Updated August 02, 2022

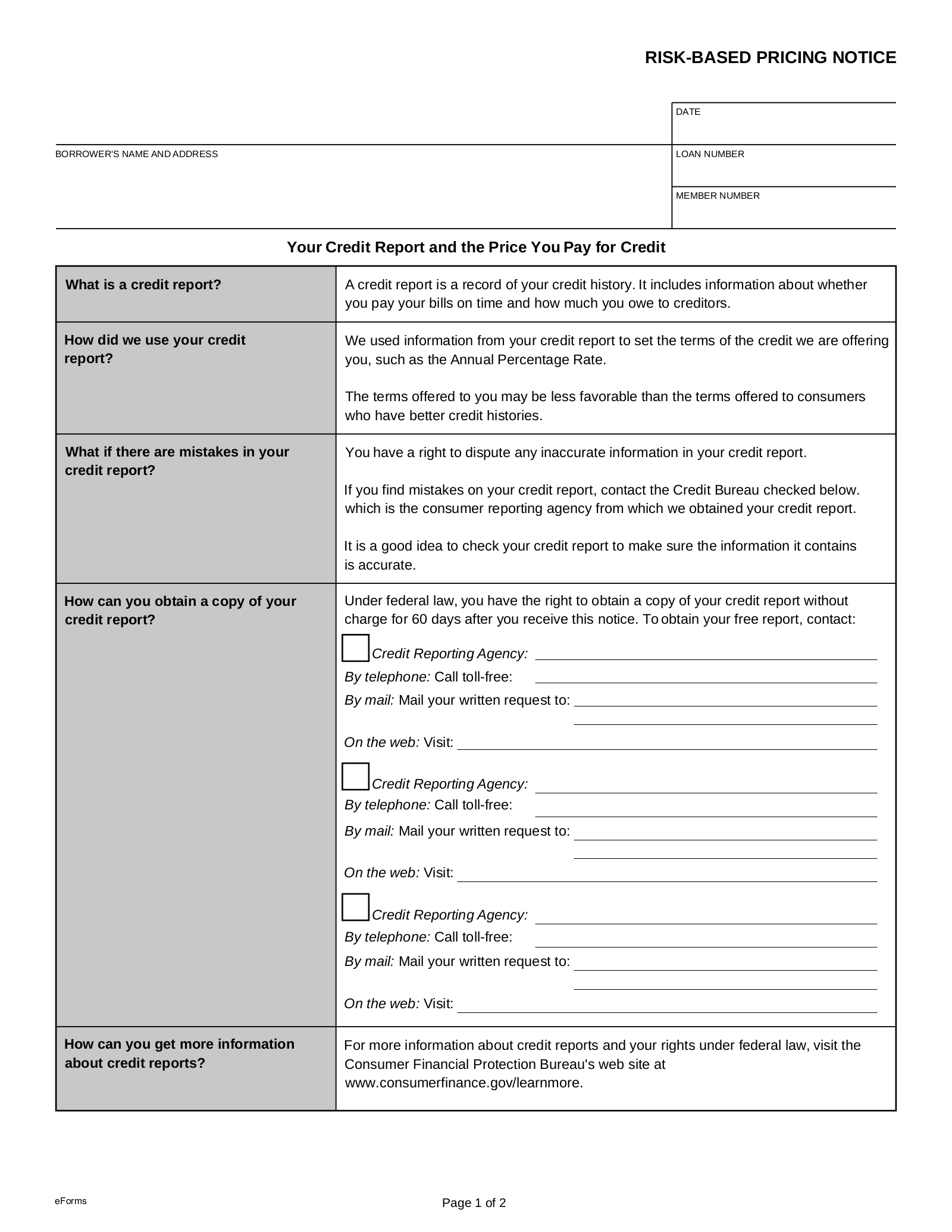

A risk-based pricing notice is given to an individual when offered “less favorable” financing or material terms—such as a higher annual percentage rate (APR) or a higher deposit requirement—based on their consumer credit report. The notice makes a disclosure to the applicant that their credit report was used in the process of determining their creditworthiness. In addition, it outlines the weaknesses in their credit history and gives a valid reason for the less-than-favorable rate.

Under the Fair Credit Reporting Act and its provisions on risk-based pricing, a creditor is required to provide a written or verbal notice to any applicants who are denied or offered unfavorable rates based on their credit report. This disclosure must be provided after the rates have been set—but before the applicant is contractually obligated.

A creditor is also legally required to notify customers if a credit report is used to increase the interest rate for an existing line of credit.

Statute – 12 CFR § 1022.72

Common Use

- Loans (auto, student, etc.);

- Mortgages (fixed or variable); and

- Credit cards (secured and unsecured)

Pricing Methods (3)

Under the requirements set forth in the risk-based pricing rules, a lender issuing credit under risk-based pricing can identify which customers must legally receive a notice by using one of three methods:

Direct Comparison Method

In this approach, a creditor compares the material terms offered to one applicant with the terms offered to others for the same type of financing product. If, by comparison, the applicant is only eligible for less-favorable terms due to information or potential risk identified on their credit report, the creditor must provide a risk-based pricing notice to this individual. Due to this method’s difficulty in practice, it is not commonly used.

Credit Score Proxy Method

If an applicant’s credit score is used to determine the material terms offered, the creditor can employ the “40/60” proxy method by taking all or a sample of their customers’ credit scores and calculating a score that places 40% of them above the cutoff and 60% under. Applicants whose credit scores fall below the 40/60 cutoff must receive a risk-based pricing notice.

Under this method, the cutoff score must be re-calculated at least every two years. If a creditor uses more than one credit score to determine the terms of credit granted, the same method must be used to calculate the cutoff score. And if a customer does not have a credit score available, the creditor must still provide a risk-based pricing notice.

For new creditors whose customer base cannot provide sufficient data, their 40/60 cutoff point can be determined by market research or third-party data—for up to one year. After a year, the cutoff point must be recalculated using their own customers’ credit scores.

Tiered Pricing Method

The tiered pricing method allows the creditor to place customers in pricing tiers based on their credit reports and issue their material terms accordingly. This means that those in the top tiers are likely to receive the lowest APR, while customers in the bottom tiers are only eligible for credit under higher rates.

For pricing methods that have four tiers or fewer, all customers not in the very top tier must be given a risk-based pricing notice. For five or more pricing tiers, customers below the second tier must be notified. Generally, a risk-based pricing notice is required for all customers who fall below the top 30% to 40% of the pricing tiers.