Updated April 15, 2024

A Missouri beneficiary deed is a document used to convey real property to a designated beneficiary. By completing this document, the transferor ensures that the real estate bypasses probate proceedings upon his or her death. In the meantime, the transferor retains ownership of the respective property and has the right to revoke the beneficiary deed.

Table of Contents |

Requirements

- Notary: Required (§ 442.130)

- Recording: Must be recorded with the recorder of deeds in the county where the real property is located prior to the owner’s death (§ 461.025)

- Witnesses: Not required

Legal Description

A Missouri beneficiary deed must include a legal description of the real property. This written statement is referenced during the title search and offers very specific information regarding the property’s location and boundaries.

Legal descriptions can be found on property tax statements or the current deed. The recorder of deeds can also provide this information.

Example

“Lot 10 of Tract No. 5823, in the City of St. Louis, County of St. Louis, State of Missouri, as per Map recorded in Book 20, Page 23 of Maps…”

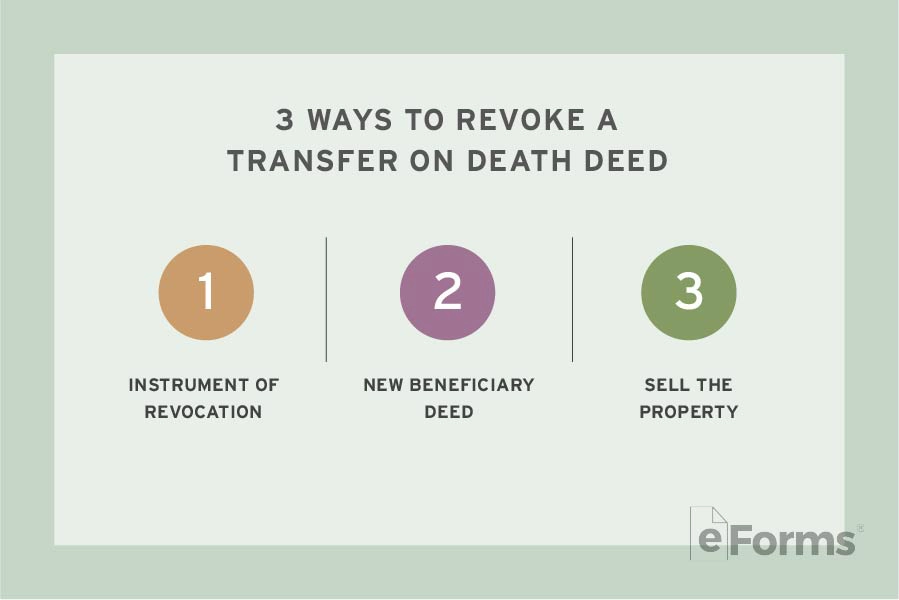

Revocation

To revoke a beneficiary deed in Missouri, property owners must (§ 461.033):

- Complete an instrument of revocation and have the document notarized and recorded prior to their death; or

- Record a new beneficiary deed; or

- Sell the property and record a new deed.

Where to Record

A beneficiary deed in Missouri must be recorded with the recorder of deeds in the county where the property is located before the property owner’s death (§ 461.025). Specific recording instruments and fees vary by county.