Updated September 22, 2023

A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. All three credit reporting bureaus (Equifax, Experian, and TransUnion) accept dispute requests online, standard mail, and by phone. By law, the credit bureau must give a response within 30 days upon receiving notice.

Laws – 15 U.S. Code § 1681i

Credit Bureau Extension

In addition to the 30-day response time, if the requestor provides additional information after the original request, the credit bureau is entitled to an additional 15 days (45 days total).

Table of Contents |

Dispute an Item on a Credit Report

- Step 1 – Get a Free Credit Report

- Step 2 – Identify the Questionable Debts

- Step 3 – Gather Internal Records

- Step 4 – Creating the Dispute

- Step 5 – Sending the Dispute

- Step 6 – Wait Thirty (30) Days

- Step 7 – Receive a Response

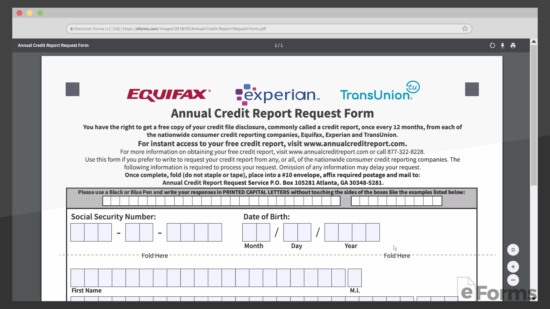

Step 1 – Get a Free Credit Report

Under federal law, all three (3) bureaus (Equifax, Experian, and TransUnion) must provide a credit report that is free of charge to a resident of the United States on an annual basis.[1]

AnnualCreditScore.com – The only website that offers all three (3) bureaus with no credit card required.

- Request By Mail – Annual Credit Report Request Form (pdf)

To get a credit report, a consumer must provide their:

- Full Name;

- Mailing Address (last 6 months);

- Housing Status (rent or own);

- Date of Birth;

- Social Security Number (SSN); and

- Undergo a Personal Verification Test (this may involve providing additional information such as student loan payment amounts, State of birth, past addresses, and vehicle information).

Once the report is available, any and all account marks, collections, and debt will appear along with the FICO score (300 to 850).

Step 2 – Identify the Questionable Debts

Carefully identify all collection accounts that may not have validity, are over seven (7) years old or were already paid.

Even if an amount is outstanding that is valid, in some cases, the debt collector will have changed or may not respond to a request. Therefore, it’s advised to request as many strikes against the credit report as possible.

Step 3 – Gather Internal Records

It’s best to include as much information as possible when questioning a debt. Therefore, it’s best to check all bank statements, credit card accounts, and any other internal financial documents to locate any records that match the outstanding debt.

Any available information will be needed to be attached to the dispute when disputing the claim.

Step 4 – Creating the Dispute

When formulating the dispute, it’s recommended and often to include the following:

- Collection Account Number (#);

- Collection Date(s);

- Description (product or service provided);

- Copy of the Credit Report; and

- Copies of any Additional Evidence of Information.

Once all information about the questionable debts is collected the individual is ready to file a formal dispute with all three (3) credit bureaus.

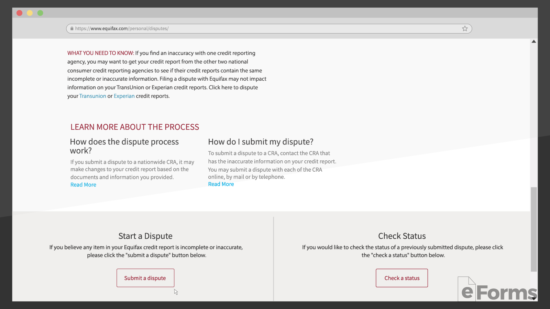

Step 5 – Sending the Dispute

In most cases, if there is a debt listed on an individual’s account it will be listed on all three (3) bureau credit reports. Therefore, it’s in the best interest to request disputes to the following:

- File Dispute Online

- Phone: 1(800) 864-2978

- Mail Dispute Letter – Equifax Information Services LLC, P.O. Box 740256, Atlanta, GA 30374

- File Dispute Online

- Phone: 1(888) 397-3742

- Mail Dispute Letter – Experian, P.O. Box 4500, Allen, TX 75013

- File Dispute Online

- Phone: 1(800) 916-8800

- Mail Dispute Letter – TransUnion LLC Consumer Dispute Center, P.O. Box 2000, Chester, PA 19016

Step 6 – Wait Thirty (30) Days

Under federal law, the credit bureau has thirty (30) days to investigate the matter. Depending on the circumstances of the debt, there may be contacted to request further information.

If further information is provided by the individual then the credit bureau has an additional fifteen (15) days to provide a final answer on the matter.

Step 7 – Receive a Response

Hopefully, when the credit bureau responds the letter will entail that the items were removed from the report. If so, there is nothing left to do and the outstanding balance should have already been removed and there may be an immediate improvement in the individual’s overall FICO score.

If the outstanding balance was not removed the individual will need to contact the current holder of the debt in the next step.

Other Methods to Dispute a Debt (3)

- Request a “Validation of the Debt”

- Wait Six (6) Months (from last dispute)

- Wait Seven (7) Years for the Debt to Expire

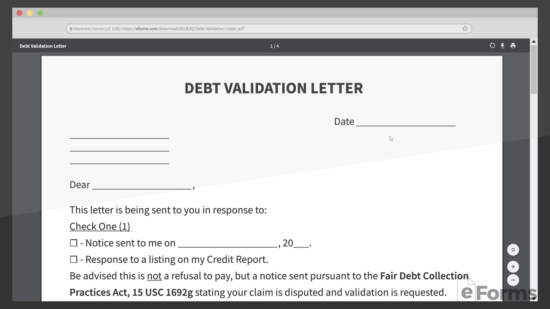

1. Request a “Validation of the Debt”

In accordance with federal law,[2] a debtor may request where a debt came from by submitting a Debt Validation Letter. This will require the debt holder to obtain the name and address of the original creditor.

If the debt holder cannot produce the name and address of the original creditor within thirty (30) days then the debt is no longer liable and may be removed the individual’s credit report.

2. Wait Six (6) Months (from last dispute)

If the debt holder validates the debt by responding with the original creditor’s name and address the best option is to wait six (6) months and attempt to re-attempt the process again from

Most debts are bought and sold and there is a chance the new holder of the debt won’t respond to a dispute request. In such a case, the debt would be removed from the credit report.

3. Wait Seven (7) Years for the Debt to Expire

Under federal law, a debt remains on your credit report for a period of seven (7) years from the date of issue.[3]

Therefore, if the debt collector is persistent whenever the debt is disputed, the individual will have to wait the full period for it to go off their credit report. Most likely, an additional dispute will be required to be placed as they do not automatically get deleted after the seven (7) year period.

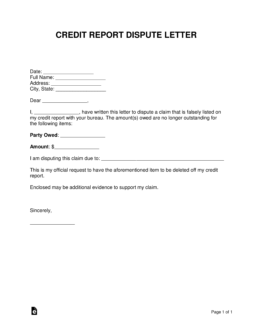

Sample Dispute Letter

CREDIT REPORT DISPUTE LETTER

[DATE]

[NAME OF DEBTOR]

[STREET ADDRESS]

[CITY, STATE]

[ZIP CODE]

[NAME OF CREDIT BUREAU]

[STREET ADDRESS]

[CITY, STATE]

[ZIP CODE]

Dear [CREDIT BUREAU],

I, [NAME OF DEBTOR], have written this letter to dispute a claim that is falsely listed on my credit report with your bureau. The amount(s) owed are no longer outstanding for the following items:

Party Owed: [NAME OF DEBT HOLDER]

Amount: [OUTSTANDING BALANCE]

I am disputing this claim as the business is no longer in existence. This is my official request to have the aforementioned item to be deleted off my credit report.

Enclosed are copies of documents that prove my statement.

Sincerely,

[NAME OF DEBTOR]

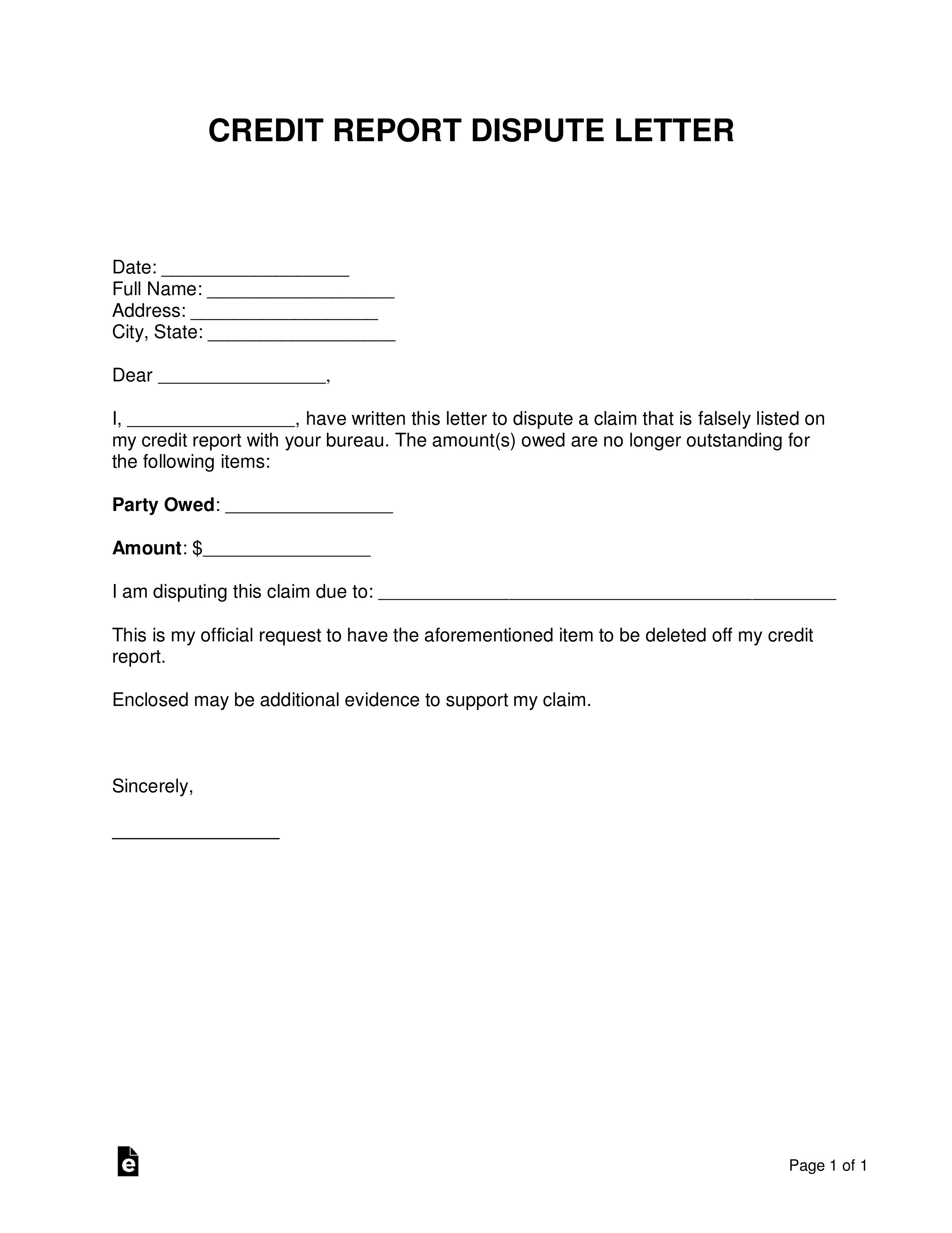

How to Write

Download: PDF, MS Word (.docx) OpenDocument Text

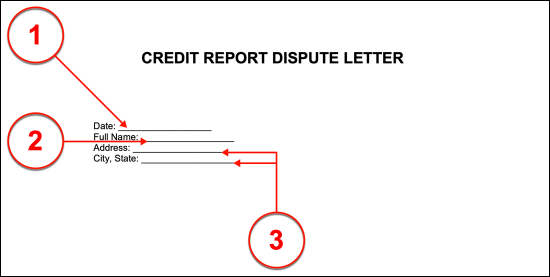

I. Letter Header

(1) Date Of Dispute Statement. The calendar date when this dispute statement is made by the Debtor should be supplied to the start of this letter’s header.

(2) Full Name. Your Name, as the Debtor filing a dispute, must be supplied with the date of this letter in the header area. Locate the line “Name” then supply your full name as requested.

(3) Address. Furnish your complete address using the remaining spaces provided in the header. Notice there will be a separate line (“Address”) where your building number, street, unit number or P.O. Box number may be furnished. It is strongly recommended that you use your home address and that the address presented here can be considered active and well-monitored.

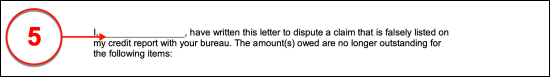

II. Statement Of Dispute

(4) Introduction. The name of the Credit Bureau Contact Person that you wish this letter be directed to should be furnished to the blank line after the word “Dear.” It is suggested to make every effort to address this letter to a specific Party with the concerned Credit Bureau, however, if this is not possible, this letter may be addressed to a specific Department within the Credit Bureau as well.

(5) Name Of Debtor. The statement made will require that the name of the Party who believes an error has been made with his or her credit be provided to the first space. Thus, as the Party who believes an error in your credit account(s) has occurred, present your entire name in the first blank line displayed in the letter’s body.

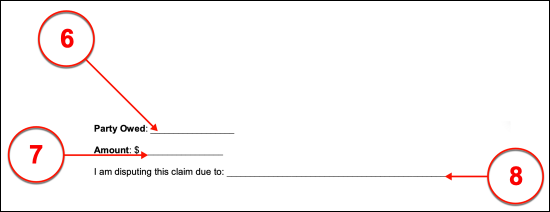

IV. Contended Debt

(6) Party Owed. The full name of the Entity that claims to hold an unpaid debt on your account must be identified to the Credit Bureau being consulted on this matter. To this end, supply the Debt Holder’s legal name. If this Entity’s legal name includes any abbreviations or a suffix indicating status (for example “Corp.,”), make sure such items are included.

(7) Amount Owed. The dollar amount that the Debt Holder claims you owe should be documented to properly address this issue. Use the figure that was last quoted to you in the most recent communication, notice, or bill that has been issued by the Debt Holder.

(8) Basis For Dispute. This letter must present a specific reason that explains why the Debt Holder’s claim of unpaid debt is invalid. It will be important to specifically name the product, service, loan, etc. that the Debt Holder claims you left unpaid. Additionally, make sure that copies of any documentation supporting your dispute are attached to this letter. For example, if the debt was paid then attach a record of the payment (i.e. verification number, canceled check, a pdf from the Debt Holder with the transaction details, etc.) and refer to it by title as an attachment in this area. Keep in mind the Debt Holder retains the option to take any effort to argue this dispute so it will be best to present as much evidence for your claim that the debt is an error, falsely made, or expired. To this end, consulting with a qualified professional (i.e. an Accountant, Credit Consultant, or Attorney) is always recommended.

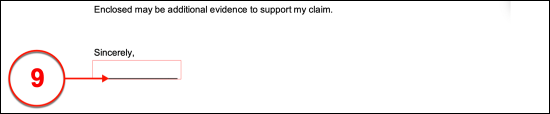

V. Signature Closing

(9) Debtor Signature. Finally, sign this letter. Your signature will be viewed as an instrument to verify that the letter above is an accurate representation of the dispute you wish to engage in.