Updated June 02, 2022

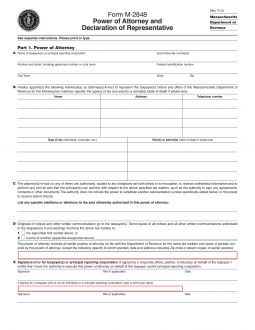

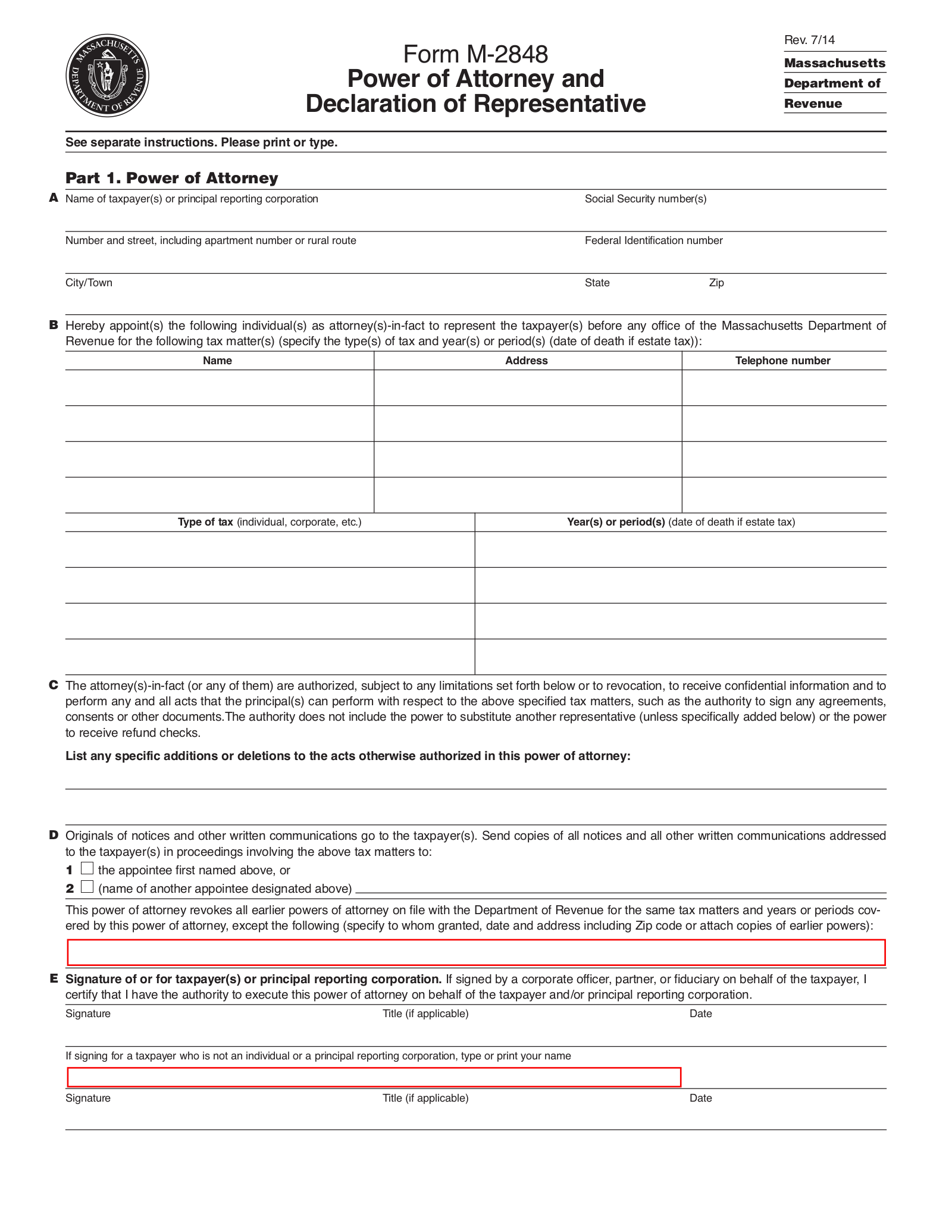

A Massachusetts tax power of attorney form (M-2848), otherwise known as the Department of Revenue Power of Attorney and Declaration of Representative, is a form that allows you to appoint a tax professional to make tax filings or obtain tax information from the Department of Revenue on your behalf. Several pieces of information will be required so that it may be properly completed. The identity of each concerned party and a description of the powers being delegated are examples of such required facts for this form’s completion. Make sure all the items supplied to this form are accurate and legal so it may be processed in a timely fashion.

How to Write

1 – Open The Tax Powers Designation Form

The buttons below the form preview will enable you to open or download the form required for this type of Power Appointment. Open this form as the file type you wish to work. Regardless of whether you will fill this out manually or onscreen, it is recommended that you save at least one copy for your records.

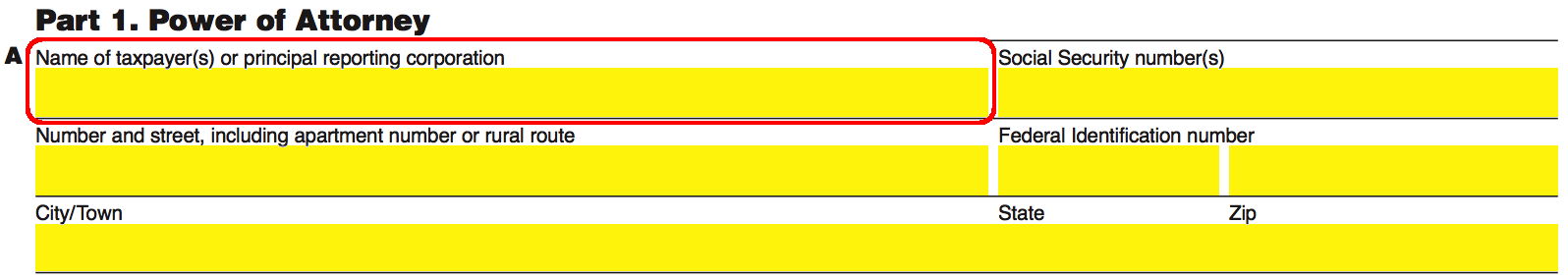

2 – Supply The Requested Principal Taxpayer Information

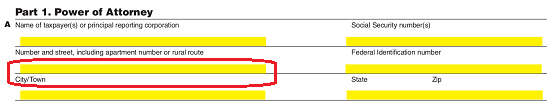

In “Part 1. Power Of Attorney,” information to identify the Taxpayer who intends to empower an Attorney-in-Fact or Representative must be reported in the first section and the Powers he or she wishes to grant an Attorney-in-Fact will need to be defined. Note: If the Principal Taxpayer is an individual who has filed jointly with a Spouse, the Identity, Location, and Signature areas must contain that Spouse’s items.

In the space labeled “Name Of Taxpayer(s) Or Principal Reporting Corporation,” enter the Full Name of the individual Taxpayer who wishes to give Principal Power to an Agent or the Name of the Business Entity (including applicable suffixes) that intends to grant Power to a Representative through this form.

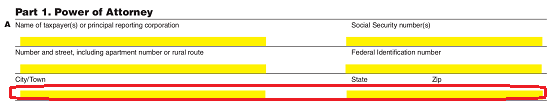

Below the Name of the Principal Taxpayer, enter the Street Address of this entity. A space labeled “Number And Street, Including Apartment Number Or Rural Route” has been provided for this purpose.  Continue this address report by entering the City/Town, State, and Zip Code on the next blank line.

Continue this address report by entering the City/Town, State, and Zip Code on the next blank line.

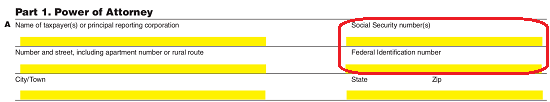

We shall now turn our attention to the two labeled areas on the right. If the Principal Taxpayer is an individual, then enter his or her Social Security Number just below the words “Social Security Number(s).” If the Principal Taxpayer is a business entity then enter this entity’s FEIN just below the words “Federal Identification Number.”

3 – Document The Agent(s) And The Granted Principal Power Appointment

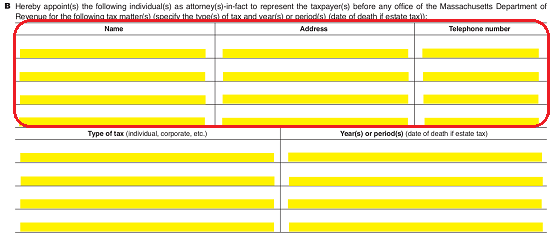

Now that we have identified the Taxpayer intending to grant Principal Power to an individual, we will need to supply the Identity of these Agents and define what, precisely, that Agent may do with Principal Power. This will be done in Section B.

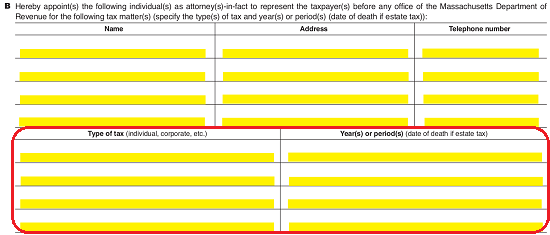

The first table presented will have three columns: Name, Address, and Telephone Number. Report the Name of the Agent assuming Principal Power in the first column, his or her Address in the second column, and his or her Daytime Office/Cell Telephone Number in the last column. The first Agent listed here may be sent copies of correspondence if the Principal desires it. This does not apply to the second, third, etc. Agents being appointed with Principal Taxpayer Power. It should be noted that an individual’s Name is mandatory here. Do not report the Name of a Business in the first column as this will be unacceptable.

The next table will call for a strict definition of what Tax Matters in what Years the Appointee may exert Principal Authority in. Enter the “Type of Tax (individual, corporate, etc.)” the Attorney-in-Fact will have Principal Authority in. Then, in the second column, report the Year or the Period Time of the Tax Matters in the Agent’s Principal Authority. Note: If this concerns an Estate Tax, enter the Year of Death.) In order to make sure this Power Appointment is fully defined and accurately reflects the Principal Taxpayer’s instructions and intentions, Section C will provide a couple of blank lines where the Principal Taxpayer may include any circumstances, limitations, restrictions, or additions in relation to the Powers granted or the individual Appointed Representatives.

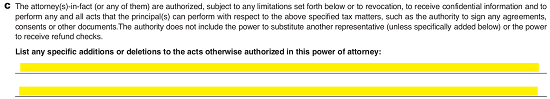

In order to make sure this Power Appointment is fully defined and accurately reflects the Principal Taxpayer’s instructions and intentions, Section C will provide a couple of blank lines where the Principal Taxpayer may include any circumstances, limitations, restrictions, or additions in relation to the Powers granted or the individual Appointed Representatives.

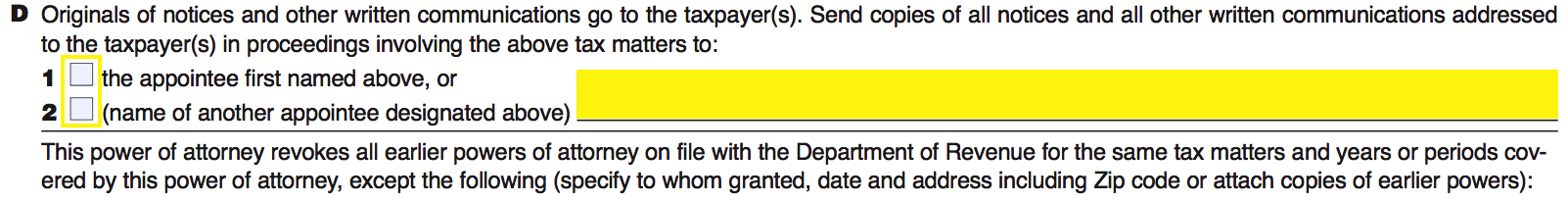

Section D will give the Principal an option to have copies of his or her communications regarding the Tax Matters listed above sent to either the first Appointed Agent recorded above or another individual altogether. If the Principal wishes copies of the Principal Taxpayer correspondence sent to the first Appointed Agent named, then mark the Box Number 1. If the Principal wishes copies of this Principal Taxpayer correspondence sent to another individual, then mark Box Number 2 and supply the Name of that recipient on the blank space provided. If the Principal Taxpayer does not wish anyone to automatically receive copies of correspondence concerning the Tax Matters the Appointed Agent has Principal Authority in, then neither of these boxes should be marked.

The next statement shall declare that all other conflicting Power Appointments issued in the past shall be revoked through this paperwork. However, if the Principal wishes to keep previous Powers in effect then, below the statement beginning with “This Power Of Attorney Revokes…” enter the Name of the Agent who should retain Power, the Date/Address/Zip Code declared on this previously issued Power, and attach a copy of that paperwork to this form. If the previously issued Power Document is not attached, it may be revoked or there may be a significant delay in this paperwork’s submission process.

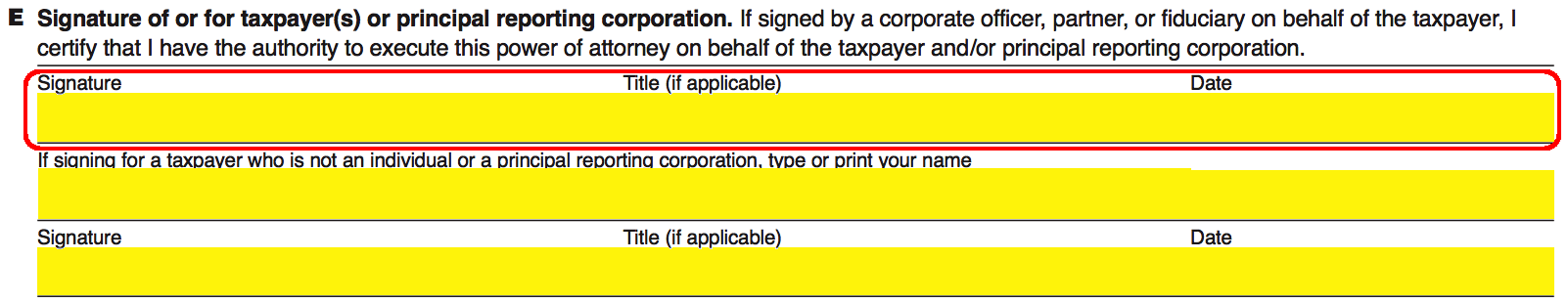

4 – The Principal Taxpayer’s Signature Must Be Presented

In Section E, the Principal Taxpayer who is delegating this Appointment of Power must sign his or her Name on the blank space below the word “Signature.” If he or she has a Title, this should also be recorded in the appropriate area adjacent to the Signature. Finally, the Principal Taxpayer must enter the Calendar Date below the word “Date” on this line.

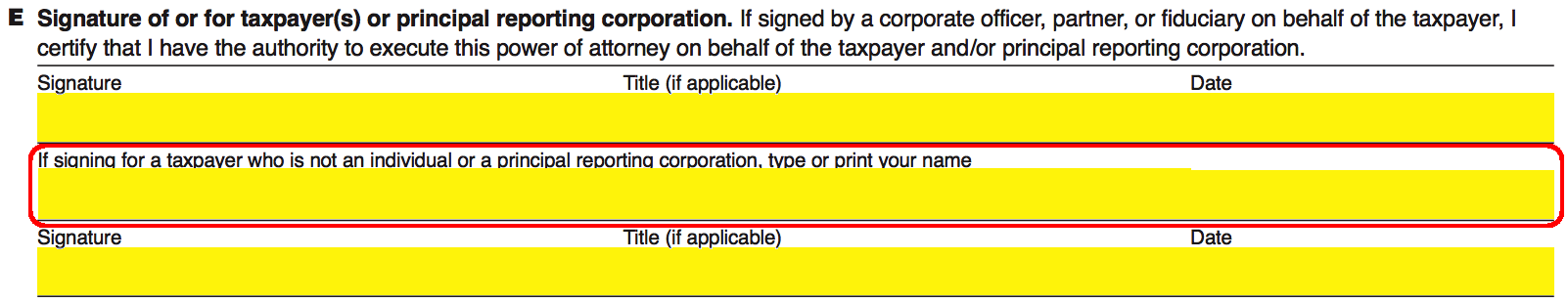

If the Signature Party, is not the Principal Taxpayer (i.e. a Business Entity), then he or she must make sure to provide a Printed Name on the next blank line.

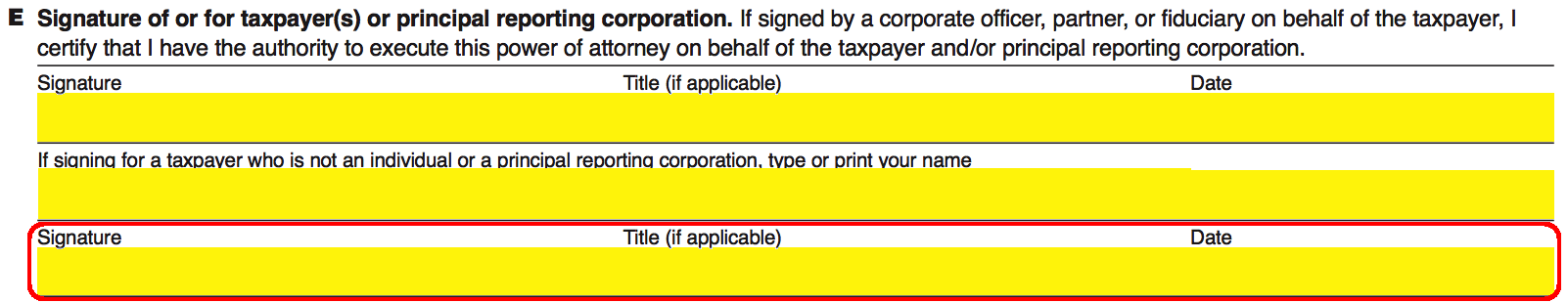

The last Signature line has been provided in the event the Principal Taxpayer is an individual who has filed jointly with a Spouse. The Spouse will need to Sign this line, report his or her Title, and enter the Date he or she signed this line.

5 – Additional Items Concerning This Appointment Must Be Supplied

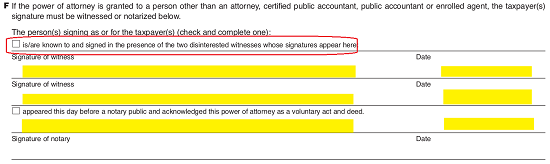

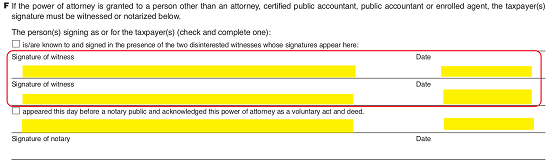

Section F has been provided in the event the Appointee is not an Attorney, Certified Public Accountant, or Enrolled Agent. In this case, the Principal Taxpayer’s Signature must be performed before two Signature Witnesses and a Notary Public.

One of the Witnesses must check the box just before the words “is/are known to and signed in the presence of the two disinterested witnesses…”  Each Witness must sign the blank line labeled “Signature of Witness” This signature must be Dated in the space below the word “Date.”

Each Witness must sign the blank line labeled “Signature of Witness” This signature must be Dated in the space below the word “Date.”

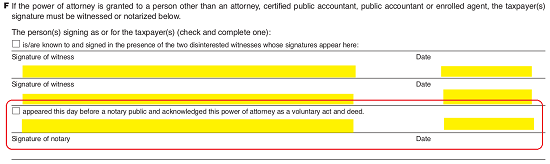

The Notary Public must check the box labeled “Appeared This Day Before A Notary Public…” Then sign his or her Name on the “Signature of Notary” line. The Date of Signature must be entered in the adjacent area of this line.

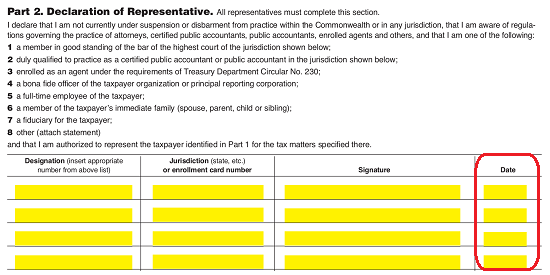

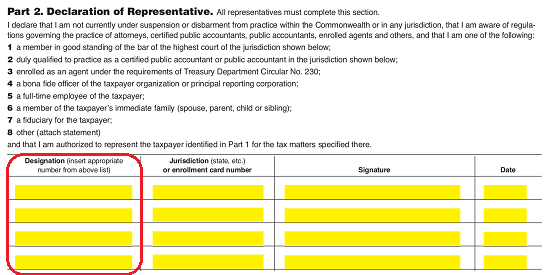

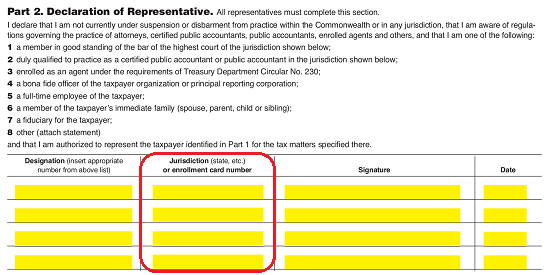

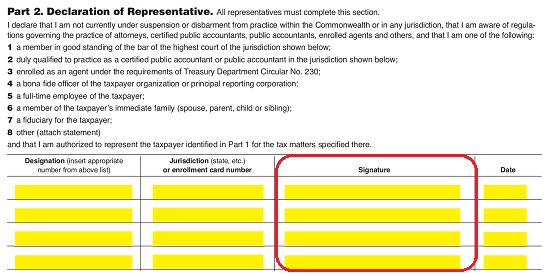

In “Part 2. Declaration Of Representative,” the Appointee must read the statement then go through the numbered list of Appointee roles/titles. When he or she is able to self-identify, the Attorney-in-Fact will need to enter the List Number corresponding to his or her role definition in the first column of the table provided. Note: If the Attorney-in-Fact does not see a clear description, then enter Number 8 and provide an attachment of this “Designation.”  The “Jurisdiction Or Enrollment Card Number” the Appointee holds must be entered in the second column.

The “Jurisdiction Or Enrollment Card Number” the Appointee holds must be entered in the second column.  The Signature Column must be signed by the Attorney-in-Fact.

The Signature Column must be signed by the Attorney-in-Fact. This signature must be Dated in the last column.

This signature must be Dated in the last column.