Updated May 31, 2022

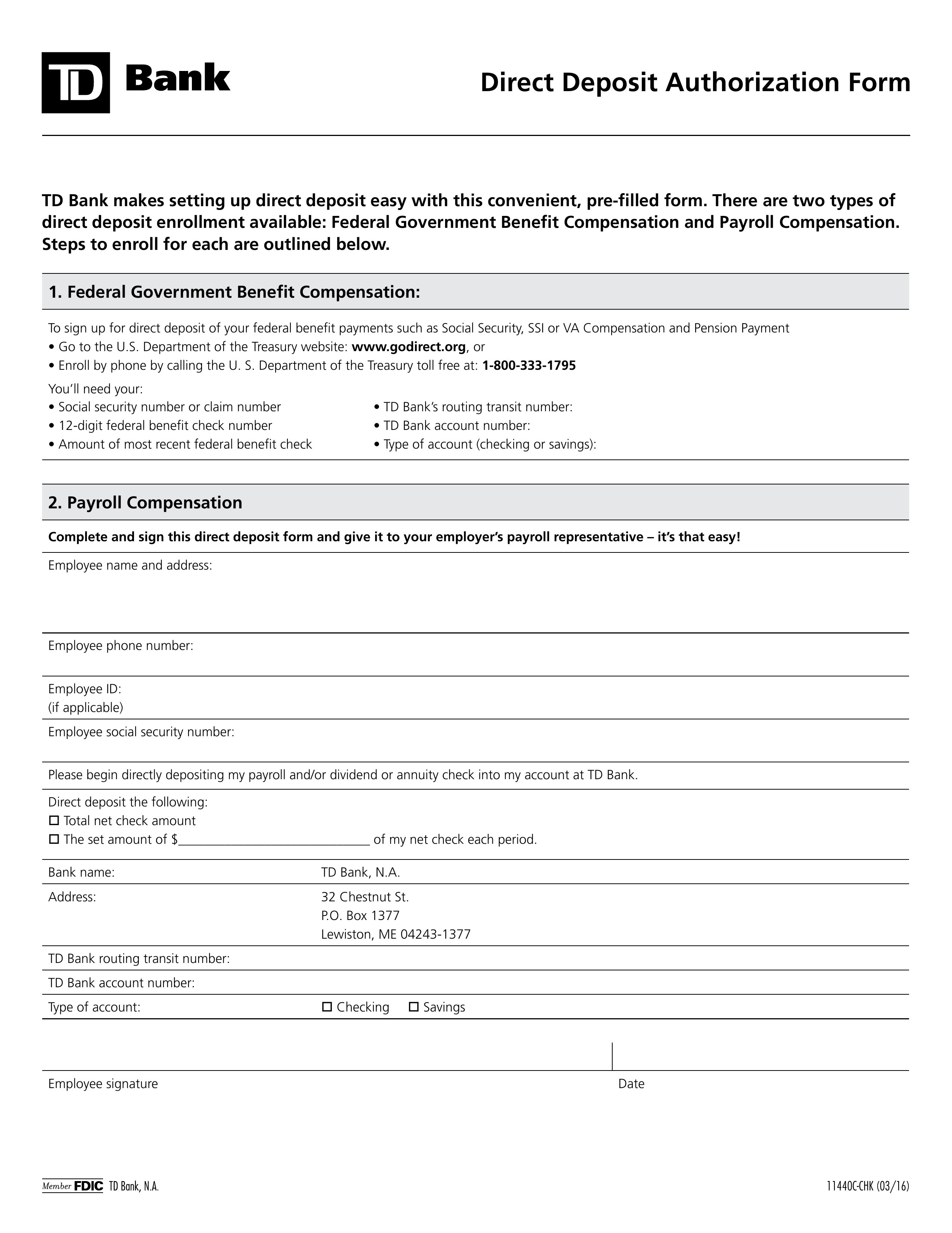

The TD Bank direct deposit form may be used to set up your Employer Payroll Compensation or Government Benefit Compensation to be deposited in a TD Bank Account you hold. Merely fill out the form then submit it to your Employer or Government Paying Entity. If you are filling this out to receive Government Payroll Compensation but are unsure where to submit it, then contact the United States Department of Treasury through this site: www.godirect.gov. Some very sensitive information will be contained on this document, so it is generally considered wise to confirm the proper entity receives it.

How to Write

Step 1 – Download the TD Bank Direct Deposit Form with the button labeled “PDF” on the right. You may use a PDF program to enter the requested information on your screen or you may print it then supply the requested information.

Step 2 – Read the information in Item 1. This will provide some background as to the use of this form and the items you will need to satisfy its requirements. When you are ready to begin, locate Item 2 then, under the words “Employee Name and Address,” report your Full Name and Complete Address. This information should be consistent with the information TD Bank and your Employer have on file.

Step 3 – On the next line, report your Daytime Phone Number below the words “Employee Phone Number.”

![]()

Step 4 – You will need to continue self reporting by entering your Employee Identification Number in the space following the words “Employee ID.” Not every company will issue a separate Employee ID Number, so if your place of employment does not, you may leave this area blank. If your place of employment does issue such Identification, you must report it here.

Step 5 – On the blank line beneath the words “Employee social security number,” fill in your Social Security Number. This must be accurately reported.

Step 6 – Indicate if you would like the Full Amount of each Paycheck to be directly deposited to your TD Bank Account by placing a mark in the first check box below the words “Direct deposit the following.” If you wish a set amount to be deposited into the account receiving the deposit then place a mark in the second check box below these words, then report this amount on the blank line preceding the words “of my net check each period.”

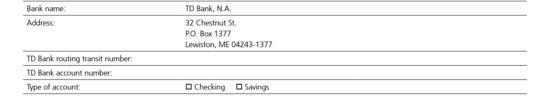

Step 7 – The next area will Name TD Bank as the Financial Institution of the target account. Do not edit this area, unless instructed to do so by TD Bank. Then, in the space next to the words “TD Bank routing number,” report the Routing Number for your branch. This number will be the digits in the lower left hand corner of your personal checks.

Step 8 – On the next line, following the words “TD bank account number,” enter the Account Number you wish the Direct Deposit transaction to occur. That is, where you would like your paycheck to be deposited. Typically, this will be the string of digits in the lower right hand corner of your personal checks.

Step 9 – On the line beginning with the words “Type of account” place a mark in the check box labeled “Checking” or the check box labeled “Savings” to define the Account Number you entered. You may only choose one and this must be the type of account associated with the number you entered in Step 8.

Step 10 – Sign your Name on the blank line at the end of this document just above the words “Employee Signature” then, enter the Date you have signed this form.

![]()

Step 11 – If you have filled out this form to receive payroll compensation, then print this form and submit it to your employer. If you are seeking Direct Deposits of your Government Benefit Compensation, then you must contact the Department of Treasury directly to find where you must submit it.