Updated June 02, 2022

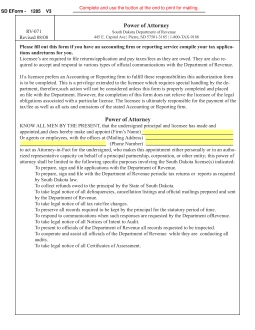

A South Dakota Tax Power of Attorney (Form RV-071) is used to appoint an accountant or other tax professional to handle your tax filings in South Dakota. As there are no income taxes in South Dakota, this is for other types of licensing taxes.

How to Write

1 – The Appointment To Deliver Tax Powers In South Dakota Can Be Downloaded Here

The document required to assign a Principal’s Firm as his or her Representative with Principal Powers in Tax Matters has been made available through the buttons presented on this page (below the image). Download this template using one of these buttons

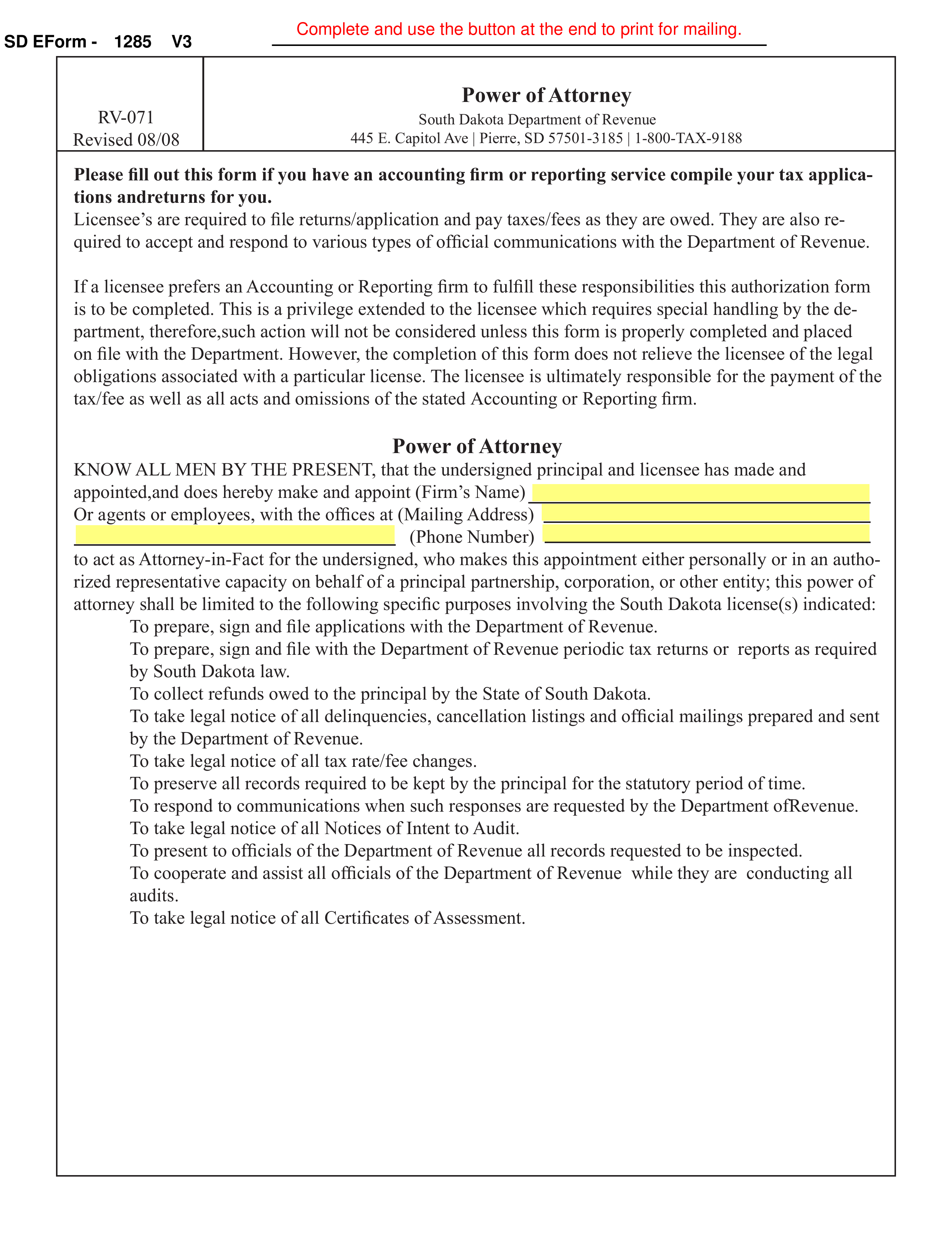

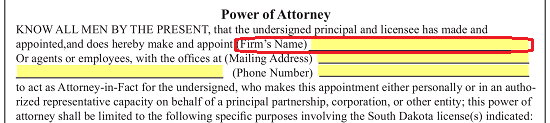

2 – Declare The Principal’s Representative Identity

This form will contain several areas meant to define the entity the Principal intends to name as his or her Attorney-in-Fact. This will be the entity that can act as the Principal and use Principal Authority to make decisions on behalf of the Principal when dealing with the South Dakota Department of Revenue

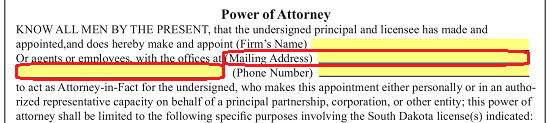

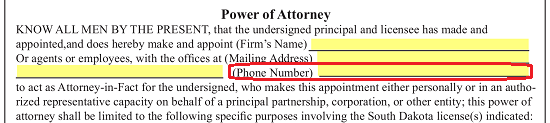

Record the Legal Name of the Attorney-in-Fact on the blank space after the parentheses label (Firm’s Name). The Mailing Address of the Attorney-in-Fact Firm will also need to be documented. Use the second blank line to record this.

The Mailing Address of the Attorney-in-Fact Firm will also need to be documented. Use the second blank line to record this. Finally, the Phone Number where the Department of Revenue may reach the Attorney-in-Fact during daytime hours must be provided. Locate the blank line after “Phone Number” then enter this Phone Number.

Finally, the Phone Number where the Department of Revenue may reach the Attorney-in-Fact during daytime hours must be provided. Locate the blank line after “Phone Number” then enter this Phone Number.

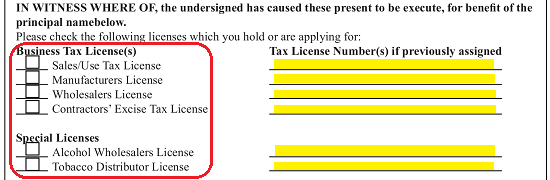

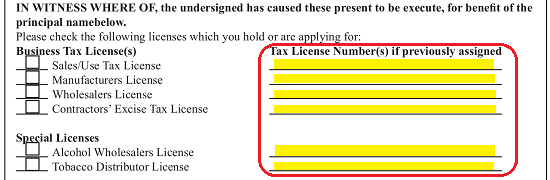

3 – The Principal Must Self-Report On License Information

This form will concern an Attorney-in-Fact’s Principal Powers in applying for or maintaining a license the Principal intends to have or retain. The type of License in question will need to be defined for either of these reasons for naming an Attorney-in-Fact. Locate the left-hand column with the bold titles “Business Tax License(s)” and “Special Licenses” at the end of this template’s declaration, then mark the checkbox corresponding to each type of License the Attorney-in-Fact will wield Principal Power with. The Attorney-in-Fact may represent Principal interests with the Business License(s) “Sales/Use Tax License,” “Manufacturers License,” ” Wholesalers License,” and/or “Contractors’ Excise Tax License” and/or the “Special Licenses” “Alcohol Wholesale License” and/or “Tobacco Distributor License” The right-hand column, titled “Tax License Number(s) If Previously Assigned” will need the License Number of any of the check marked items on the left. Each of the checklist items will have a corresponding blank line in this area. If the Principal is using the Attorney-in-Fact to apply for a License, then its corresponding blank line may be left blank

The right-hand column, titled “Tax License Number(s) If Previously Assigned” will need the License Number of any of the check marked items on the left. Each of the checklist items will have a corresponding blank line in this area. If the Principal is using the Attorney-in-Fact to apply for a License, then its corresponding blank line may be left blank

4 – Both Parties Must Supply An Authentic Signature Of Intent

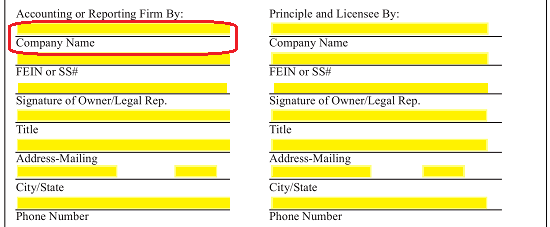

The next section of this document will require some items from the Principal and the Attorney-in-Fact. Here the Principal will execute this document through his or her Signature while the Attorney-in-Fact must formally accept the Powers granted through an Acknowledgment Signature. We will begin with the Attorney-in-Fact. Locate the bottom left column on the second page with the title “Accounting Or Reporting Firm By”

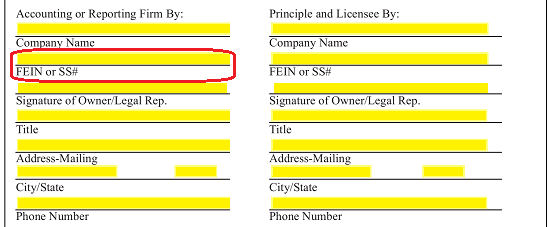

The individual representing the Attorney-in-Fact Firm or the Attorney-in-Fact (if an individual) must Print the Business Entity Name or his or her own Name on the blank line labeled “Company Name.” Below the Printed Name of the Attorney-in-Fact, the Signature Party must either enter the Federal Entity Identification Number assigned to the Firm he or she is representing or, if a person, his or her Social Security Number.

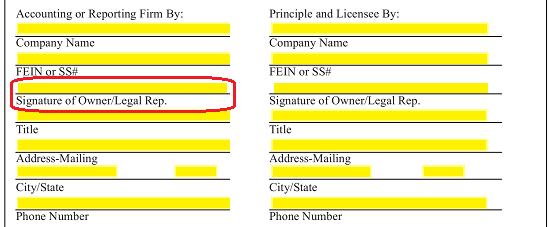

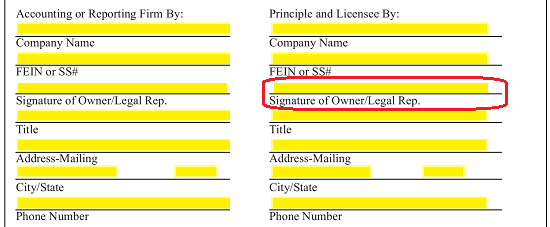

Below the Printed Name of the Attorney-in-Fact, the Signature Party must either enter the Federal Entity Identification Number assigned to the Firm he or she is representing or, if a person, his or her Social Security Number. The Attorney-in-Fact must sign this form to acknowledge and accept the Principal Powers delivered here. If the Attorney-in-Fact is a business entity, then an Authorized Representative must act as the Signature Party. He or she will need to sign the blank line labeled “Signature Of Owner/Legal Rep.” If the Attorney-in-Fact is a person, then he or she should sign this line as well.

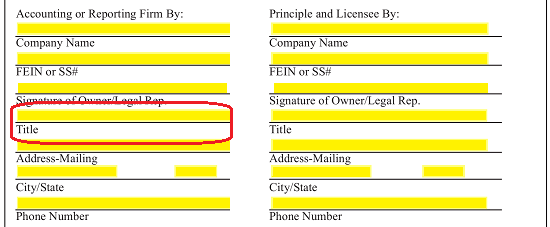

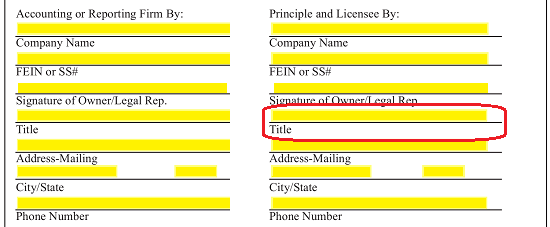

The Attorney-in-Fact must sign this form to acknowledge and accept the Principal Powers delivered here. If the Attorney-in-Fact is a business entity, then an Authorized Representative must act as the Signature Party. He or she will need to sign the blank line labeled “Signature Of Owner/Legal Rep.” If the Attorney-in-Fact is a person, then he or she should sign this line as well.  Below this, the Signature Attorney-in-Fact should document the Title he or she holds (especially, if the Signature Party is an Authorized representative)

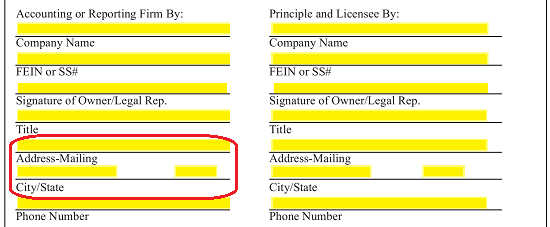

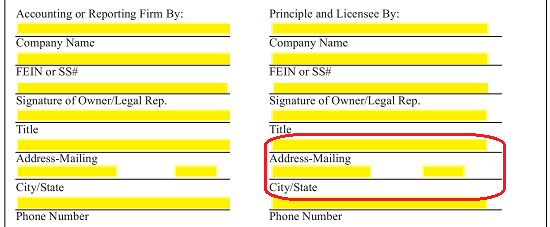

Below this, the Signature Attorney-in-Fact should document the Title he or she holds (especially, if the Signature Party is an Authorized representative) The next two blank lines “Address-Mailing” and “City/State” call for the Attorney-in-Fact’s Legal Address. Make sure to supply his or her Zip Code after the State.

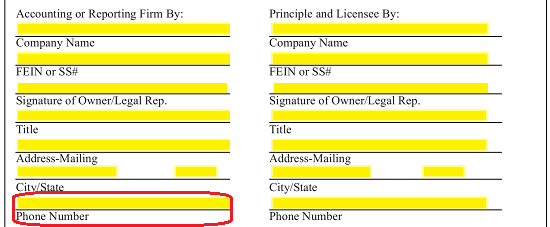

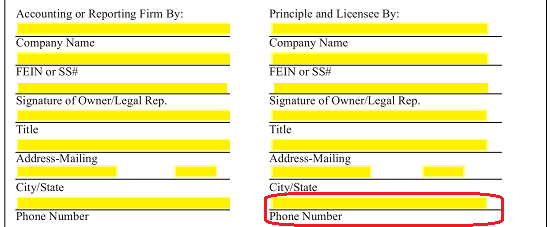

The next two blank lines “Address-Mailing” and “City/State” call for the Attorney-in-Fact’s Legal Address. Make sure to supply his or her Zip Code after the State. Finally, the last blank space in this column must have the Attorney-in-Fact’s Contact Telephone Number recorded

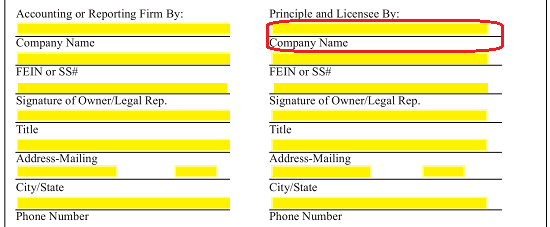

Finally, the last blank space in this column must have the Attorney-in-Fact’s Contact Telephone Number recorded  The Principal will need to attend to the column titled “Principal And Licensee By.” If the Principal is a business entity, then its Legal Name must be printed on the blank line labeled “Company Name.” If the business entity is a human being, then the Principal must print his or her Name here.

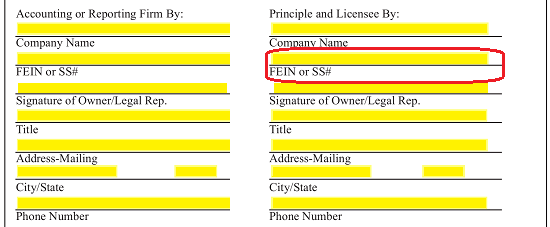

The Principal will need to attend to the column titled “Principal And Licensee By.” If the Principal is a business entity, then its Legal Name must be printed on the blank line labeled “Company Name.” If the business entity is a human being, then the Principal must print his or her Name here. The next blank space, “FEIN OR SS#,” will need to have the Principal’s Tax I.D. Number entered by the Principal. If the Principal is a Business Entity, this line is where its Federal Entity Identification Number should be placed. If the Principal is a person, the Principal should record his or her Social Security Number on this line.

The next blank space, “FEIN OR SS#,” will need to have the Principal’s Tax I.D. Number entered by the Principal. If the Principal is a Business Entity, this line is where its Federal Entity Identification Number should be placed. If the Principal is a person, the Principal should record his or her Social Security Number on this line. The Principal must sign the “Signature Of Owner/Legal Rep” line. This action may be performed by an Authorized Representative if the Principal is a Business. If the Principal is a person then he or she should sign this line.

The Principal must sign the “Signature Of Owner/Legal Rep” line. This action may be performed by an Authorized Representative if the Principal is a Business. If the Principal is a person then he or she should sign this line. If the Principal Signature is performed by an Authorized Representative of a Business, then the Signature Party should report the Title he or she holds with the Principal Entity.

If the Principal Signature is performed by an Authorized Representative of a Business, then the Signature Party should report the Title he or she holds with the Principal Entity. The Principal must document his or her “Address-Mailing,” “City/State,” and Zip Code.

The Principal must document his or her “Address-Mailing,” “City/State,” and Zip Code. The last item required of the Principal will be the Contact “Phone Number” the Department of Revenue may use to contact the Principal directly

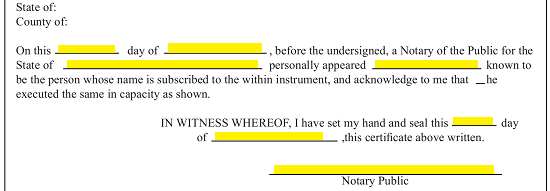

The last item required of the Principal will be the Contact “Phone Number” the Department of Revenue may use to contact the Principal directly  The final area of this document will need the participation of the Notary Public who will Notarize its final execution.

The final area of this document will need the participation of the Notary Public who will Notarize its final execution.