Updated July 17, 2023

A California deed of trust is a deed used in connection with a mortgage loan. It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. A short form deed of trust for use in typically smaller and non-institutional loans secured by any type of real property (commercial and residential) located in California. A deed of trust is on file with the county recorder along with a deed showing that the owner was granted the property.

Although there is a suggested statutory form for mortgages, no statutory form is recommended or required for trust deeds. Most commonly, the construction of the form provides that, if the grantor pays the indebtedness at maturity, then the trustee must reconvey to the grantor.

Signing (Cal. Civ. Code § 2952) – Must be signed in the presence of a notary public.

How to Write

Download: PDF, MS Word, OpenDocument

Step 1 – Obtain The California Deed Of Trust Form For Your Use

Download the Deed Of Trust form on this page to issue one for a California property by selecting the “PDF,” “Word,” or “ODT” buttons on this page. Optionally, you may also utilize the “Adobe PDF,” “MS Word,” or “OpenDocument” text links above.

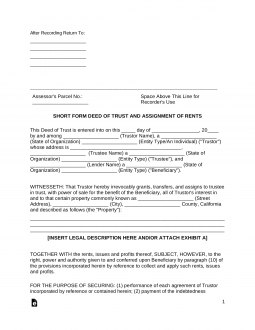

Step 2 – Determine And Present Where This Deed Must Be Returned

The area in the upper left-hand corner of this page, directly under the instruction “After Recording Return To,” requires your entry of the exact mailing address where this deed should be returned once it has been recorded by the County. Generally, the Trustee will be expected to hold this document. Do not place any information on the right side of the page above the line dividing the header from the body of this deed.

Step 3 – Report The Assessor’s Parcel Number

The “Assessor’s Parcel No.” line just above the title requires that you supply the concerned property’s parcel number as reported on this property’s tax documents. ![]()

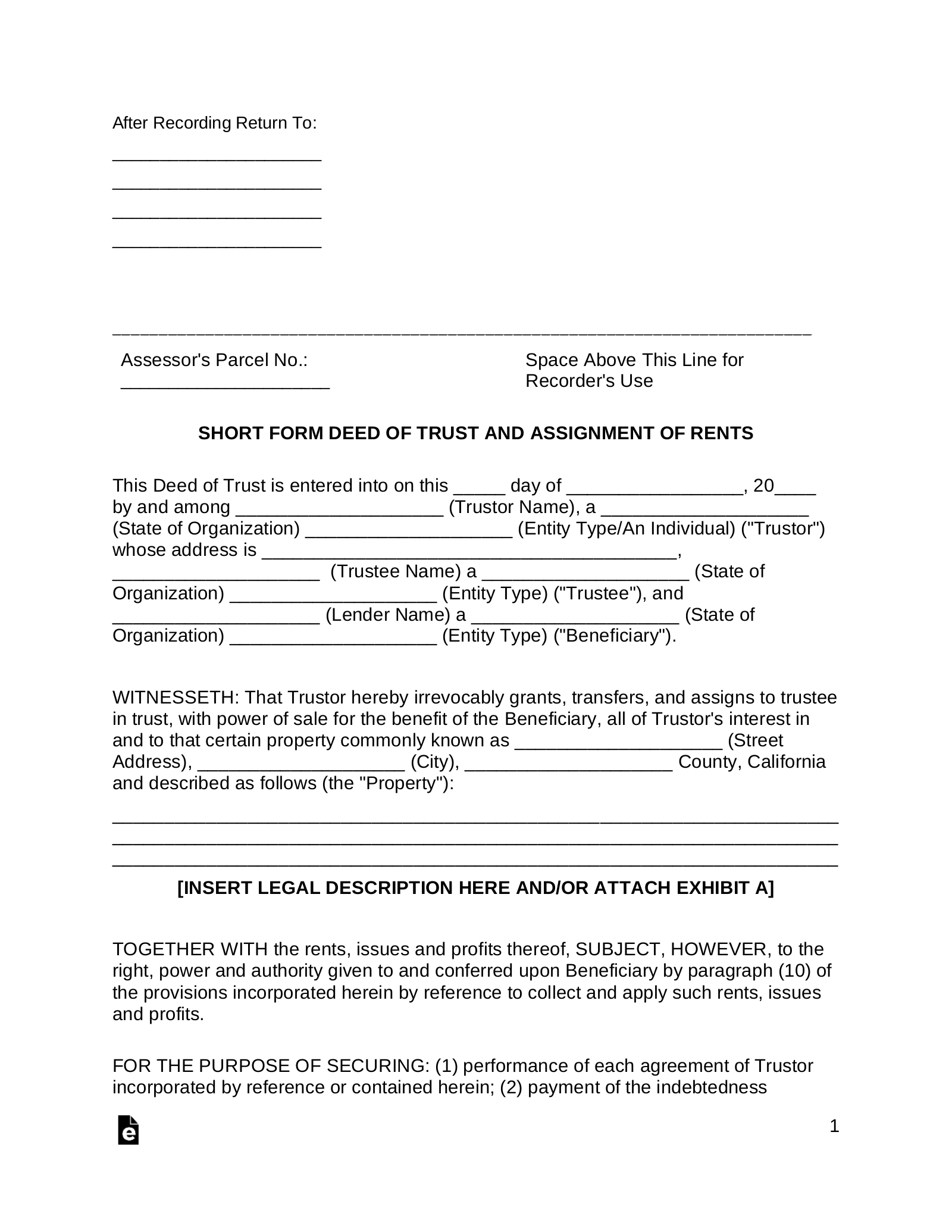

Step 4 – Record The Effective Date Of This Deed

The first statement below the title of this deed will seek several pieces of information that must be documented before this paperwork’s execution. The first of these items is meant to be furnished across the first three blank lines following the phrase “…Entered Into On This.” Record the calendar day, month, then the two-digit year when this trust is formally entered by all three parties. ![]()

Step 5 – Produce The Debtor’s Identity As The Trustor

This statement will continue by calling for the full name of the Debtor (Mortgagor) using the property as collateral. This must be an entity, such as a Homeowner or Business, who currently owns and has authority or control over the property being discussed. The blank space attached to the parentheses label “Trustor Name” seeks this information. Once you’ve produced the Trustor’s name, use the blank space that follows it to record what state this entity resides in or carries out its operation. ![]() Continue this identification process with the Trustor’s “Entity Type.” The space before the label “Entity Type/An Individual” requires either the type of Business Entity (i.e. corporation, store, individual, etc.) reported on its contents.

Continue this identification process with the Trustor’s “Entity Type.” The space before the label “Entity Type/An Individual” requires either the type of Business Entity (i.e. corporation, store, individual, etc.) reported on its contents. ![]()

Step 6 – Deliver The Debtor’s Location

Lastly, the official address where the Trustor can be reached will close out the Trustor’s portion of this statement. The space immediately after the words “…Whose Address Is” will accept this information. ![]()

Step 7 – Identify The Trustee

The Trustee who will assume authority over this property for the duration of the Trustor’s loan or mortgage must be properly documented on the blank space corresponding to the “Trustee Name” label by entering his or her name to this space then the State where this Party carries out business or maintains a residence on the next available space. ![]()

Step 8 – Describe The Trustee

As we have done so with the Trustor, we must identify the type of Entity the Trustee is considered by the government and the public. Thus, indicate if this is a business, a non-profit, or a private citizen on the blank space attached to “(Entity Type)(Trustee).”

![]()

Step 9 – Report The Identity Of The Beneficiary

The “Beneficiary” who shall hold an interest in the property for the duration of the mortgage once this document is executed must now be identified by the statement we are working on. The blank line attached to the “Lender Name” label must display the Beneficiary’s full legal name. In nearly all cases, this will be a financial institution such as a bank. You will also need to identify the State where this entity legally operates on the next available line.![]()

Step 10 – Further Define The Beneficiary

Finally, complete this statement by reporting exactly what type of entity is the Beneficiary. The last blank space will require this legal definition entered as its contents.

![]()

Step 11 – Document The Concerned Property’s Location

Naturally, the control of a property cannot be delivered to an entity such as the Trustee unless a specific definition to that property is given. Thus, seek out the first blank space in the “Witnesseth…” paragraph then use it to make a record of the street address where the concerned property can be seen, accessed, and entered.![]() Continue this report with the “City” and the California County where the property’s physical address is found on the next two blank lines.

Continue this report with the “City” and the California County where the property’s physical address is found on the next two blank lines. ![]()

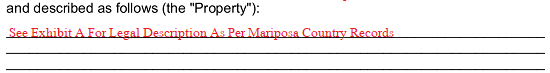

Step 12 – Further Define This Property With Its Legal Description

The power a deed conveys requires that we give additional definition to the property so that no misunderstandings occur. For this goal, the blank lines underneath the “Witnesseth…” paragraph are presented as a display area for the property’s legal description. If you do not have a current legal description or a deed with the legal description (in which case, it is recommended you confer with an attorney), you may obtain it from your local Recorder’s Office or Registrar of Deed’s Office.

Step 13 – Discuss The Original Loan, Mortgage, Or Promissory Note

Now, the “Original Principal Sum” of the mortgage or loan must be recorded. This is the amount of money the Trustor must pay the Beneficiary so that the Trustee will release the property to the possession of the Trustor. Seek this dollar amount from your records, then produce it on the blank line attached to the dollar sign in the “For The Purpose Of Securing” declaration. ![]()

Step 14 – If The Trustor Is An Entity You Must Prepare The Execution Area With Some Information

Several paragraphs will supply the language necessary for this short form deed to function properly. This paperwork will not be considered complete unless it has been executed by the Trustor before a Notary Public. To this end, two optional signature areas are presented. One of which must be signed. The first area is reserved for a Trustor who is a Business Entity. Let us assume our Trustor is a Sole Proprietorship where all the paperwork regarding the property’s documents, ownership, and taxes are in the company’s name. In this case, locate the (first) heading “Trustor” after the closing “Signature Page Follows.” The Trustor section here will contain several bracketed labels that should be replaced with their topic. Thus, replace “Trustor Name” with the legal name of the Trustor Business. ![]() Once, you’ve supplied this name, record the State where this Party operates along with the type of entity that best defines it in place of the labels “State Of Organization” and “Entity Type.”

Once, you’ve supplied this name, record the State where this Party operates along with the type of entity that best defines it in place of the labels “State Of Organization” and “Entity Type.” ![]()

Step 15 – Produce The Trustor Signature

The signature of the Trustor is the next item that must be furnished. In the example where the Trustor is a business entity, the signature must be supplied with a couple of additional items. The Authorized Representative or the Owner of the Business should seek out the blank line after the word “By” then sign his or her name on it. ![]() The full “Name” of the Signature Party representing the Trustor Business must be produced on the blank space immediately following the signature.

The full “Name” of the Signature Party representing the Trustor Business must be produced on the blank space immediately following the signature. ![]() If the Trustor is a Business Entity, then record the “Title” its Signature Party holds within its structure.

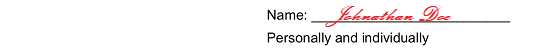

If the Trustor is a Business Entity, then record the “Title” its Signature Party holds within its structure. ![]() If the Trustor is a private citizen then only his or her signature will be necessary after the “Signature Page Follows” statement. He or she is only obligated to sign the “Name” line just above the words “Personally And Individually” in the second signature area that is available.

If the Trustor is a private citizen then only his or her signature will be necessary after the “Signature Page Follows” statement. He or she is only obligated to sign the “Name” line just above the words “Personally And Individually” in the second signature area that is available.

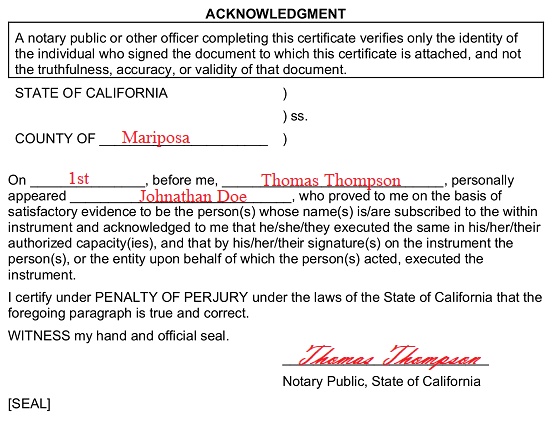

Step 16 – Relinquish The Short Form Deed To The Notary In Attendance

As soon as the Trustor has signed this document, he or she must release it to the Notary Public who has witnessed this act. The Notary Public, in turn, will record the County, Signature, the Parties present, then his or her credentials and seal. The section below the Trustor’s signature has been included for this entity’s use.

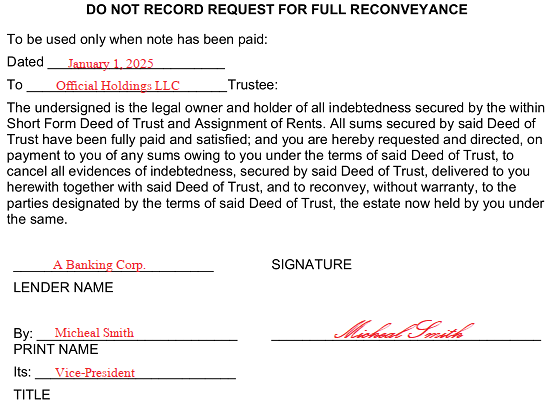

Step 17 – Documentation Informing The Trustee Of Payment Has Been Included

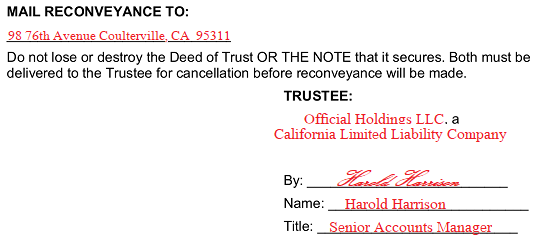

Once, the mortgage or loan has been paid to the Beneficiary, the Trustee should have this paperwork returned to him or her with the last page filled out. The area beneath the “Do Not Record Request For Full Reconveyance” will only be completed by the Beneficiary upon satisfaction of the concerned debt or mortgage amount.  The second part of this page will document where the Trustee will receive the above statement. Only the Trustee may supply this information.

The second part of this page will document where the Trustee will receive the above statement. Only the Trustee may supply this information.