Updated March 21, 2024

A debt settlement agreement is a contract signed between a creditor and a debtor to re-negotiate or compromise on an outstanding debt. This is usually when a debtor wants to make a final payment or structure a payment plan.

It is recommended that the debtor asks to settle the debt for 25% to 30% when starting negotiations.[1]

Any claims made on the debtor’s credit report should also be removed.

Debt Settlement Facts (2011 to 2020)

The average debtor has the following profile when starting a debt settlement program:

- $28,000 of outstanding debt;

- Average of 6.93 outstanding accounts;

- 74% of debtors pay off at least 1 account;

- Debtors pay off 55% of their outstanding debt;

- 32% write down (and after accounting for settlement fees).[2]

Sample

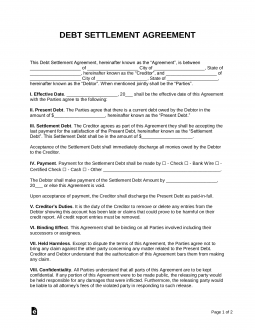

This Agreement is for the negotiation and compromise of a debt under the following terms and conditions:

The Parties. [NAME OF CREDITOR] with a mailing address of [ADDRESS], City [CITY], State of [STATE] shall be known as the “Creditor”. [NAME OF DEBTOR] with a mailing address of [ADDRESS], City of [CITY], State of [STATE] shall be known as the “Debtor”. When mentioned jointly shall be known as the “Parties”.

Debt Settlement. It is understood amongst the Parties that the Debtor has an outstanding debt with the Creditor. Through the mutual interest of the Parties, they agree that this outstanding debt shall be marked as paid if Debtor shall make payment of $[AMOUNT] by [DATE].

Post-Payment. After the payment has been made by the Debtor the Creditor shall make any and all efforts to remove the outstanding debt from the Credit Reporting Agencies. Furthermore, the Creditor declares that they will not make additional information that could harm the Debtor’s credit report.

By signing below, the Parties agree to abide by the terms and conditions of this Agreement.

Debtor’s Signature ______________ Date ______________

Creditor’s Signature ______________ Date ______________