Updated April 10, 2024

The Illinois deed forms are the legal method for one person to convey real estate or real property to another. The person transferring the property is typically called the grantor and the person receiving the property is typically called a grantee. Transfers are usually completed after the buyer has made sure to research the property to know what interest he or she is buying. This is called a title search or property search. In addition, after the document is signed, it is important to make sure the original is filed by the grantee at the local county recorder.

Laws – 765 ILCS 5 (Conveyances Act)

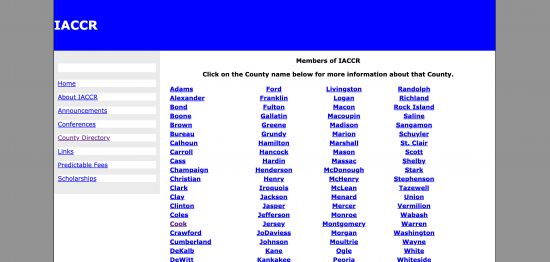

Recording – All deeds must be filed within the County Recorder’s Office where the property is located. Find your Recorder’s Office by selecting the County you are located.[1]

Transfer Tax (Form PTAX-203) – The form can be filed physically with the PDF Form or can be Filled-in Online (Applicable Counties have the option to process the form online).

Signing – All deeds must be signed and acknowledged with a notary present.[2]

Deed Types (4)

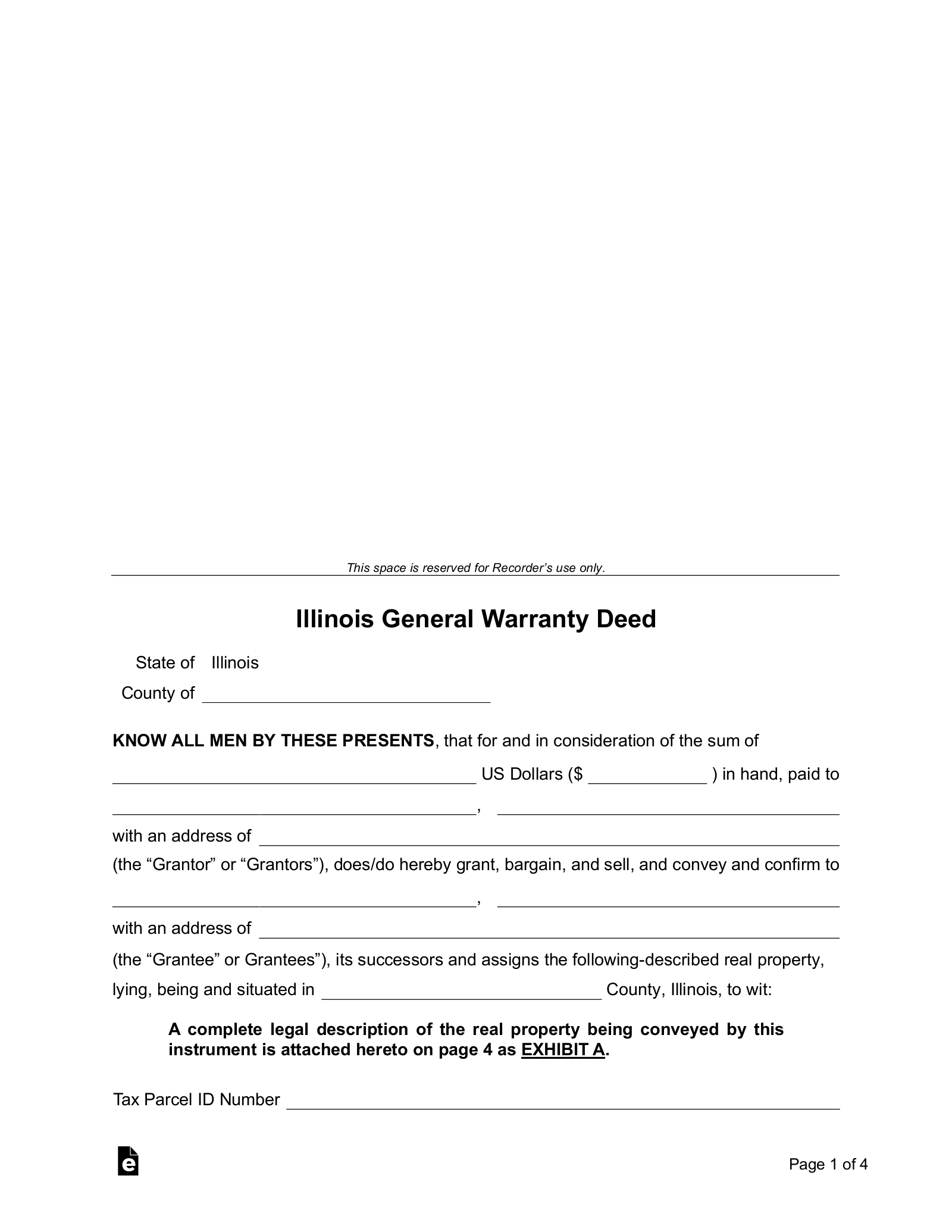

General Warranty – This type of deed conveys title to a property to another and includes a guarantee from the seller that they are selling the property free and clear of any claims from others.

General Warranty – This type of deed conveys title to a property to another and includes a guarantee from the seller that they are selling the property free and clear of any claims from others.

Download: PDF, MS Word, Open Document

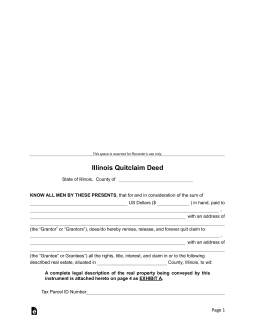

Quit Claim – A quit claim is the opposite of the warranty deed in that it provides no guarantee that the seller may sell the property or that seller owns the property.

Quit Claim – A quit claim is the opposite of the warranty deed in that it provides no guarantee that the seller may sell the property or that seller owns the property.

Download: PDF, MS Word, Open Document

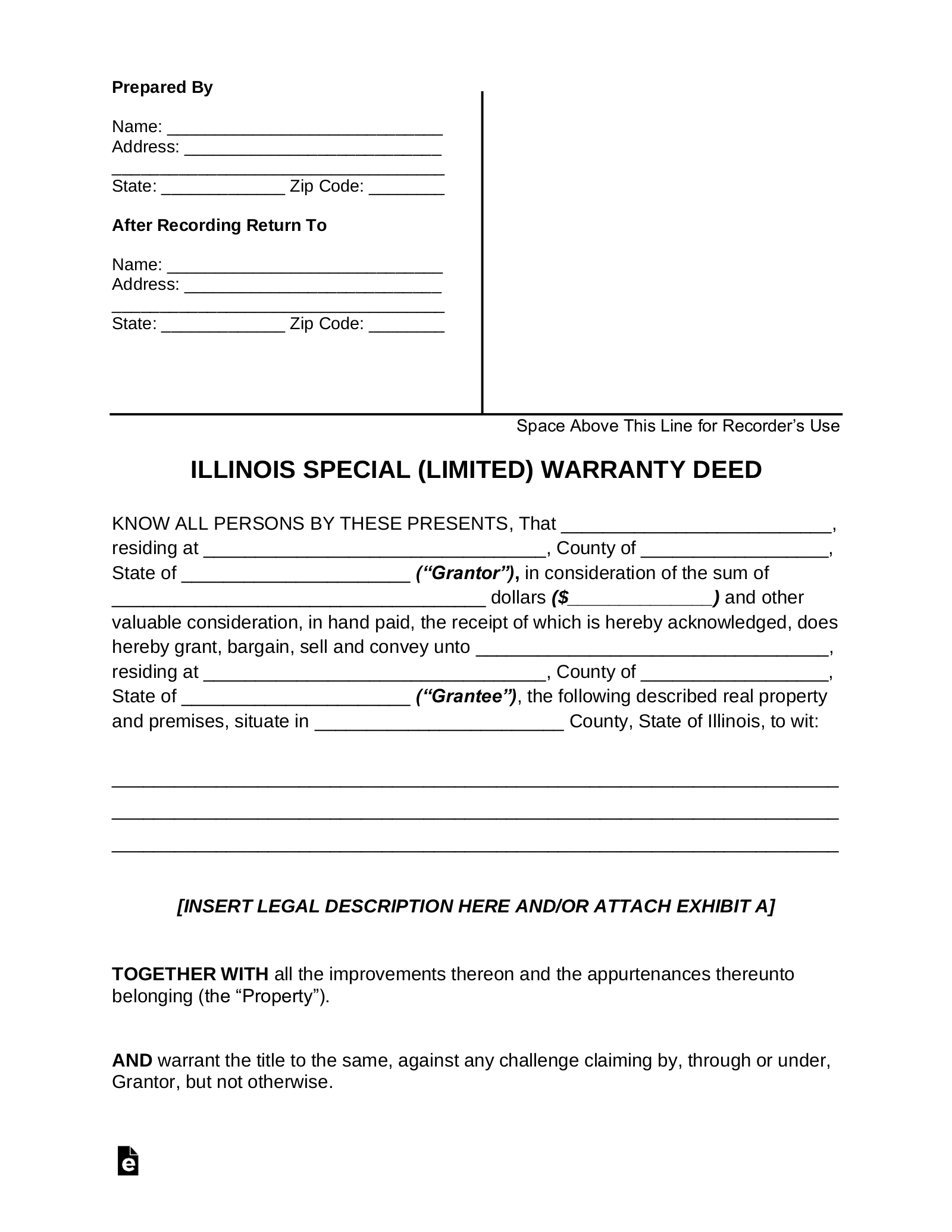

Special Warranty – This type of deed is used to convey property with a limited warranty. The buyer guarantees that they have not transferred any interest in the parcel during their ownership.

Special Warranty – This type of deed is used to convey property with a limited warranty. The buyer guarantees that they have not transferred any interest in the parcel during their ownership.

Download: PDF, MS Word, Open Document

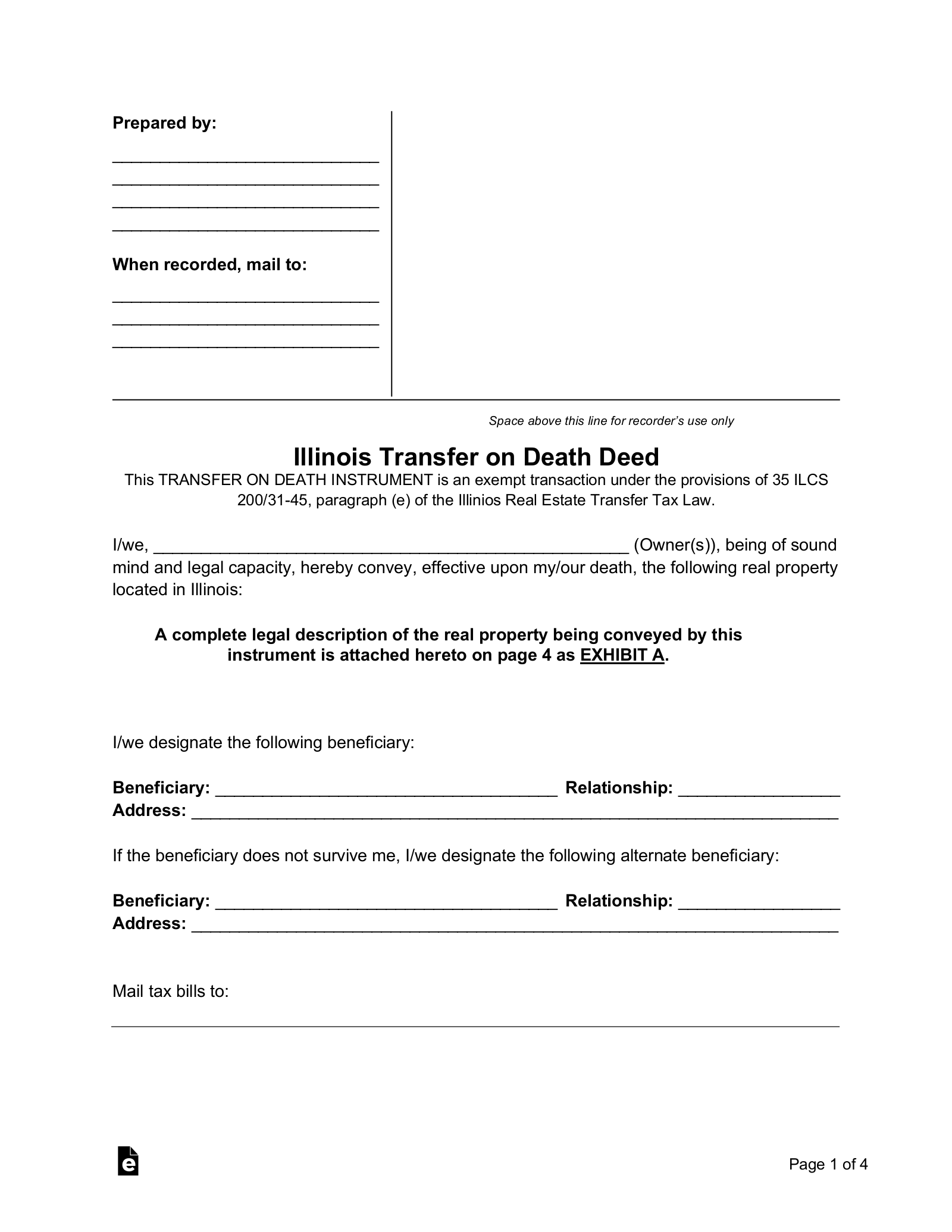

Transfer on Death – This type of deed allows someone to transfer property without undergoing probate.

Transfer on Death – This type of deed allows someone to transfer property without undergoing probate.

Download: PDF, MS Word, Open Document

Illinois Property Search (5 steps)

A property search is necessary whenever you are buying a parcel of land. This gives you a chance to make sure there weren’t interests transferred to others in the past that may be an issue in the future. Many title companies recommend that you search the transfers on the property back 50 years. In Illinois, the property records are located at the county recorder. You can go there in person to conduct a search or you can check the county recorder’s website to see if they offer online searching. Make sure to determine how far back you can go and if they have all the records before you rely solely on online searching. Cook County provides instructions on how to check the deed.

Step 1

Go to this county directory and click on the county in which the property is located.

Step 3

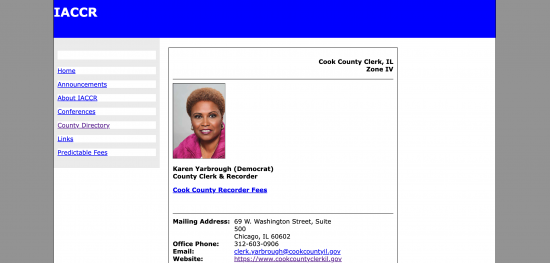

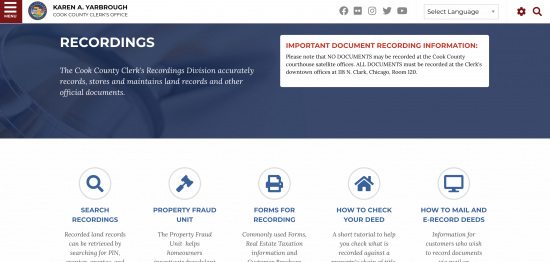

You will be brought to the Cook County Clerk’s website listing the Cook County Clerk Divisions. Click the link for “Recordings”.

Step 4

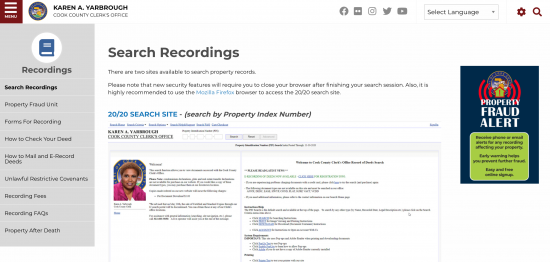

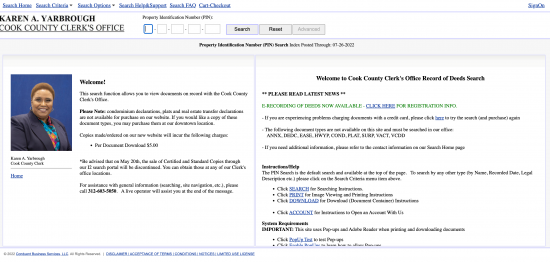

Once you are at the recorder’s site, click the button that says “Search Recordings”.

Step 5

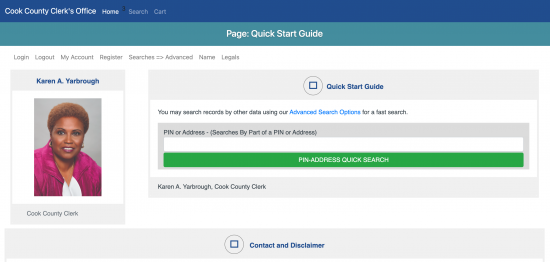

Use the 20/20 Search Site tool to search by Property index number (found on the property’s tax bill). Use the Onyx Search Site tool to search by address.

20/20 Search Site

Onyx Search Site