Updated March 21, 2024

An Ohio LLC operating agreement is a legal document between the owners (members) of a company that sets the rules on how it will operate. Similar to a partnership agreement, it will establish the members and their ownership interests. The agreement should include terms such as officers, member responsibility, capital contributions, and how profits will be distributed. It is required that all members must sign.

Is an Operating Agreement REQUIRED in Ohio?

No. Ohio state law does not mandate that businesses must adopt an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – For use by a single owner who would like to outline the procedures and policies for their company. With the completion and filing of the document, the owner will separate themselves from their business, relieving them from any concerns with regard to their private assets.

Single-Member LLC Operating Agreement – For use by a single owner who would like to outline the procedures and policies for their company. With the completion and filing of the document, the owner will separate themselves from their business, relieving them from any concerns with regard to their private assets.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by entities that will have more than one (1) member. The document, upon completion and filing with the State, shall provide the needed separation between the owners and the company, in the event that any legal financial obligations should present themselves.

Multi-Member LLC Operating Agreement – For use by entities that will have more than one (1) member. The document, upon completion and filing with the State, shall provide the needed separation between the owners and the company, in the event that any legal financial obligations should present themselves.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

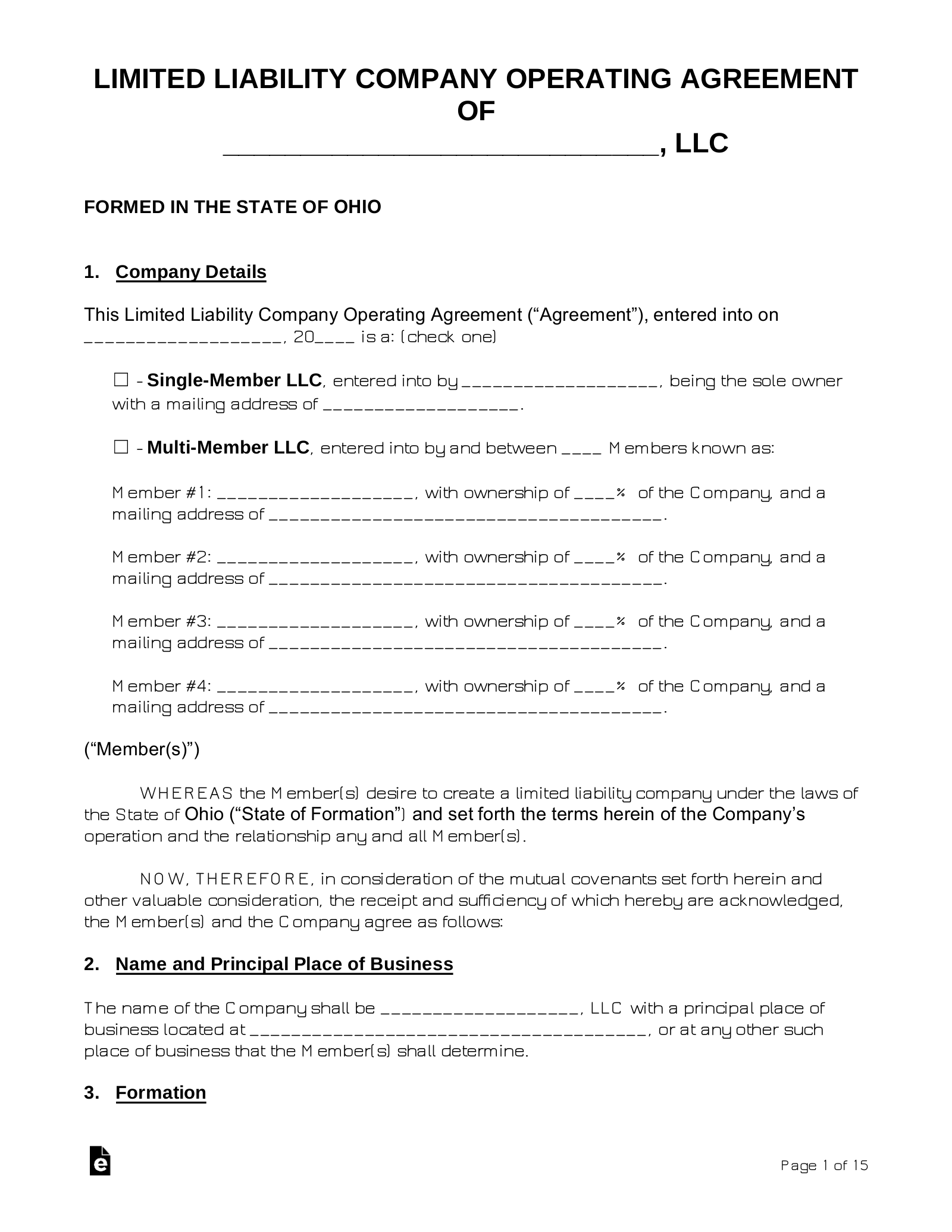

How to Form an LLC in Ohio (6 steps)

- Statutory Agent

- LLC Type

- Registration Documents

- Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

Applicants attempting to file an LLC in Ohio should first ensure that their chosen business name is available for use. By conducting a Preliminary Search for the name in the State’s records, it will be possible to verify its availability by making certain that the name is not deceptively similar to that of another business currently operating within the State.

3. Registration Documents

The State accepts LLC filings by mail or online. Choose the link below which matches your LLC type and desired method of application.

- Domestic – Articles of Organization

- Online – create a profile first

- PDF (Form 115-LCA) – see instructions here

- Foreign – Registration of a Foreign LLC

- Online – create a profile first

- PDF (Form 106-LFA)

4. Filing Fee

A $99 filing fee will be required in order for the Ohio Secretary of State to process your submission. The following methods of payment are accepted by their offices:

- Payment Online

- Major credit card

- Payment by Mail

- Check/money order made payable to the ‘Ohio Secretary of State’

- Credit card authorization form (included in application)

Online filers will be prompted to supply the fee upon completion of the application. If filing by mail, attach the fee and send all articles to the following address:

Ohio Secretary of State, P.O. Box 670, Columbus, OH 43216

5. Operating Agreement

The LLC operating agreement is an internal document used to establish operating procedures and policies for the company. Drafting an operating agreement is not mandatory; however, it is recommended as it provides proof of the rules and responsibilities agreed upon during formation.

6. Employer Identification Number (EIN)

Once you have filed with the Ohio Secretary of State, you should immediately apply for an Employer Identification Number (EIN). The EIN is used by the Internal Revenue Service to oversee the financial activity of entities operating in the country and it is entirely necessary if your business plans to hire employees or open bank accounts.

- Apply for an EIN by completing the Online Application or file by mail using PDF of IRS Form SS-4.

Laws

- Ohio Revised Limited Liability Company Act – Chapter 1706

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement” means all of the valid written or oral agreements of the members or, in the case of a limited liability company consisting of one member, a written declaration of that member, as to the affairs of a limited liability company and the conduct of its business.