Updated June 22, 2023

An insurance assignment allows a beneficiary (assignor) to transfer all or a portion of the proceeds to someone else (assignee). This is especially common with life insurance when a family does not have the money to pay for the funeral expenses and chooses to assign a portion of the decedent’s life insurance proceeds to cover the funeral costs.

Can be Used for

- Collateral on a loan;

- Transferring benefits;

- Transfer claims; and

- Paying debts related to the policyholder.

Assigning Life Insurance Proceeds

When assigning life insurance proceeds (such as to a funeral home), the beneficiary will commonly assign the costs for the specific service only (not the entire life insurance amount).

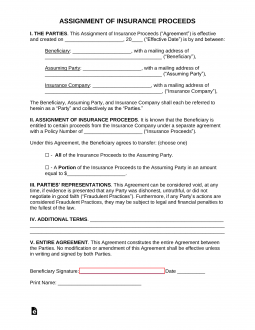

Sample Insurance Assignment

Download: PDF, MS Word, OpenDocument

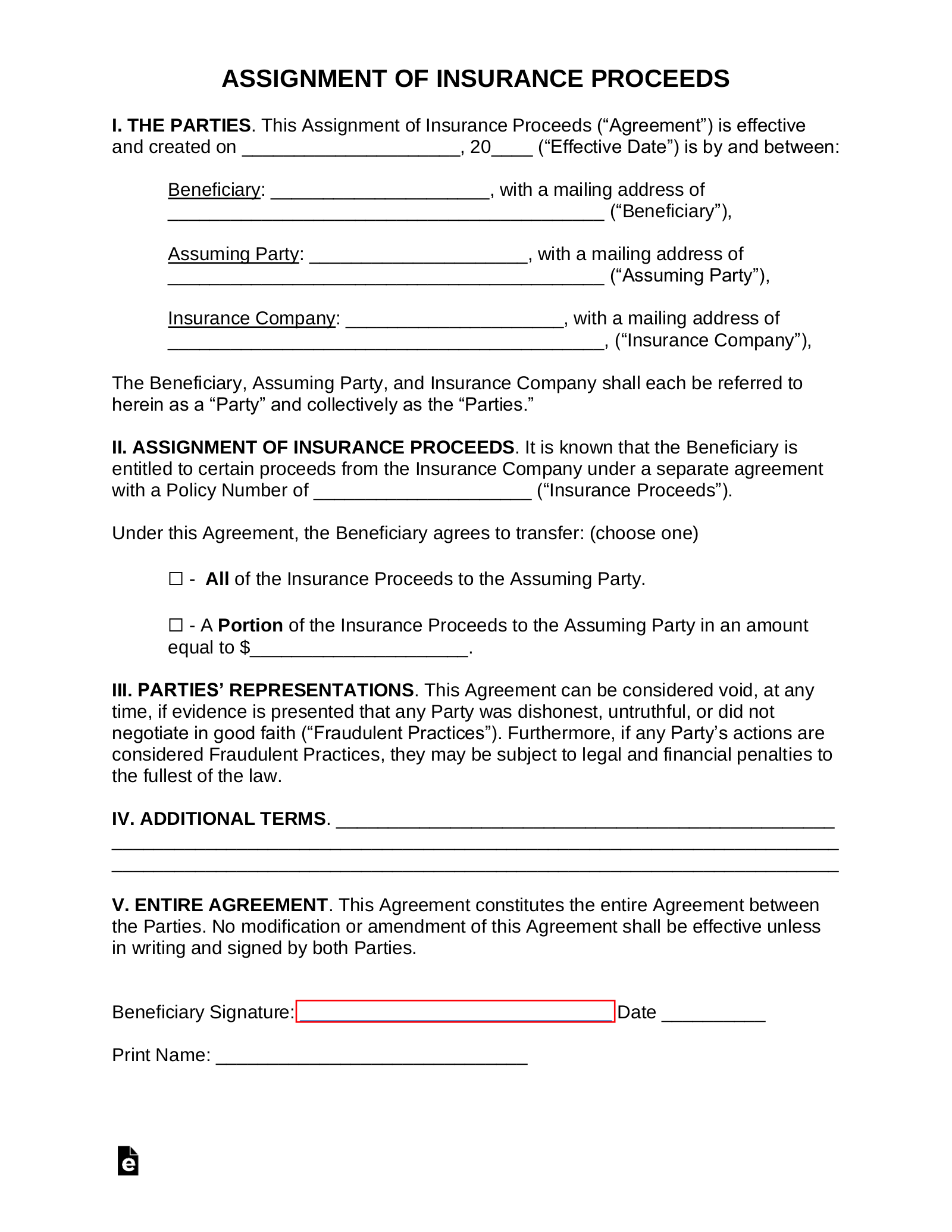

ASSIGNMENT OF INSURANCE PROCEEDS

I. THE PARTIES. This Assignment of Insurance Proceeds (“Agreement”) is effective and created on [DATE] (“Effective Date”) is by and between:

Beneficiary: [BENEFICIARY’S NAME], with a mailing address of [BENEFICIARY’S MAILING ADDRESS] (“Beneficiary”),

Assuming Party: [ASSUMING PARTY’S NAME], with a mailing address of [ASSUMING PARTY’S ADDRESS] (“Assuming Party”),

Insurance Company: [INSURACE COMPANY’S NAME], with a mailing address of [INSURACE COMPANY’S MAILING ADDRESS] (“Insurance Company”),

The Beneficiary, Assuming Party, and Insurance Company shall each be referred to herein as a “Party” and collectively as the “Parties.”

II. ASSIGNMENT OF INSURANCE PROCEEDS. It is known that the Beneficiary is entitled to certain proceeds from the Insurance Company under a separate agreement with a Policy Number of [INSURANCE POLICY NUMBER] (“Insurance Proceeds”).

Under this Agreement, the Beneficiary agrees to transfer: (choose one)

☐ – All of the Insurance Proceeds to the Assuming Party.

☐ – A Portion of the Insurance Proceeds to the Assuming Party in an amount equal to $[PORTION OF DEBT AMOUNT].

III. PARTIES’ REPRESENTATIONS. This Agreement can be considered void, at any time, if evidence is presented that any Party was dishonest, untruthful, or did not negotiate in good faith (“Fraudulent Practices”). Furthermore, if any Party’s actions are considered Fraudulent Practices, they may be subject to legal and financial penalties to the fullest of the law.

IV. ADDITIONAL TERMS. [ADDITIONAL TERMS & CONDITIONS]

V. ENTIRE AGREEMENT. This Agreement constitutes the entire Agreement between the Parties. No modification or amendment of this Agreement shall be effective unless in writing and signed by both Parties.

Beneficiary Signature: ______________________________ Date __________

Print Name: ______________________________

How to Write

Download: PDF, MS Word, OpenDocument

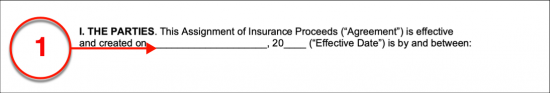

I The Parties

(1) Assignment Effective Date. The first day this document makes its assignment conditions and terms active should be established at the beginning of the first article.

(2) Beneficiary. The Insurance Policy Beneficiary will have to be identified for this assignment to function properly. This will be the Party who is designated on the concerned insurance policy as the Recipient of its benefits (i.e. payment). Produce this Beneficiary’s full name and address.

(3) Assuming Party. The Party who shall be entitled to some or all of the beneficiary payout of the concerned insurance policy must be named and his or her mailing address documented.

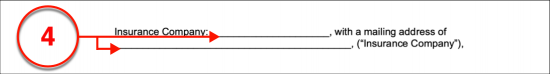

(4) Insurance Company. The name of the Insurance Company where the policy is held must be presented in its entirety. This must be its legal name including the status suffix it was registered under as an Entity.

II. Assignment Of Insurance Proceeds

(5) Policy Number. Identify the policy number the Insurance Company has assigned to the account where the discussed payments shall originate.

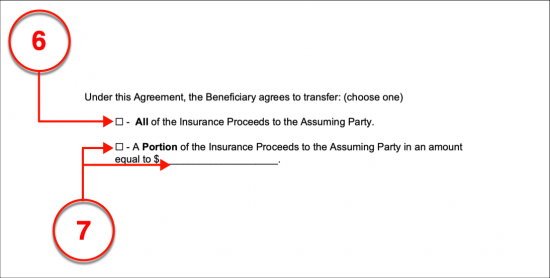

(6) Assigning All Proceeds. The Beneficiary must establish the portion of the payment that will be assigned to the Assuming Party. If this assignment will, however, deliver the entire insurance payment to the Assuming Party then the language of the first checkbox statement should be adopted as the definition to the second article. To arrange for the full dollar amount of the insurance proceeds to be assigned to the Assuming Party, select the first checkbox statement.

(7) Designating A Portion Of Proceeds. As mentioned, the Beneficiary may only need to assign a portion of the insurance proceeds to the Assuming Party. This can be done with a selection of the second checkbox statement available. This definition will need the exact dollar amount to be delivered to the Assuming Party documented where requested.

IV. Additional Terms

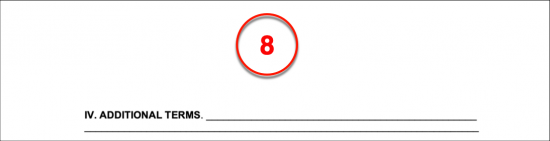

(8) Full Terms And Conditions. This assignment must be fully defined before it is signed. Therefore, if there are any specifics that have not been covered thus far then present them as “Additional Terms” in the space provided.

V. Entire Agreement

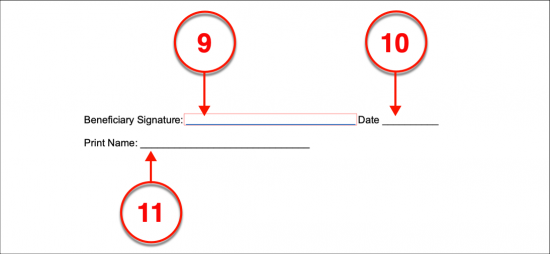

(9) Beneficiary Signature. The intent of the Beneficiary to release funds from an insurance policy through this assignment must be verifiable. To this end, the Beneficiary must sign this assignment under the direction of an active Notary Public.

(10) Date. Immediately after signing this document, the Beneficiary must document the current date.

(11) Printed Name.

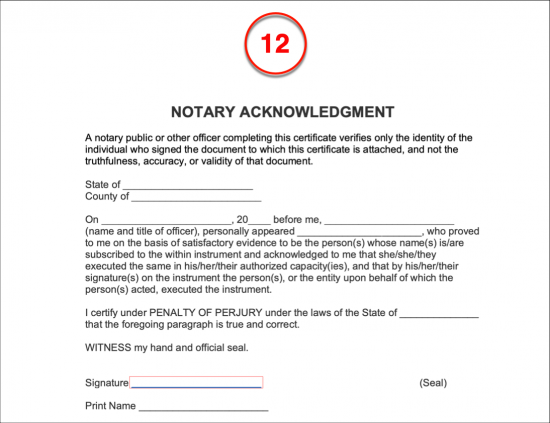

Notary Acknowledgment

(12) Notarization. As mentioned, it is imperative that the Beneficiary’s signature can be verified as an authentic signature. The Notary Public will be able to show the Beneficiary’s identity and signing as verifiable through the notarization process. Thus, only the Notary Public who has completed the notarization process on the provided signature can supply the acknowledgment needed in the final section.