Updated May 13, 2024

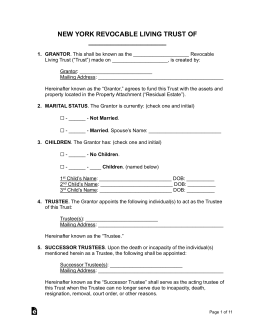

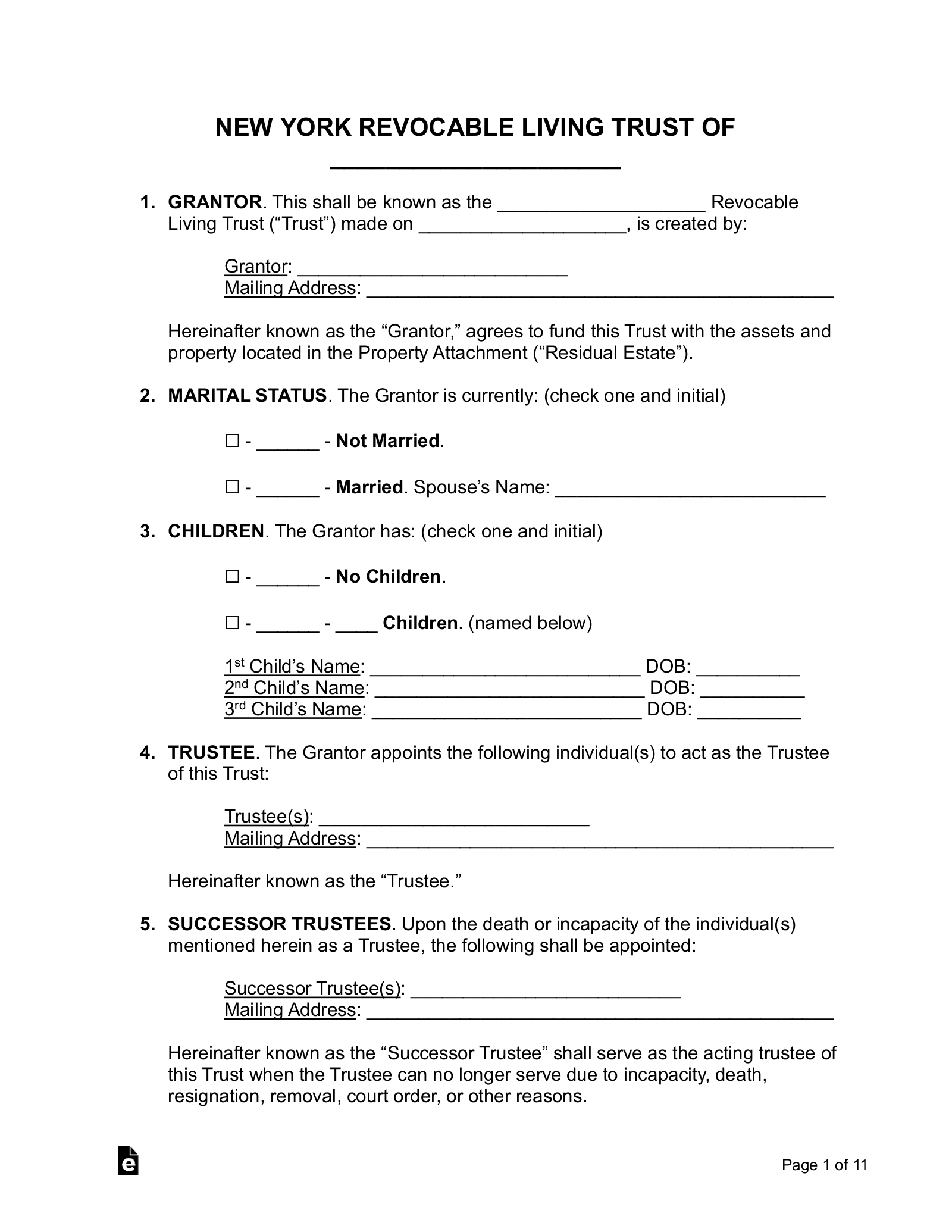

A New York living trust is a legal document wherein a person’s property and assets are transferred into the hands of a trustee to be managed until the individual’s death. Upon the death of the person who created the trust, known as the “grantor,” their assets are immediately distributed to their beneficiaries, avoiding the lengthy probate process.

Requirements (2)

Registration

Charitable trusts must be registered with the New York State Attorney General. The trustee must file a copy of the trust instrument and either Form CHAR001-LT, if it is a charitable lead trust, or Form CHAR001-RT, if it is a charitable remainder trust.[3]

Laws

Amending/Revoking – A living trust is considered irrevocable unless the terms of the trust expressly state that it is revocable.[4] Any amendment or revocation must be in writing and acknowledged, unless the terms of the trust state otherwise.[5]

Bond Requirement – The trustee may be required by the court to give a bond in order to receive letters of administration[6] or if they move out of state.[7]

Certification of Trust – There is no statewide statute in New York governing the use of certifications of trust in regard to living trusts.

Co-Trustees – Unless contradicted by the terms of the trust, if there are three or more co-trustees, they may act by majority decision. If there are only two co-trustees, they must act jointly.[8]

Contesting a Trust – Any action to contest the validity of a trust must be commenced within six years of the grantor’s death.[9]

Costs Related to the Trust – With respect to the allocation of receipts and expenditures, the trustee must act in accordance with the terms of the trust or in a way that would be deemed reasonable and equitable by an outside observer.[10]

Jurisdiction – If a living trust has assets in New York, or if the acting trustee resides in the state, the surrogate’s court of the county where the assets or trustee are located has jurisdiction over the trust.[11]

Oral Trusts – A living trust must be in writing.[12] The State of New York does not recognize oral trusts.

Pet Trusts – A trust may be validly created for the care of a designated domestic or pet animal. The trust terminates when the animal beneficiary or beneficiaries are no longer alive.[13]

Signing Requirements – The grantor and trustee must formally acknowledge the execution of the trust in front of a notary or in front of two witnesses who must also sign the trust instrument.[2]

Spendthrift Provision – A beneficiary’s interest in income from trust property may not be transferred, whether by assignment or otherwise, unless the power to transfer their interest is expressly given to the beneficiary by the terms of the trust.[14]

Trustee’s Compensation – The trustee may receive commissions on the principal or property paid out from the trust at a rate of 1%. The trustee is also entitled to compensation for any legal services they performed in the administration of the trust.[15]

Trustee’s Duties – The trustee must follow the prudent investor standard and exercise reasonable caution in administering the trust in accordance with its terms and purposes.[16] They must also administer the trust in the interest of the beneficiaries.[17]

Trustee’s Powers – Unless contradicted by the terms of the trust or a court decree, the trustee is empowered to accept additions to the trust, invest and reinvest trust property, and perform other transactions in the administration of the trust.[18]

Sources

- EPTL § 7-1.14

- EPTL § 7-1.17(a)

- New York State Attorney General – Trusts and Estates

- EPTL § 7-1.16

- EPTL § 7-1.17(b)

- SCP § 710(2)

- SCP § 710(3)

- EPTL § 10-10.7

- CPLR § 213

- EPTL § 11-2.1(a)(1)

- SCP § 207(1)

- EPTL § 7-1.17(a)

- EPTL § 7-8.1(a)

- EPTL § 7-1.5(a)(1)

- SCP § 2309(1)

- EPTL § 11-2.3(b)(2)

- EPTL § 11-2.1(a)(1)

- EPTL § 11-1.1(b)