Updated June 02, 2022

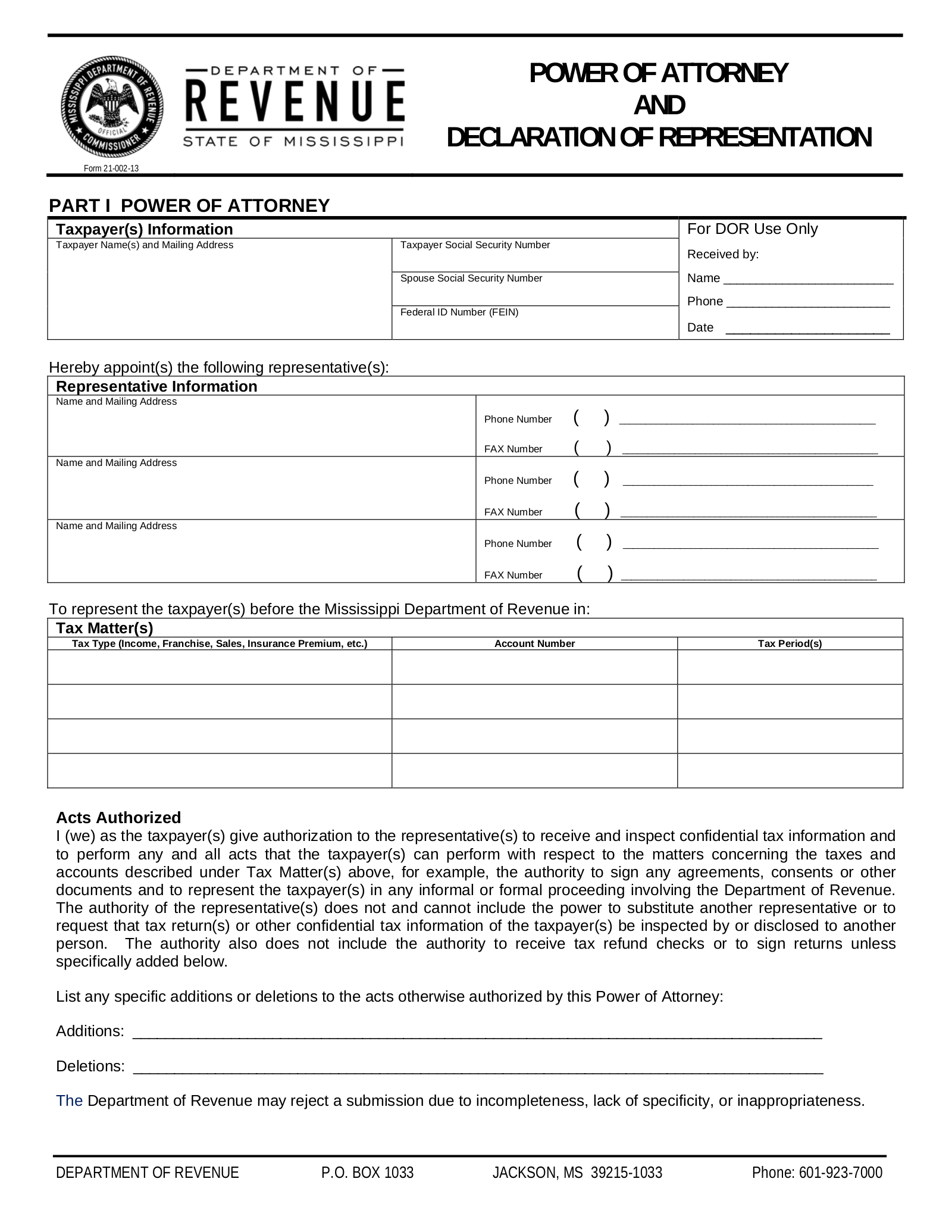

A Mississippi tax power of attorney (Form 21-002), otherwise known as the “Department of Revenue Power of Attorney and Declaration of Representation,” is a document you can use to designate a tax professional to act on your behalf in interactions with the Department of Revenue in Mississippi. Mississippi will not allow a person other than yourself obtain information or transact any other business on your behalf without this form.

How to Write

1 – Open The Mississippi Tax Authority Form

This State Of Mississippi Department Of Revenue Form may be accessed through the image button on this page. If you have a PDF editing program, you may work on screen otherwise you may print this form using an up to date browser.

2 – Identify The Taxpayer And Supply The Requested Information

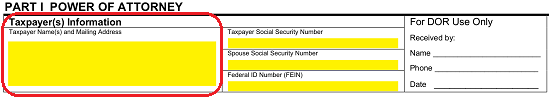

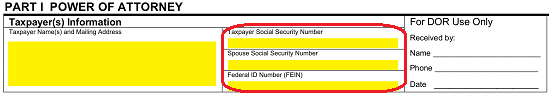

To begin reporting here, locate the first table, “Taxpayer(s) Information.” It will be important to note that if the Principal Taxpayer has filed jointly with a Spouse, that Spouse’s information must also be supplied to this section.

In the first box, labeled “Taxpayer Name(s) and Mailing Address,” enter the Full Name of the Taxpayer then record his or her Mailing Address. If the Taxpayer has filed with a Spouse, then his or her Name and Mailing Address must be supplied in this box. If this is a Business Entity, then fill in the Full Name of the Business Entity, including any required Suffixes that must be applied.  The next column will provide three boxes: “Taxpayer Social Security Number,” “Spouse Social Security Number,” and “Federal ID Number (FEIN).” If the Taxpayer is an individual who filed singly, enter his or her Social Security Number in the first box of this column. If the Principal Taxpayer filed jointly, then fill in both the “Taxpayer Social Security Number” and “Spouse Social Security Number” boxes. If, however, the Principal Taxpayer is a Business Entity then skip the first two boxes and enter that entity’s Federal Entity Identification Number in the third box of this column.

The next column will provide three boxes: “Taxpayer Social Security Number,” “Spouse Social Security Number,” and “Federal ID Number (FEIN).” If the Taxpayer is an individual who filed singly, enter his or her Social Security Number in the first box of this column. If the Principal Taxpayer filed jointly, then fill in both the “Taxpayer Social Security Number” and “Spouse Social Security Number” boxes. If, however, the Principal Taxpayer is a Business Entity then skip the first two boxes and enter that entity’s Federal Entity Identification Number in the third box of this column.

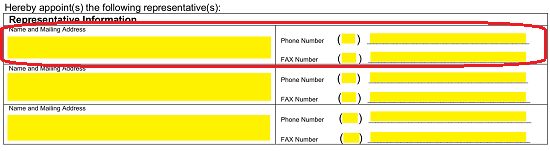

3 – The Representative Agent Accepting Principal Authority Must Be Identified

The individual accepting Principal Authority in the Principal Taxpayer’s Tax Matters will be identified in the second table. There will be enough room to declare three Representatives. If there are others, you should continue the roster in an attachment. Each Representative that is being assigned Principal Authority here must have his or her Name, Mailing Address, Phone Number, and Fax Number documented. If this information is not present, a Representative may not be able to wield Principal Power.

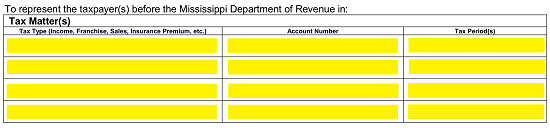

4 – Supply A Detailed Account Of The Principal Authority Being Designated To The Agent

The Tax Matters each Representative Agent you listed above will also need to be discussed. A third table, titled “Tax Matters,” has been provided. It will have three columns: “Tax Type,” “Account Number,” and “Tax Period(s).” Use this table to list each Type of Tax a Representative may act upon in the first column (i.e. Income Tax). Then, in the “Account Number” column, list the Account Numbers associated with that Tax Type. Finally, in the third column, assign a Period of Time or Year of the Tax Matter the Representative can wield Principal Authority over.  There will be two blank lines in the “Additions And Deletions” section. If the Principal has any additional Powers or extensions of Powers that should be assigned to the Agent, they should be recorded on the blank space labeled “Additions.” If there are any restrictions or limitations the Principal wishes to impose on the Tax Powers granted here, they should be recorded on the blank line labeled “Deletions.”

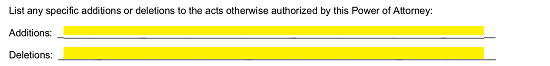

There will be two blank lines in the “Additions And Deletions” section. If the Principal has any additional Powers or extensions of Powers that should be assigned to the Agent, they should be recorded on the blank space labeled “Additions.” If there are any restrictions or limitations the Principal wishes to impose on the Tax Powers granted here, they should be recorded on the blank line labeled “Deletions.”

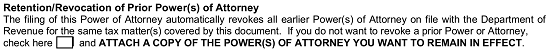

5 – Address Any Previous Authorities Concerning The Tax Matters Granted Here

Now we shall turn our attention to a conditional statement that needs to be addressed. Locate the heading “Retention/Revocation Of Prior Power(s) Of Attorney.” If there is a prior Power of Attorney that should stay active despite the issuance of this form, then mark the checkbox in this paragraph and attach a copy of this prior Power of Attorney. Leach this checkbox blank if there is no prior Authority or if a prior Authority should be revoked with the execution of this paperwork.

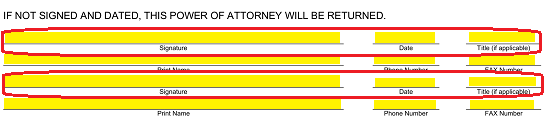

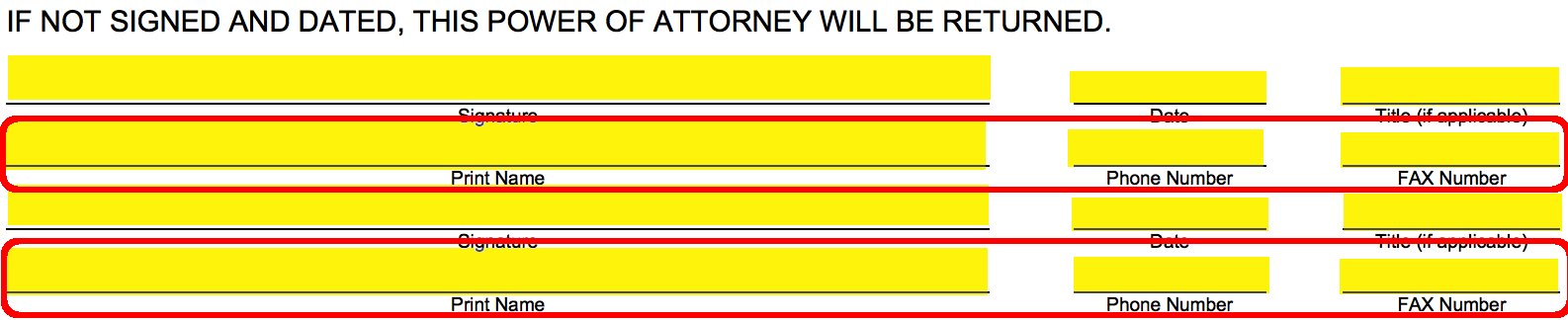

6 – The Principal Taxpayer’s Signature Is Mandatory To Submit This Form

The last section in Part I will be a series of blank lines. Here, each Taxpayer reported in the first table must sign the “Signature” line, then enter the current Date and any applicable Title he or she holds.

Each Principal Taxpayer must print his or her Name on the blank line below his or her Signature then, on the adjacent lines, record the Phone Number and Fax Number where he or she can be reliably reached.

7 – Additional Information Regarding The Agent Must Be Submitted At The Time Of Agent Signature

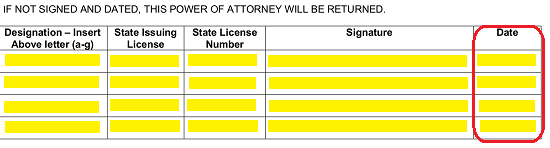

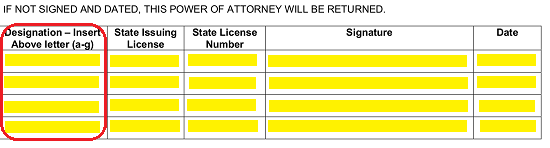

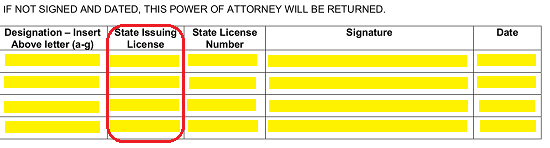

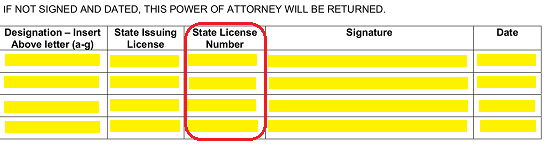

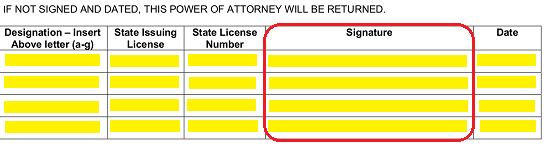

Part II will focus on the Representative Agent elected in this form. He or she will need to locate which of the lettered statements in the list provided best describes his or her role/function. Once this task is completed, the Representative should turn his or her attention to the table provided.

In the first column, “Designation – Insert Above Letter,” the Representative should enter the letter from the list that best defines him or her. Note: If entering “g,” make sure a description has been supplied on the blank line following the words “…Provide Explanation.”

If the Agent holds a State License, the State the Agent holds a License with should be presented in the second column.

Follow through this report by making sure the Agent’s State License Number is displayed in the third column.  The fourth column must be signed by the Representative Agent.

The fourth column must be signed by the Representative Agent.  The fifth column must have the Date the Agent signed this form recorded.

The fifth column must have the Date the Agent signed this form recorded.