Updated August 23, 2023

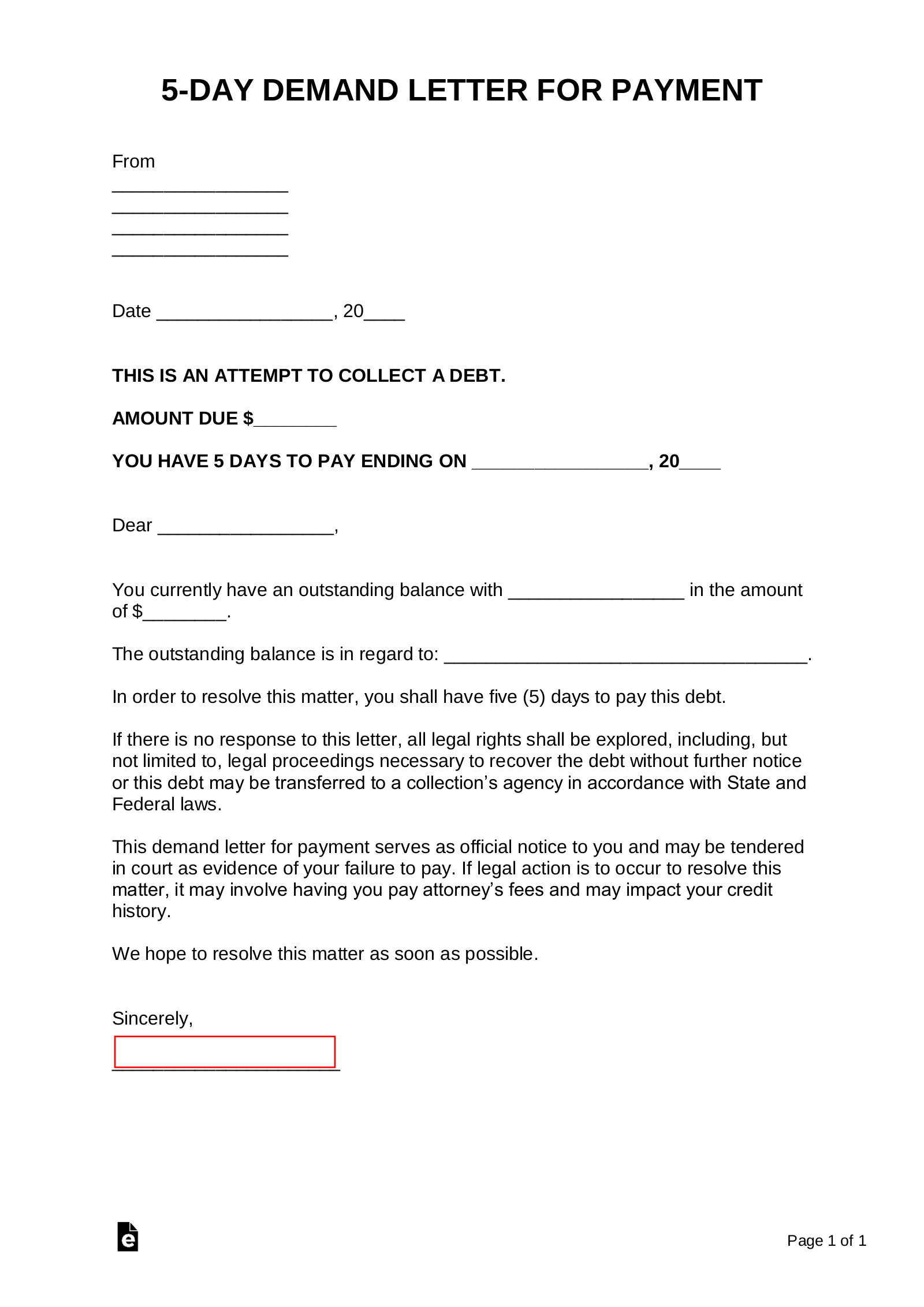

A 5-day demand letter for payment is sent to a debtor as a final reminder notice before legal action is taken. This short amount of time should only be used if there have been multiple reminders about the debt with no communication. Depending on the amount that is owed, the creditor may attempt to file a small claims case or seek the civil court system.

5-Day Notice to Quit – Use to inform a tenant that they are late on rent and have 5 days to pay or vacate the property.

When to Use

5-Day Demand Letters for Payment are utilized for several reasons, the most common being:

- For a customer who purchased goods;

- To obtain payment for past-due loans (personal, automobile, etc.); and

- To obtain payment on utility bills that remain unpaid.

An individual should respond immediately upon receiving a 5-Day Demand Letter for Payment, as it can result in further legal action by the creditor or collector.

How to Serve (4 steps)

- Detail the Amount and Past Due Date

- Give 5 Days to Cure Debt

- Detail the Consequences for Failure to Pay

- Deliver the 5-Day Demand Letter

1. Detail the Amount and Past Due Date

Gather all pertinent documents to ensure there is proof of money owed by the debtor. This could encompass any receipts, emails granting extensions, documentation of partial payments, documentation of stopped checks, loan information, number of car payments, etcetera. Documentation will need to be provided to ensure the previously agreed upon terms were not met. All past due payments and any applicable late penalties incurred should be itemized and detailed with an amount for each line and a final total amount at the end. Ensure to add taxes, past due fees, or administrative charges as applicable.

2. Give 5 Days to Cure Debt

The debtor should be provided time to rectify the situation, and dependent on the debt, along with local state laws, this time can vary. However, the date for which payment must be received in full, should be clearly written and leave no room for confusion by the debtor. This could lead to delays. Time frames can range from 10 days to 30 days, which is most common.

3. Detail the Consequences for Failure to Pay

Upon providing a fair amount of time to cure the debt, the collector should also state the significance if the debtor does not pay in full. Providing a strong alternative (avoid small claims court due to lawsuit) if the issue does not get rectified is also an option, to help assist in immediate resolution. The debt may also be sent to a collection agency to act on the behalf of a company or individual attempting to collect a debt.

4. Deliver the 5-Day Demand Letter

Upon completion of the letter, the 5-Day Demand Letter should be sent via registered or certified mail and also sent electronically, if possible. Sending contact to the individual via multiple avenues creates a lower opportunity for an individual to avoid making payment.