Updated September 22, 2023

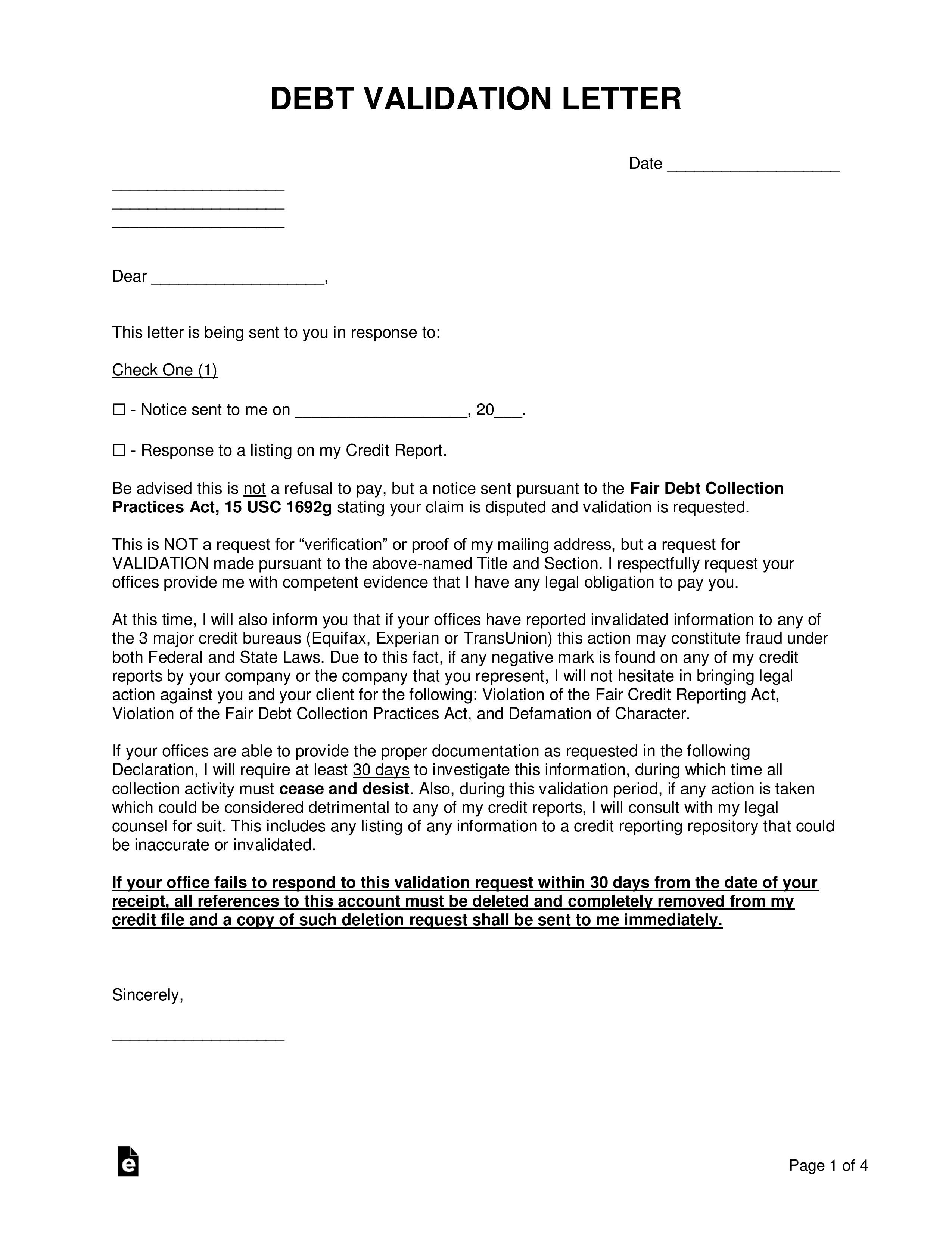

A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the Fair Debt Collection Practices Act. The letter must be sent within 30 days of receiving notice of the attempt to collect.

Table of Contents |

How to Send a Debt Validation Letter

Step 1 – Write the Debt Validation Letter

The suspected debtor is not required to defend themselves. The letter’s sole purpose is to ask that the creditor submit the creditor’s name and address in addition to why the individual is responsible for the debt.

Step 2 – Add a Cease and Desist Addendum (optional)

An individual may inform a collection agency that they do not wish to be called or contacted by any means necessary.[1] This informs the creditor that the consumer is aware of the debt that is owed but does not want to be contacted or else the creditor may face legal action.

Step 3 – Sign the Documents

For the letter to be considered legally served on the creditor it must be sent by United States Postal Service with a return receipt. After the creditor receives the validation letter they will have to sign the receipt and it will be sent back to the debtor.

Step 4 – Send and Wait 30 Days

Under federal law, the creditor will have 30 days to conduct their investigation and send their findings to the debtor.[2] If the creditor does not get back to the suspected debtor within the 30-day period, the collection is no longer valid.

Sample Debt Validation Letter

REQUEST FOR DEBT VERIFICATION

From

[SENDER NAME AND ADDRESS]

To

[RECIPIENT NAME AND ADDRESS]

Date [DATE]

To Whom This May Concern,

I, [NAME OF SENDER], have received information regarding a debt that is being claimed against me. Through my rights, in accordance with 15 U.S. Code § 1692g, I hold the right to verify the total debt amount, including any fees, and who the original party that is making the claim. After receiving such information I will review and respond within the 30-day period allotted to me under federal law.

If it is found that there is no evidence of this debt under my name then I demand that all credit bureaus and financial institutions be made aware or a complaint will be filed to the respective local or federal agency.

Furthermore, I request that you cease and desist any future telephone communication, whether through my residential or employment numbers. I am aware of the request for payment by your company and any further telephone communication shall be considered harassment in violation of 15 U.S. Code § 1692d and shall be subject to State and Federal penalties.

I appreciate your efforts in this matter and look forward to your response.

Regards,

[SENDER NAME]

Signature: ______________

Sample Cease and Desist Addendum

CEASE AND DESIST ADDENDUM

I, [NAME OF SENDER], am aware of my rights as a consumer under the Fair Debt Collection Practices Act, specifically § 805(c), and demand that you cease and desist any contact with me in reference to this collection. This addendum in no way admits or considers myself responsible for this debt. In addition, this addendum also requests for you to cease and desist the use, or potential use, of any third (3rd) party to contact me in reference to this collection.

IF THERE IS ANY VIOLATION OF THIS CEASE AND DESIST A COMPLAINT SHALL BE MADE TO THE FEDERAL TRADE COMMISSION.

Regards,

[SENDER NAME]

Signature: ______________