required to file an operating agreement with the Secretary of State after successfully filing for formation. The form is used to standardize the management structure, operating procedures, policies, and any other provision established by the ownership.

5. Employer Identification Number (EIN)

An Employer Identification Number (EIN) should be obtained directly after filing your LLC. This unique number is used for the purpose of reporting tax information to the Internal Revenue Service. To apply, complete the Online Application or submit IRS Form SS-4 through the mail.

Laws

- Limited Liability Company Act – Title 31, Chapter 21

- Operating Agreement Statutes

- § 31-1521 (Limited liability company agreement – scope, function, and limitations)

- § 31-1523 (Limited liability company agreement – effect on company and members; preformation agreement)

- § 31-1524 (Limited liability company agreement – effect on third parties and relationship to records effective on behalf of company)

“Limited Liability Company Agreement” Definition

“Limited liability company agreement” means any agreement, whether referred to as a limited liability company agreement, operating agreement or otherwise, written, oral or implied, of the member or members as to the affairs of a limited liability company and the conduct of its activities. A limited liability company agreement of a limited liability company having only one member is not unenforceable by reason of there being only one person who is a party to the limited liability company agreement. A limited liability company agreement includes any amendments to the limited liability company agreement.