Updated September 25, 2023

A triple-net (NNN) commercial lease agreement is a contract between a landlord and a tenant that pays for the three (3) ‘nets’, property insurance, real estate taxes, and common area maintenance (CAM). These costs are usually estimated for the year and incorporated into the rent on a monthly basis. At the end of the year, if the costs were lower then the tenant gets a refund, and if more then the tenant will owe the difference. Tenants will usually request the triple-net (NNN) amount to be capped based on the expenses for the previous year.

Table of Contents |

What is a Triple-Net (NNN) Lease?

A triple-net (NNN) lease is a contract for commercial property where the tenant is responsible for all expenses related to the property, specifically, property insurance, real estate taxes, and common area maintenance (CAM). In most triple-net (NNN) leases, this also includes all utilities and services used by the tenant. This mainly applies to retail, industrial property, and free-standing buildings.

What does NNN Mean?

Net, Net, Net

Refers to a commercial lease where the tenant pays for:

- Net – Property Insurance

- Net – Real Estate Taxes

- Net – Common Area Maintenance (CAM)

What is Common Area Maintenance (CAM)?

Common area maintenance, simply known as “CAM” or “CAM’s”, are expenses that are attributed to the cost of maintaining the property. What is defined as CAM’s should be outlined in the lease agreement and commonly are:

- Building repairs

- Cleaning (common areas)

- HVAC expenses

- Landscaping

- Management (on-site repairman)

- Outdoor lighting

- Parking lot maintenance

- Security

- Signage

- Snow removal

Capping NNN Expenses

To protect the tenant, a maximum cap of the NNN expenses is commonly negotiated by the landlord and tenant. This is on a price per square foot ($/SF) basis.

For multi-year leases, the cap will generally increase 5% to 10% each year.

Pro-Rata Share

A tenant is liable for their pro-rata share of real estate expenses for the entire property.

For example, if the tenant is located in a strip mall renting 10,000 square feet, while their space is only 1,000 square feet, the tenant would be responsible for 10% of the NNN expenses.

Landlord’s Responsibilities

Even though the tenant pays for the triple-nets through their monthly rent, the landlord will be the one actually making the payments.

For example, the landlord will directly pay the property insurance, real estate taxes, and property maintenance expenses while being reimbursed through the payment of triple nets.

In addition, the landlord will be required to take an accounting of all the expenses on the property. At the end of the year, if the triple net expenses were lower than expected the tenant will be reimbursed. If more than the triple-net rate, the tenant will be billed the extra costs.

How to Calculate

For the lazy, use the calculator provided by Austin Tenant Advisors. For those looking to calculate themselves use the formulas below:

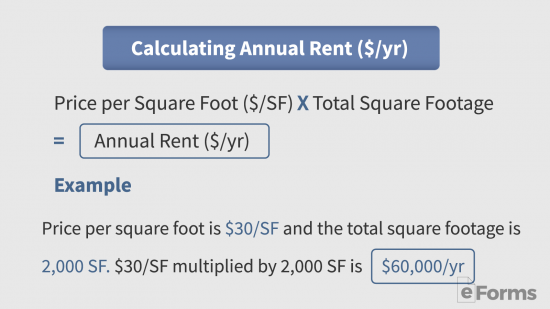

Calculating Annual Rent ($/yr)

Price per Square Foot ($/SF) X Total Square Footage = Annual Rent ($/yr)

Example: Price per square foot is $30/SF and the total square footage is 2,000 SF. $30/SF multiplied by 2,000 SF is $60,000/yr.

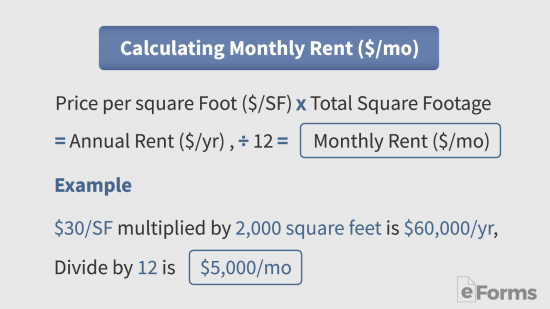

Calculating Monthly Rent ($/mo)

Price per Square Foot ($/SF) X Total Square Footage = the Annual Rent ($/yr) and ÷ by 12 = Monthly Rent ($/mo)

Example: $30/SF multiplied by 2,000 square feet is $60,000/yr. Divide by 12 is $5,000/mo.

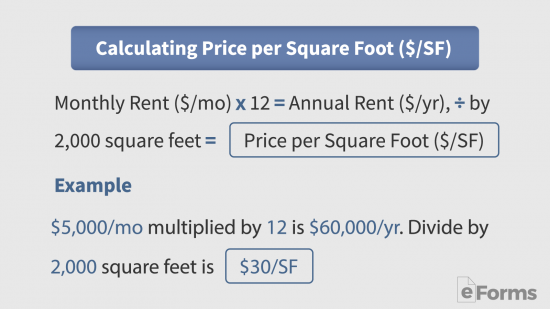

Calculating Price per Square Foot ($/SF)

Monthly Rent ($/mo) X by 12 = the Annual Rent ($/yr) and ÷ by the Total Square Footage = Price per Square Foot ($/SF).

Example: $5,000/mo multiplied by 12 is $60,000/yr. Divide by 2,000 square feet is $30/SF.

Triple-Net vs Gross Lease

| TENANT PAYS | GROSS | MODIFIED-GROSS | TRIPLE-NET (NNN) |

|---|---|---|---|

| Property Insurance | x | √* | √ |

| Real Estate Taxes | x | √* | √ |

| Common Area Maintenance | x | √* | √ |

| Utilities | √* | √* | √ |

| Repairs | x | √* | √ |

| x – tenant does not pay, √* – conditional, √ – tenant pays | |||

NNN Pros and Cons

A triple-net (NNN) lease is known for being a long-term fixed arrangement although with only minimal rent increases.

NNN Pros

- Long-term lease;

- Expenses are controlled; and

- It provides a fixed income.

NNN Cons

- The landlord must track and pay the expenses;

- Rent increases are minimal (in most cases);

- If build-to-suit, there is high exposure if the tenant defaults.

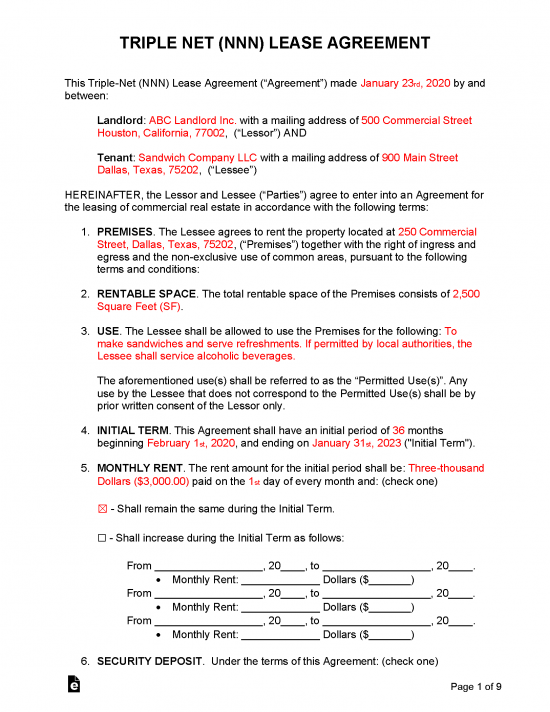

Sample Triple Net (NNN) Lease

Download: PDF, MS Word, OpenDocument

Related Agreements

Co-Working Lease – For independent contractors that primarily work online to rent shared office space with limited amenities.

Gross Lease – Commercial lease where the tenant only pays a fixed monthly rent amount along with their utilities. The landlord pays for all property maintenance, taxes, and insurance.

Modified Gross Lease – Commercial lease where the tenant pays a portion of the expenses related to the property.

Office Lease – Commercial lease designated for professional use and services.