Updated April 12, 2024

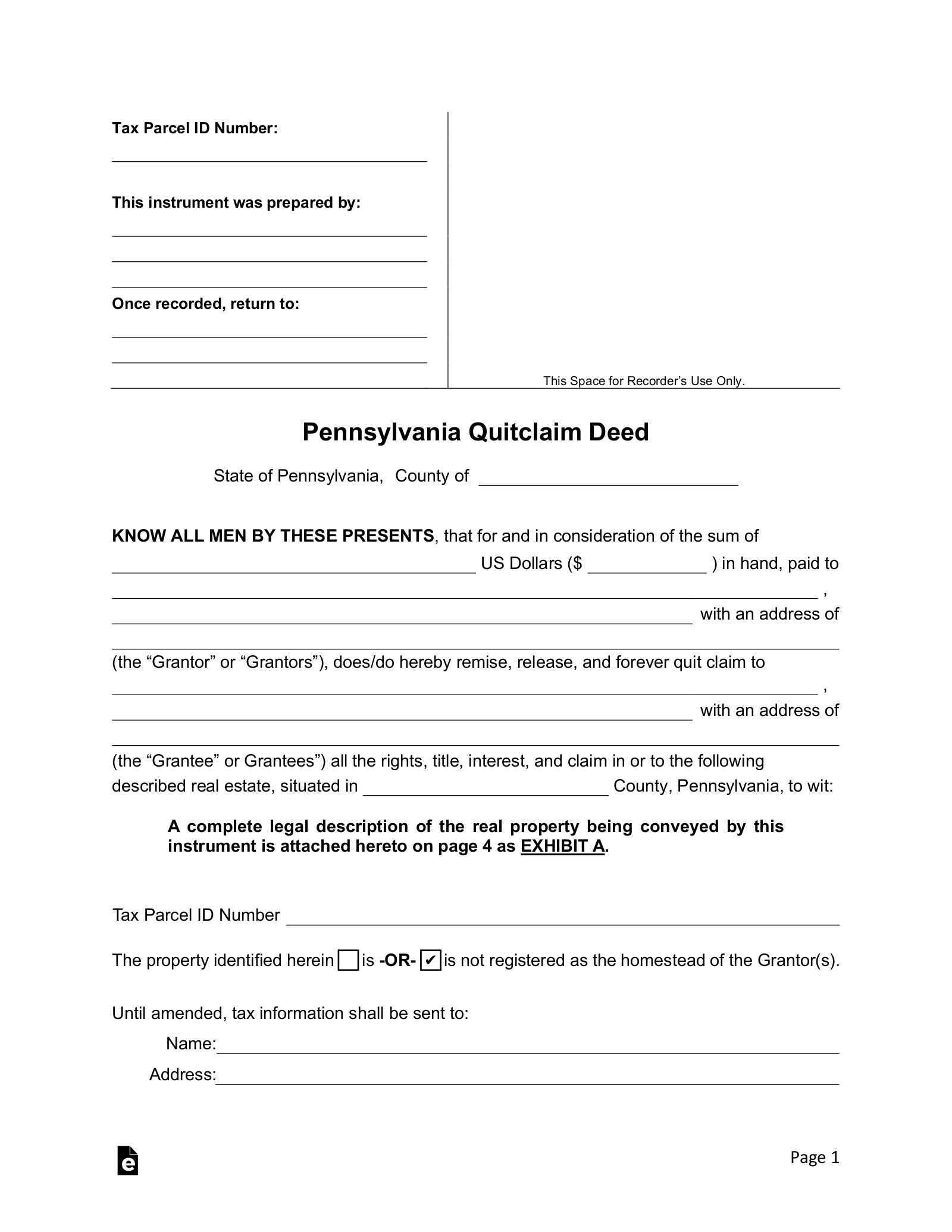

A Pennsylvania quit claim deed is a basic form that allows for the quick transfer of an interest or claim on property from one party to another. This document will define such items as the Consideration Paid, the Grantor, Grantee, and the Property in combination with the required language for this document. This form must be filed with the Pennsylvania Recorder of Deeds servicing the same County as that of the Property at hand. It should be noted; this document does not act as verification of the Grantor’s actual status. Thus, it is typically used with familiar parties.

Laws

- Certificate of Residency (PDF or Microsoft Word) – All new owners of real estate in Pennsylvania are required to submit their official residency.

- Checklist – Use this recording guide to ensure that you have all the documents and information required to perform the filing with the Register of Deeds.

- Philadelphia County – Form 82-127 is required in Philadelphia County only.

- Previous Recorded Information – The previous recording information is required. This can be the previous deed book and page number or the instrument number, depending on the county.

- Realty Transfer Tax Statement (Form REV-183 EX) – All quit claims must have this form and between a 1% to 2% transfer tax paid (based on the sales price). You may view your County’s Transfer Tax to get an estimate of how much the buyer and seller will have to pay (usually split 50/50 among the parties).[1]

- Recording – All quit claim filings must be completed at the Recorder’s Office located in every County (See Full List of County Websites).

- Signing – Though a grantor’s signature must not be witnessed for the deed to be effective, many county recorder offices will reject a deed for recording without a formal acknowledgment by a notary public.[2][3]

- Statute – 21 P.S. § 7

- UPI (Uniform Parcel Identifier) Stamp – After payment of the Realty Transfer Tax a UPI Stamp will be placed on the deed. This stamp will be required to get the deed recorded.