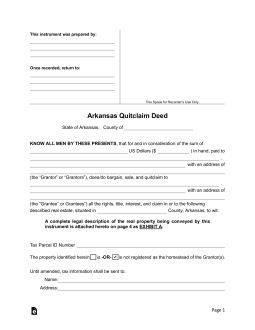

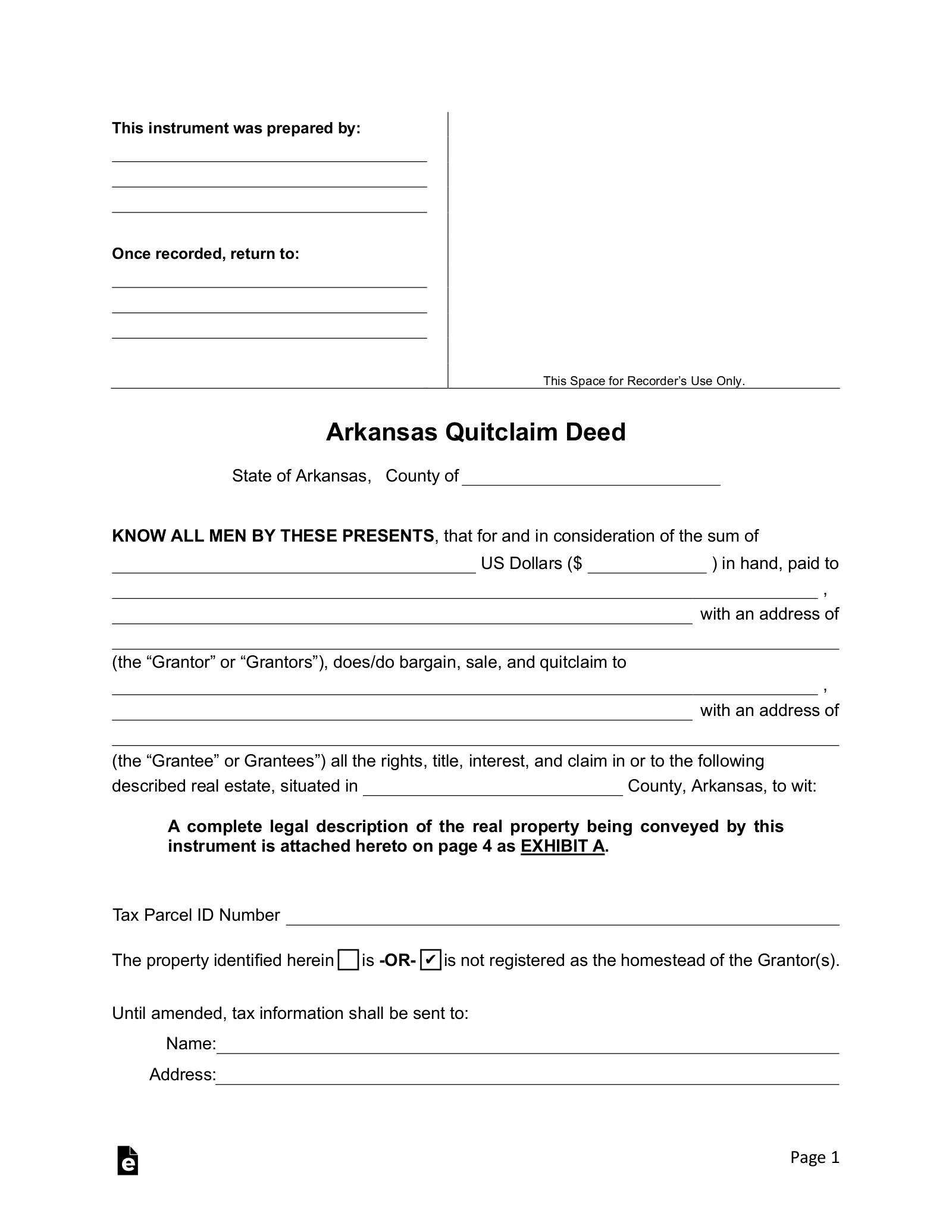

Updated December 11, 2023

An Arkansas quitclaim deed is a form that is used to transfer property from a seller to a purchaser without any warranty on the title. This type of deed only transfers the interest that the seller owns which may be no interest at all or clear title to the property. The seller is merely stating that he or she is giving up any claim to the property that they may or may not have. That is why it is called a “quitclaim”. In all transfers, it is important that the purchaser completes a title search so he or she knows what he or she is purchasing, but it is especially important when a property is transferred by a quitclaim.

Laws

- Recording – All quitclaims are to be submitted to the Circuit Court (See Map) along with the required filing fee.[1]

- Signing – A quitclaim deed has the requirement of the Grantor(s) signing in front of a notary public and 2 disinterested witnesses.[2]

- Statute – § 18-12-209[3]

- Taxes – According to the Dept. of Finance and Administration the tax rate on any real estate transfer is $3.30 per $1,000. This must be paid and submitted with the Tax Compliance Affidavit before a recording may be completed.