Updated April 11, 2024

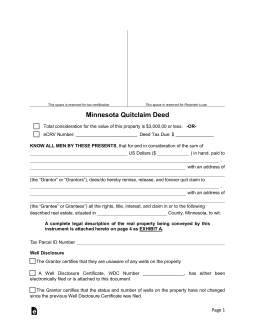

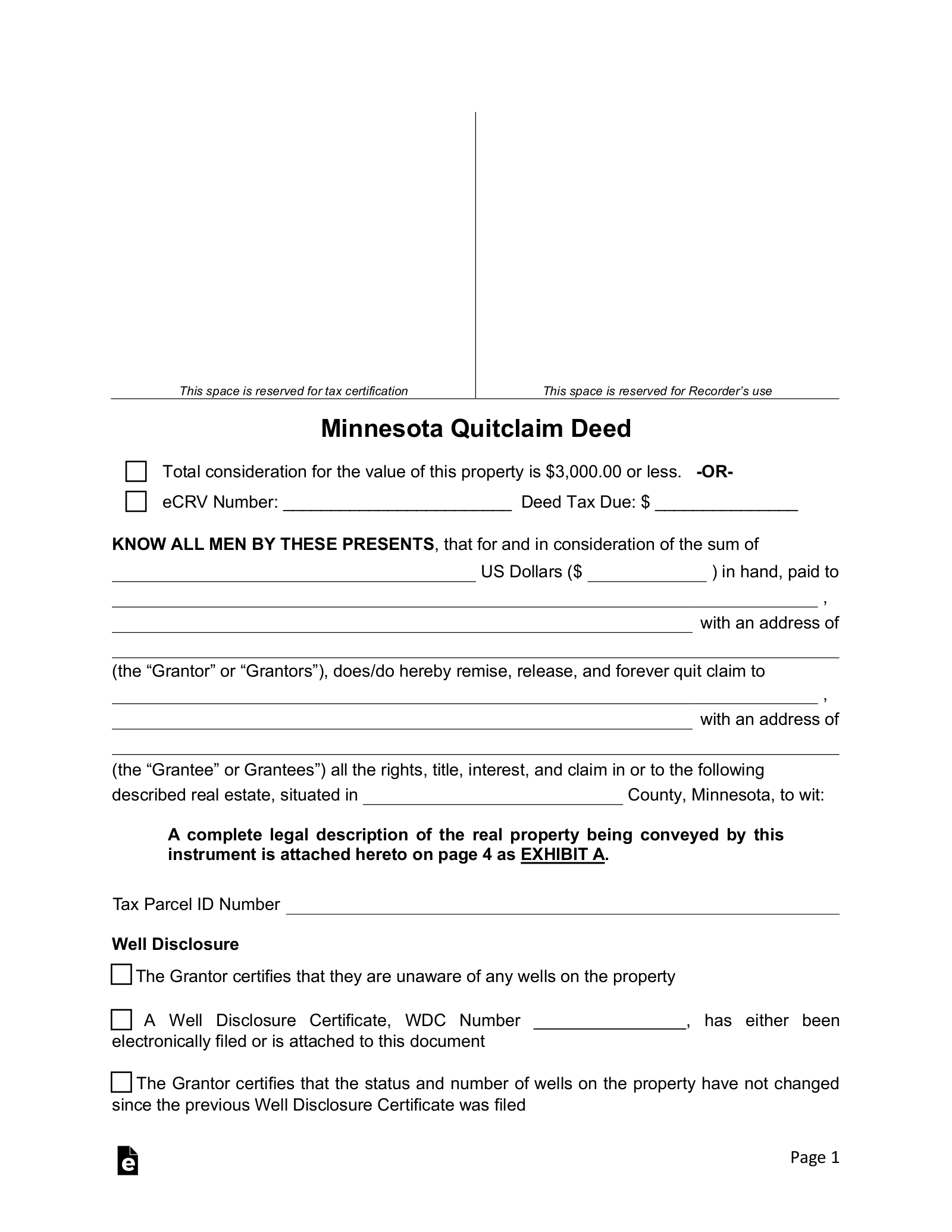

A Minnesota quitclaim deed is a legal form used to convey property in the state of Minnesota. This form of transfer comes with no guarantee that the seller can transfer the property legally or that he or she has unfettered title to the premises. This type of deed is often used in close situations such as when a person desires to transfer the property to his or her trust or to a close family member. However, in order to ascertain what interest is being transferred, it is important that a complete title search is conducted.

Laws

- Recording – All deeds must be registered with the County Recorder’s Office.[1]

- Signing – A quitclaim deed must be signed with the Grantor(s) present with a Notary Public present.[2]

- Statute – § 507.07

- Well Disclosure Certificate – If the property has a new well since the property was owned by the Seller then the Well Disclosure Certificate must be attached to the deed (or Filed Electronically).

- eCRV – This document needs to be filed for all properties worth equal or more than $1,000. It can be Processed Online or the physical form (See Sample) may be obtained by contacting your local Recorder’s office.

- Checklist – Use to make sure that all the documents, fees, and attachments (if applicable) are included for the recorder for filing.