Updated September 13, 2023

A Michigan small estate affidavit is a document that allows a petitioner, known as an “affiant,” to stake a claim on property from the estate of a deceased loved one, known as the “decedent.” In Michigan, this process is available to estates that have a value of $15,000 — as adjusted for cost of living (see below) — or less. There is a waiting period for filing this document, and any other potential heirs must be accounted for before it is honored.

Laws

- Days After Death – Twenty-eight (28) days. (M.C.L.A. 700.3983(1))

- Maximum Amount ($) – $15,000. M.C.L.A. 700.3983(1)(a). However, this amount is subject to cost-of-living adjustments pursuant to M.C.L.A. 700.1210. The State Treasurer certified the cost-of-living adjustment factor for the 2021 calendar year is 1.613, which increases the figure by 61.3%. For 2021, the maximum amount is $24,000. (For other years, see the treasurer’s memo regarding the matter.)

- Signing – This form requires the signature of the affiant in the presence of a notary public.

- Statutes – Act 386 of 1998, Article III, Part 11, § 700.3982 through § 700.3988 (Collection of Personal Property by Sworn Statement, Small Estates, and Summary Administrative Proceedings)

How to File (3 steps)

2. Gather Documents

- Affidavit of Decedent’s Successor for Delivery of Certain Assets Owned by Decedent

- Copy of Death Certificate

Video

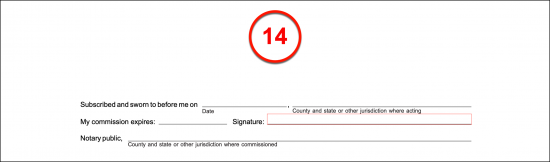

How to Write

Download: PDF

(1) Michigan Decedent Estate. To begin, produce a record of the Michigan Deceased’s full name. This is the Party who has passed away and whose estate is the focus of this petition.

ARTICLE 1

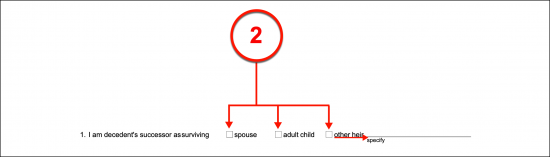

(2) Affiant As Michigan Decedent Survivor. Commonly, either the Spouse or an Adult Child of the Michigan Deceased will fill out this form to seek the Decedent’s remaining estate. If so then either the “Spouse” or “Adult Child” checkbox should be selected to establish the Affiant’s status. If, however, the Petitioner (or Affiant) is someone other than the Michigan Decedent’s “Spouse” or “Adult Child” then select the “Other Heir” checkbox and define the relationship the Affiant holds with the Michigan Decedent.

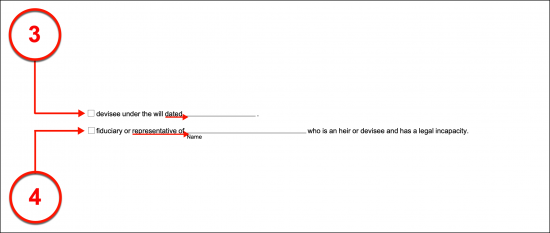

(3) Affiant As Devisee Under The Will. If the Affiant has been named in the will as a Recipient of real estate then, select the appropriate checkbox. This selection requires the date of the Michigan Decedent’s will to be presented.

(4) Affiant As Fiduciary Or Representative of Michigan Deceased. If the Affiant is a Fiduciary or other Representative of the Heir behind this petition, then select the “Fidicuary Or Representative” box. The full name of this Agent will be required to complete this selection.

ARTICLE 2

(5) County And State Of Residency At the Time Of Death. The Michigan Decedent’s residence at the time of death should be defined as the County and State where he or she lived.

(6) Date Of Michigan Decedent’s Death. The death certificate generated when the Michigan Decedent passed away should be reviewed. The date that he or she died should be found on this certificate then dispensed to the second article.

ARTICLE 6

(7) Property Entitled To The Affiant. All property the Affiant expects from the Michigan Decedent’s estate should be established in article six. If possible record the monetary worth of each property as well especially if any bank accounts and other intangible assets are involved.

ARTICLE 7

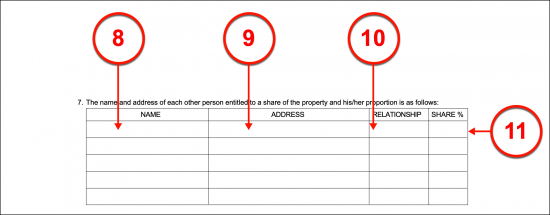

(8) All Parties Entitled To Michigan Decedent’s Property. The name of every other Heir entitled to any part of the Michigan Decedent’s estate should be listed in the table provided. Several other pieces of information on the Michigan Decedent’s Heirs will be requested by this table. Make sure that all the information recorded in this table is on the same row as the Heir it refers to. If more room is needed to define every Michigan Decedent Heir, then an attachment may be used to present their information.

(9) Address Of Additional Heirs. The address where each Heir can be contacted should be recorded. If the Heir has a separate mailing and residential address, then document both.

(10) Relationship Between Heir And Michigan Decedent. Whether the Michigan Decedent’s Heir was a family member or friend, the nature of the relationship they shared should be documented to the third column.

(11) Share Expected By Heir. The portion or the percentage of the Michigan Decedent’s estate that should be delivered to each Heir named must accompany the information on this table.

NOTARIZED AFFIANT SIGNATURE

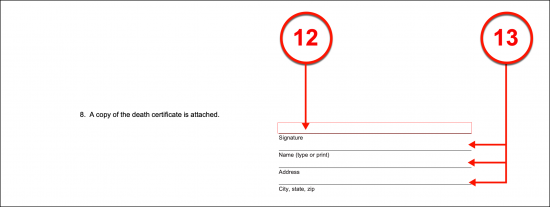

(12) Michigan Affiant Signature. The Affiant (or Petitioner) to the Michigan Decedent’s estate must produce a notarized signature to this document once all the attachments are accounted for and present.

(13) Name And Address Of Michigan Affiant. After signing his or her name, the Signature Affiant or Petitioner should print his or her name and address.

(14) Notary Verification Of Michigan Affiant Signature. A Notary Public with an active commission will authenticate the Signature Petitioner’s identity then subject the signature to the notarization process.