Updated March 05, 2024

A demand letter for payment is a request for money owed that is commonly the last notice given by the creditor. The party owed should include language that motivates the debtor to make payment. Examples include giving a discount if the debtor decides to pay or threatening to send the debt to collections.

Table of Contents |

By Type (22)

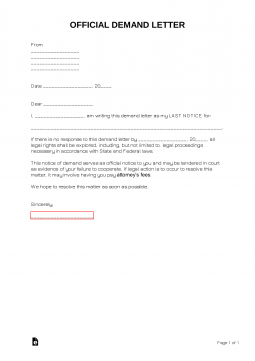

What is a Demand Letter?

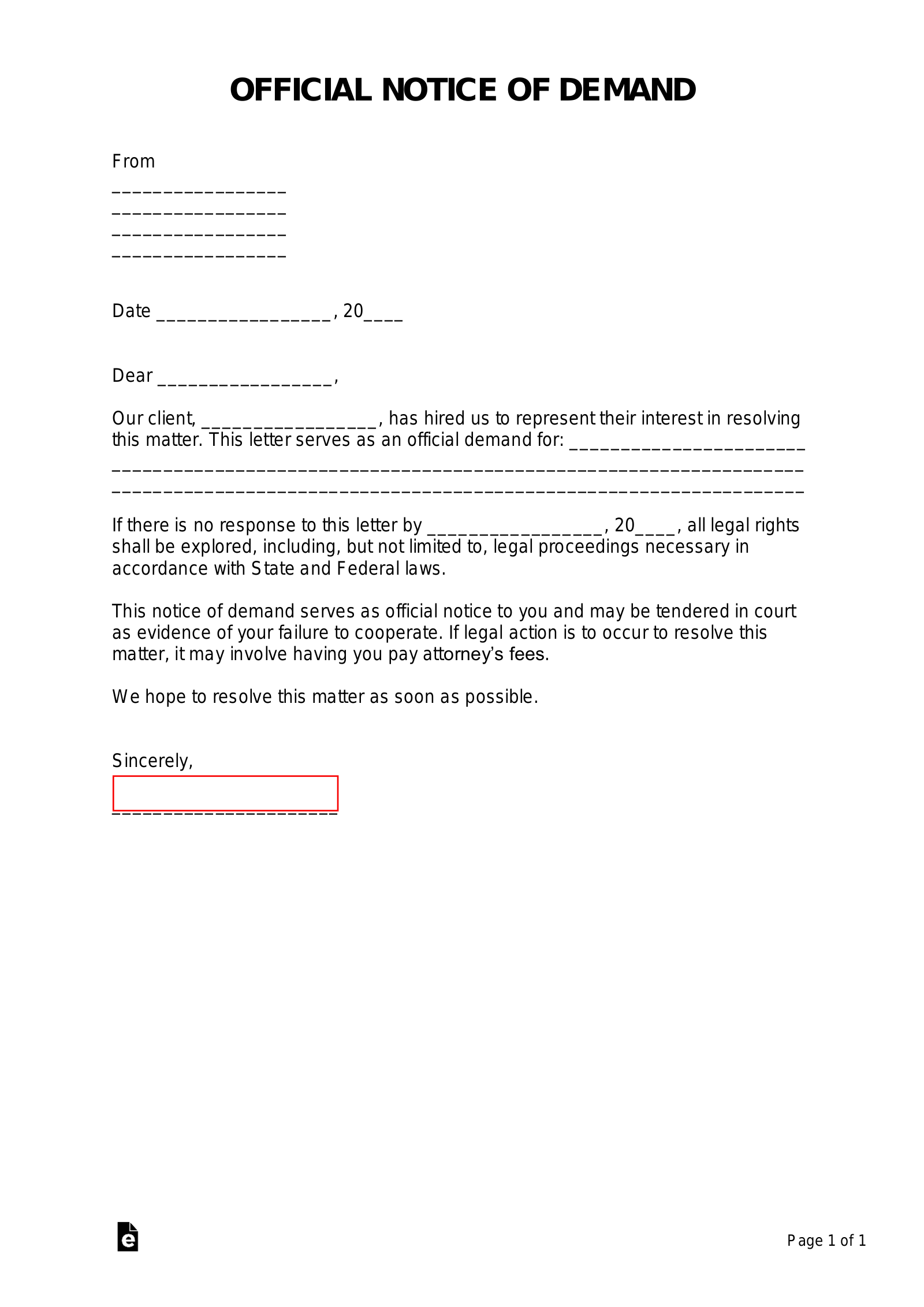

A demand letter is an official notice requesting money, possession of assets, or action on a legal matter. It is most commonly used when requesting money for a past-due amount. A demand letter is usually the last attempt to find a solution with another party before legal action is filed.

Tips for Writing

- Avoid inappropriate language and remain professional

- Provide complete, truthful, and accurate details of the issue

- Provide the appropriate timeframe for resolution

- Provide the financial amount the appropriate party needs to furnish

- Attach appropriate evidential documents

- Avoid implying any sort of extortion

Eviction

An eviction notice is a demand for payment for late rent. This notice is defined by each state giving the tenant a specified number of days to repay the rent owed. If the tenant does not pay within the state-required time period, the tenant will be required to vacate the premises.

How to Send a Demand Letter (5 steps)

- Decide What to Ask

- Calculate the Offense

- Give a Timeframe to Fix the Issue

- File a Lawsuit (if the breach isn’t satisfied)

- Collect and Receive Payment

1. Decide What to Ask

It’s important to keep the amount below the small claims maximum in your state. The creditor must also describe, in the demand, the amounts that are owed by finding invoices or agreements that prove the debtor actually owes the money. Under the Fair Debt Collection Practices Act, the creditor may only be able to request payment for documentation on file.

2. Calculate the Offense

Gather all pertinent documents to ensure you have proof of money owed. This could include receipts, invoices, law enforcement records, evidence of work, copies of returned checks, etc. Documentation will need to be provided to ensure the previously agreed-upon terms were not met. All damages incurred should be itemized and detailed with an amount for each line and a final total amount at the end.

3. Give a Timeframe to Fix the Issue

The demand letter should provide a clearly written deadline for the recipient. Upon completion of the letter, the demand letter should be sent via Certified Mail and also sent electronically, if possible. This will ensure the individual understands the issue as a high priority, reducing the risk that the party involved does not receive the letter.

4. File a Lawsuit (if the breach isn’t satisfied)

Small Claims Court (less than the state-required amount) – If the receiving party has not responded in a satisfactory manner, a lawsuit may be filed. This is done to get a judgment against the receiving party, which could lead to a settlement. The receiving party may also be responsible for all attorney’s fees incurred.

Money Owed vs. Breach of Contract

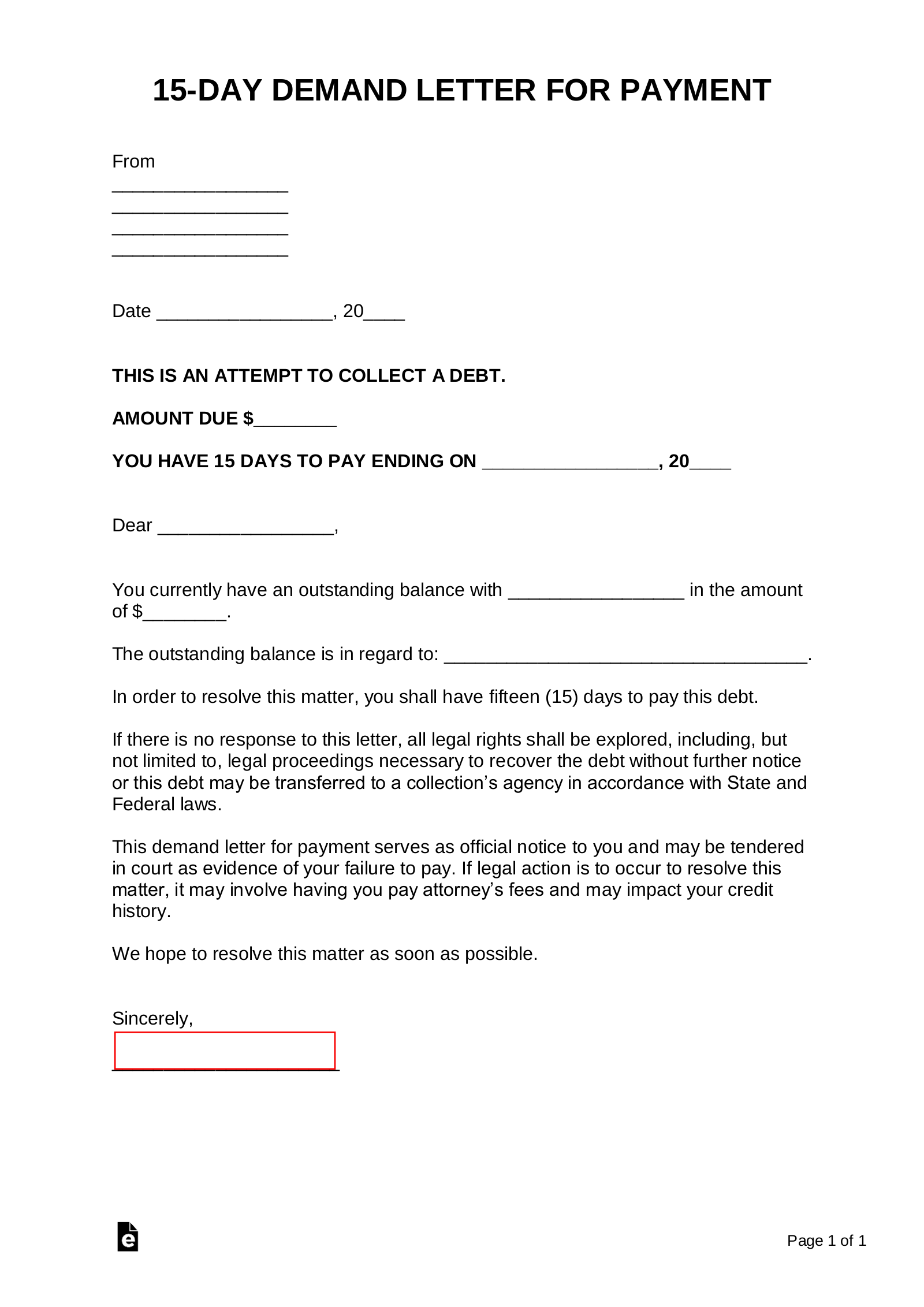

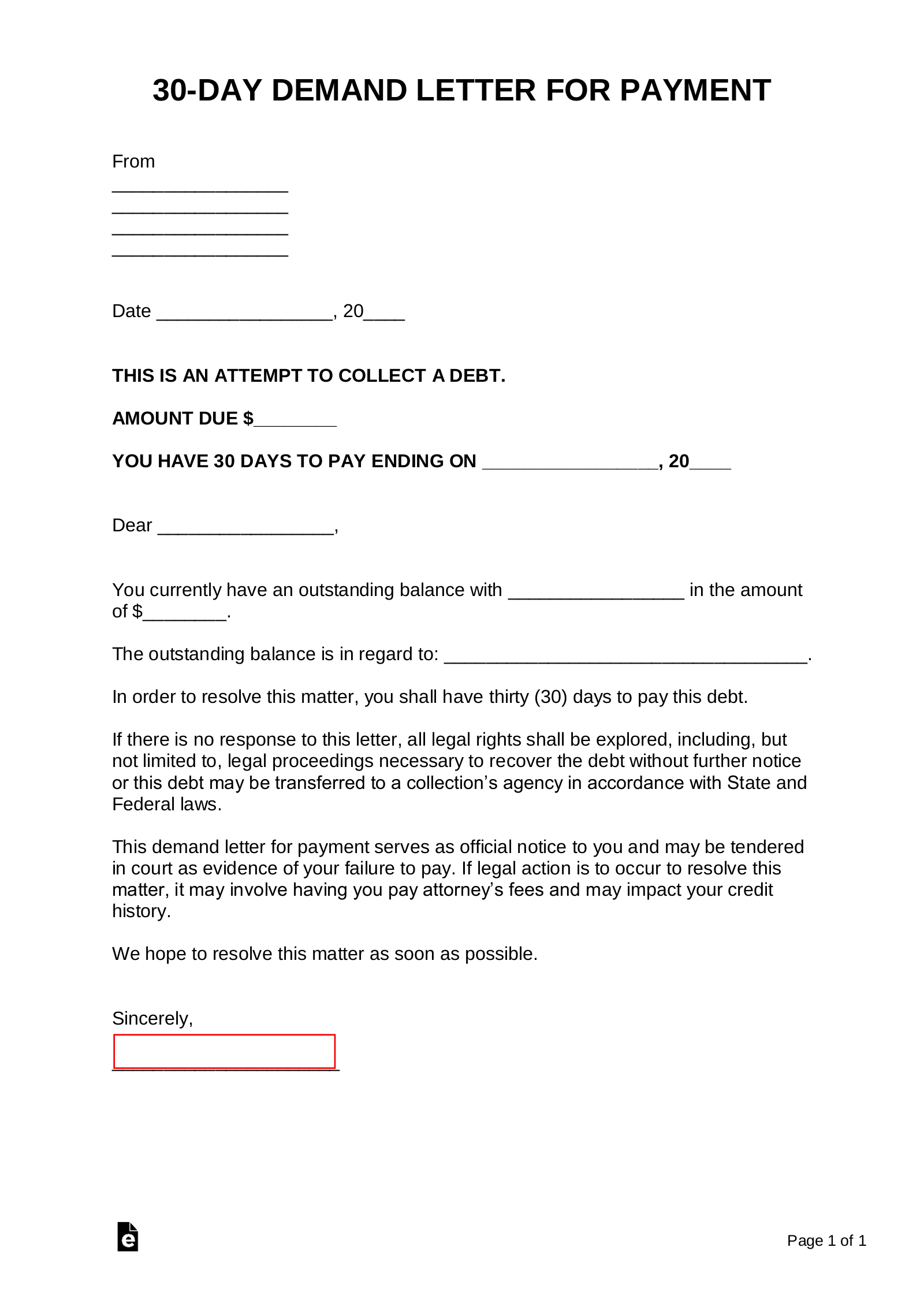

Money Owed Demand Letter – Strictly for debts or outstanding balances. It should detail the amount due, itemizing any penalties or interest, along with any acceptable payment plans.

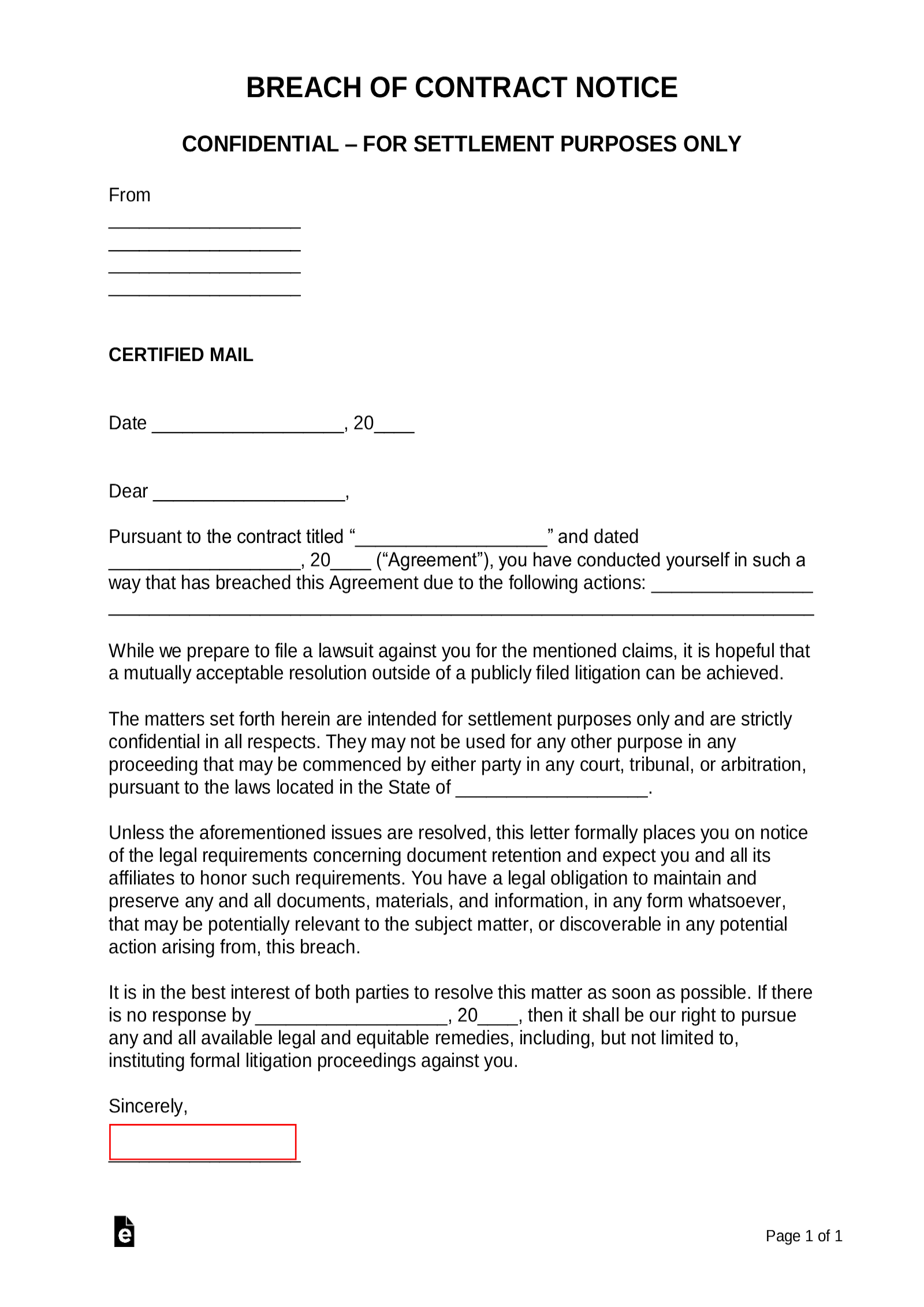

Breach of Contract Demand Letter – Strictly for contract violations. It should outline how the other party may be in compliance or else damages may incur.

How Long Do Settlements Take?

The time a settlement takes to be fulfilled can vary. On average the traditional timeframe stands around two to six weeks for the parties to come to an agreement. This is due to the fact that there are additional steps once that decision has been made, including acquiring all required signatures, having checks processed, and providing the checks to the appropriate parties.

Small Claims Amounts ($): By State

Below are the maximum allowable amounts in each state’s small claims court.

| State | Maximum Amounts ($) | Statute |

| Alabama | $6,000 | § 12-12-31 |

| Alaska | $10,000 | § 22.15.040 |

| Arizona | $3,500 | § 22-503 |

| Arkansas | $5,000 | “Guide to Small Claims Court” |

| California | $10,000 for individuals or sole proprietors, $5,000 for corporations and other entities. | § 116.210-116.270 |

| Colorado | $7,500 | § 13-6-403 |

| Connecticut | $5,000 | § 51-15(d) |

| Delaware | $15,000 | § 9301 |

| Florida | $8,000 | Rule 7.010(b) |

| Georgia | $15,000 | § 15-10-2 |

| Hawaii | $5,000 | § 633-27, “Your Guide to Small Claims Court” |

| Idaho | $5,000 | § 1-2208(1)(a) |

| Illinois | $10,000 | Rule 281 |

| Indiana | $6,000 for employment-related, $10,000 for all other matters. | Rule 8(c), Small Claims Manual (2022) |

| Iowa | $6,500 | § 631.1 |

| Kansas | $4,000 | § 61-2703(a) |

| Kentucky | $2,500 | § 24A.230 |

| Louisiana | $5,000 | § 5202 |

| Maine | $6,000 | § 7482, “A Guide to Small Claims Cases” |

| Maryland | $5,000 | § 4-405 |

| Massachusetts | $7,000 | § 218-21 |

| Michigan | $6,000 | § 600.8401 |

| Minnesota | $15,000 | § 491A.01 |

| Mississippi | $3,500 | § 9-11-9 |

| Missouri | $5,000 | “Missouri Small Claims Court Handbook” |

| Montana | $7,000 | § 25-35-502 |

| Nebraska | $3,900 | § 25-2802, Small Claims |

| Nevada | $10,000 | § 73.010 |

| New Hampshire | $10,000 | § 503-1 |

| New Jersey | $3,000 | “New Jersey Judiciary Small Claims” |

| New Mexico | $10,000 | § 34-8a-3 |

| New York | $5,000 for City Courts, $3,000 in Town and Village Courts, $10,000 for New York City, and $5,000 for Nassau and Suffolk Counties | NY Small Claims |

| North Carolina | $10,000 | § 7A-210 |

| North Dakota | $15,000 | § 27-08.1-01 |

| Ohio | $6,000 | § 1925.02(A)(1) |

| Oklahoma | $10,000 | § 1751 |

| Oregon | $10,000 | § 55.011-55.140 |

| Pennsylvania | $12,000 | “Bringing Suit Before a Magisterial District Judge” |

| Rhode Island | $5,000 | § 10-16-1 |

| South Carolina | $7,500 | § 22-3-10 |

| South Dakota | $12,000 | § 15-39-45.1 |

| Tennessee | $25,000 | § 16-15-501(d) |

| Texas | $10,000 | § 26.042 |

| Utah | $11,000 | § 78A-8-102 |

| Vermont | $5,000 | “A Guide to Small Claims Proceedings in Vermont” |

| Virginia | $5,000 | § 16.1-122.2 |

| Washington | $5,000 | § 12.40.010 |

| Washington D.C. | $10,000 | § 11–1321 |

| West Virginia | $10,000 | § 50-2-1 |

| Wisconsin | $10,000 | § 799.01(d) |

| Wyoming | $6,000 | § 1-21-201 |

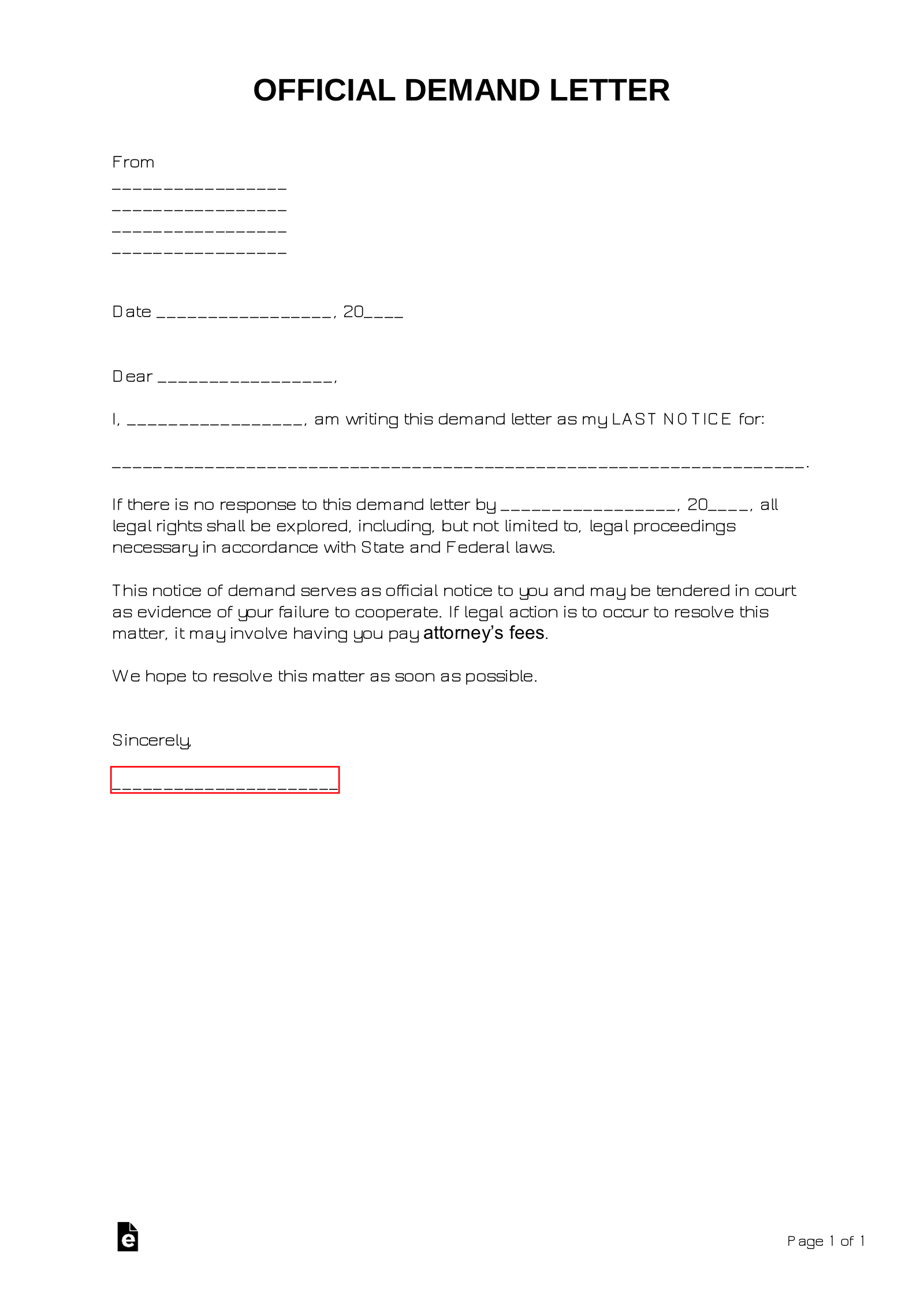

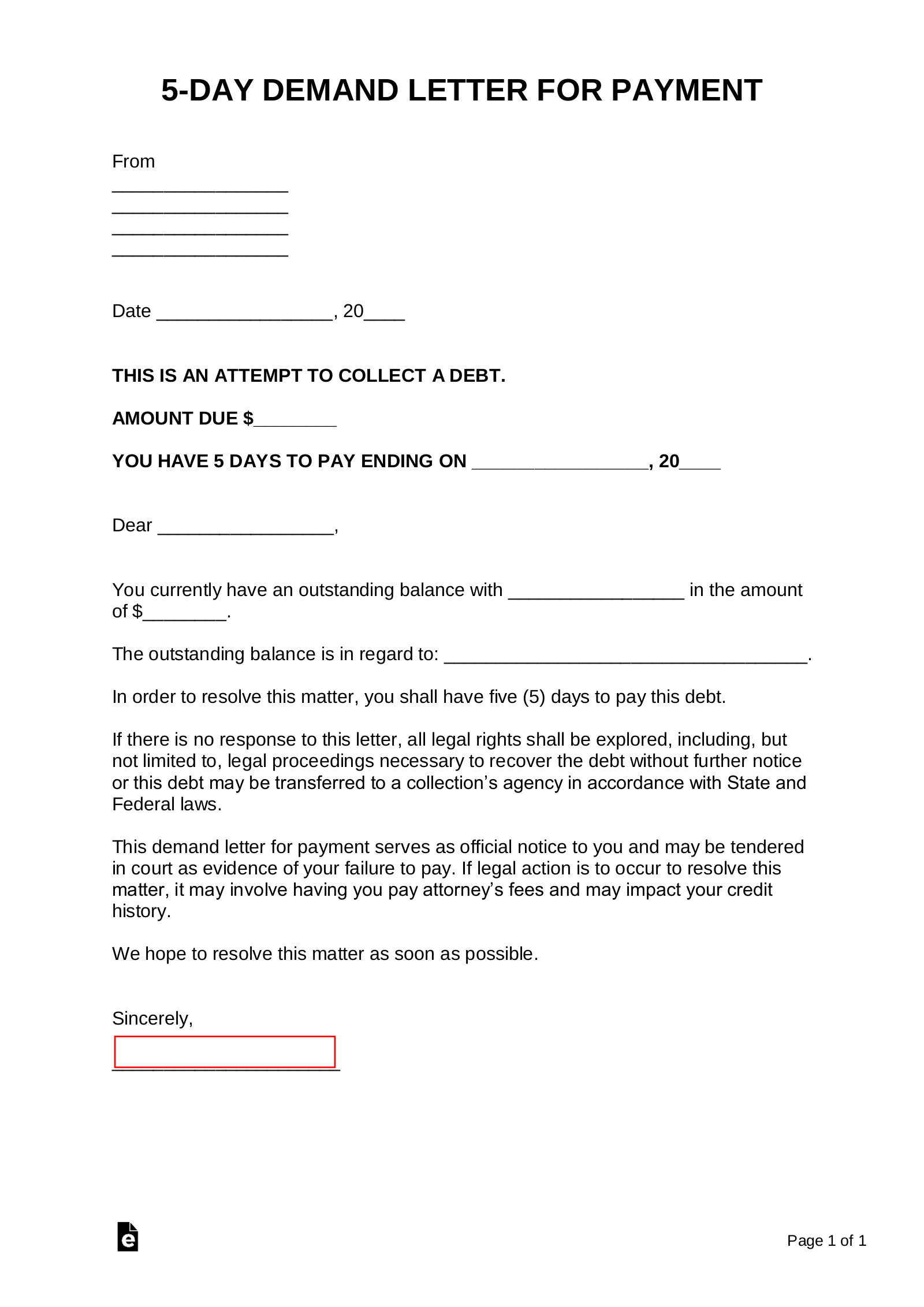

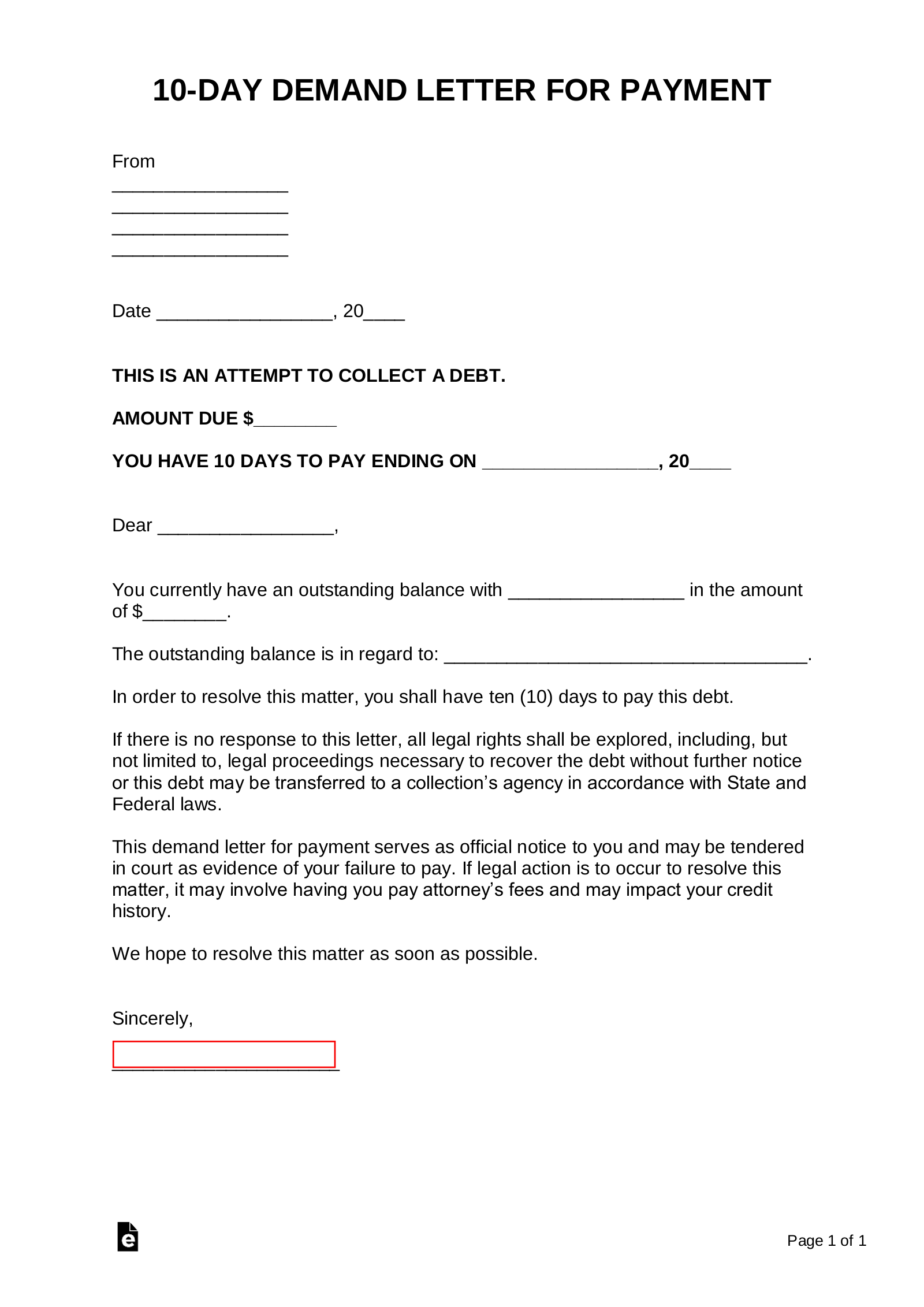

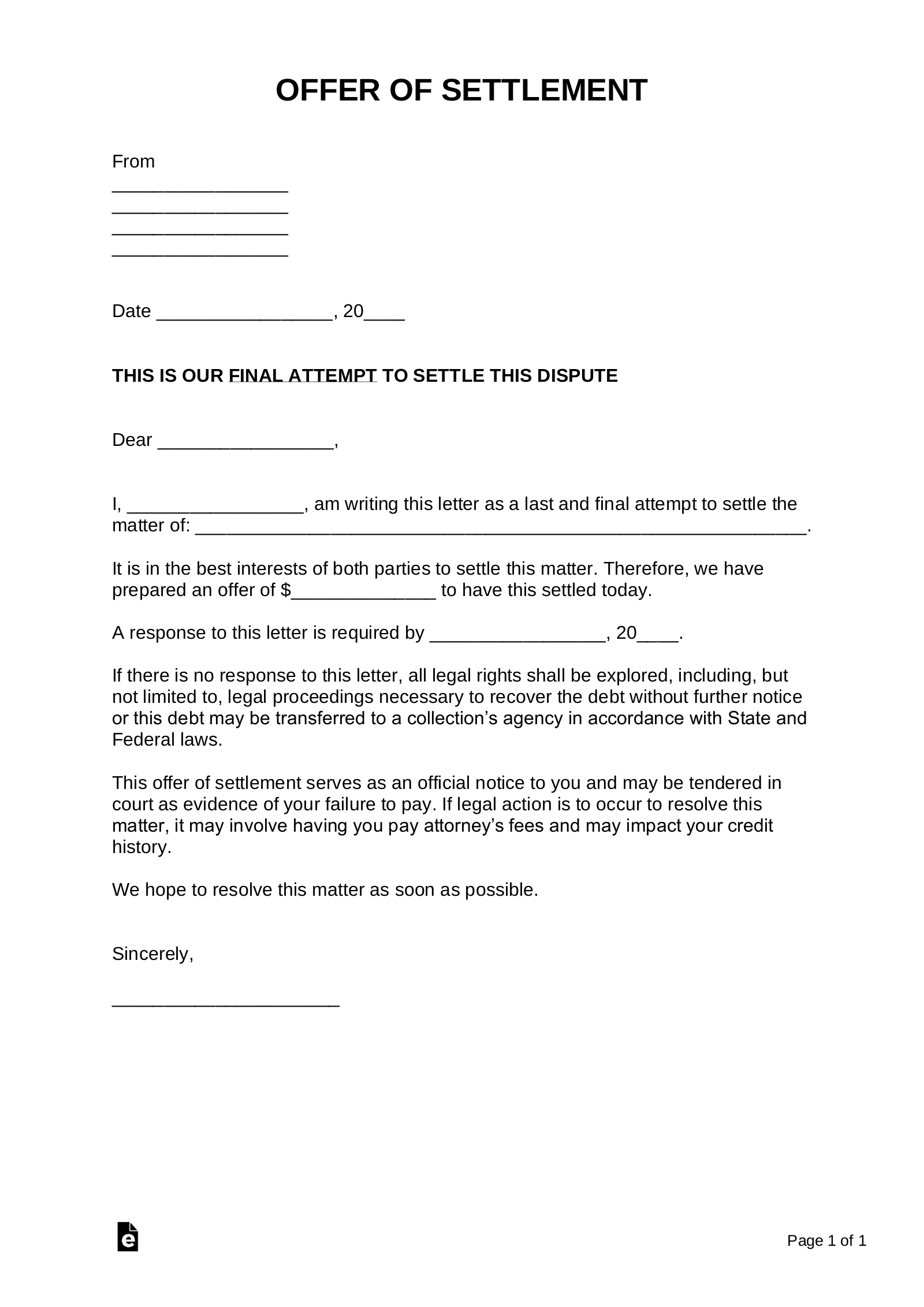

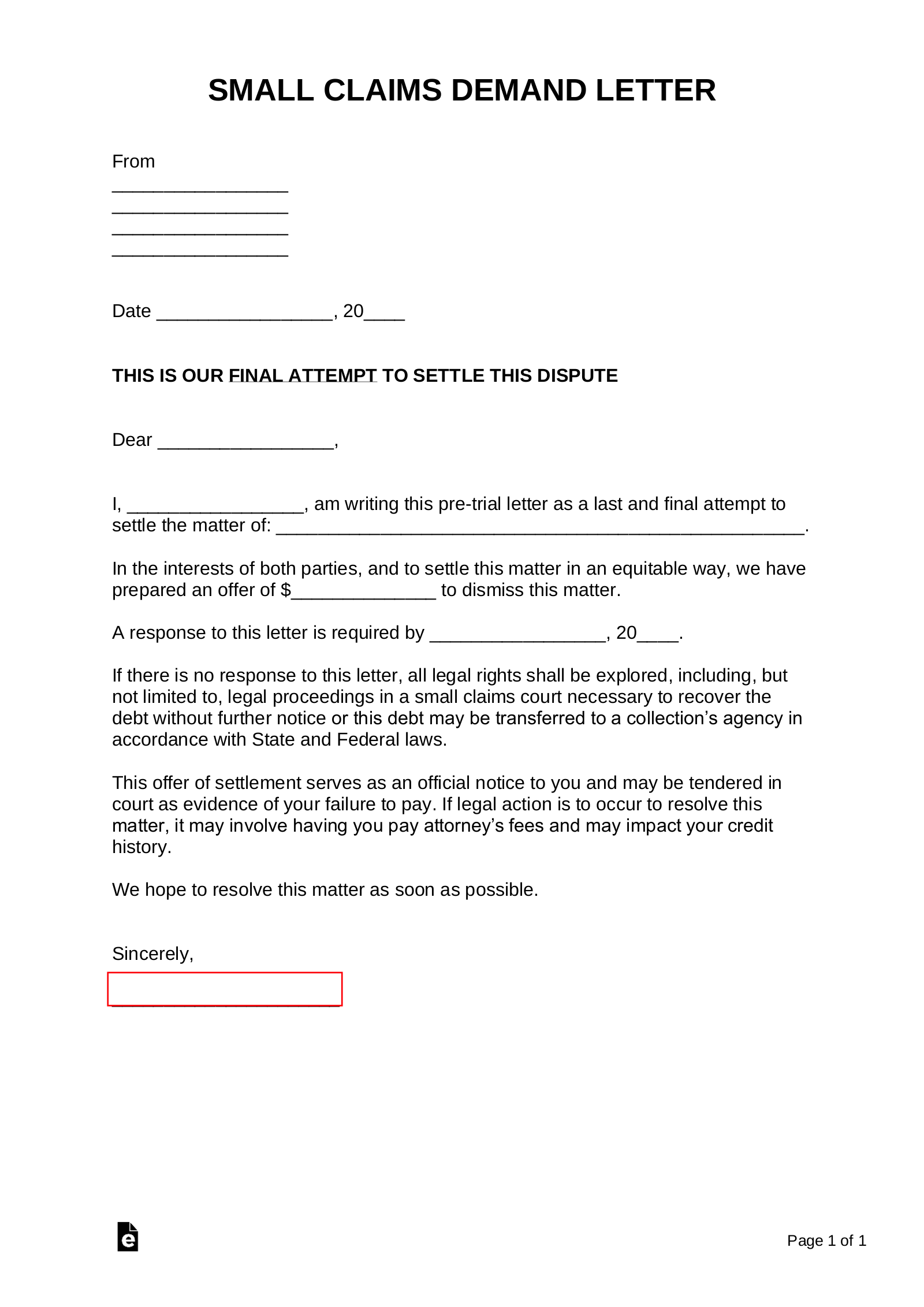

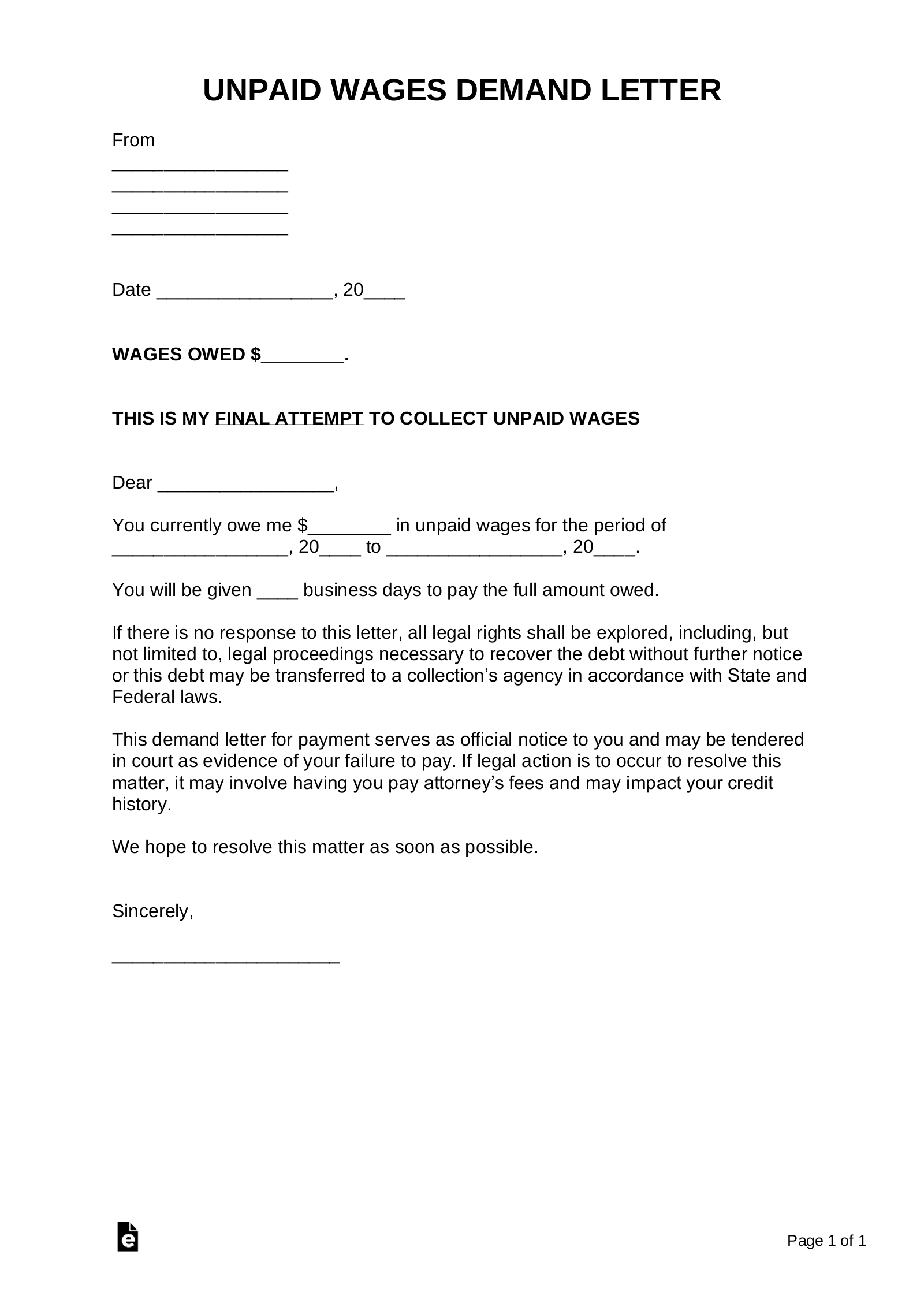

Samples (3)

Below are three samples of demand letters:

Sample 1 – Demand for Payment

Quick Clean, Inc.

22 Johnson Rd.

Clementon, NJ 08021

(555) 555-5555Sara Johnson

123 Fake Ave.

Ossining, NY 10562May 15, 2019Dear Sara Johnson,This letter serves as a formal demand for payment of your outstanding balance with Quick Clean, Inc. in the amount of $1,250.On April 5, 2019, you received cleaning services at 123 Fake Ave. Payment for the services was due on April 15, 2019. As of the writing of this letter, your outstanding balance is 30 days late. A copy of the original invoice detailing the balance is attached to this document.Unless you contact us immediately to discuss how your outstanding balance will be paid, we will be forced to pursue legal action to recover the debt which may leave you liable to pay attorney’s fees, filing costs, and your credit history may be affected. Please note this letter may be presented in court as evidence of your failure to pay.Prompt attention to this matter would be appreciated.Sincerely,John Smith

Account Manager

Quick Clean, Inc.

Sample 2 – Breach of Contract

Kruger Industrial Smoothing, LLC

55 Franklin Rd.

Avon, CT 06001VIA CERTIFIED MAILMr. Ashton Stewart

2299 Main St.

Bloomfield, CT 06002Jan. 6, 2019Dear Mr. Stewart,Pursuant to the contract titled “Granite Restoration Agreement” dated Nov. 14, 2018 (the “Agreement”), Kruger Industrial Smoothing, LLC has fulfilled its contractual obligations by restoring your granite countertop. Section 7 of the Agreement states that you were to provide payment in full for the services rendered by Dec. 1, 2019. To date, you have yet to make a payment and are therefore in breach of the Agreement.According to our records, your initial balance was $224. A late fee of $25 has been added to your balance resulting in a total payable charge of $249.We request that you contact us immediately to arrange for the settlement of this matter. If you fail to furnish the payment by Jan. 10, 2019, please take notice that we are prepared to seek any and all legal remedies necessary to recover the debt including, but not limited to, initiating a formal lawsuit against you for the mentioned claims.Sincerely,Sandy Donovan

Kruger Industrial Smoothing, LLC

Sample 3 – From an Attorney

McMaster & Cranston, LLC

234 Silver Lake Rd.

Adamsville, RI 02801Feb. 7, 2019Mrs. Allison Hanover

Vandelay Window Installation, Inc.

65 Park St.

Barrington, RI 02806RE: Compensation for improper installation of waterproof flashingDear Mrs. Hanover,This letter has been sent on behalf of our client, Mr. Terry Calloway, to inform you of a payment owed to Mr. Calloway for the following reason: On Oct. 14, 2018, our client hired your company, Vandelay Window Installation, Inc., to install a new awning window above his kitchen sink. A representative of your company, Mr. Donald Price, arrived at our client’s home on Oct. 21, 2019 and completed the installation. However, Mr. Price failed to properly adhere the waterproof flashing to the window sill which resulted in water damage to the drywall and surrounding area.Despite several requests, your company has yet to make an attempt at repairing the damage caused by Mr. Price’s negligence. Mr. Calloway was forced to hire another company to repair the damage resulting in a $1,445 charge. Receipts for the repairs in question are attached to this letter.We at McMaster & Cranston hereby request that you compensate Mr. Calloway by refunding him the full amount of $1,445. If payment is not made within five business days, we will take immediate legal action to resolve this matter and you may be required to pay attorney’s fees.Yours Truly,Thomas McMaster

Attorney

Law Offices of McMaster & Cranston, LLC