Updated June 23, 2023

A recurring ACH payment authorization form authorizes a creditor to deduct recurring payments from a client’s bank account. The payment will be charged at the end of each bill’s cycle or on the recurring dates specified.

Common Uses

- Memberships;

- Subscriptions;

- Payment plans (loan repayments);

- Service contracts; and

- For products being purchased on a repeated basis.

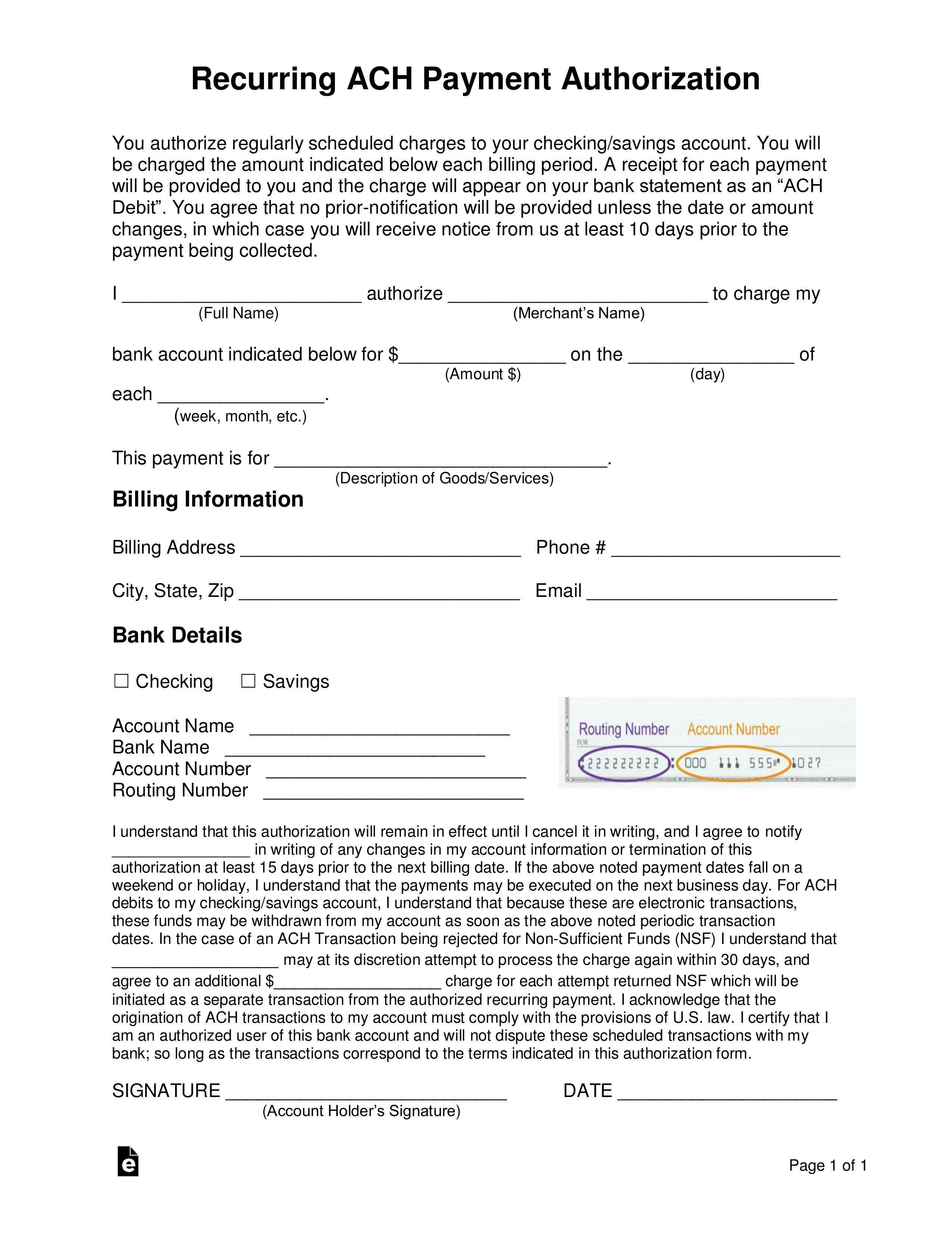

How to Write

Download: PDF, MS Word, OpenDocument

Step 1 – Download the authorization document – begin by reviewing the information at the top of the document:

- If the account holder is in agreement, enter the merchant’s name who shall receive permission to collect a one-time payment from the bank account

- Submit the full name of the account holder

- Enter the merchant’s name

- Submit the amount that the account holder will authorize for deduction

- Enter the date in which the one-time payment may be deducted

- Provide a description of the good and/or services for which payment shall be deducted on the specified date

Step 2 – Billing Information – Submit:

- Submit the account holder’s billing address

- City, State, Zip Code

- Telephone number

- Email address

Step 3 – Bank Details – Provide the following information

- Check the account to be used for the deduction

- Account name

- Bank name

- Account number

- Routing number

Step 4 – Account Holder’s Final Authorization and Signature

- The account holder must read the authorization statement at the end of the form

- Enter an amount agreed upon between the parties, that will be charged, in the event the attempt at deducting the payment, fails

- Again enter the merchant’s name, allowing permission for them to continue to deduct payment for up to 30 days after the attempt has failed

- The account holder must then enter their signature

- Date of signature in mm/dd/yyyy format