Usury Rate

By Type (2)

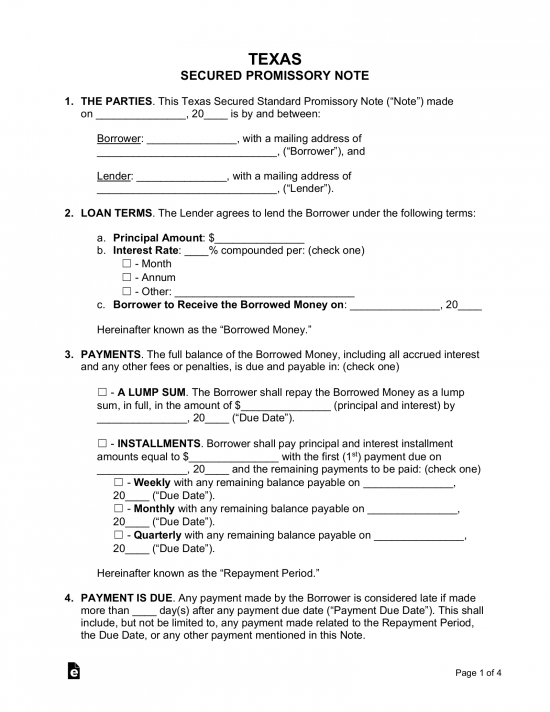

Secured Promissory Note – This template includes a section where an item is declared as security. This item should be of similar value as to the balance of the note and is only given to the lender if the borrower cannot recover from default.

Secured Promissory Note – This template includes a section where an item is declared as security. This item should be of similar value as to the balance of the note and is only given to the lender if the borrower cannot recover from default.

Download: PDF, MS Word, OpenDocument

Unsecured Promissory Note – Does not include a section for security, increasing financial risk for the lender. To help prevent a case in which the borrower defaults on the balance, the lender should be extra wary when selecting a borrower. Credit checks and personally knowing the borrower can substantially improve the transaction for the lender.

Unsecured Promissory Note – Does not include a section for security, increasing financial risk for the lender. To help prevent a case in which the borrower defaults on the balance, the lender should be extra wary when selecting a borrower. Credit checks and personally knowing the borrower can substantially improve the transaction for the lender.

Download: PDF, MS Word, OpenDocument

Usury Statute

The maximum rate or amount of interest is 10 percent a year except as otherwise provided by law. A greater rate of interest than 10 percent a year is usurious unless otherwise provided by law. All contracts for usurious interest are contrary to public policy and subject to the appropriate penalty prescribed by Chapter 305.

The parties to a written agreement may agree to an interest rate, or in an agreement described by Chapter 345 (Retail Installment Sales), 347 (Manufactured Home Credit Transactions), 348 (Motor Vehicle Installment Sales), or 353 (Commercial Motor Vehicle Installment Sales), an amount of time price differential producing a rate, that does not exceed the applicable weekly ceiling.