Updated November 13, 2023

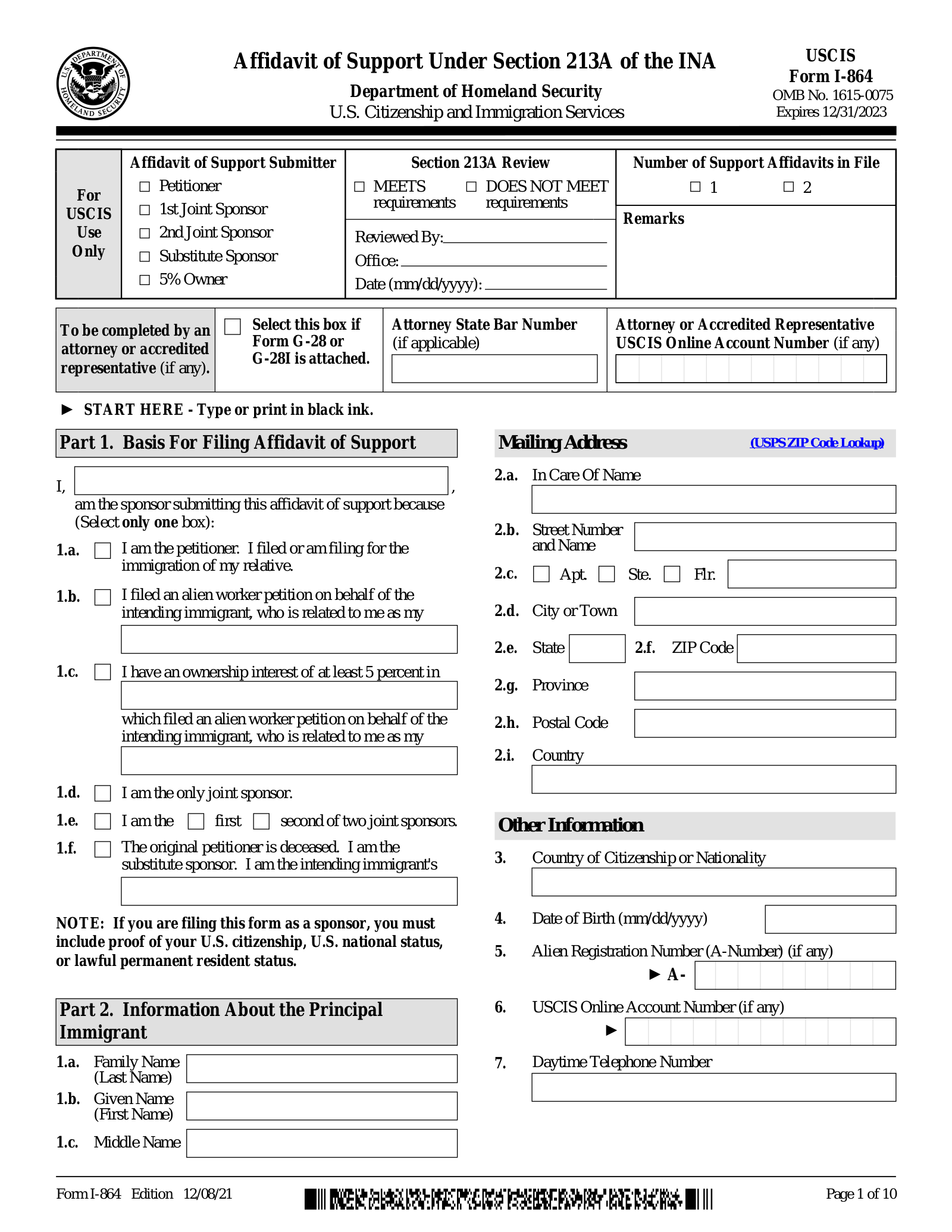

An affidavit of support (Form I-864) is a binding contract between the U.S. government and a person agreeing to sponsor an immigrant. It is submitted as part of the intending immigrant’s green card application. The purpose is to show that the immigrant has sufficient financial resources and is not likely to rely on public benefits. Once filed, the affidavit confers a legal obligation on the sponsor to provide financial support to the immigrant if necessary.

Eligibility

To qualify as an affidavit of support sponsor, the affiant must be a U.S. citizen or lawful permanent resident and meet minimum household income requirements.

Table of Contents |

When is an Affidavit of Support Required?

Most immigrants seeking permanent residence in the U.S. are required to have a sponsor file Form I-864 on their behalf. This includes sponsors’ immediate relatives, extended family, and some employment-based immigrants.

Not Required

Some categories of immigrants do not need an affidavit of support, though other forms may be required. These include:

- Individuals who have earned 40 qualifying work credits[1]

- Children of U.S. citizens who automatically qualify for citizenship[2]

- Other special categories of immigrants[3]

Who Can File an Affidavit of Support?

- Age: Sponsors using Form I-864 must be at least 18 years old

- Citizenship: Must be a U.S. citizen or lawful permanent resident.

- Residence: Required to maintain a permanent residence in the U.S.[4]

Sponsors living outside the U.S. may meet the domicile requirement under special circumstances, including qualifying employment (employment by the U.S. government) or good-faith intent to re-establish residence in the U.S. before the immigrant arrives.

Income Requirements

Sponsors must show that they can financially support the immigrant(s). If the sponsor does not meet the threshold based on their individual income, assets and income contributed by other household members may be listed in the affidavit. Only assets that can be liquidated within one year and without placing a significant burden on the owner can be included.[5]

If the sponsor’s annual income is greater than 125% of the Federal Poverty Guidelines for their household, they qualify on income alone. It drops to 100% if the sponsor is on active duty in the Armed Forces or Coast Guard and sponsoring a spouse or child.

Sponsor’s Financial Responsibility Under I-864

By filing Form I-864, the sponsor agrees to take responsibility for the financial welfare of the sponsored individual. Because the sponsor’s resources and assets are available to support the immigrant, the immigrant may be ineligible to receive certain government benefits like food stamps, health insurance, and supplemental security income.[6]

If the immigrant receives covered public benefits, the providing agency can initiate legal action to recover the cost from the sponsor. Joint sponsors and household members listed on the affidavit are also responsible. Any person listed as a joint sponsor or contributing household member can be held individually liable for the full extent of any debts owed.

When do the Sponsor’s Obligations End?

Generally, Form I-864 is designed to ensure immigrants have financial support until they either become independent or cease to pursue lawful permanent residency. The sponsor’s legal responsibility to support the immigrant terminates when one of the following events takes place (note that divorce does not qualify):

- The immigrant becomes a U.S. citizen

- The immigrant acquires 40 quarters of work credits (usually ten years)

- The immigrant ends their lawful permanent residency and leaves the country

- The immigrant passes away

Sponsors, joint sponsors, and contributing household members will still be responsible for outstanding debts accumulated during the course of the sponsorship.[7]

How to File (5 Steps)

- Complete and Sign Affidavit

- Gather Supporting Evidence

- File Documents

- Appear for Background Check

- Monitor Application Status

1. Complete and Sign Affidavit

When the person you are sponsoring is scheduled for a visa interview or applying for permanent resident status, complete Form I-864. Review the entire form and read each instruction carefully. Be prepared to enter detailed information about your employment, tax returns, household income, assets, and the immigrant(s).

Provide your signature electronically or in ink. Stamped and typewritten signatures are not accepted.

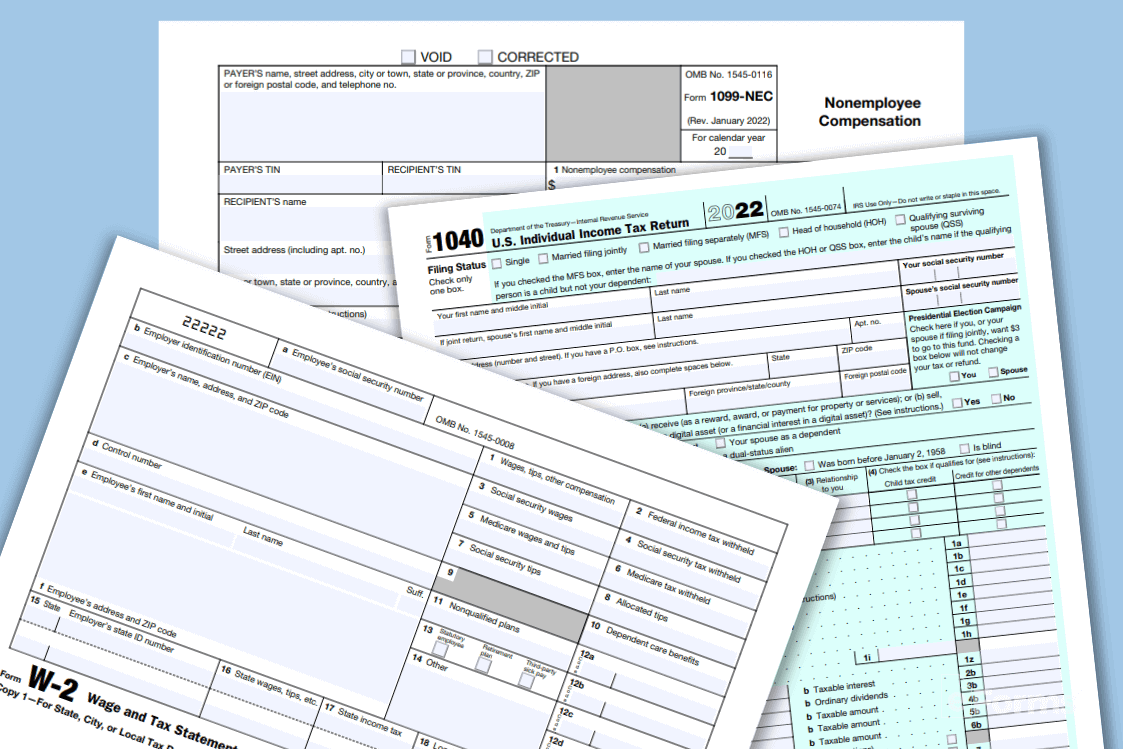

2. Gather Supporting Evidence

At the time of filing, you will be required to provide documentation to verify your income. All sponsors are required to file a copy of their most recent Federal income tax returns, along with W-2s, 1099s, and other proof of income. If you were not required to file a tax return, you must submit a statement describing your situation.

Other documents may be required depending on individual circumstances, including military status, other assets or income listed in the affidavit, identification documents, and more. See the U.S. Citizen and Immigration Services (USCIS) Checklist of Required Initial Evidence to determine what applies to you.

3. File Documents

Give a legible copy of the signed affidavit and copies of all supporting documents to the intending immigrant to file along with their other immigration forms. They will need to send their forms to the appropriate USCIS Lockbox Filing Location. USCIS does not charge a filing fee.[8]

5. Monitor Application Status

The affidavit will become effective once the applicant’s green card is approved. This process often takes over a year. Applicants can reference processing times and check their case status online.

Penalties and Fines

It is crucial to provide complete and accurate information when filing an Affidavit of Support. The government may seek to corroborate information with employers, other government agencies, and financial institutions. If a document or fact is knowingly falsified, there may be fines or criminal prosecution in addition to rejecting the petition.[9]

Sponsors who are not U.S. citizens are required by law to report changes to their addresses within ten days, and all sponsors are encouraged to keep their addresses up to date with the USCIS.[10] Those who need to report an address change can do so online.

Sources

- 42 U.S.C. 413

- Child Citizenship Act FAQ | Department of State

- Form I-360 | USCIS

- Who Can Be a Financial Sponsor? | Department of State

- Form I-864 Instructions | USCIS

- Sponsored Immigrants and Public Benefits | National Immigrant Law Center

- Responsibilities as a Sponsor | USCIS

- Filing Fee | USCIS

- Form I-864 Instructions: Penalties | USCIS

- 8 U.S.C. 1183a(d)