Updated April 11, 2024

A Mississippi special warranty deed is a form that may be used to convey real property in the state of Mississippi. Like the warranty deed, this type comes with a guarantee from the seller or grantor that the property is free from hidden claims against the title, however, it only guarantees claims arising out of the grantor’s ownership, nothing that comes out of previous owners of the property.

After the deed is completed properly and executed by the requisite parties, it must be recorded with the chancery court clerk in the judicial district in which the property is located.

Laws – Title 89 – Real and Personal Property

Statutory Language – Miss. Code Ann. § 89-1-35

Recording – All deeds are to be recorded with the Chancery Court Clerk.[1]

Signing – This form must be signed with the Grantor(s) in the presence of a Notary Public.[2][3]

How to Write

Download: PDF, MS Word, OpenDocument

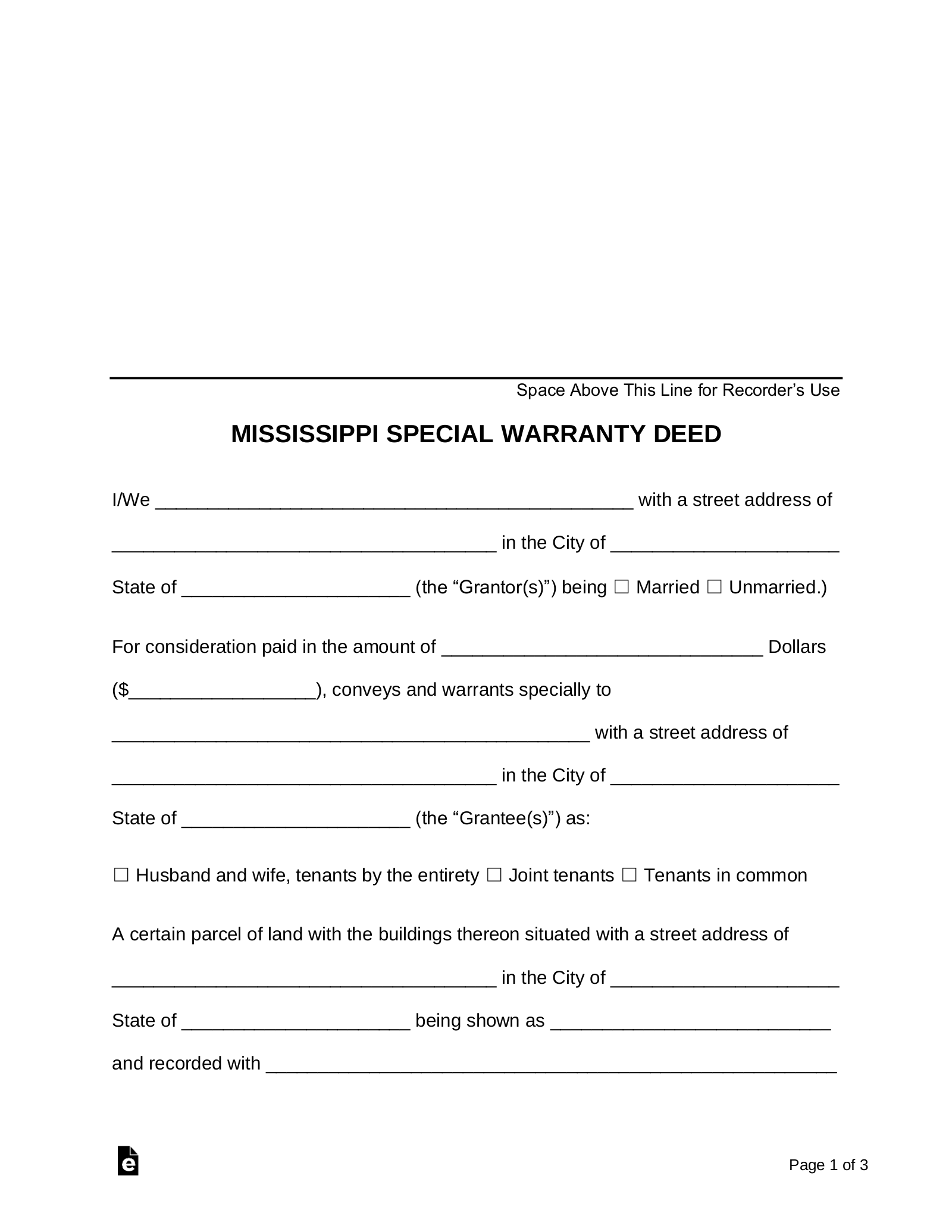

I. Mississippi State Of Property Transfer

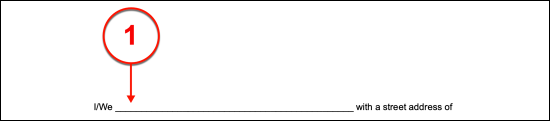

(1) Mississippi Property Grantor. The Mississippi Property Owner or Owners that intend to grant and release their Mississippi property ownership to a Buyer/Grantee must be identified. Make use of the first line to present the entire name of each current Mississippi Property Owner (or Grantor) to the statement displayed.

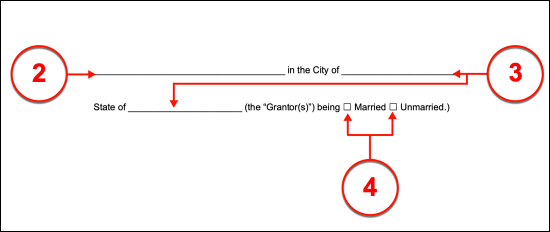

(2) Address Of Mississippi Property Grantor. Furnish the home address of each Mississippi Property Owner/Grantor. This statement assumes three items will be needed to define one Grantor’s home address thus, supply the street address where requested before continuing to report the County, and State of the Mississippi Grantor being discussed. Keep in mind this information is mandatory, meaning that if more than one Mississippi Property Owner/Grantor is operating through this paperwork then each one’s address must be documented.

(3) Residential County And State Of Mississippi Grantor.

(4) Mississippi Grantor Marital Status. If there is more than one Mississippi Property Owner (or Grantor) participating in this document then their marital status should be discussed. Select the “Married” checkbox or the “Unmarried” checkbox to establish whether the Grantors above are a married couple (presently) or are not married to one another.

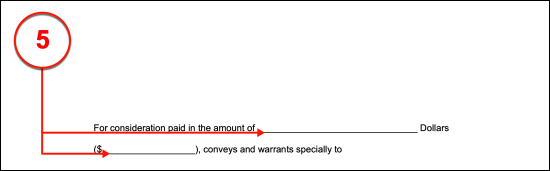

(5) Payment Received By Grantor. A record of the amount of money paid to the Grantor for the Mississippi property must be included for this action to proceed with this paperwork. Write out the payment the Mississippi Grantor received for this property then continue to the parentheses where a numerical entry that defines this amount should be dispensed.

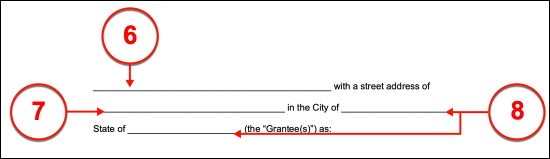

(6) Paying Grantee Identity. The Mississippi Grantee will usually be the same Party who has paid the above amount however this is not mandatory. Whoever is named as the Grantee in this document shall be placed as the Recipient of the Mississippi Grantor’s ownership over the concerned real estate. Deliver the full name of each Mississippi Grantee to receive property ownership through this statement.

(7) Mississippi Grantee Address. The address of every Mississippi Grantee should be dispensed to this statement. A separate area has been reserved for the building number/ street/apartment number (street address), for the County of residence, and for the State of the Mississippi Grantee’s residence. Make sure that each Mississippi Grantee’s name is presented with his or her entire home address.

(8) Mississippi Grantor Home County And State.

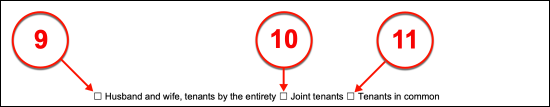

(9) Mississippi Grantee Status. If there will be more than one Mississippi Grantee, then the level of ownership each will assume over the Mississippi land or premises should be discussed. One of three checkboxes should be chosen to establish this status. For instance, if the Grantee(s) should be reported as married then select the first checkbox. This will indicate the Grantees involved are “Husband And Wife” and will share ownership according to the terms of their marriage.

(10) Non-Married Equal Owners. Select “Joint Tenants” if the Mississippi Grantees are not married but will each enjoy equal ownership over the property.

(11) Grantees As Tenants In Common. If the Grantees are not married and will not share equal ownership over the property then select “Tenants In Common.” This option will assume that the Grantees have set their own paperwork regarding property ownership in motion.

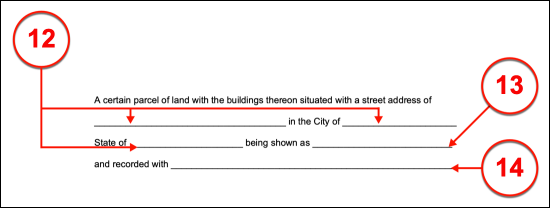

(12) Mississippi Property Address. It is imperative the Mississippi property being transferred is established. Thus, deliver the complete address of the Mississippi property. Begin with its street address, then provide confirmation of the County and State (Mississippi) where it is located.

(13) Legal Description Of Mississippi Property. Reproduce the legal description of the Mississippi real property.

(14) Mississippi County Recorder Information. Identify the Mississippi County Recorder Office where the records for this property are kept.

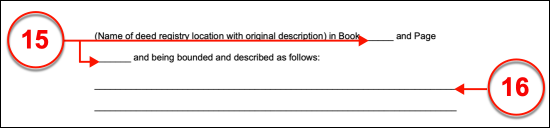

(15) Recording Details. Present the Book and Page where the property’s legal description can be reviewed or requested from the Mississippi County Recorder in charge of maintaining this information.

(16) Legal Description Of Mississippi Property. Furnish an exact reproduction of the Mississippi property’s legal description as it appears in the Country Recorder’s Office.

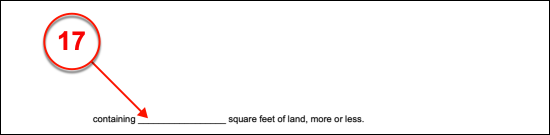

(17) Mississippi Property Area. Record the number of square feet making up the parcel of land being conveyed.

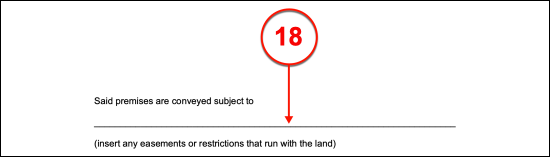

(18) Property Encumbrances, Easements, Or Restrictions. The Mississippi Grantor shall use this document to transfer to the Grantee the same level of property ownership he or she enjoys. Therefore, if the Mississippi Grantor currently has any debts or encumbrances on the property, each of these should be documented. Furnish a report on any debts or damages on the property that the Mississippi Grantor has caused or is currently responsible for.

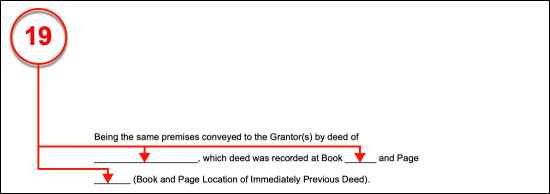

(19) Previously Issued Deed Information. Verify that the property being conveyed from the Grantor is the same as the one defined above by confirming the registry location, book, and page location of the last deed filing made for this property before this one.

(20) Mississippi Conveyance Statement Effective Date. The calendar date when the Mississippi Grantor signs his or her name should be presented to the final statement.

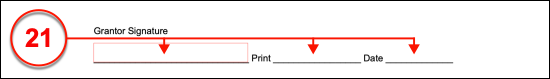

(21) Mississippi Grantor Signature. Every Grantor of Mississippi property will be required to sign his or her name to effect the transference of this property’s ownership to the Grantee. The Mississippi Grantor must perform this signature act under the oversight of a Notary Public as well as produce his or her printed name and address. This requirement is placed on all Mississippi Grantors that were named as such in the first statement.

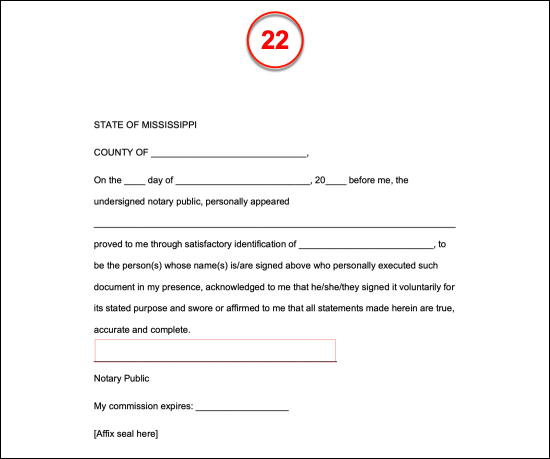

(22) Required Notary Public Participation. The Mississippi Property Owner/Grantor(s) signing this paperwork will need to participate in the notarization process with an observing Notary Public. Once done the Notary will conclude the process by providing a record of it in the final statement.