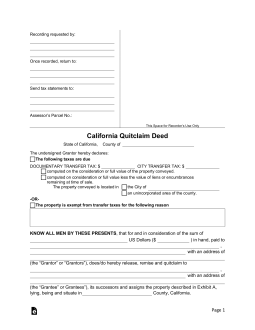

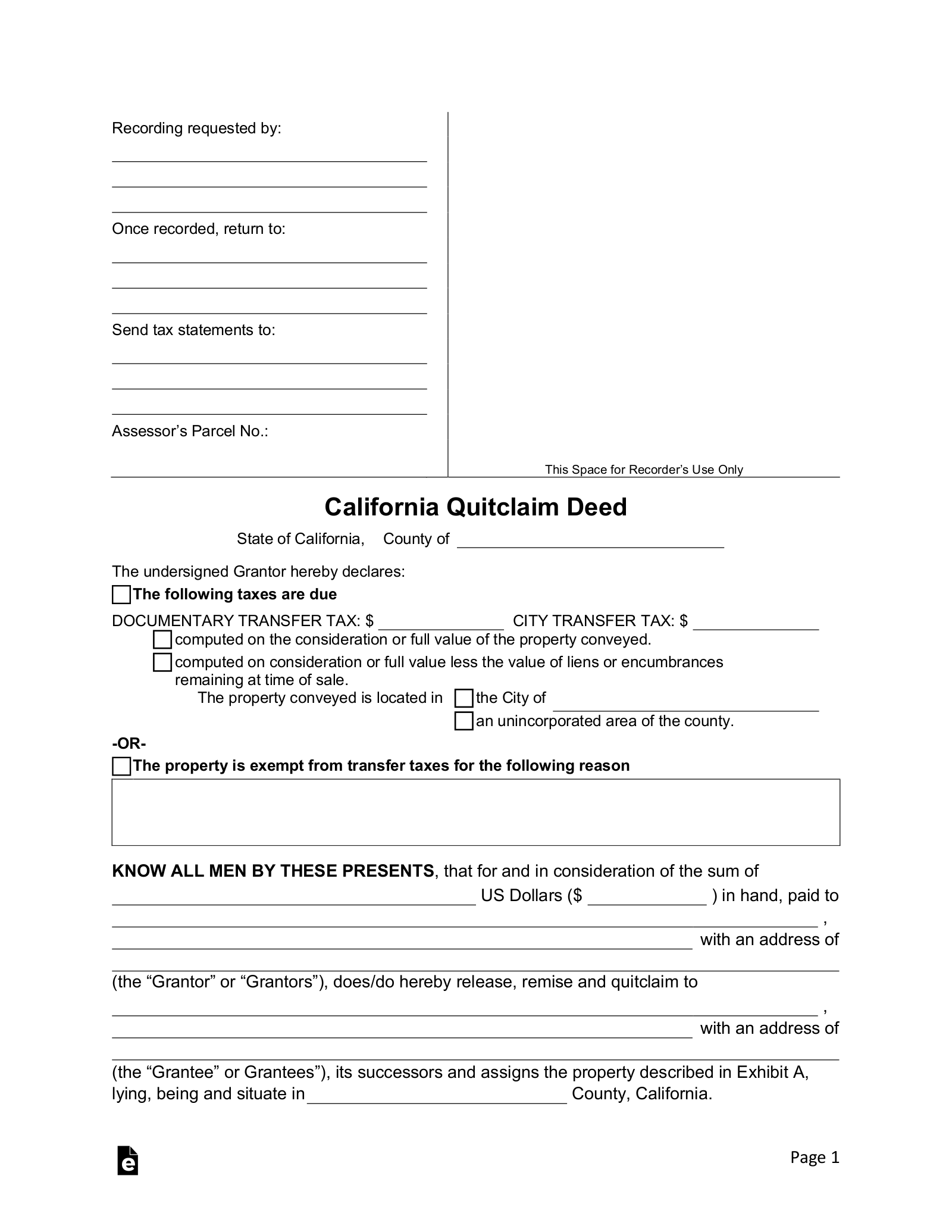

Updated December 11, 2023

A California quitclaim deed is used to transfer the interest that a person may have in a given piece of real estate to another person. With a quitclaim, there is no guarantee as to the interest being transferred. Basically, the grantor (the person transferring the interest) is stating that he or she will not make any claims they may have to the property. It provides the least amount of protection to a buyer. However, a buyer can research the property in question, called a title search, to ascertain the interest that the grantor has to be sure of what interest they are buying in the property and what encumbrances or restrictions may exist on the property.

Laws

- Preliminary Change of Ownership (Form BOE-502-A) – Form that is required to be filed along with the Quit Claim Deed at the Recorder’s Office.

- Recording – The form may be filed at the County Recorder’s Office where the property is located.

- Signing – Required to be executed with a Notary Public viewing the grantor(s) signature(s).

- Transfer Tax – The Documentary Transfer Tax must be entered in the quitclaim deed. Use the Transfer Tax Calculator to determine.

- Assessor Parcel Number (APN) – This is required to be included in the legal description in the quitclaim deed. This number may be obtained from Assessor’s office (See List of County Assessors).

- Sample – Completed Quit Claim Deed (Sample)