Updated July 19, 2023

An adverse action notice is a document sent to an individual when their application is denied because of a credit report or a background check, also known as a “consumer report.” Under the Fair Credit Reporting Act (FCRA), this notice is legally required when a person is denied employment, housing, credit, or insurance.[1]

Notice Requirements (FCRA)

An adverse action notice must include the following requirements:

-

- Rejection notice. Informs an applicant that they were rejected (adverse action);

- Required statement. A statement that the decision was made in part by a consumer report and not specifically by the consumer reporting agency;[2]

- Agency details. The name, address, and telephone number of the consumer reporting agency;

- Dispute. The applicant has the right to dispute the accuracy or completeness of any information made on the consumer report; and

- 60 days. That they may obtain the consumer report within 60 days.

Source: 15 U.S. Code § 1681m(a)[3]

Table of Contents |

By Type (8)

Background Check Adverse Action Notice – For any criminal history check. Background Check Adverse Action Notice – For any criminal history check.

Download: PDF, MS Word, OpenDocument |

Credit Report Adverse Action Notice – For any credit check. Credit Report Adverse Action Notice – For any credit check.

Download: PDF, MS Word, OpenDocument |

Employment Adverse Action Notice – Directed towards any report generated related to employment. Employment Adverse Action Notice – Directed towards any report generated related to employment.

Download: PDF, MS Word, OpenDocument |

Landlord (Tenant) Adverse Action Notice – Informing a tenant that their housing application was denied. Landlord (Tenant) Adverse Action Notice – Informing a tenant that their housing application was denied.

Download: PDF, MS Word, OpenDocument |

Loan Adverse Action Notice – For any denied credit, advance, or financing. Loan Adverse Action Notice – For any denied credit, advance, or financing.

Download: PDF, MS Word, OpenDocument |

Mortgage Adverse Action Notice – For the rejection of mortgage applications only. Mortgage Adverse Action Notice – For the rejection of mortgage applications only.

Download: PDF, MS Word, OpenDocument |

Pre-Adverse Action Notice – For employers that have found an issue with an employee’s background. It gives them a chance to explain the problem. Pre-Adverse Action Notice – For employers that have found an issue with an employee’s background. It gives them a chance to explain the problem.

Download: PDF, MS Word, OpenDocument |

Risk-Based Pricing Notice – A lender offers “less favorable” financing to an individual. Risk-Based Pricing Notice – A lender offers “less favorable” financing to an individual.

Download: PDF |

What is a Consumer Report?

A consumer report is a profile generated by a reporting agency using public records to determine an individual’s creditworthiness and character. Employers, landlords, and lenders use it to build a profile of an individual. Depending on the requested details, a small fee is usually associated with producing a consumer report, usually between $19 to $75.

Definition

The term “consumer report” means any written, oral, or other communication of any information by a consumer reporting agency bearing on a consumer’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living which is used or expected to be used or collected in whole or in part for the purpose of serving as a factor in establishing the consumer’s eligibility for:

(A) credit or insurance to be used primarily for personal, family, or household purposes;

(B) employment purposes; or

(C) any other purpose authorized under this title.[4]

Source: 15 U.S. Code § 1681a(d)(1)[5]

Authorization

It is generally necessary to obtain the applicant’s consent to collect the consumer reports forming the basis of an adverse action notice decision. This request involves:

- Explaining that a consumer report of some kind will occur as a part of processing the application;

- Laying out the applicant’s rights under the FCRA and the Equal Credit Opportunity Act; and

- Obtaining a signature to authorize receiving the report.

It’s common to include authorizations of this kind in the application itself. For example, they are often a part of rental applications and job applications.

‘Ban the Box’

Many states and local governments have recently passed laws limiting employers’ ability to use a job applicant’s criminal history to deny a position. These requirements, also known as “Ban the Box” laws, eliminate the “checkbox” that often appears on a job application asking whether the applicant has past criminal convictions.

These laws do not necessarily prevent employers from considering criminal history in hiring decisions. However, they may limit the stage of the hiring process at which they remain eligible, something that should be made clear in obtaining authorization to obtain consumer reports. In New York City, for example, the law prevents employers from describing these reports as a “background check.

These vary considerably from state to state. In some cases, they only apply to employers of a specific size, and in others, they do not apply to private employers.

Who is Required to Provide an Adverse Action Notice?

It is the responsibility of the person receiving and denying an application for credit, employment, a place to live, or other benefits to sending the adverse action notice. Because federal law requires these notices, failing to provide one when required exposes a person or company to potentially serious consequences. Applicants who do not receive an adverse action notice or receive one that is deficient or lacking can file a report with the Equal Employment Opportunity Commission. A pattern and practice of failing to provide notice can result in a penalty of $3500 per violation.

It’s also important to remember that the notice specifies it is from the person or company to which the applicant applied. Contracting the tasks associated with adverse action notices to third parties is common, such as obtaining credit reports and mailing the notice. This activity is permitted, but the notice must indicate that the entity receiving the application, not the one sending the notice, made the adverse decision and is responsible for the notice.

Adverse Action Notice Exceptions

Although employers, landlords, bankers, and others should take seriously the responsibility to deliver an adverse action notice, they are not required to provide one every time they do something that is not in the interest of an applicant. The law around adverse action notices defines instances of denials that do not require an adverse action notice, including:

- Changes that were agreed to by an applicant;

- Changes that result from an account’s inactivity, delinquency, or default;

- Denials of credit made at the point of sale;

- Declining to extend credit when it is legally prohibited; and

- Refusing to extend a type of credit because the company or entity does not offer it.

Credit Score

One of the most commonly used resources in situations that require creating an adverse action notice is the credit score. A credit score is a three-digit number that is based on several types of information—including a person’s payment history, existing debt, and how much of their available credit they are currently using.

It’s normal for credit scores to vary based on when they are checked, the type of data relied on, and the model of the company that is creating the score. Despite this variation, credit scores are often among the most influential data relied on by car dealerships, mortgage lenders and other credit providers.

As a result, federal law requires that companies disclose a potential customer’s credit score in an adverse action notice if the information was “used” by the person or company making the decision. The term “used” can be somewhat vague, but providers of adverse action notices should err on the side of caution when it comes to including credit scores: the credit score should be included if it was a factor in the decision, even if it was not a “significant factor.”

Disposal of Records

The law around adverse action notices requires that companies make the materials on which they based their decision available to the person impacted. For most businesses, this means holding on to the records for at least 60 days after they deliver the adverse action notice.[6] However, once the period for the affected person to ask to view the records has passed, the company that sent the adverse notice has an obligation to destroy the records obtained about that person to protect their privacy.

Sample Landlord Adverse Action Notice

ADVERSE ACTION NOTICE

[DATE]

[LANDLORD NAME]

[STREET ADDRESS]

Dear [RECIPIENT NAME],

Thank you for applying to rent [ADDRESS OF PROPERTY APPLIED FOR]. Unfortunately, I cannot approve your application at this time due to our review of information obtained through a consumer report.

I made this decision, not the reporting agency, but you have the right to contact the consumer reporting agency to obtain the report that was the basis of my decision. Here is their information.

Consumer Reporting Agency: [AGENCY NAME]

Telephone: [TELEPHONE NUMBER]

Mailing Address: [FULL ADDRESS]

Under federal law, you have the right to obtain the report used in this decision within sixty (60) days of this notice. If, after receiving the report, you find that there are errors or omissions, you may dispute any aspect of the consumer reporting’s agency report. To do so, you must contact them directly.

I appreciate your understanding, and best of luck in the future.

Sincerely,

_________________________

Sample Employer Adverse Action Notice

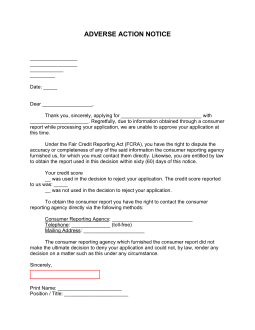

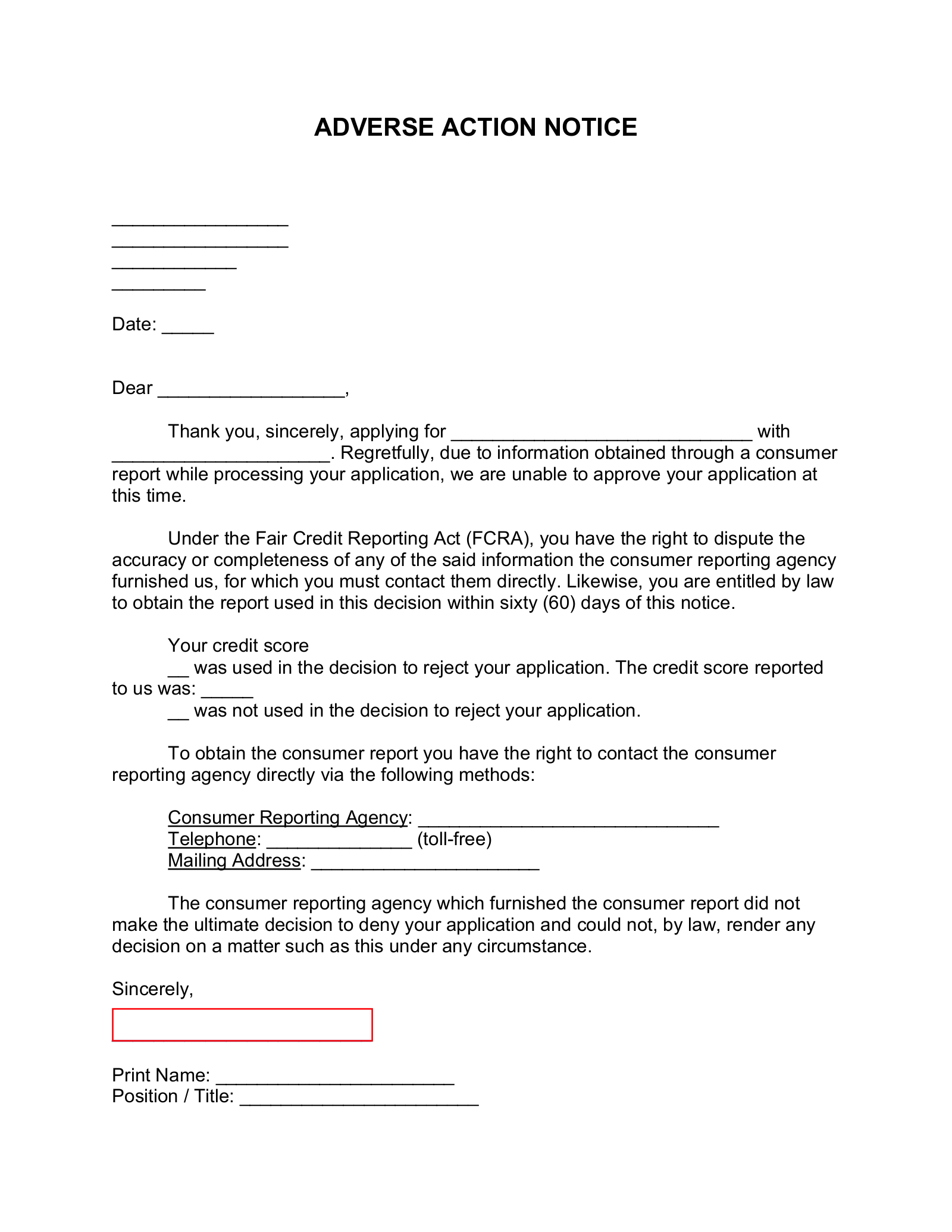

ADVERSE ACTION NOTICE

[DATE]

[COMPANY NAME]

[STREET ADDRESS]

Dear [APPLICANT NAME],

Thank you for applying for [POSITION] with [COMPANY]. Regretfully, due to information obtained through a consumer report while processing your application, we are unable to approve your application at this time.

Under the Fair Credit Reporting Act (FCRA), you have the right to dispute the accuracy or completeness of any of the information in the consumer on which we partially based our decision. To do so, you must contact the agency we hired to prepare the report directly. You are entitled by law to obtain the report used in this decision within sixty (60) days of this notice.

To obtain the report you have the right to contact the reporting agency directly via the following methods:

Consumer Report Agency: [AGENCY NAME]

Telephone: [TELEPHONE NUMBER]

Mailing Address: [FULL ADDRESS]

The agency which furnished the consumer report did not make the ultimate decision to deny your application and could not, by law, render any decision on a matter such as this under any circumstance.

Sincerely,

_________________________