Updated December 19, 2023

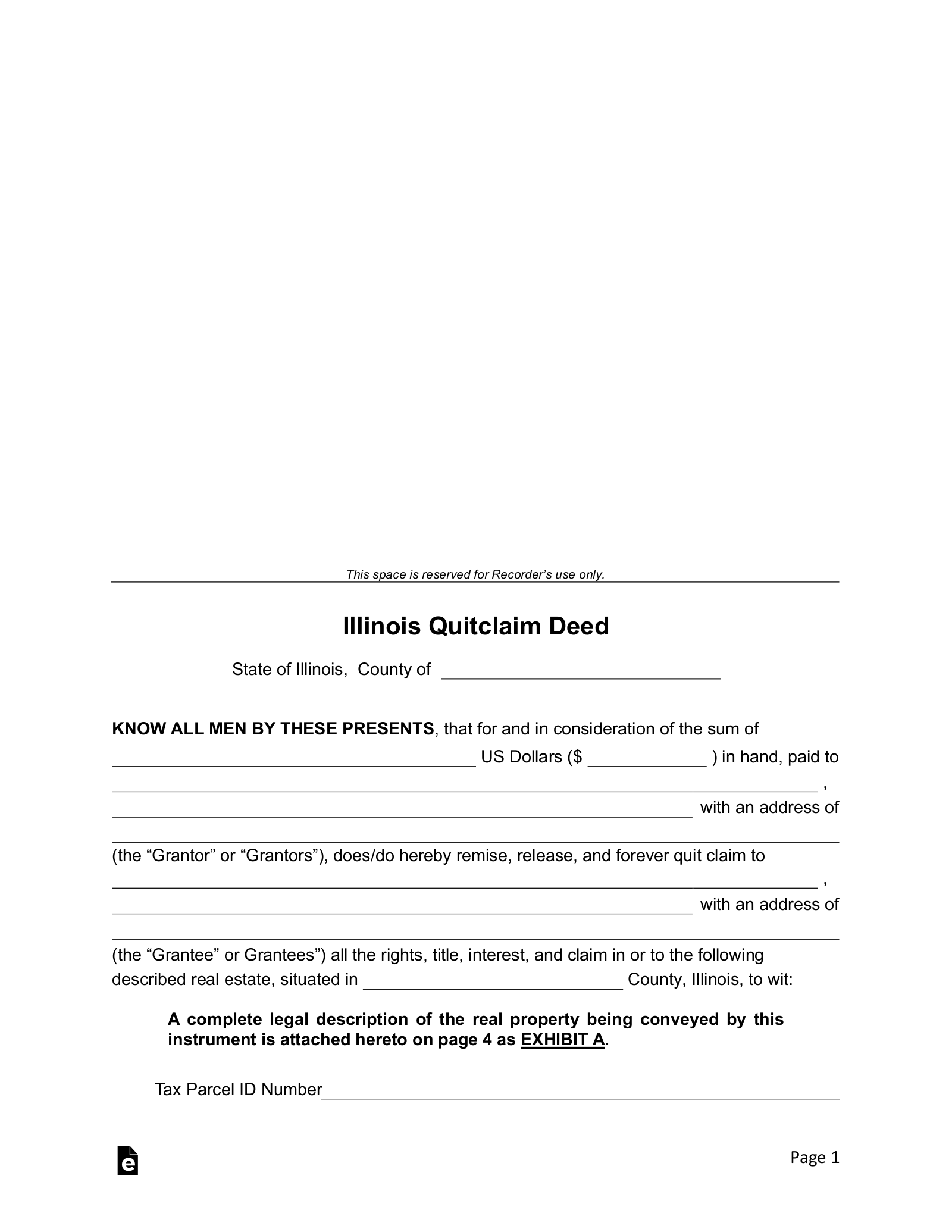

The Illinois quitclaim deed is used to convey real estate in Illinois from one party to another. However, unlike a warranty deed, the seller or grantor is not required to warrant the title to the property he is selling. In other words, he or she will not guarantee that they own the property or that they have clear title to the property or that they have the authority to sell the property. As in all property transfers, it is important that the buyer perform a complete property search to ascertain what right to the property he or she is actually purchasing.

Laws

- Recording – The quitclaim deed must be recorded in the County Recorder’s Office where the real estate is located (See County List).

- Signing (765 ILCS 5/20) – A quit claim deed in the State of Illinois is required to be signed with a notary public present before being recorded.

- Statute – 765 ILCS 5/10

- Transfer Tax Declaration (Form PTAX-203) – The transfer tax must be paid prior to or at the time of filing the quitclaim deed. This can be done by filling in the form in Adobe PDF, Online, or you can File Electronically if you are living in an applicable county.