Usury Rate

By Type (2)

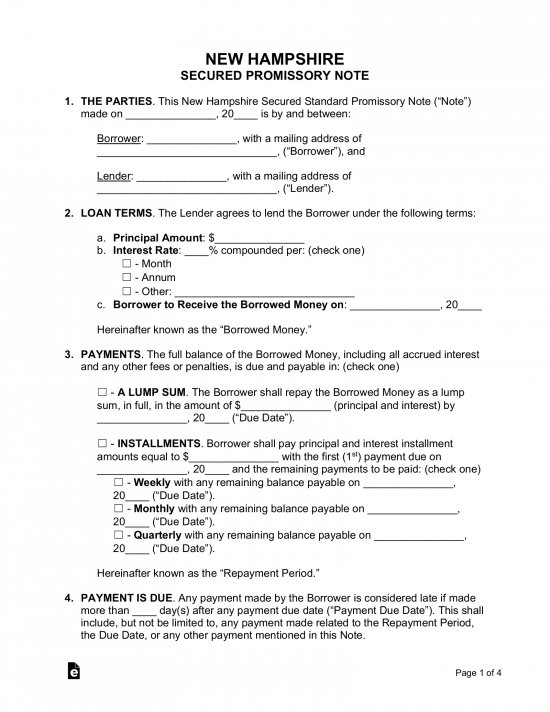

Secured Promissory Note – Includes a section for secure lending. Security works by using a piece of property relatively equal to the loaned amount of money. If the borrower fails to make payments and defaults on the balance, the lender receives the item in security to help offset the unpaid balance.

Secured Promissory Note – Includes a section for secure lending. Security works by using a piece of property relatively equal to the loaned amount of money. If the borrower fails to make payments and defaults on the balance, the lender receives the item in security to help offset the unpaid balance.

Download: PDF, MS Word, OpenDocument

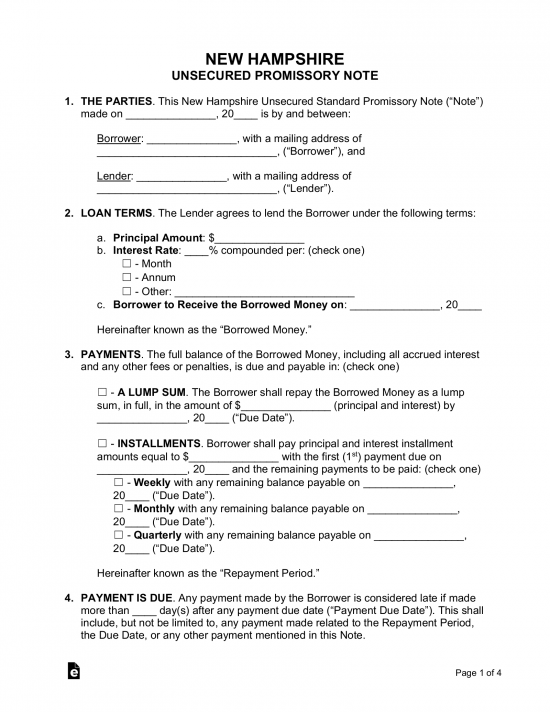

Unsecured Promissory Note – Does not include an area where security can be declared. This adds considerable risk to the transaction for the lender. If the borrower enters into default on the balance, the lender has no concrete way of obtaining the unpaid balance. One option is to bring the borrower to small claims court.

Unsecured Promissory Note – Does not include an area where security can be declared. This adds considerable risk to the transaction for the lender. If the borrower enters into default on the balance, the lender has no concrete way of obtaining the unpaid balance. One option is to bring the borrower to small claims court.

Download: PDF, MS Word, OpenDocument

Usury Statute

I. The annual rate of interest in all business transactions in which interest is paid or secured, unless otherwise agreed upon in writing, shall equal 10 percent. No consumer credit transaction, as defined in RSA 358-K:1, V, shall be subject to this paragraph. If agreed upon in writing, interest on business transactions may include charging other than simple interest.

II. The annual simple rate of interest on judgments, including prejudgment interest, shall be a rate determined by the state treasurer as the prevailing discount rate of interest on 26-week United States Treasury bills at the last auction thereof preceding the last day of September in each year, plus 2 percentage points, rounded to the nearest tenth of a percentage point. On or before the first day of December in each year, the state treasurer shall determine the rate and transmit it to the director of the administrative office of the courts. As established, the rate shall be in effect beginning the first day of the following January through the last day of December in each year.