Updated January 17, 2024

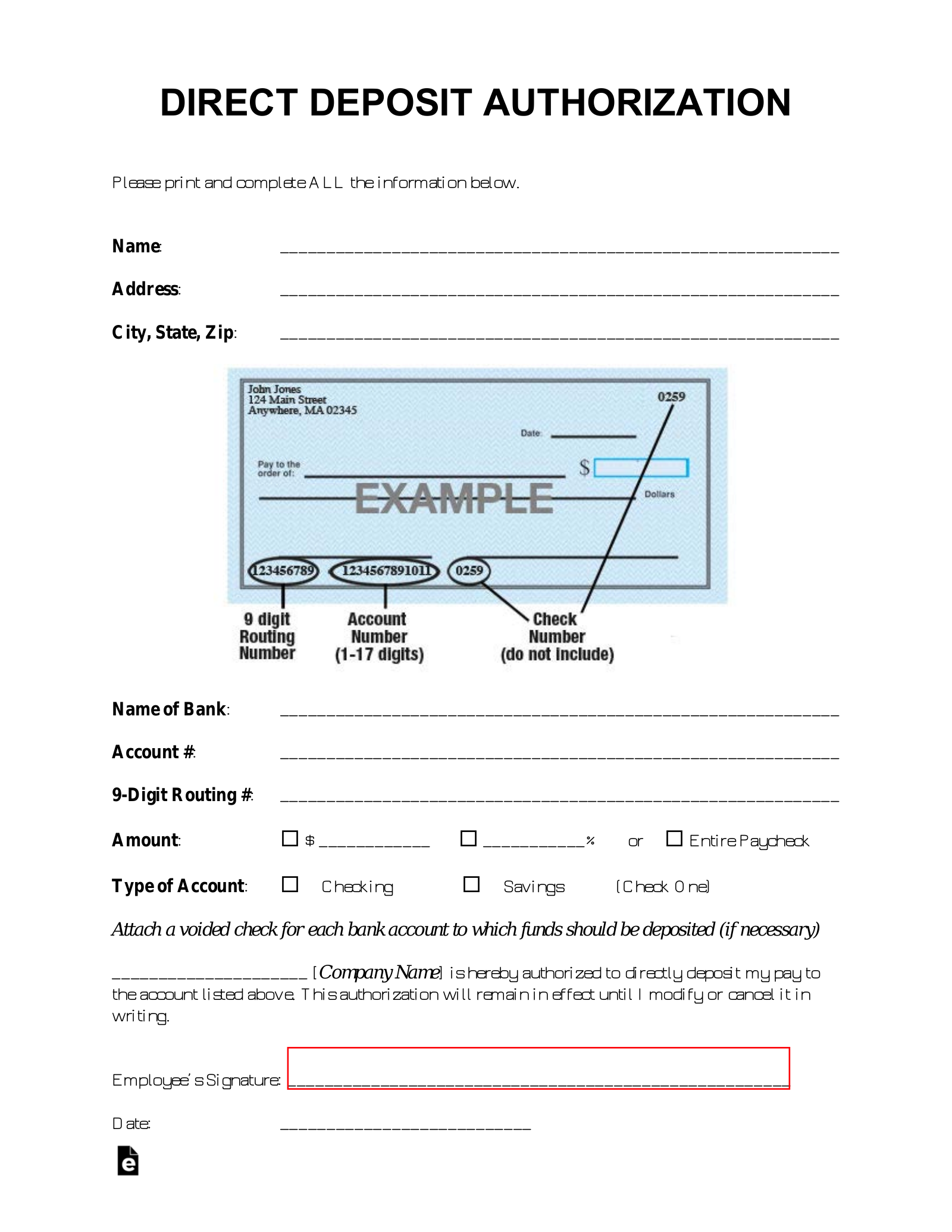

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Typically, an employer requesting authorization will require a voided check to ensure that the account is valid.

After completing, an employer will be able to send payments directly to the employee’s bank account.

Table of Contents |

By Type (2)

Download: PDF

Does Not Require a Voided Check

Does Not Require a Voided Check

Download: PDF, MS Word, OpenDocument

By Bank (20)

- ADP

- Bank of America

- BB&T

- Capital One (360)

- Chase

- IHSS

- Intuit / QuickBooks

- Key Bank

- Navy Federal Credit Union (NFCU)

- NetSpend

- Paychex

- PNC Bank

- RushCard

- Social Security Admin

- Standard (Form 1199a)

- SunTrust

- TD Bank

- US Bank

- USAA

- Wells Fargo

(Video Overview)

How to Add an Employee to Payroll (5 steps)

- Employer Needs to Have an EIN

- Collect Required Government Forms from Employee

- Give and Collect Employer Forms

- Add to Payroll

- File Form 941 with the IRS Every Quarter

An employer will need an individual’s personal and banking information to add them to their payroll service. This will allow the employer to pay the employee while deducting federal, state, and local taxes directly from their gross pay.

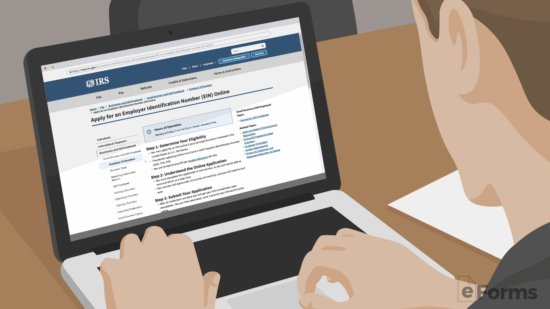

1. Employer Needs to Have an EIN

- Apply on the IRS website

- Apply via mail with Form SS-4

This is often referred to as the “social security number” for a business. An Employer Identification Number (EIN) is nine digits in the following format: xx-xxxxxxx. This is free to obtain for a business entity that is created in any of the 50 states and territories. The IRS will ask generic questions about the status of the entity and its functions. After 10-15 minutes, the EIN number will be provided in a completed Form SS-4 at the end of the session.

If the applicant applies through the mail, it will take approximately 10-15 business days.

3. Give and Collect Employer Forms

The employer should give the following forms to the employee:

The employer should give the following forms to the employee:

- Employee Contract Agreement

- Employee Handbook

- Onboarding / New Employee Letter

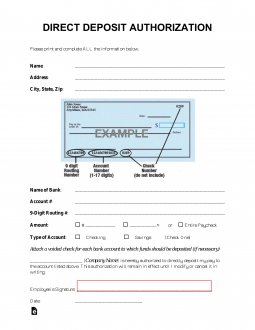

- Direct Deposit Authorization Form (PDF, MS Word, Open Document Text)

The employee will be required to complete and return the Direct Deposit Authorization Form for the employer to add the information to their payroll and begin depositing their pay into their account.

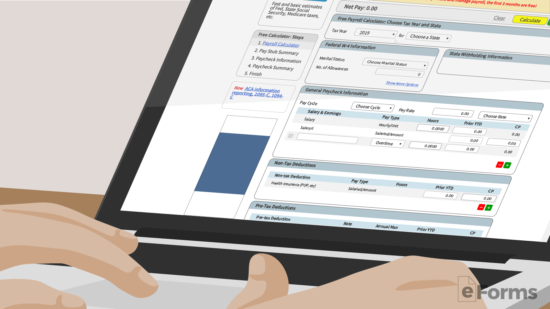

4. Add to Payroll

When adding an employee to an employer’s payroll schedule, they will be responsible for withholdings and deductions. An employer can choose to deduct these items on their own or elect to pay for a payroll service that does this automatically.

When adding an employee to an employer’s payroll schedule, they will be responsible for withholdings and deductions. An employer can choose to deduct these items on their own or elect to pay for a payroll service that does this automatically.

The employer will have two choices.

- Do-It-Yourself Payroll – Use a Free Online Calculator while using IRS Publication 15 (scroll to “Percentage Method Tables for Income Tax Withholding” on page 45).

- Payroll Providers – The most popular providers are Gusto, OnPay, Xero, and ADP. These providers allow the process and payment to federal and state tax authorities to be much easier for the employer. Depending on if the service saves enough time to compensate for the payment, this may be the best solution for a busy entrepreneur that doesn’t have time to process payroll by hand.

The deductions the employer is required to make are as follows:

- Government Deductions – These include federal income tax (FIT), social security and medicare (also known as FICA), state tax deductions, and any local income taxes.

- Other Deductions – If the employer has other deductions they must be subtracted as well. These include but are not limited to: health insurance, retirement plans (401(k)), and any deductions for charitable donations.

5. File Form 941 with the IRS Every Quarter

IRS Form 941 must be filed with the Internal Revenue Service on a quarterly basis.

IRS Form 941 must be filed with the Internal Revenue Service on a quarterly basis.

The form details the following quarterly information:

- Total number of employees

- Social Security and Medicare withholding amounts

- Sick or leave pay

- Insurance claims

- Any other required revenue details.

The form should be filed in accordance with the following periods:

- 1st Quarter – Jan. 1 to March 30 is due May 10

- 2nd Quarter – April 1 to June 30 is due Aug. 10

- 3rd Quarter – July 1 to Sep. 30 is due Nov. 10

- 4th Quarter – Oct. 1 to Dec. 31 is due Feb. 10

At this time the accounting of the business is complete with the employee successfully added to their payroll system.

The employer will need to collect the necessary government-required forms to ensure the individual is allowed to work in the United States. These include:

The employer will need to collect the necessary government-required forms to ensure the individual is allowed to work in the United States. These include: