Updated September 14, 2023

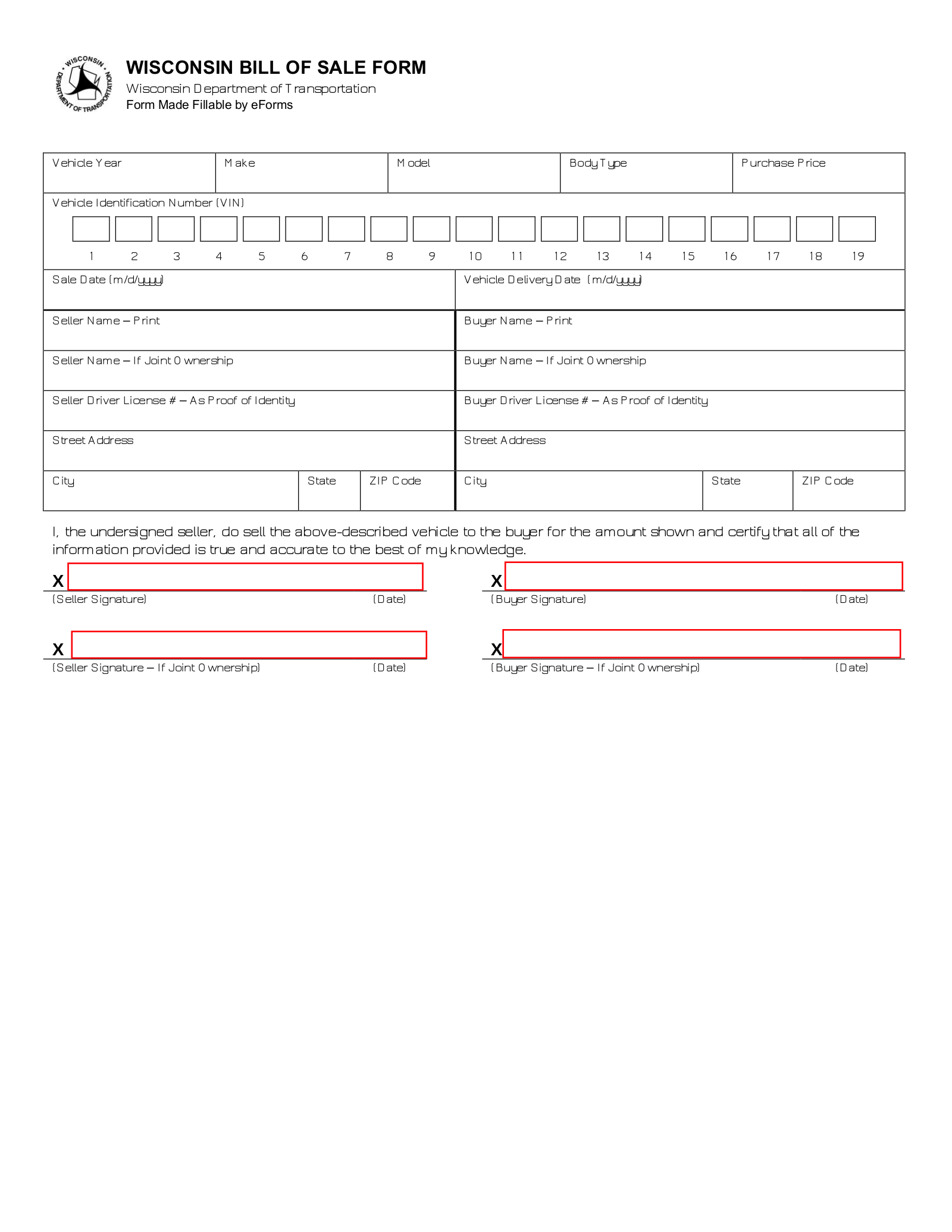

A Wisconsin motor vehicle bill of sale is a document that records and formalizes the legal transfer of ownership of a vehicle in the State of Wisconsin. The bill of sale should provide identifying information about the buyer and the seller, a description of the vehicle, and a listing of the terms of the exchange. The form is not required when selling a motor vehicle, although it can be helpful for an individual’s records or in subsequent permit applications.

Signing Requirements – Both the buyer and the seller must sign.

Table of Contents |

Registering a Vehicle

Wisconsin residents must register vehicles that they intend to use on Wisconsin roads. If the vehicle is purchased at a dealership, the dealer will traditionally handle these responsibilities on the buyer’s behalf, but for the transactions between private parties, the buyer must take affirmative steps to register. The state does not set a deadline for how quickly the registration process must be initiated after purchasing a vehicle, stating only that it should be done “immediately.”[1] (Those waiting on registration applications to be processed may use a temporary tag until the process has been completed.) Registration for most vehicles endures for one year, though some smaller vehicles, such as motorcycles and mopeds, may be registered for two-year periods. Subsequent registrations may be renewed online.

Where to Register

For transfers of ownership in which a vehicle titled in Wisconsin is being exchanged, registration may be done online using the eMV Public service. (Note that eMV Public is available for almost all vehicles except for the largest trucks and mobile homes.) Registration for other kinds of transactions must be completed in person at any of the WI DOT Office Locations or by mail.

Required Documents

- The Certificate of Title signed by the previous owner of the vehicle. If there are any alterations or errors on the title, Form MV 2489 is also required

- If not applying online, a Title and License Plate Application (Form MV1)

- A Bill of Sale is not required but is recommended

- Driver’s license or other valid photo ID

- Proof of insurance that meets the minimum state requirements:[2]

- $25,000 for the injury or death of a single person

- $50,000 for the injury or death of more than one person

- $10,000 for damage to property

- A lien release, if the vehicle is subject to a lien at the time of sale

- If the buyer or seller is represented by an agent, a Motor Vehicle Power of Attorney

- Proof of payment of all fees and taxes, including

- The registration fee for the vehicle type

- Local sales tax for the county in which the vehicle buyer resides

- A wheel tax, if driving an eligible vehicle

- Title fee

- If the vehicle is a hybrid or electric car, a fuel surcharge