Updated May 31, 2024

A commercial lease application is completed by a potential tenant and reviewed by a landlord to verify a business’s income and liabilities. The landlord is recommended to charge an application fee for conducting the credit check. The applying tenant may be asked to produce past tax returns and bank statements to prove the business’s revenue and profit.

How to Screen a Commercial Tenant (7 steps)

- Obtain the Rental Application

- Verify the Business with the State

- Obtain the Business’s PAYDEX Score

- Obtain Personal Credit Check

- Contact References

- Personal Guarantee

- Making the Decision

1. Obtain the Rental Application

The landlord must first receive the application from the tenant with most or all the details entered. From here the landlord will be able to view the information and make an instant decision of whether or not the business is deemed worthy of the space.

If so, the landlord will need to begin verifying the information that was entered by the tenant.

2. Verify the Business with the State

All 50 States have a Secretary of State’s office or equivalent where an entity may be looked up to ensure it is currently in good standing with the respective State. If the entity is not in good standing then they may not be able to conduct financial transactions.

3. Obtain the Business’s PAYDEX Score

Once the business has been verified it will now need to have a credit check conducted. This can be completed by using one of the following third (3rd) party services:

- Experian – $49.95 for a one (1) time report (See Sample)

- Nav.com – $24.95 / month (cancel anytime)

- Dun & Bradstreet – $61.99 per report

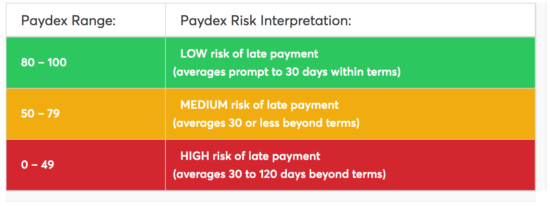

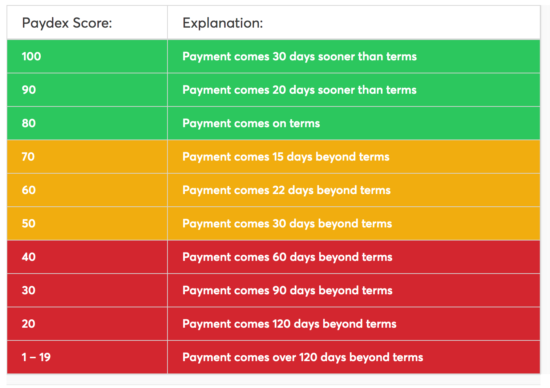

After you have conducted your search you will receive a PAYDEX score from 1 to 100 based on the business’s credit worthiness. The higher the score the better.

Below is an explanation of the PAYDEX score:

4. Obtain Personal Credit Check

In addition to viewing the financials of the company the owners should also have their credit checked. A standard personal credit check is more commonly known as a score between 300 to 850 (highest being the best). You can obtain a detailed credit score through one (1) of the following sources:

- RentPrep.com – $28

- ScreeningWorks.com – $30

- MyRental.com – $30

- E-Renter.com – $32

A credit score of a commercial tenant is expected to be at a minimum of 700 for it to be considered credible. This is an above-average rating although due to the legal and financial liability that comes with commercial property an added creditworthiness should be required when leasing to businesses.

5. Contact References

Depending on what was entered by the applicant, the landlord will need to verify their tenant’s rental history, bank account balances, and any credit references. All of these references may be conducted over the phone. The applicant’s bank may request to see the consent and signature on the rental application before informing the landlord of any bank balances.

6. Personal Guarantee

If the landlord is debating whether or not to accept the applicant a personal guarantee should be added to the lease. This would ensure to the landlord that even if the business fails in the space that is being rented the person that “guarantees the lease” will continue paying rent until the expiration of the lease.

7. Making the Decision

If the tenant is accepted, a commercial lease should be drafted, agreed to, and signed by the parties. If the tenant was declined, the landlord should authorize a tenant rejection letter and describe the reasons why they were denied.

Related Forms

Commercial Lease Agreement – Use after the tenant has been accepted to write a legal contract between the landlord and tenant.

Commercial Lease Agreement – Use after the tenant has been accepted to write a legal contract between the landlord and tenant.

Download: PDF, MS Word, OpenDocument

Residential Rental Application – Use for an applicant looking for an application for a room, apartment, or home.

Residential Rental Application – Use for an applicant looking for an application for a room, apartment, or home.

Download: PDF, MS Word, OpenDocument