Updated June 02, 2022

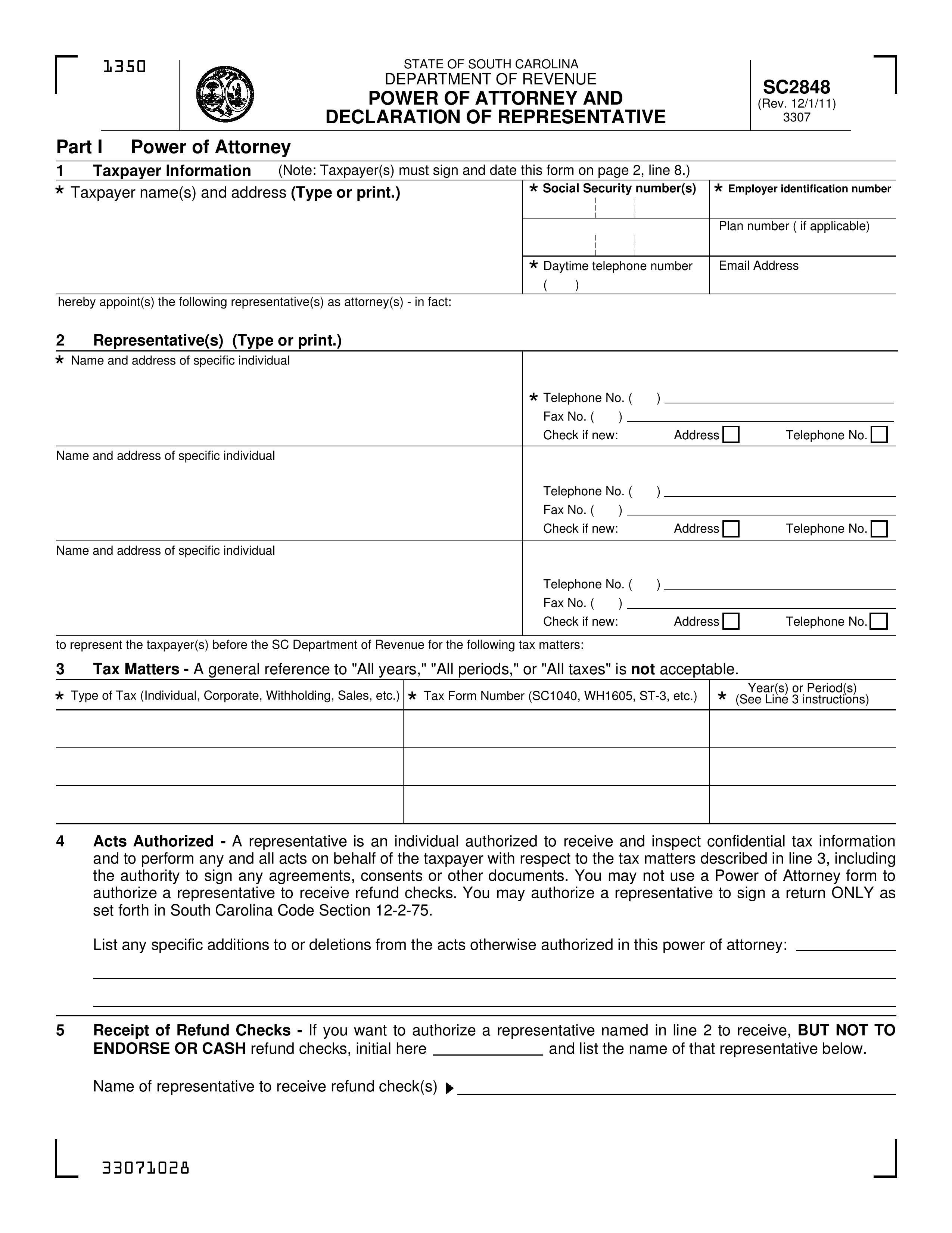

A South Carolina Tax Power of Attorney (Form SC-2848) or “Department Of Revenue Power Of Attorney And Declaration Of Representative” is a required submission when you wish to grant someone with the authority to act on your behalf when dealing with the South Carolina Department of Revenue. Generally, such paperwork is required when you need the representation of a tax professional or an attorney can provide. Once the Department Of Revenue approves this paperwork the Agent you name will have the ability to represent by performing tasks such as obtaining your tax information, making inquiries, and making filings on your behalf with using the records he or she is allowed access to.

How to Write

1 – The South Carolina Form To Delegate Tax Powers To An Agent Should Be Downloaded

The paperwork on this page will enable a South Carolina Taxpayer the ability to appoint a Representative with the Principal Authority to act as the Principal with the South Carolina Department Of Revenue. This form can be obtained using the buttons under the preview presented.

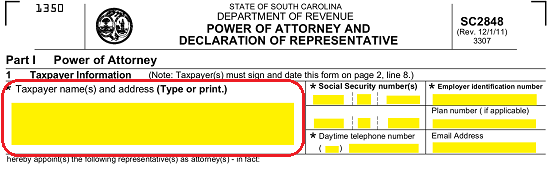

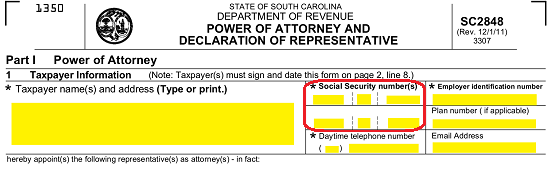

2 – Name The Principal Who Intends To Delegate Authority To An Agent

Part I of this form will need to make sure the Principal is fully identified and easy to locate. Use the first box in the first row to record the Full Name and the Complete Address of the Principal signing this form. It is important that if the Principal has filed jointly with a Spouse then his or her Name and Address must be recorded here as well.  The next box in this row will have a few areas to attend to. If the Principal(s) is a human being, then record his or her Social Security Number in the space provided. Two distinct areas under the heading “Social Security Number” have been supplied in case two individuals are listed in the first box.

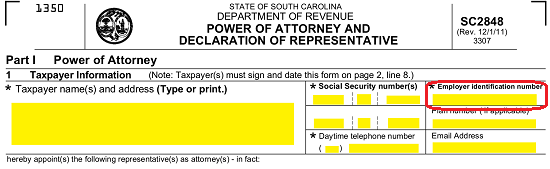

The next box in this row will have a few areas to attend to. If the Principal(s) is a human being, then record his or her Social Security Number in the space provided. Two distinct areas under the heading “Social Security Number” have been supplied in case two individuals are listed in the first box.  If the Principal is a Business Entity with a Federal Entity Identification Number, then record this number under the label “Employer Identification Number”

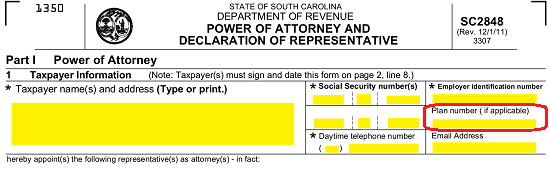

If the Principal is a Business Entity with a Federal Entity Identification Number, then record this number under the label “Employer Identification Number” If the Principal has a Tax Plan Number, this should also be recorded. An area labeled “Plan Number (If Applicable) has been supplied for this purpose.

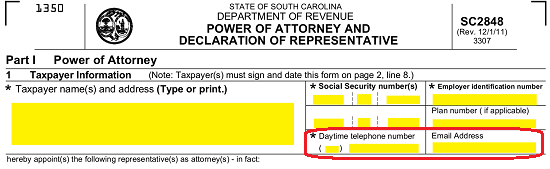

If the Principal has a Tax Plan Number, this should also be recorded. An area labeled “Plan Number (If Applicable) has been supplied for this purpose.  The final two items in this row (labeled “Daytime Telephone Number” and “Email Address”) call for a well-maintained Telephone Number and E-Mail Address can be reliably reached quickly.

The final two items in this row (labeled “Daytime Telephone Number” and “Email Address”) call for a well-maintained Telephone Number and E-Mail Address can be reliably reached quickly.

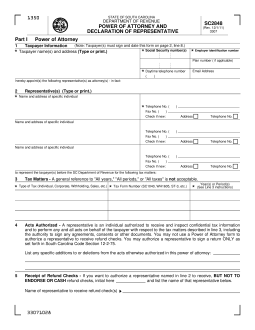

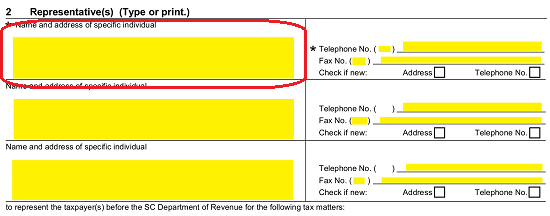

3 – Declare The Identity Of Each Attorney-in-Fact Being Assigned Here

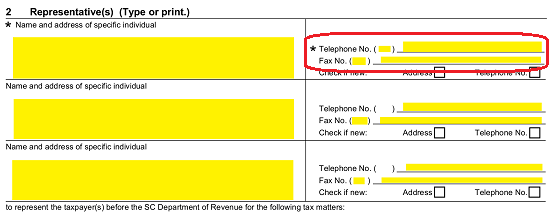

The individual the Principal wishes to use as an Attorney-in-Fact and will be granted Principal Authority must be clearly identified as such. This task can be accomplished in the table bearing the label “2 Representative(s) (Type Or Print)” It is worth mentioning that only an individual may be given Principal Powers using this form. To document the Name and Address of this person, enter his or her Name and Address in the area under the label “Name And Address Of Specific Individual” The box adjacent to the reported Attorney-in-Fact’s Name and Address will contain a few labeled areas where you can document his or her Phone Number and Fax Number (on the blank lines labeled “Telephone No.” and “Fax No.”

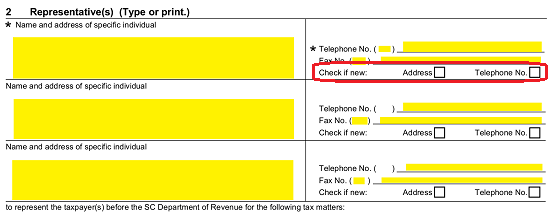

The box adjacent to the reported Attorney-in-Fact’s Name and Address will contain a few labeled areas where you can document his or her Phone Number and Fax Number (on the blank lines labeled “Telephone No.” and “Fax No.” If either of these pieces of information represents a recent change in the Attorney-in-Fact’s Contact Information for the Department Of Revenue, then mark either the checkbox marked “Address” and/or “Telephone No.” to signify this.

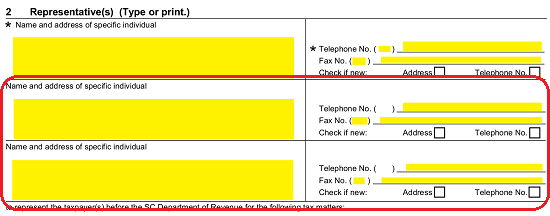

If either of these pieces of information represents a recent change in the Attorney-in-Fact’s Contact Information for the Department Of Revenue, then mark either the checkbox marked “Address” and/or “Telephone No.” to signify this.  There will be enough room to record a total of three Attorneys-in-Fact on this page. You may use the second and third rows for this purpose. If more room is required, you may add an attachment with this roster and the required information.

There will be enough room to record a total of three Attorneys-in-Fact on this page. You may use the second and third rows for this purpose. If more room is required, you may add an attachment with this roster and the required information.

4 – The Tax Powers The Principal Appoints To The Attorney-in-Fact Must Be Detailed

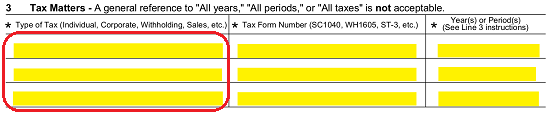

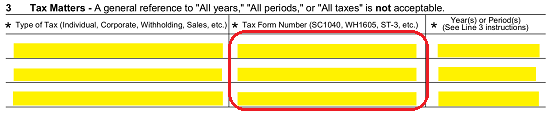

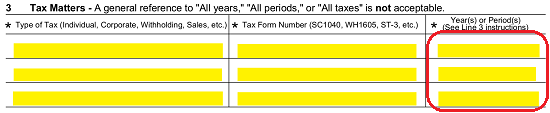

The Principal will need to discuss what Powers will be delivered to the Attorney-in-Fact. A specific area designated to organize this report has been provided in “3 Tax Matters.” Here a concise table will accept the information defining what Tax Subjects the Attorney-in-Fact may wield Principal Power over will need to report. Document this in the first column (labeled “Type Of Tax”). Some examples include ” Individual Income Tax,” “Corporate,” “Sales Tax,” etc.). The next column will be labeled “Tax Form Number” and will call for the Tax Forms the Agent may represent the Principal with and relating to the Matters named in the first column to be reported.

The next column will be labeled “Tax Form Number” and will call for the Tax Forms the Agent may represent the Principal with and relating to the Matters named in the first column to be reported.  Finally, the “Year(s) Or Period(s)” of the Tax Matters (reported in the first column) that the Agent may wield Principal Power over should be recorded. Make sure you name specific Periods of Time as general answers will cause a rejection of this form’s submission.

Finally, the “Year(s) Or Period(s)” of the Tax Matters (reported in the first column) that the Agent may wield Principal Power over should be recorded. Make sure you name specific Periods of Time as general answers will cause a rejection of this form’s submission.

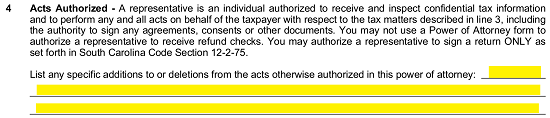

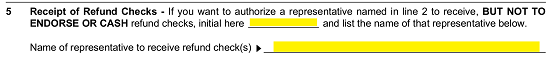

You may limit or restrict the Agent’s use of Principal Power by documenting the Principal’s Limitations on these Powers using the blank lines furnished in “4 Acts Authorized.” If the Principal intends to grant additional Powers to the Agent or allow for additional actions, then he or she should consult with an Attorney to make sure such intentions are allowable. The Department Of Revenue will have separate requirements depending on what the Principal’s goals are in (i.e. A very strict criteria must be satisfied to give the Agent the right to sign a return for the Principal).  Next, in “5 Receipt Of Refund Checks,” the Principal may name the Agent that he or she has designated to receive any Refund Checks that must be mailed to him or her. To approve this ability to the Agent, the Principal must initial the blank line after the words “…Refund Checks, Initial Here” then record the Name of the Agent who the Department of Revenue may mail the Principal’s Refund Checks too on the next blank line. This does not give the Agent the right to cash or endorse any such check. Any Agent named here will only be able to receive a Refund check for the Principal and must be one of the Agent’s named.

Next, in “5 Receipt Of Refund Checks,” the Principal may name the Agent that he or she has designated to receive any Refund Checks that must be mailed to him or her. To approve this ability to the Agent, the Principal must initial the blank line after the words “…Refund Checks, Initial Here” then record the Name of the Agent who the Department of Revenue may mail the Principal’s Refund Checks too on the next blank line. This does not give the Agent the right to cash or endorse any such check. Any Agent named here will only be able to receive a Refund check for the Principal and must be one of the Agent’s named.

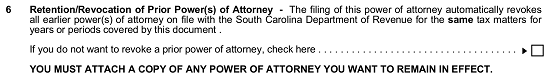

For the Principal Powers defined in this document to be delivered to the Agents named in this document, no previously issued Powers over the same matters will stay in Effect. Generally speaking, this is a default that prevents any confusing clashes of Principal Powers. However, the Principal may have a previously issued appointment that should remain in Effect even after the execution of this document. If so, then mark the checkbox in “6 Retention/Revocation Of Prior Power(s) Of Attorney” and attach a copy of the Power Document that should remain in Effect.

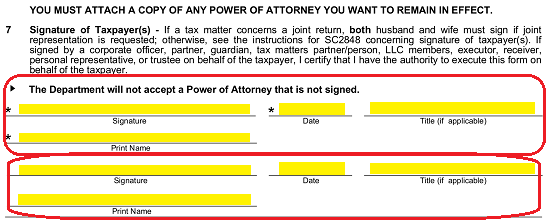

5 – The Principal Must Supply His Or Her Signature Before Submitting This Form

This form must be Signed by the Principal upon its completion. No information can be reported, altered, or removed once this document has been signed so the Principal should give this paperwork a focused review of all its contents and any attachments that accompany it. Once the Principal approves of all this information, he or she should locate “7 Signature Of Taxpayers” then sign his or her Name on the line labeled “Signature,” enter the Date of the day he or she signed this document on the adjacent blank line, fill in any applicable Title held on the “Title (If Applicable)” line, and present his or her Printed Name on the “Print Name” line. Two such areas have been provided in case two individuals have been reported in box 1 of this form (i.e. Principal and Jointly Filed Spouse).

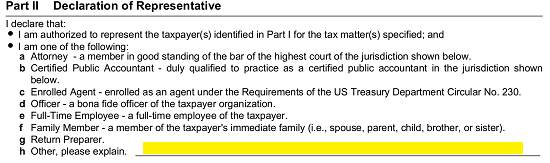

6 – The Attorney-in-Fact Must Also Supply A Report And Signature

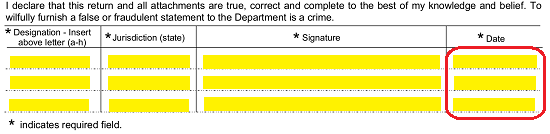

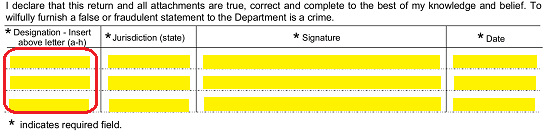

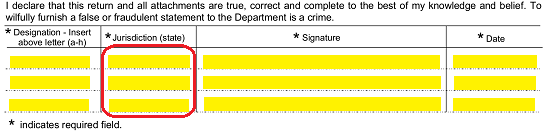

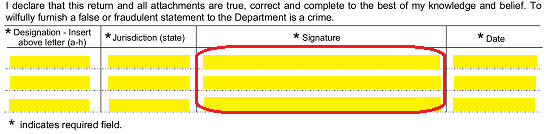

The Attorney-in-Fact will also need to participate directly in the Principal Execution and Submission of this form. In “Part II Declaration Of Representative” the Agent will need to read through the lettered list provided under the words “I Declare That.” If none of the list items contains a role that applies to the Agent, then he or she must report his or her role or status on the blank lines after the words “H Other, Please Explain.” The table below this list will begin with the column labeled “Designation – Insert Above Letter (A-H)” where the Agent must record the letter corresponding to the item that best defines his or her status or role.

The table below this list will begin with the column labeled “Designation – Insert Above Letter (A-H)” where the Agent must record the letter corresponding to the item that best defines his or her status or role.  The second column, “Jurisdiction (State)” will call for the area where the Agent may practice his or her profession or where he or she is licensed.

The second column, “Jurisdiction (State)” will call for the area where the Agent may practice his or her profession or where he or she is licensed.  The Agent must sign his or her Name in the “Signature” column.

The Agent must sign his or her Name in the “Signature” column.  The Date of the Agent’s Signature must be supplied by the Agent at the time of singing in the last column.

The Date of the Agent’s Signature must be supplied by the Agent at the time of singing in the last column.