Updated May 31, 2022

The Social Security Direct Deposit Form, sometimes referred to as “Form 1199A,” is a method to deliver the information required by the Social Security Administration for beneficiaries wishing to receive their payments as electronic transfers. In order for this paperwork to be accepted, it must list some very basic but necessary facts regarding the recipient of the benefits. For instance, this form will call for the Name of the recipient, Address, Bank Account Number, Bank, and Branch to be reported. This information will allow an Electronic Transfer of Funds to occur properly on a regular basis.

Online Setup – https://www.ssa.gov/myaccount/

Telephone Setup – 1-800-772-1213 (TTY 1-800-325-0778)

For Canadian Residents – Form SSA-1199-CN

Request for Payments by Check – FS Form 1201W

How to Write

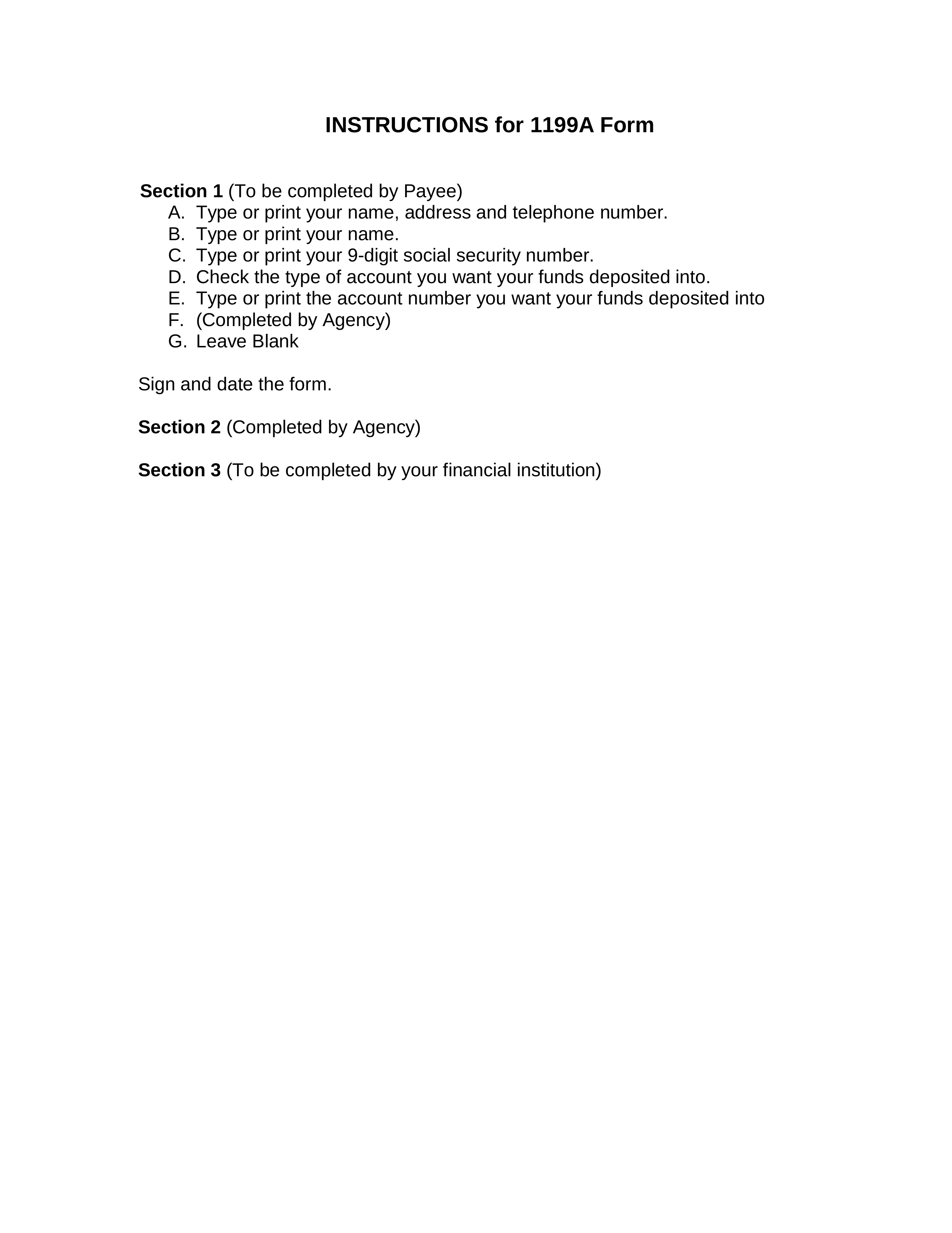

Step 1 – To begin, download the document using the PDF Button underneath the image on the right hand side of this page. Then, beginning on Page two (2) read all of the information at the top of the form

Step 2 – Payee Information will be addressed in Sections A through C. You must submit the following information where appropriate:

- First line in Section A: Enter the Payee’s Last Name, First Name and Middle Initial

- Second line in Section A: Enter the Payee’s Street Address (Building Number/Street/Ste Number)

- Third line in Section A: Enter the Payee’s City, State, Zip Code

- Fourth line in Section A: Enter the Payee’s Telephone number (with area code)

- Section B: Enter the Name(s) of the Person(s) who shall be entitled to the Payment

- Section C: Submit the Claim or Payroll Identification Number for each party (Prefix,Suffix)

Step 3 – Next, we will need to provide some specifics regarding the Financial Institution and Payee’s Account involved in Sections D through G. You will need to supply the following information:

- Section D: Select the check box labeled “Checking” or “Savings” to define the Type of Account your payment must be deposited in.

- Section E: Report the Account Number to receive the Direct Deposits using the string of boxes provided (one digit per box).

- Section F: Select the Type of Payment that will be deposited in the Payee’s Account (i.e. “Social Security”) by marking the correct box.

- Section G: If there shall be an allotment of Payment, enter the type and amount. This section is optional.

Step 4 – The Payee or Joint Payee Certification Section must be completed – Read the statement and continue:

- The Payee must Sign his or her Name on the line labeled “Signature.”

- The Payee must provide the Date he or she is Signing this form on the line labeled “Date.”

Step 5 – The Joint Account Holder’s Certification section is conditional and should only be addressed if the target Account is jointly held by the Payee and another individual – Both parties must read and agree to the statement in the box provided:

- Both parties must enter their signatures

- Date the signatures in mm/dd/yyyy format

Step 6 – Section 2 – This section must be completed by the payee or the financial institution only –

- The Name of the Government Agency providing Payments to the Payee must be reported in the first box.

- The Address of the government Agency must be reported in the second box.

- Submit the depositor’s Account Title

Step 7 – Bring this form to the Financial Institution where the Payee has the Account reported on this form. Only the Financial Institution where the target account is held may fill out Section 3.

Step 8 – This completed form must be returned to the Government Agency, listed in Section 2, supplying the Payments defined in Section F to the Payee Account defined in Section E.