Updated April 12, 2024

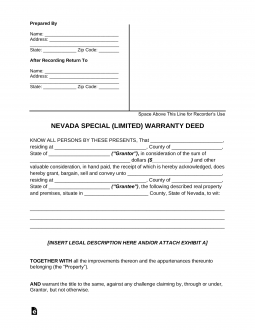

A Nevada special warranty deed is a legal document used to transfer property with a warranty. This type of warranty is limited, however, in that it is only meant to warrant that there will be no claims of interest arising out of the grantor’s ownership of the property, but unlike a general warranty, it does not include a guarantee for any claims arising out of previous ownership of the property. Similar to the other deeds, you need the grantor and the grantee’s names, the consideration paid, and a description of the property.

Laws – Title 10, Chapter 111 – Estates in Property; Conveyancing and Recording

Cover Sheet – Required to be the first (1st) page upon filing to the County Recorder’s Office.

Declaration of Value – Required form needs to be added as the last page of the deed in order for final submission.[1]

Recording – Must be recorded in the County Recorder’s Office (View County List).[2]

Signing – Required to be authorized with the Grantor(s) in the presence of a Notary Public.[3]

How to Write

Download: Cover Sheet and the Declaration of Value

Download Form: PDF, MS Word, OpenDocument

I. Mandatory Coversheet

(1) APN. The Assessor’s Parcel Number for the real property being discussed must be presented at the beginning of the cover sheet.

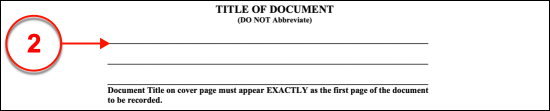

(2) Title Of Document. Reproduce the title of the document being sent precisely as it appears on the original.

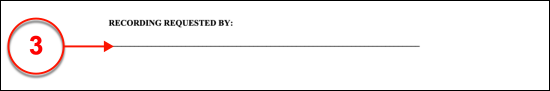

(3) Recording Requested By. Identify the Nevada Property Owner releasing his or her claim on the property with a recording of his or her full legal name.

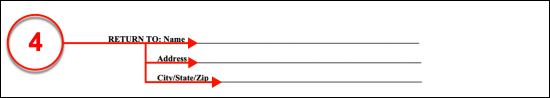

(4) Return To. The Recipient who must be set to receive the filed Nevada Declaration must be identified as the Mail or Return Recipient along with his or her full mailing address. In many cases, this will be the Purchaser of the Nevada real property or property rights or his or her Representative, Whoever is named here will receive the physical conveyance statement by mail once it has been filed with the State.

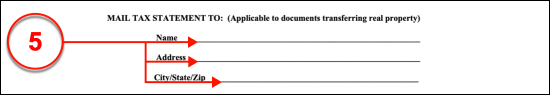

(5) Mail Tax Statement To. Similarly, the Party who should receive tax documents pertaining to this property should also be named. He or she must be identified with a production of his or her legal name and mailing address.

II. Declaration Of Value

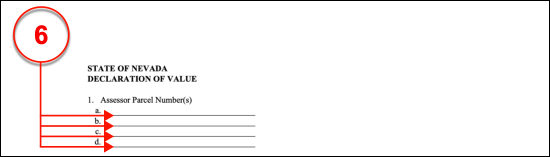

(6) Assessor Parcel Number. The State of Nevada shall require that real property be assigned a parcel number at the time of its assessment. The parcel number of every real property involved with this conveyance statement should be documented.

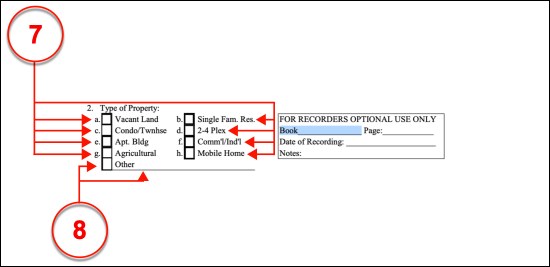

(7) Property Type. Select the appropriate property description from the checklist provided. For instance, if the Nevada property is a commercial or industrial property then place a mark in Checkbox F (labeled “Comm’l/Ind’l)

(8) Other Property Type. If the type of real property being conveyed cannot be considered vacant, a single farm residence, a condominium or townhouse, a two to four-unit multiplex, an apartment building, a commercial or industrial complex, a farm or agricultural property, or a mobile home, then select the checkbox labeled “Other” and define the type of Nevada property being covered in the space provided.

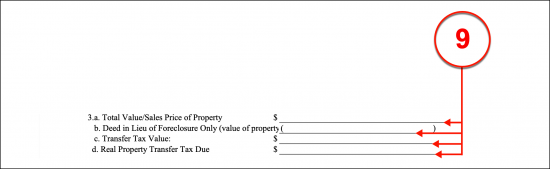

(9) Total Value/Sale Price Of Property. The dollar amount that was received for the release of Nevada property. Must be recorded on line 3A. If this transfer shall work is effected in lieu of a forclosure, then the value of the real property being transferred should be placed on line 3B. Once these figures have been supplied, subtract the 3B amount from the 3A amount to reach the “Transfer Tax Value” required by line 3C. Once done, report the real property transfer tax by recording the total dollar amount reached by assigning by calculating the rate reached at $2.55 for every $500.00 making up the value in line 3C.

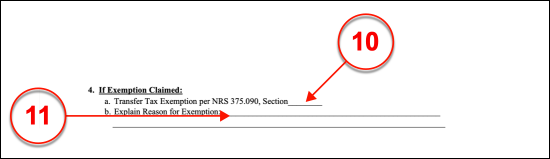

(10) Transfer Tax Exemption. If the Filer may claim a tax exemption, then cite the appropriate section from NRS 375.090 qualifying him or her to seek this relief.

(11) Reason For Tax Exemption. Establish the exact reason the transfer tax exemption can be engaged by furnishing it directly to the space provided.

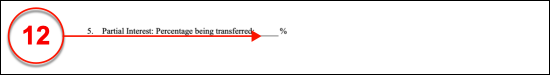

(12) Partial Interest Status. In some cases, the Filer of this document (oftentimes, the Grantor) will need to indicate that he or she only a Partial Owner of the Nevada property. If this scenario applies, then the percentage of the ownership over the Nevada property held by the Nevada Grantor must be documented.

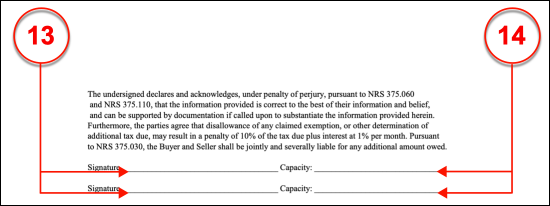

(13) Signature. The Filer of this document must sign his or her name.

(14) Capacity. The Signature Party must define his or her status in relation to the filing of this paperwork.

III. Header

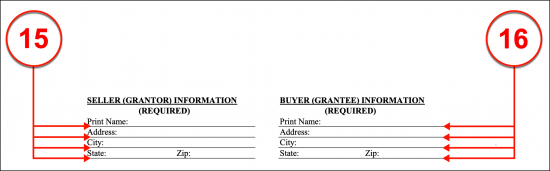

(15) Seller (Grantor) Information. The full name and residential address of the Nevada Grantor should be documented before closing this paperwork.

(16) Buyer (Grantee) Information. The Grantee or Buyer of Nevada real property must also be identified with his or her legal name and residential address.

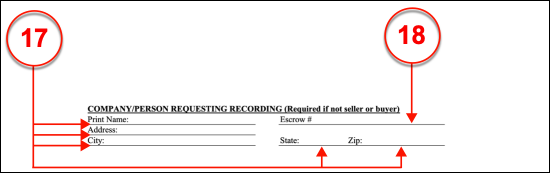

(17) Third-Party Request. If the Filer of this document is neither the Grantor nor Grantee, then his or her identity and home address must be displayed.

(18) Escrow Number. If the Third-Party (Filer) has an escrow number make sure it is produced.

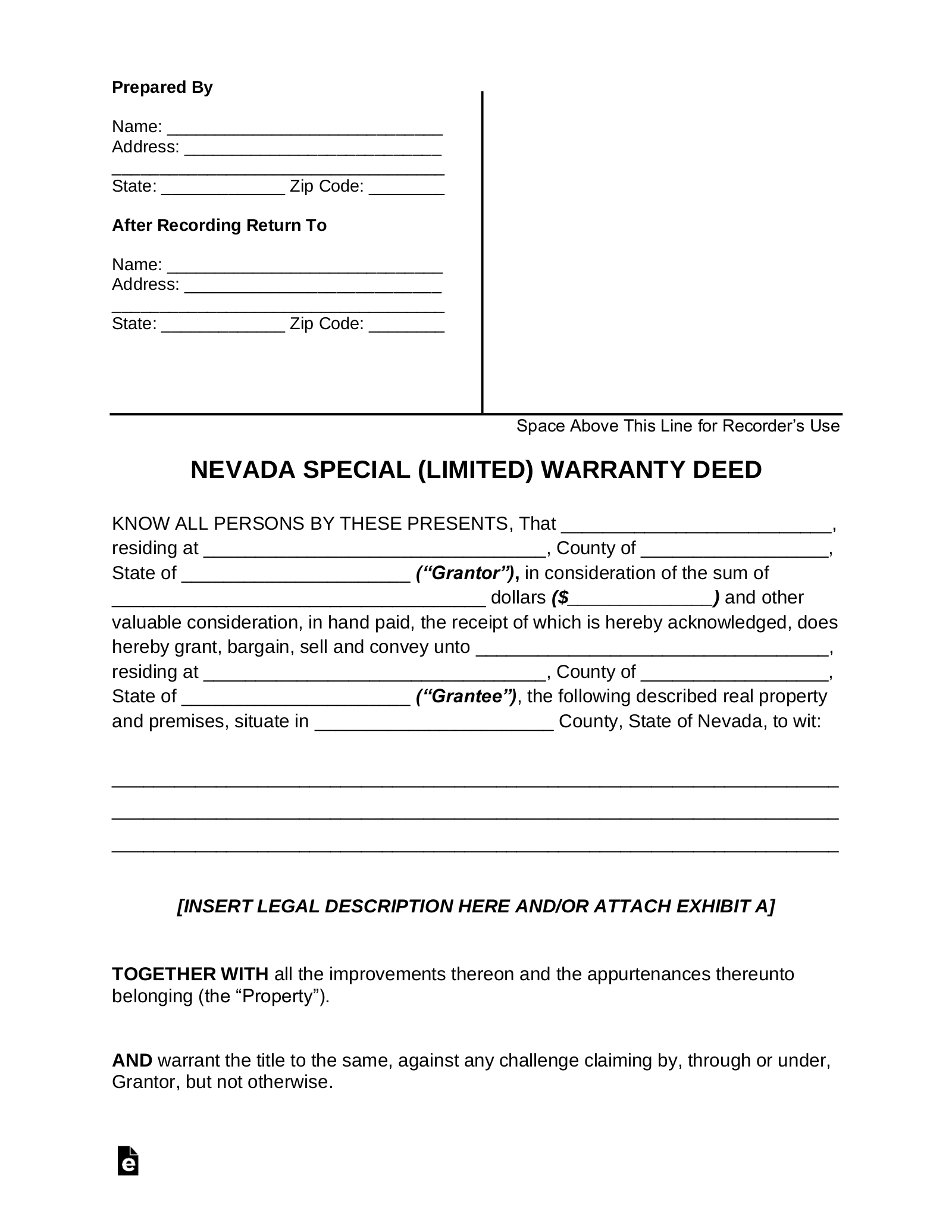

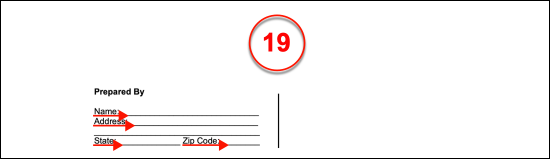

(19) Preparer. The document below expects certain pieces of information supplemented to its language. The complete name and the entire mailing address of the Preparer of the Nevada statement below must be displayed.

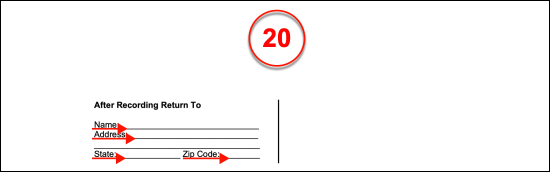

(20) Filing Recipient. As mentioned earlier, the Nevada County Recorder will seek to return this document to the appropriate Party. Generally, this is the Grantee of the Nevada real property but may be anyone from the Grantee to a Representative. Furnish the name of the Filing Recipient as well as his or her mailing address where requested by the second header area.

IV. Nevada Statement Of Conveyance

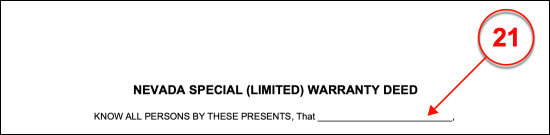

(21) Name Of Nevada Grantor. The Owner of the Nevada real estate or the Nevada real property must be dispensed to the first statement by this document. This will identify the Nevada Property Grantor of the purpose of this document.

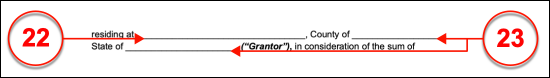

(22) Street Address Of Nevada Grantor. The building number and the street will define the street address of the Nevada Grantor. This entry must be taken from his or her residential address. If the Nevada Grantor lives in an apartment or unit then make sure to include this information as well.

(23) County And State.

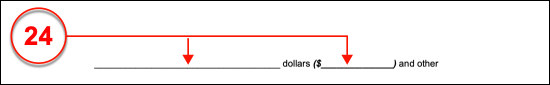

(24) Payment Amount. The dollar amount that was submitted to the Nevada Real Property Purchaser and received by the Grantor should be written out. Continue to the parentheses then reproduce this amount numerically.

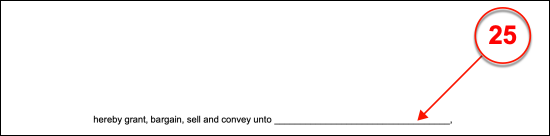

(25) Nevada Grantee Identity. The declaration made here will verify the intent of a Nevada Property Owner to release his or her real estate or real property to another Party. For this effect, the legal name of the Nevada Grantee (often the Purchaser) must be documented.

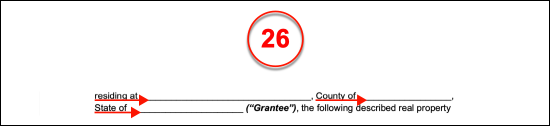

(26) Nevada Grantee Address. The street address of the Nevada Grantee is sought by this statement. Thus, dispense the building number, street, and the unit number of the Nevada Grantee’s home address.

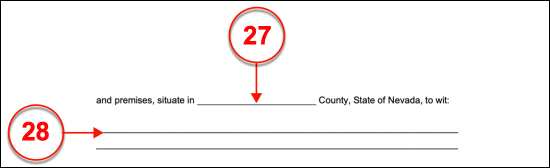

(27) County Of Nevada Property. Now that both the Nevada Property Grantor and Grantee have been properly named and the payment amount presented, it will be time to define the property the Grantor will release to the Nevada Grantee. This definition will have to begin with a record of the County where the real property is physically found or located.

(28) Nevada Property Description. The legal description of the Nevada real property will be available for review through the language of the last deed successfully filed or the County Recorder’s Office responsible for its processing and storage. A transcription of this legal description along with the geographical address of the Nevada real property will be required by this document. While a significant amount of space is presented, an attachment with this information may be furnished should more room be required.

V. Nevada Property Conveyance Execution

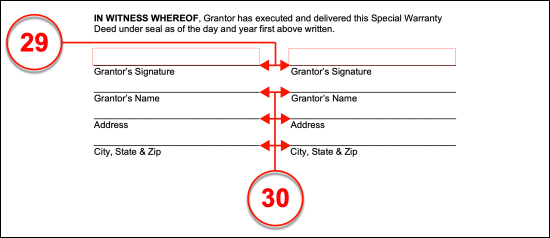

(29) Nevada Grantor Act Of Signing. The Nevada Property Owner who was identified as the Grantor must sign and print his name to effect this statement. Nevada State requires this action to occur under a qualified Notary Public’s observance.

(30) Nevada Grantor Address. The printed name and residential address of the Nevada Grantor should accompany his or her signature. Make sure the Nevada Grantor supplies this information during the signature process.

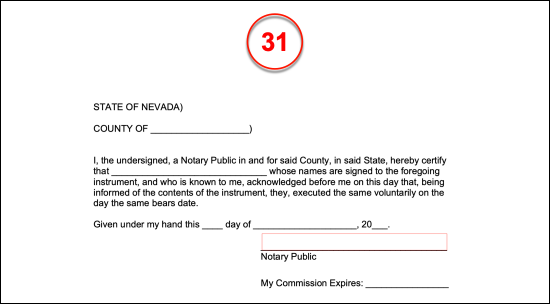

(31) Mandatory Notarization. The State of Nevada requires authentication of this statement’s signature execution. To this effect, the Notary who has observed the Nevada Grantor’s signing will supply evidence that this act was notarized.