Updated September 22, 2023

Debt letters are used by creditors and debtors to collect, verify, dispute, and settle debts in accordance with the Fair Debt Collection Practices Act. It is highly recommended that any communication between a creditor and debtor be exchanged via certified mail with a return receipt in order to have proof of delivery.

By Type (8)

Credit Report Dispute Letter – Used to dispute a claim, such as amount owed, on a credit report. Credit Report Dispute Letter – Used to dispute a claim, such as amount owed, on a credit report.

Download: PDF, MS Word, OpenDocument |

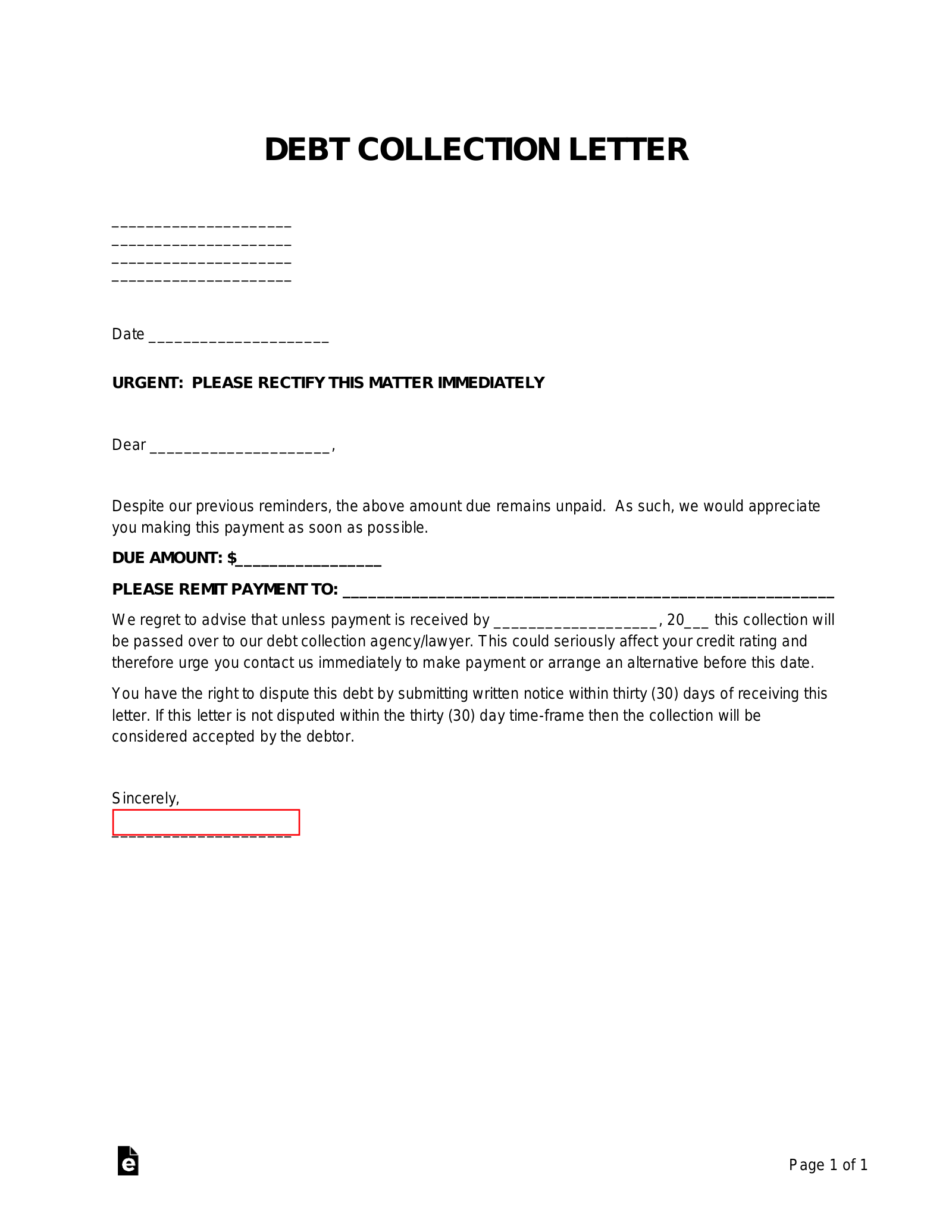

Debt Collection Letter – Used when attempting to collect a debt. Debt Collection Letter – Used when attempting to collect a debt.

Download: PDF, MS Word, OpenDocument |

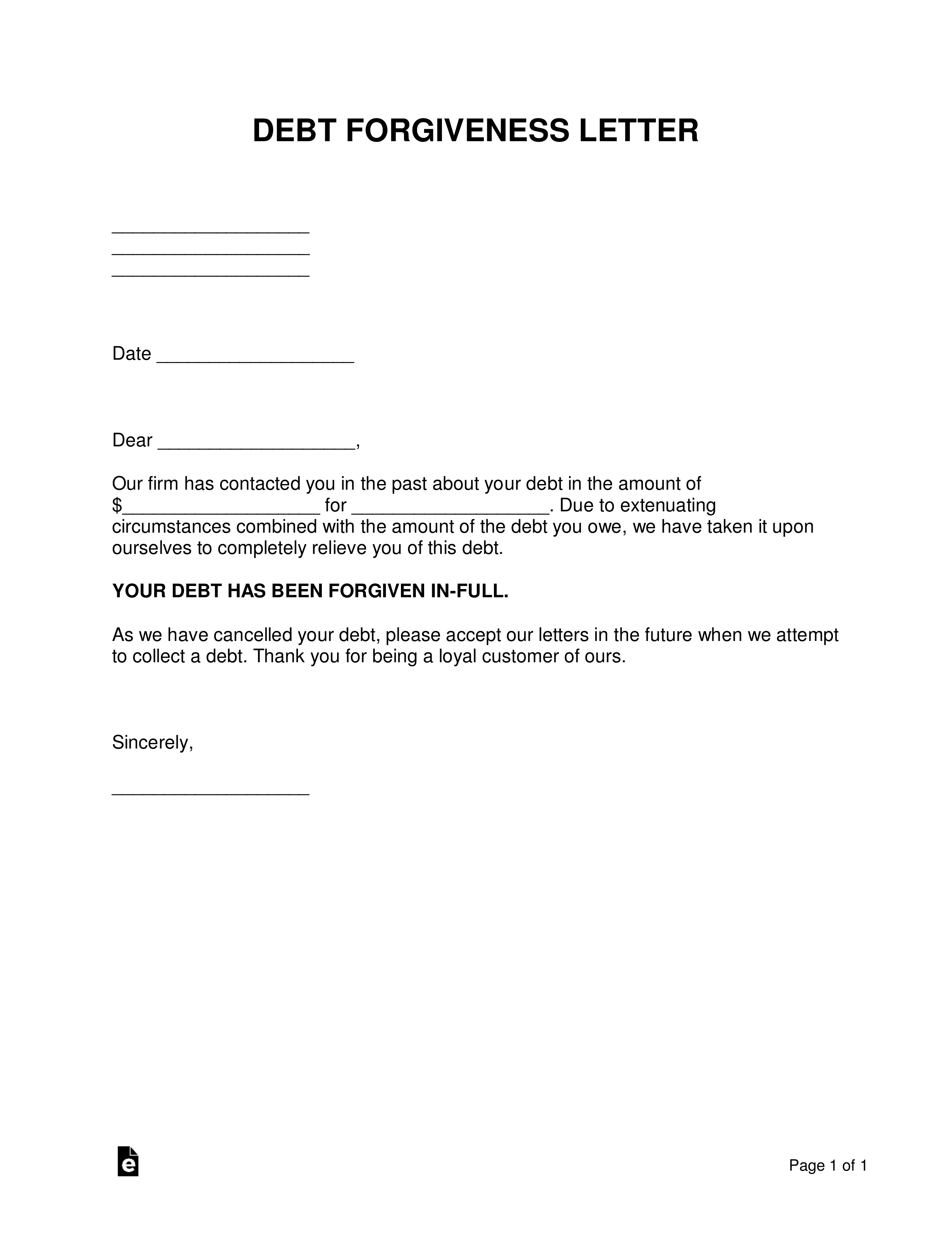

Debt Forgiveness Letter – Used to exonerate an individual or party of their debt in full. Sometimes used by creditors who chooses to “write off” a debt as a loss on their taxes rather than pursue collection. Debt Forgiveness Letter – Used to exonerate an individual or party of their debt in full. Sometimes used by creditors who chooses to “write off” a debt as a loss on their taxes rather than pursue collection.

Download: PDF, MS Word, OpenDocument |

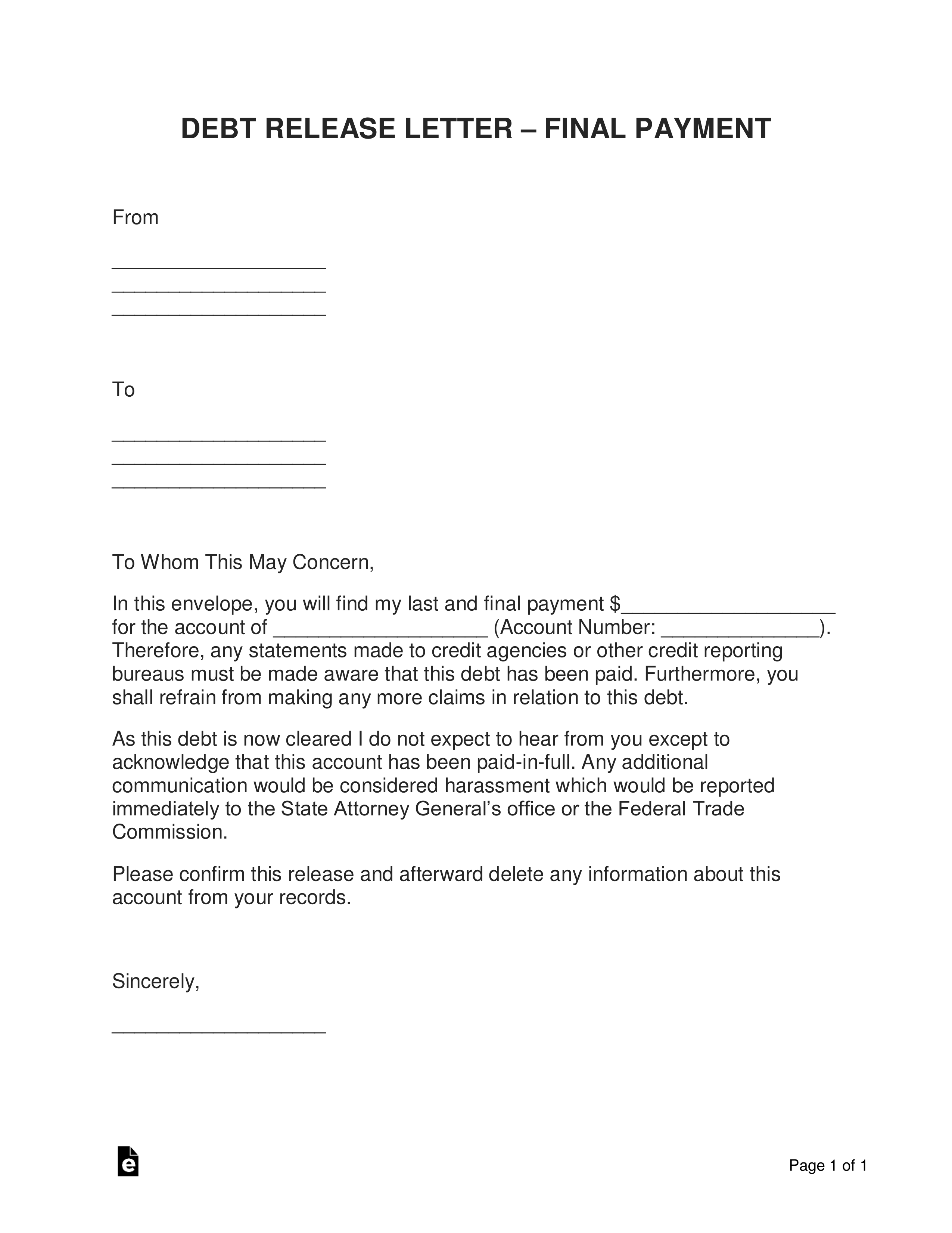

Debt Release Letter – Used as a receipt after a debt has been paid off in full. Debt Release Letter – Used as a receipt after a debt has been paid off in full.

Download: PDF, MS Word, OpenDocument |

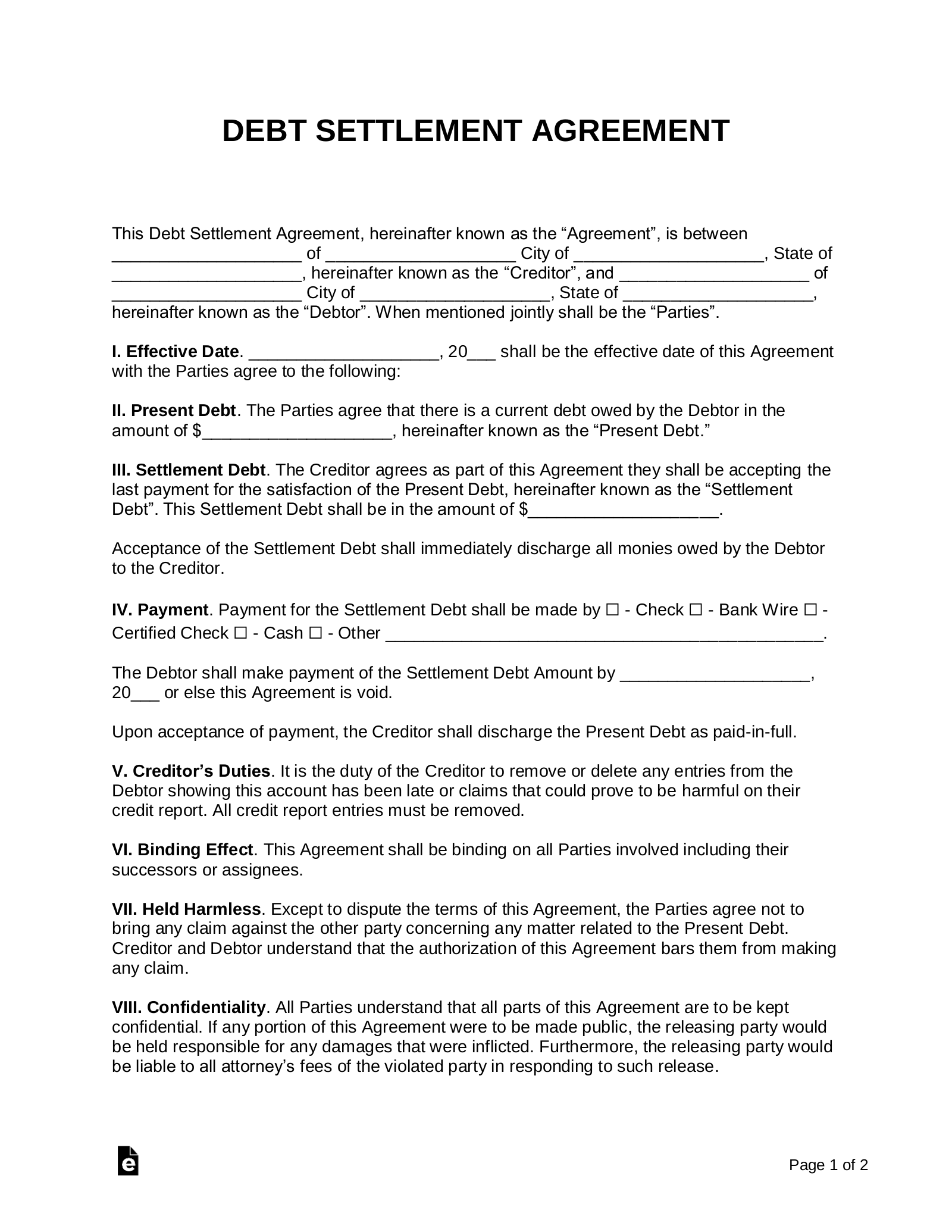

Debt Settlement Agreement – Used when two parties reach an agreement over the resolution of a debt. Debt Settlement Agreement – Used when two parties reach an agreement over the resolution of a debt.

Download: PDF, MS Word, OpenDocument |

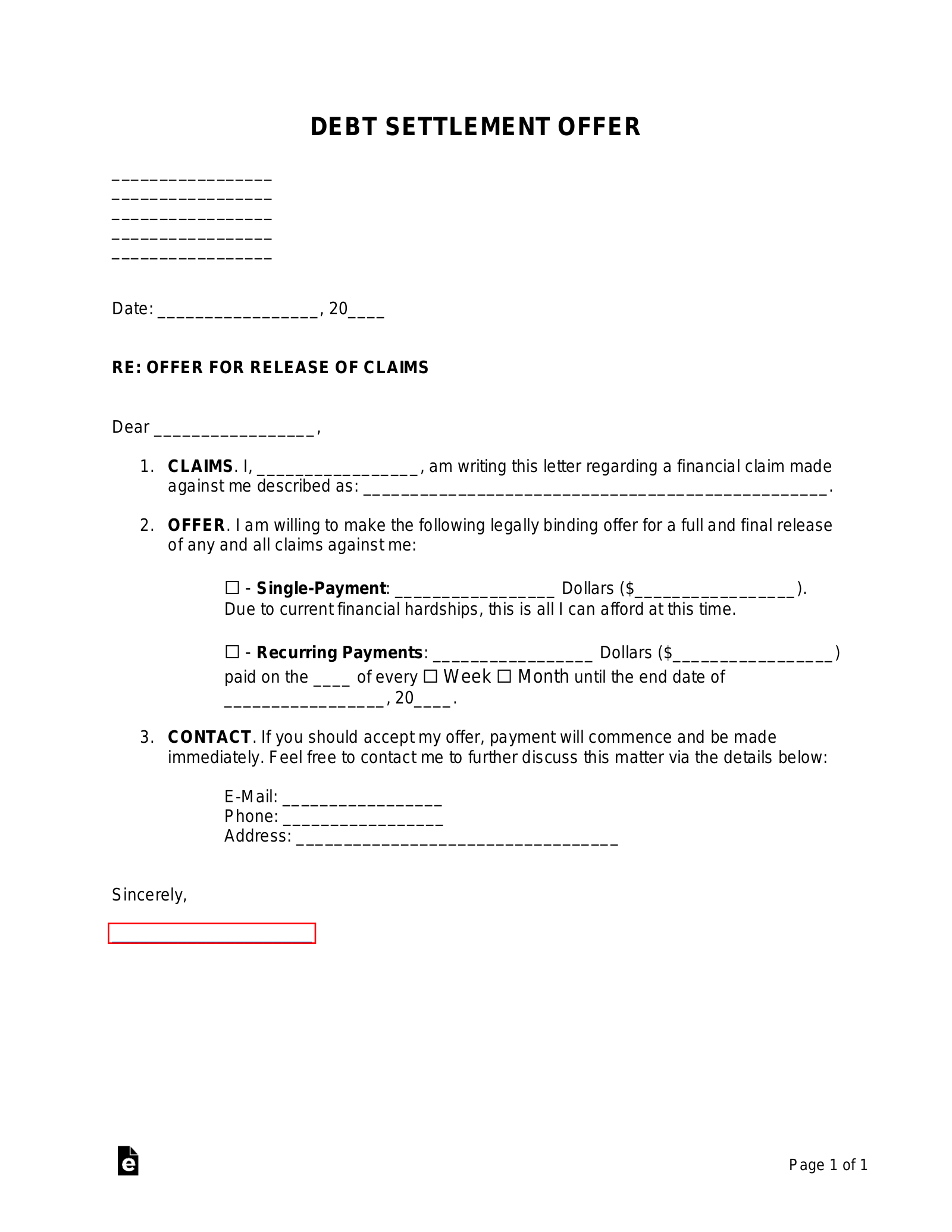

Debt Settlement Offer Letter – Used when making an offer to compromise on a debt owed. This is usually to create a new payment plan. Debt Settlement Offer Letter – Used when making an offer to compromise on a debt owed. This is usually to create a new payment plan.

Download: PDF, MS Word, OpenDocument |

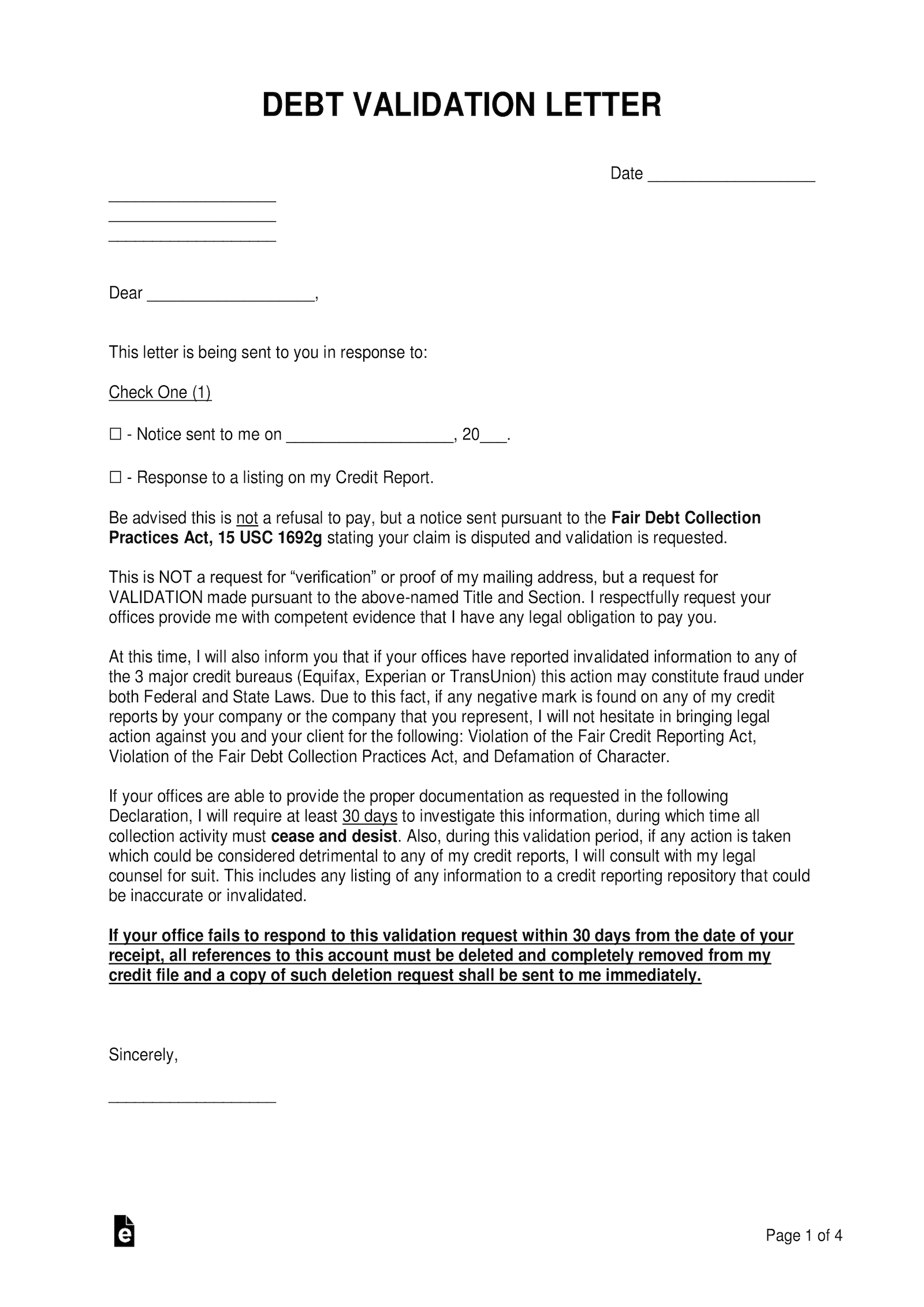

Debt Validation Letter – Used to verify a debt by requesting any and all evidence describing the debt owed. Any individual served with a collection notice reserves the right to validate their debt. Debt Validation Letter – Used to verify a debt by requesting any and all evidence describing the debt owed. Any individual served with a collection notice reserves the right to validate their debt.

Download: PDF, MS Word, OpenDocument |

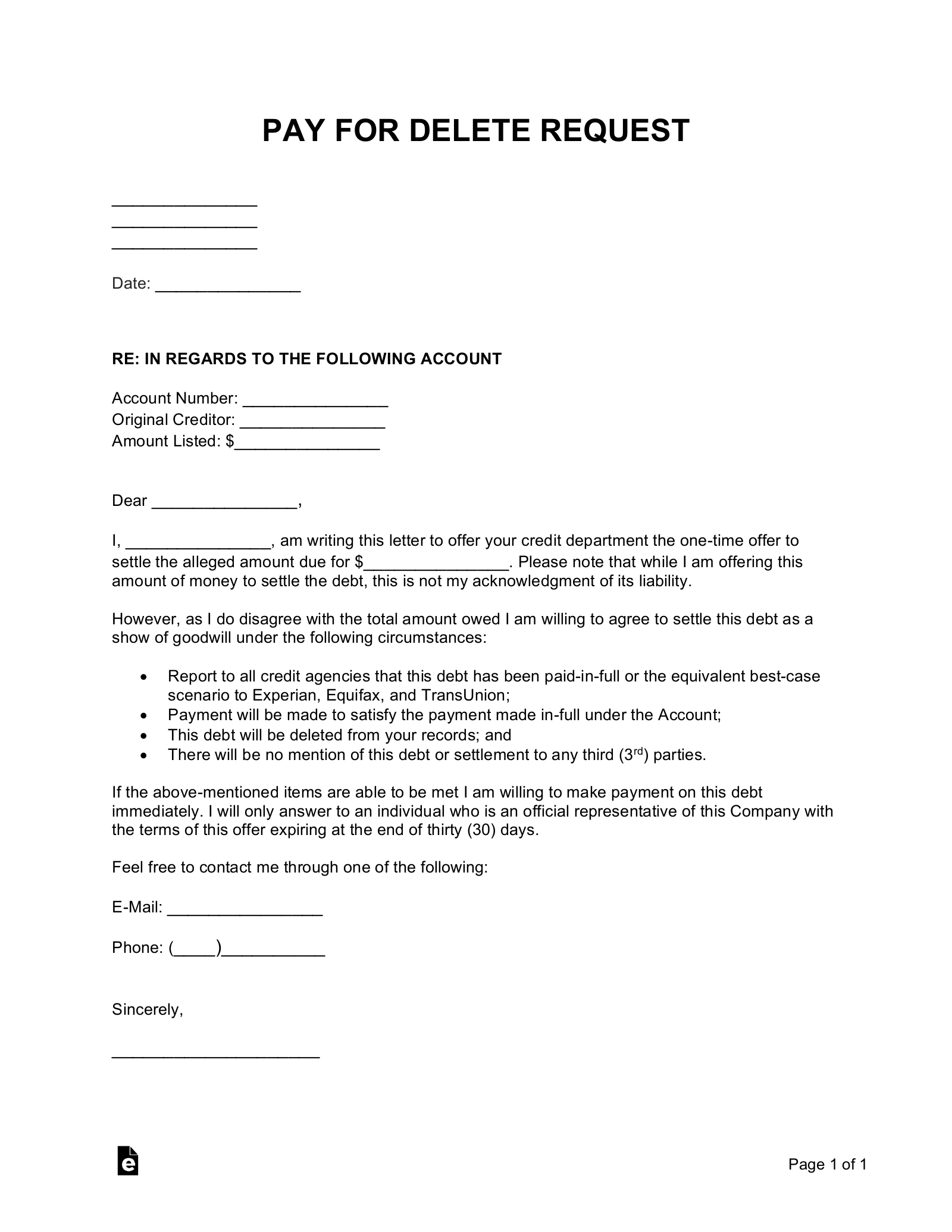

Pay for Delete Letter – Used to offer a sum to a collections agency as a settlement offer to remove the debt. Pay for Delete Letter – Used to offer a sum to a collections agency as a settlement offer to remove the debt.

Download: PDF, MS Word, OpenDocument |

How to Send a Debt Letter

Step 1 – Describe the Parties

Include the names and addresses of both the creditor and the debtor being addressed on the upper left corner of the letter. Entering the effective date is also helpful, especially for offers of settlement and other compromises.

Step 2 – Know Your Rights

The rights of the consumer and any creditor are listed in the Fair Debt Collection Practices Act ( § 1692 to § 1692p), which requires debtors to state-specific requirements when administering a debt. Under the law, the debtor has 30 days to dispute any collection.

Step 3 – Offer a Settlement

Unless the creditor feels as though the debtor is credit-worthy, most debts get discounted by up to 70% if the debtor is offering a lumpsum payment. This final payment is usually difficult for any business or collections agency to give up on as so many debts go uncollected.

Step 4 – Respond / Accept the Terms

If the letter is an offer, then reply with a counter-offer. If the letter is a claim, it is best to request its validation. Also, if there is any other contact on the letter, it is much better to communicate through phone or email since most companies have limited support through their inbound mailing process.

Related Forms

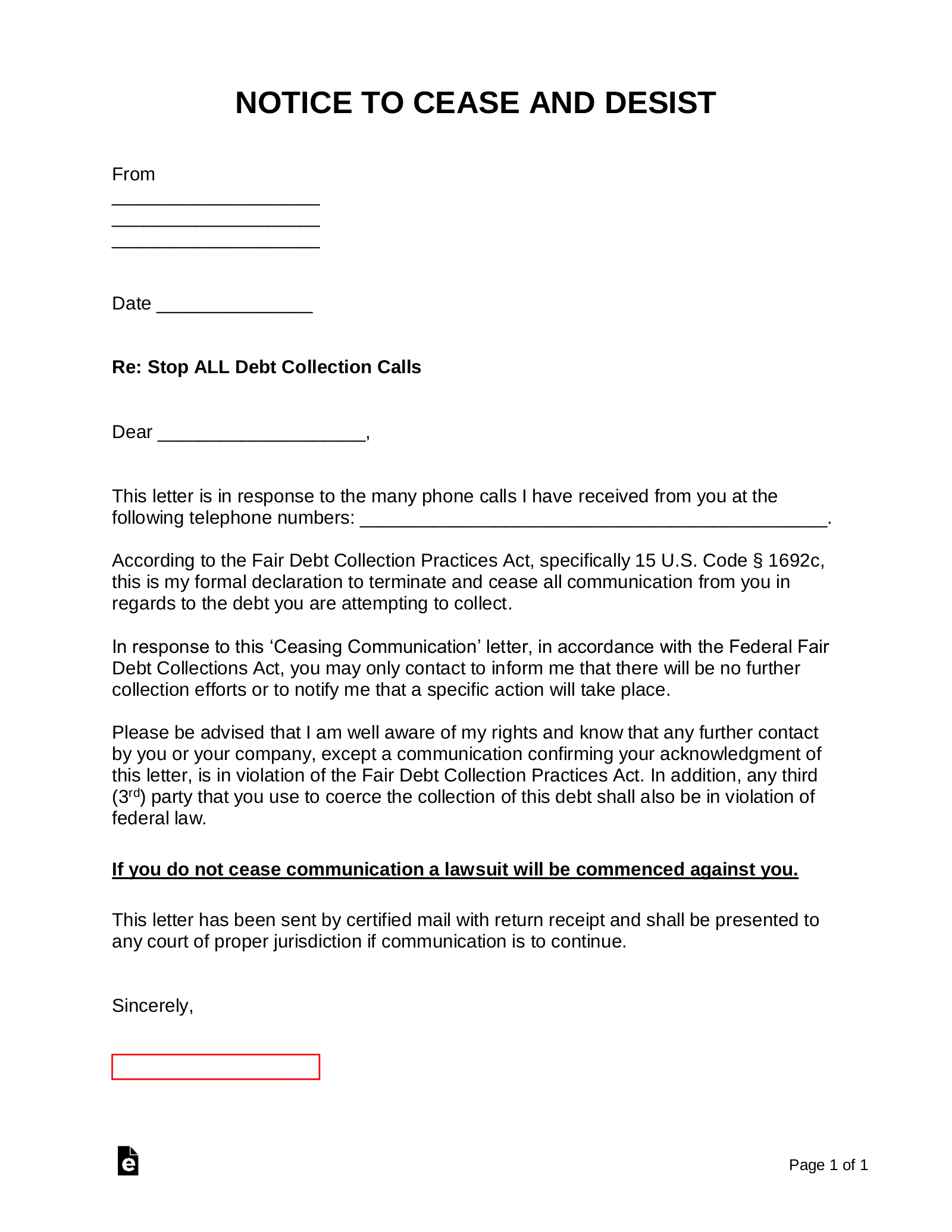

Cease and Desist Letter for Debt Collectors – Used to prohibit a debt collector from continuing to contact an individual who owes money. Once the letter has been sent, the only communication allowed is via mail. Cease and Desist Letter for Debt Collectors – Used to prohibit a debt collector from continuing to contact an individual who owes money. Once the letter has been sent, the only communication allowed is via mail.

Download: PDF, MS Word, OpenDocument |

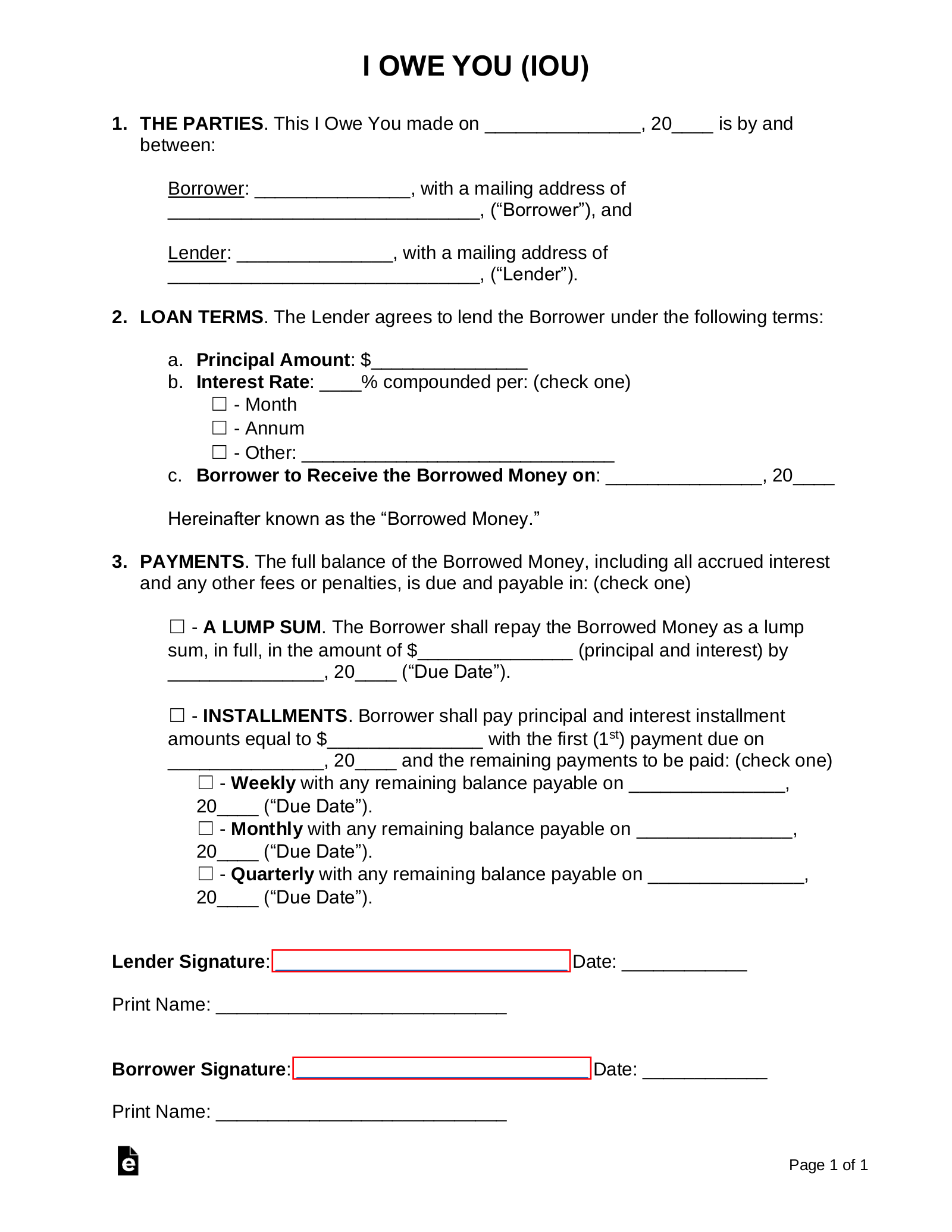

I Owe You (IOU) – Used to describe money owed to a party and when it should be repaid. I Owe You (IOU) – Used to describe money owed to a party and when it should be repaid.

Download: PDF, MS Word, OpenDocument |

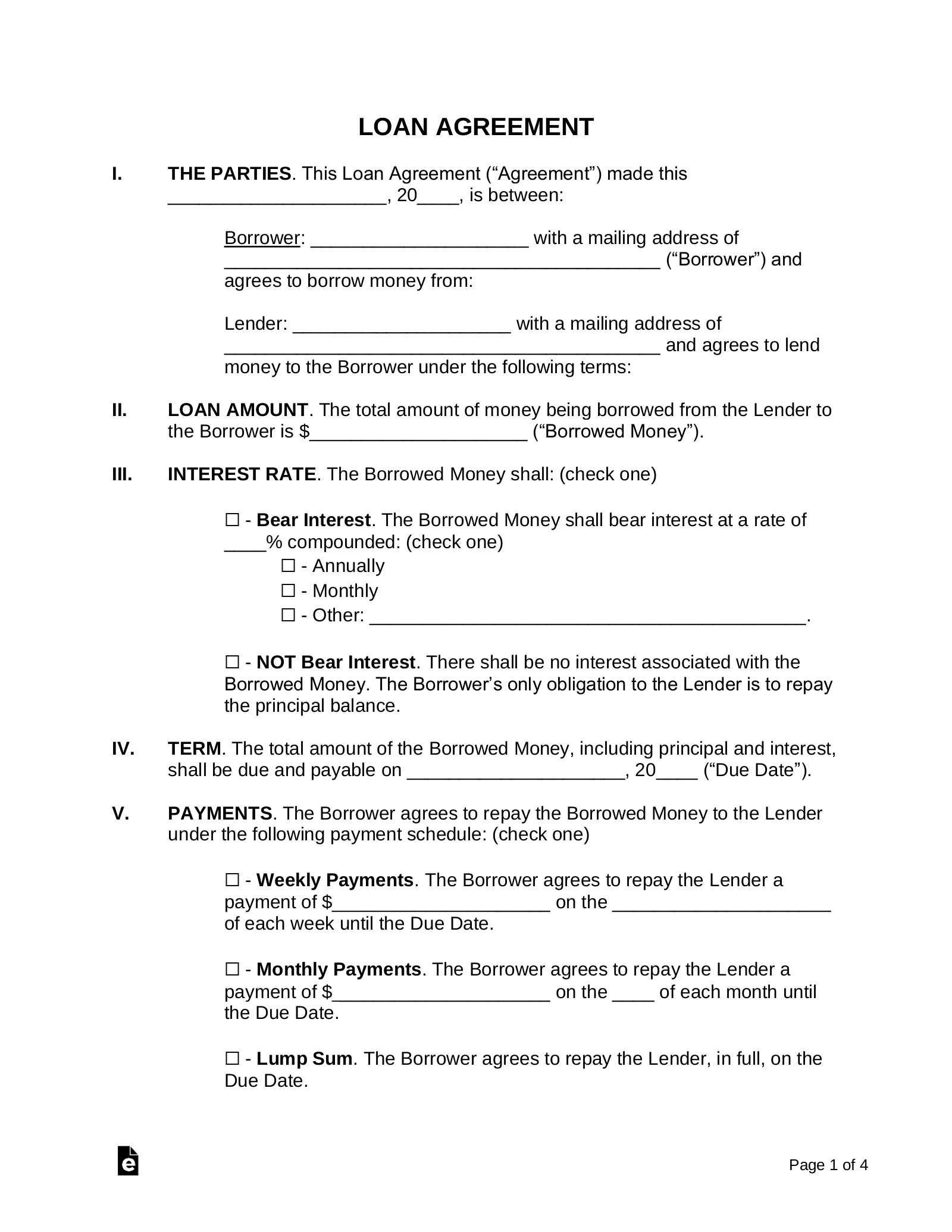

Loan Agreement – The most extensive type of document for borrowing money. Allows for late charges, security, default language, and any other terms to be set by the parties. Loan Agreement – The most extensive type of document for borrowing money. Allows for late charges, security, default language, and any other terms to be set by the parties.

Download: PDF, MS Word, OpenDocument |

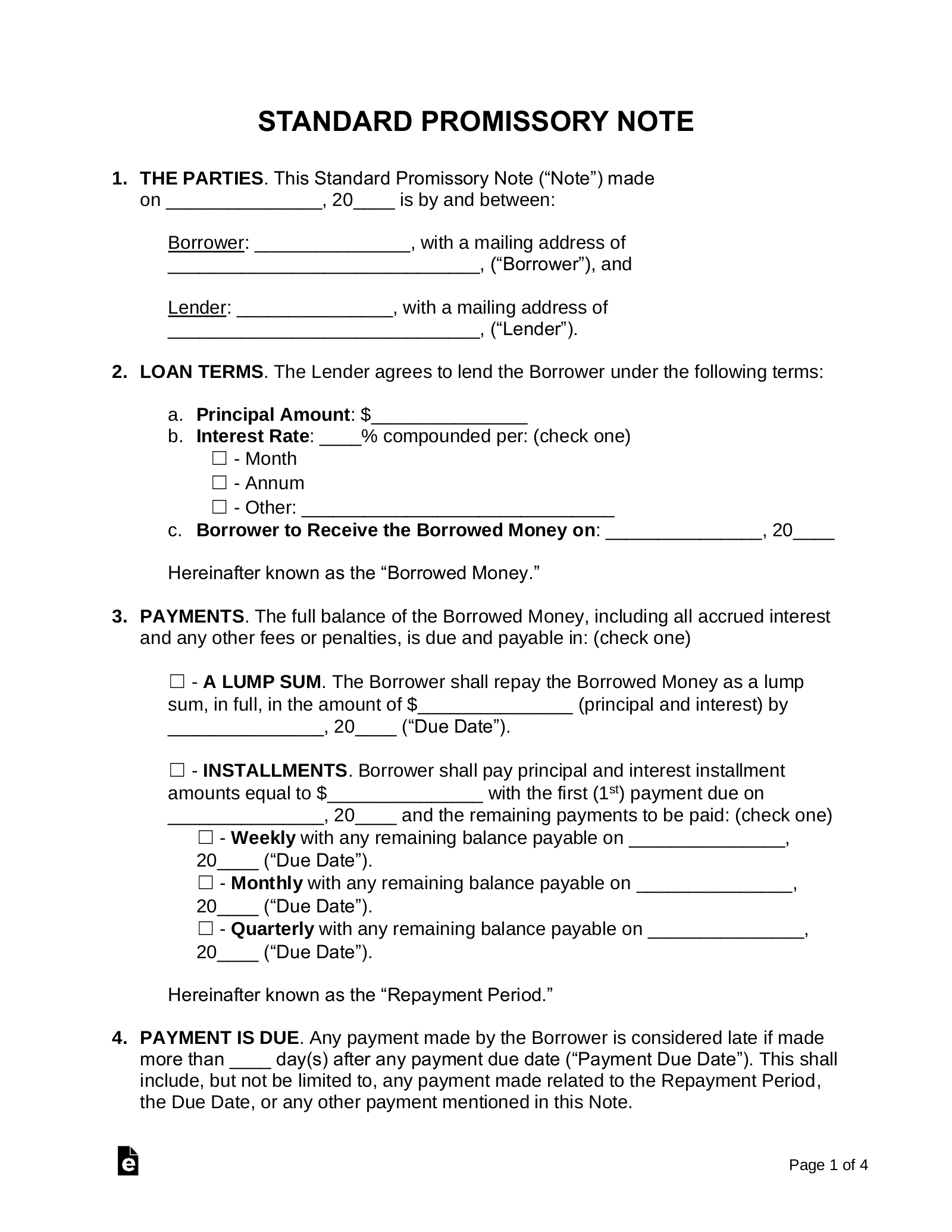

Promissory Note – Used to state when and how a loan should be repaid. Can choose whether the loan is secured by collateral. Promissory Note – Used to state when and how a loan should be repaid. Can choose whether the loan is secured by collateral.

Download: PDF, MS Word, OpenDocument |