Updated December 10, 2023

An Illinois transfer on death deed instrument (TODI) is a document that allows someone to transfer ownership of real property to a beneficiary, effective upon their death. A TODI allows the beneficiary to forgo probate proceedings, which can be time-consuming and costly.

Table of Contents |

Requirements

- Notary: Required (755 ILCS 27/45)

- Recording: Must be recorded before the transferor’s death in the county recorder’s office of the county where the property is located (755 ILCS 27/40)

- Witnesses: Two or more witnesses are required (755 ILCS 27/45)

Legal Description

Completing a TODI requires a legal description of the real property, which is a written statement defining the property’s exact location, boundaries, and easements. This information is commonly found on property tax statements or the current deed. The county recorder’s office where the property is located should also have access to the legal description.

Example

“Being all of Lot 20 in Block F of the Clear Creek Subdivision, as shown on the plat thereof recorded in Plat Book 7, at Page 34, in the Office of the Clerk of the County Commission of Cook County, Illinois, to which plat reference is hereby made for a more complete description.”

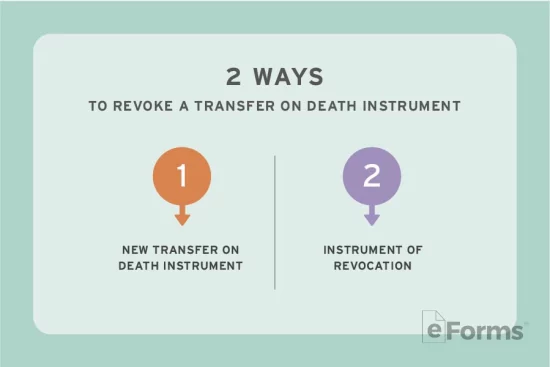

Revocation

To revoke a transfer on death deed instrument in Illinois, the transferor has two options (755 ILCS 27/55):

- Complete a new transfer on death deed instrument that expressly revokes the previous TODI; or

- Complete an instrument of revocation that expressly revokes the previous TODI.

In either case, the TODI must be executed, witnessed, and acknowledged. It must also be recorded in the county recorder’s office of the county where the property is located before the transferor’s death.

Where to Record

To properly record a transfer on death deed instrument, the transferor must complete and acknowledge the document before submitting it to the county recorder’s office where the real property is located (765 ILCS 5/28). This must occur before the property owner’s death.