Updated March 21, 2024

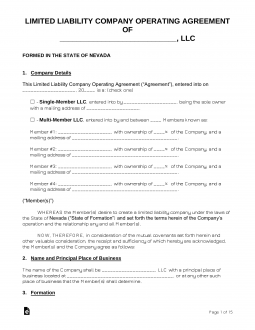

A Nevada LLC operating agreement is a legally binding document to the members of a company that reveals how it functions and its ownership. The agreement should include the company’s day-to-day activities, management, officers, capital contributions, and any other relevant business matters. It is not required under State law but is recommended as it is the only document that reveals the ownership of the entity. An operating agreement is not filed with any government office and is kept by each member.

Is an Operating Agreement REQUIRED in Nevada?

No. The State of Nevada does not legally require LLCs to adopt an operating agreement.

By Type (2)

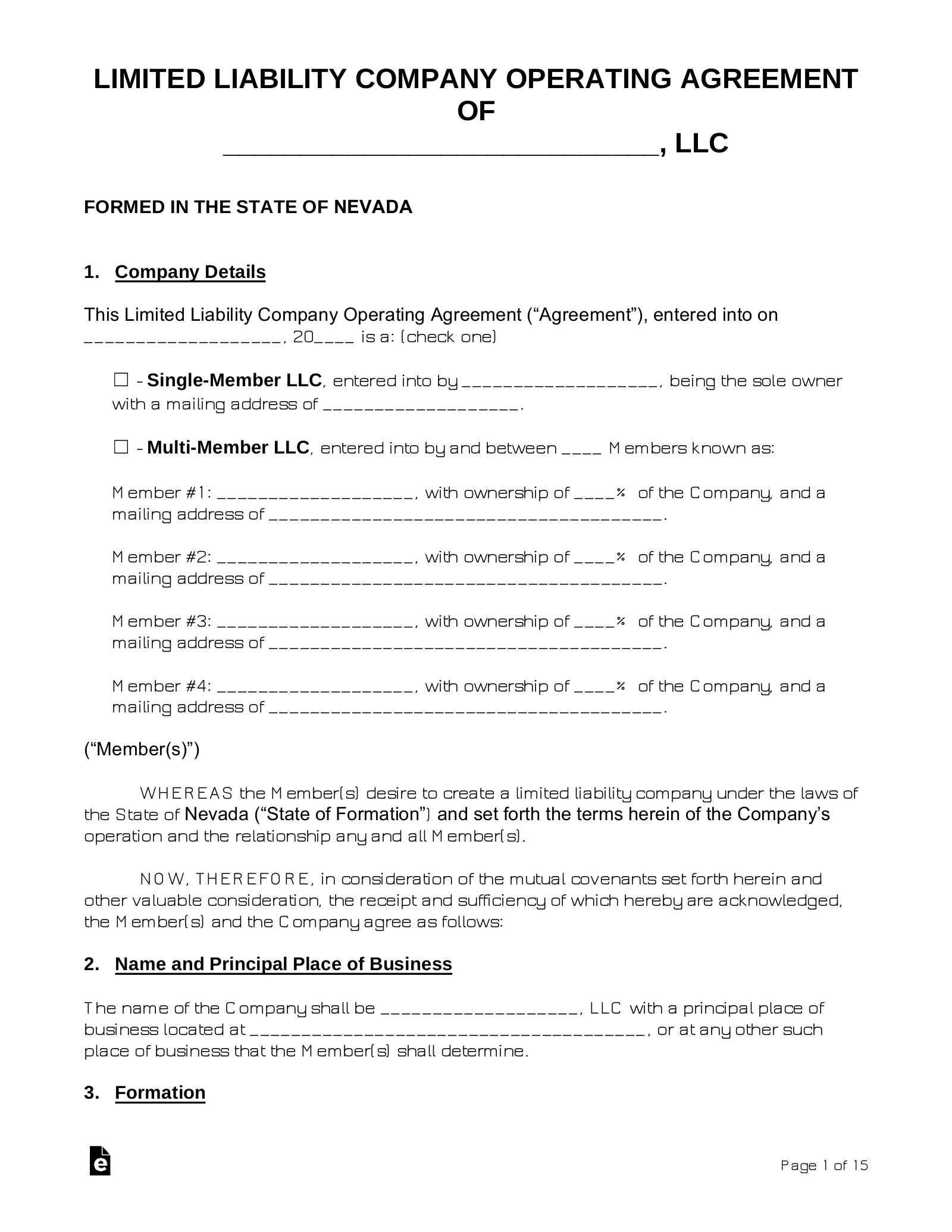

Single-Member LLC Operating Agreement – For a business that is established by a sole proprietor that shall allow them to set forth the operations of the company and provide proof that the owner is separate from the business.

Single-Member LLC Operating Agreement – For a business that is established by a sole proprietor that shall allow them to set forth the operations of the company and provide proof that the owner is separate from the business.

Download: PDF, MS Word (.docx), OpenDocument

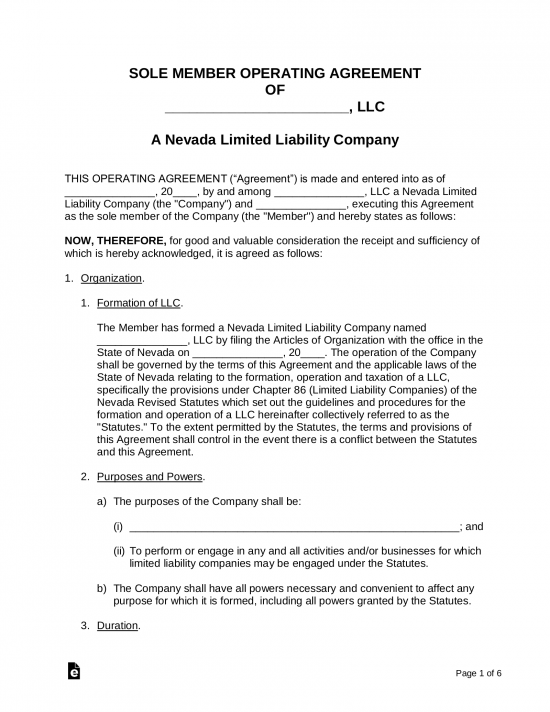

Multi-Member LLC Operating Agreement – For businesses with more than one (1) owner so that they may outline the terms, policies, and procedures of the business and among its members.

Multi-Member LLC Operating Agreement – For businesses with more than one (1) owner so that they may outline the terms, policies, and procedures of the business and among its members.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

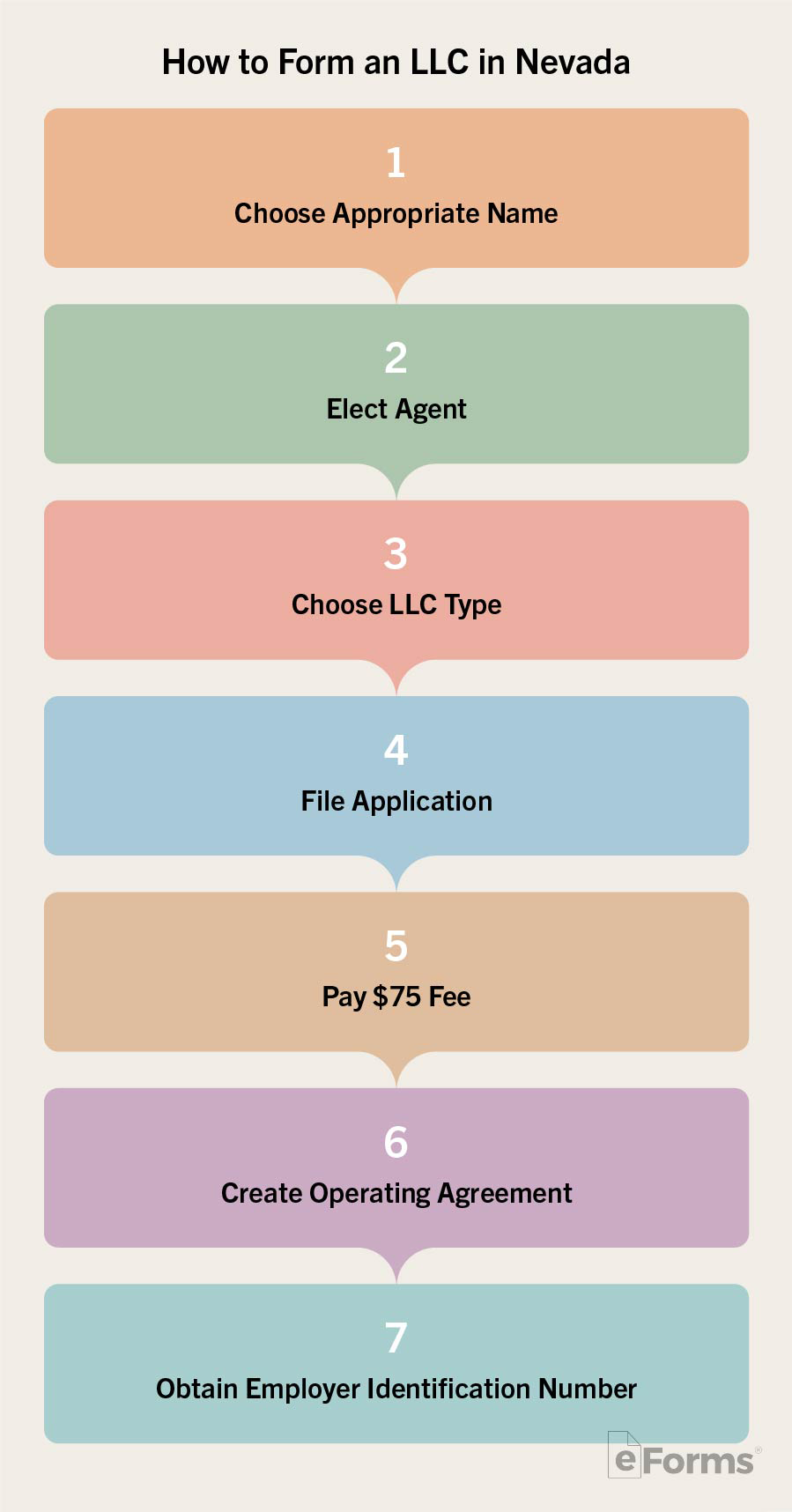

How to Form an LLC in Nevada (6 steps)

- Elect an Agent

- Domestic or Foreign

- File Online/Paper

- Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

When creating a new LLC in Nevada, choosing an appropriate name for your business is the first step towards filing successfully with the Secretary of State. The name must be completely distinguishable from any other business name on file; otherwise, your LLC filings can be rejected. Ensure that the name is unique by searching for it in the State’s Database.

1. Elect an Agent

Each LLC must elect and maintain an agent whose address will receive legal demands to be served upon the LLC, such as service of process or annual report notices. In Nevada, the agent may be either of the following:

- Person with legal residence in the State

- Domestic of Foreign business operating in the State

2. Domestic or Foreign

LLCs are categorized as either Domestic or Foreign, the difference between the two being the jurisdiction from which the LLC is initially formed. It is important to know which LLC you will be filing as you move forward.Choose your LLC type based on the following:

- Domestic – Form a new LLC within Nevada

- Foreign – Expand a preexisting LLC initially registered out of state into Nevada

4. Filing Fee

Payment of the $75 filing fee will conclude the filing process for online applicants. Individuals filing by mail or in person must attach a check/money order made out to the ‘Secretary of State’ and deliver all articles to the address below.

Secretary of State, New Filings Division, 202 North Carson Street, Carson City, NV 89701-4201

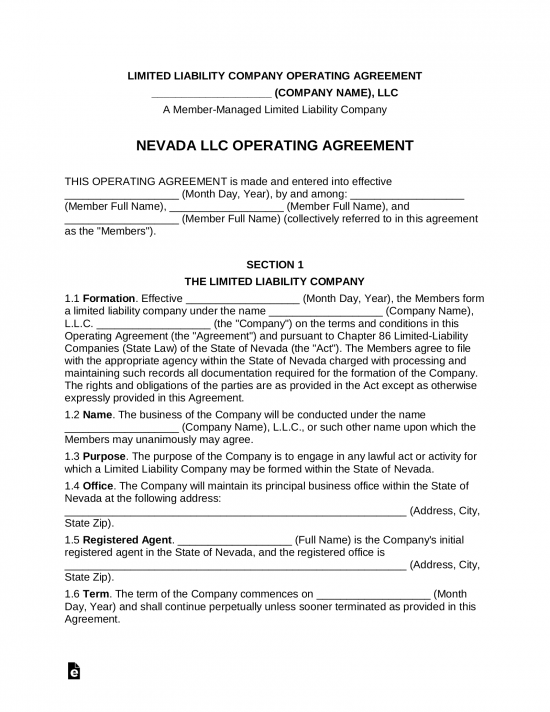

5. Operating Agreement

An operating agreement is a document used to organize the internal affairs of an LLC by establishing rules and operating procedures. There is no legal requirement for the form in Nevada, however, it is recommended that one be drafted and reviewed by the managing member(s), and thereafter signed by each member.

6. Employer Identification Number (EIN)

Most financial transactions conducted by the business will require the acquisition of an Employer Identification Number (EIN). Essentially, an EIN is the equivalent to a Social Security Number in that the Internal Revenue Service uses the identifier to oversee financial activity. Most business entities will require an EIN to accomplish the following:

- Pay employees

- Obtain loans

- Open company bank accounts

An EIN may be obtained for free on the IRS Website or through the submission of Form SS-4.

Laws

- Limited Liability Company Act – Chapter 86

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement” means any valid agreement of the members as to the affairs of a limited-liability company and the conduct of its business, whether in any tangible or electronic format.