Updated August 24, 2023

A demand letter for payment communicates a request for money owed and gives notice of the timeframe in which the payment should be made. The requesting party, the “plaintiff”, will describe the events that led to the money being owed by the other party, the “defendant,” and if the money is not paid by the response date, then legal action will proceed.

Table of Contents |

What is a Demand Letter for Payment?

A demand letter for payment is an official notice that informs another party of a payment request. The demand will describe the source of the debt along with a breakdown of its calculation. A demand is commonly sent as a final notice before the matter goes to a collection’s agency, Small Claims Court, or other legal ramifications.

Purpose of the Demand

A demand letter is often thought of as a “pre-trial” letter and when litigation really begins. The letter is modeled to act as a final warning to another party before legal action is to occur. This threat or warning of future action

How to Send a Demand Letter for Payment (4 steps)

2. Writing the Demand Letter

When writing the demand letter, it’s best to think of the strategy beforehand and what the “threat” or “incentive” should be to motivate the debtor.

When writing the demand letter, it’s best to think of the strategy beforehand and what the “threat” or “incentive” should be to motivate the debtor.

The most popular ways to entice a debtor to pay are the following:

- Collection’s Agency – Individuals that care about their credit report know that if a debt goes to a collection’s agency it will affect their credit. Therefore, letting the debtor know this may motivate the debtor to at least respond.

- Discount – A business or individual will occasionally offer a discount or “1-time offer” if the debt is paid by a certain date. Businesses will mark-down commonly up to 50% in order to get the debt settled.

- Installment Payments – Offering the debtor a payment plan is often a route that is best for young or individuals living paycheck to paycheck.

- Small Claims – If the debt is applicable (See State Maximums), threatening to go to Small Claims Court should make the debtor feel uncomfortable. If the debtor owns property a lien may be placed on their property with an official judgment against them.

After attempting to entice the debtor to settle the debt in any way possible, the closing of the letter should include all available contact methods (e.g. phone, e-mail, website, etc.).

3. Sending in the Mail

When sending the demand letter in the mail, it’s best to use the United States Postal Service’s Certified Mail with Return Receipt.

The term “certified mail” is trademarked by the United States Postal Service (USPS) and is required by the sender to inform the debtor of their money owed. The option “return receipt” means the sender will receive a log from the USPS stating when the letter was delivered and who accepted it (with their printed name and signature). This return receipt may be used in court to prove the debtor received sufficient notice before filing the case.

4. Commence Legal Proceedings

If there is no response by the debtor, there is no other choice but to advance legal proceedings or elect to hire someone else to attempt to collect the debt. The creditor has the following options:

- Forward the Debt to a Collection’s Agency – Ideal for businesses with many debtors. The costs of hiring an attorney and filing legal proceedings for every debtor a business has may outweigh the actual benefit. Therefore, teaming up with a collection’s agency that is a professional in this area may be better and the only payment is when they collect, typically 25% to 50% of the amounts collected.

- Small Claims Court – This is a cost-effective route for an individual seeking an amount that is lower than their State-mandated maximum amount for Small Claims. This commonly does not require an attorney and the cases are “fast-tracked” often being able to get a court date within 30 days.

- District/Superior Court – For amounts higher than the maximum amount provided by the State’s Small Claims Court and required hiring an attorney and obtaining sound legal advice.

Sample Demand Letter for Payment

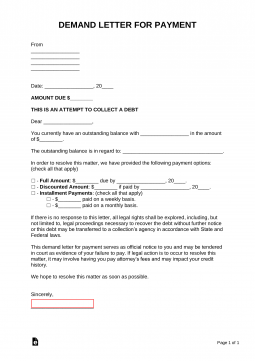

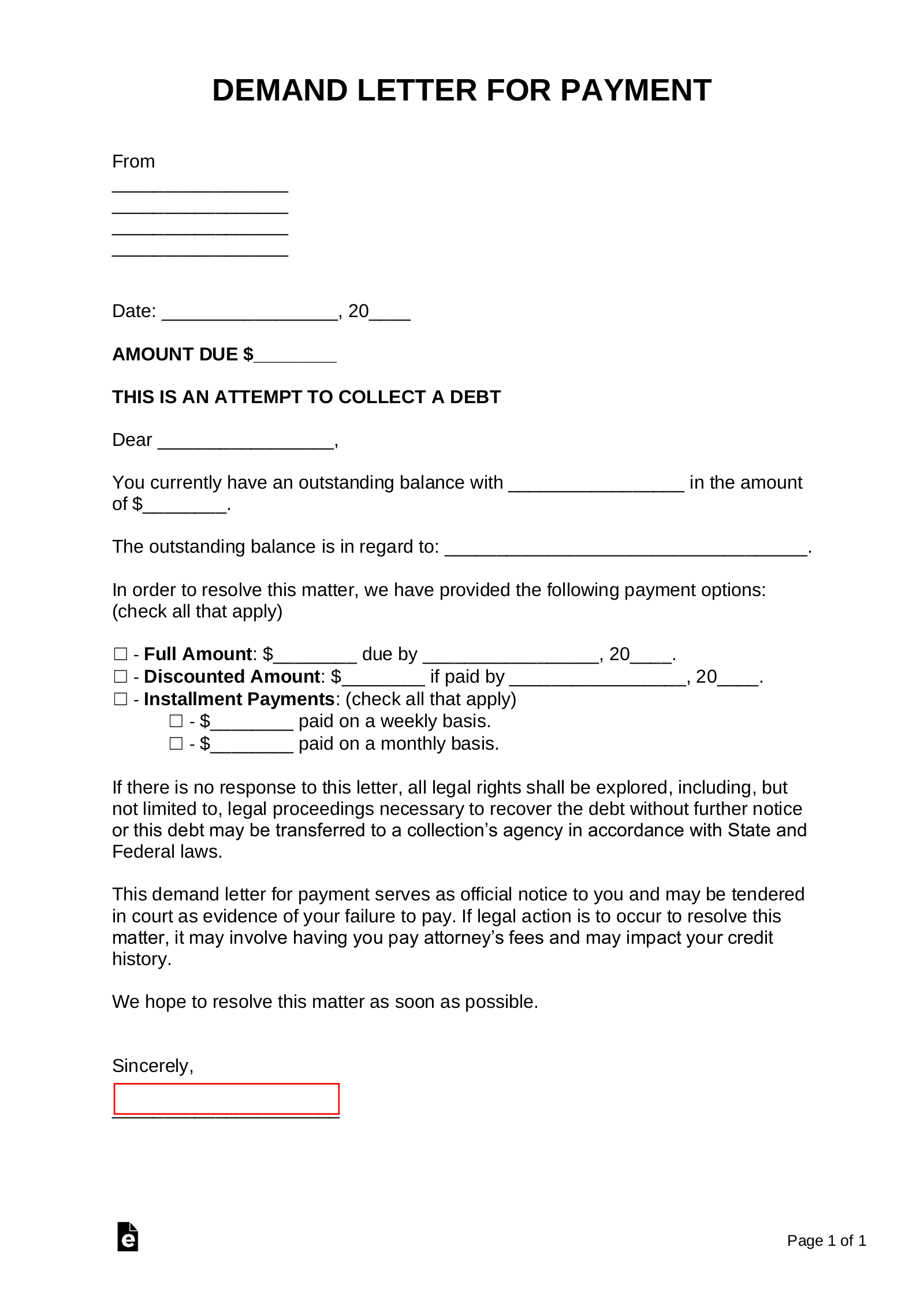

DEMAND LETTER FOR PAYMENT

From

[NAME OF SENDER]

[ADDRESS]

[CITY, STATE]

[ZIPCODE]

[DATE]

AMOUNT DUE: $[DOLLAR AMOUNT]

THIS IS AN ATTEMPT TO COLLECT A DEBT.

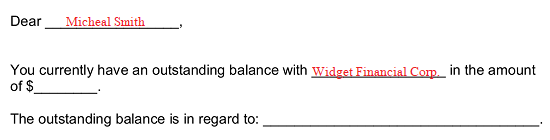

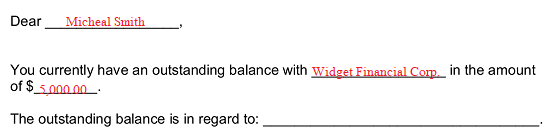

Dear [RECIPIENT],

You currently have an outstanding balance with [NAME OF DEBTOR] in the amount of $[DOLLAR AMOUNT].

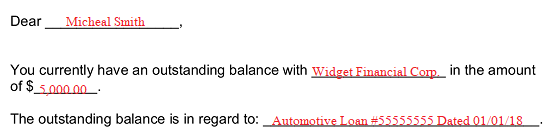

The outstanding balance is in regard to: [REASON FOR BALANCE].

In order to resolve this matter, we have provided the following payment options: (check all that apply)

☐ – Full Amount: $[DOLLAR AMOUNT] due by [DATE].

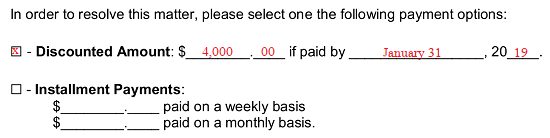

☐ – Discounted Amount: $[DOLLAR AMOUNT] if paid by [DATE].

☐ – Installment Payments: (check all that apply)

☐ – $[DOLLAR AMOUNT] paid on a weekly basis.

☐ – $[DOLLAR AMOUNT] paid on a monthly basis.

If there is no response to this letter, all legal rights shall be explored, including, but not limited to, legal proceedings necessary to recover the debt without further notice or this debt may be transferred to a collection’s agency in accordance with State and Federal laws.

This demand letter for payment serves as official notice to you and may be tendered in court as evidence of your failure to pay. If legal action is to occur to resolve this matter, it may involve having you pay attorney’s fees and may impact your credit history.

We hope to resolve this matter as soon as possible.

Sincerely,

______________________

How to Write a Demand Letter for Payment

Download: PDF, Microsoft Word (.docx), Open Document Text (.odt)

1 – Retrieve The Demand Letter Template From This Site

Utilize any of the labeled buttons paired with the image above to access the Demand Letter as a PDF (“PDF”) file or as a word processing document (“MS Word” or “ODT”)

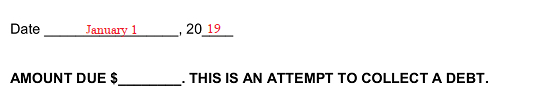

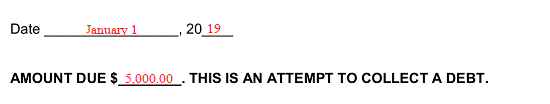

2 – Submit Material To Fulfill The Header Requirements

After you access this file, you will notice several empty lines peppered throughout this letter. You will need to employ these to make this letter applicable to the situation at hand by furnishing them with some basic information. The first set of empty lines requiring your input is under the word “From” in the upper left-hand corner. Produce the Name and address where this letter was sent from and where the Recipient should direct his or her payments and answers.  The calendar date when this letter should be considered in effect and applicable to the Recipient should be reported as a Month, two-digit calendar day, and two-digit year on the two blank spaces following the word “Date.”

The calendar date when this letter should be considered in effect and applicable to the Recipient should be reported as a Month, two-digit calendar day, and two-digit year on the two blank spaces following the word “Date.”  Next, record the dollar amount the Recipient owes, and you intend to collect using this document on the blank space in the bold statement beginning with the words “Amount Due”

Next, record the dollar amount the Recipient owes, and you intend to collect using this document on the blank space in the bold statement beginning with the words “Amount Due”  Naturally, this letter must directly address the Recipient by name. Report his or her identity on the blank space attached to the word “Dear” in the opening.

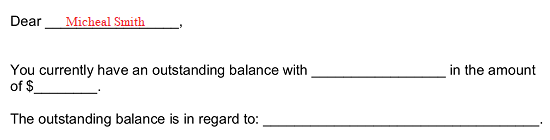

Naturally, this letter must directly address the Recipient by name. Report his or her identity on the blank space attached to the word “Dear” in the opening.

3 – Supplement The Body Of This Demand Letter’s Wording

The main area of this letter will need some attention. Locate the first statement, then use the first blank line or present the name of the entity that must receive a payment from the Recipient of this letter. You will also need to document the exact amount of money, numerically, that the Recipient owes the Payee of this letter.

You will also need to document the exact amount of money, numerically, that the Recipient owes the Payee of this letter.

The statement beginning with the term “The Outstanding Balance…” requires some point of reference for the amount owed. This can be a loan number, invoice number, or other information that the Recipient of this letter will recognize as the source of the dollar amount you listed above.

You will now need to give some detail as to what the Recipient of this letter may do as an acceptable answer to this letter. Two checkbox statements have been supplied to outline the possible actions that can be taken of which only one can be chosen. You may either check one off before sending this letter or you may leave them unchecked allowing the Recipient the choice. Regardless of the best measure that fits the situation both options will require some figures.

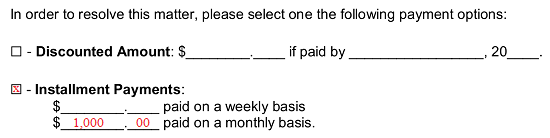

If the Payee or Sender of this letter will accept a lesser amount than that owed in exchange for a guaranteed payment on a predetermined date, then supply the dollar amount that will be acceptable to the first two blank spaces following the bold words “Discounted Amount” and document the due date for this option on the last two blank spaces.

If the Recipient may make installment payments, then you can define these by week or by month. This definition is provided by filling in either the dollar amount the Payer must submit every week, or the dollar amount the Payer must submit every month on the two appropriate blank spaces. In the example below, this letter will be satisfied if the Recipient of this letter pays $1,000.00 once a month to the Payee until the debt is satisfied.  To finalize this document, the Sender must sign the blank line below the word “Sincerely” at the bottom of this letter.

To finalize this document, the Sender must sign the blank line below the word “Sincerely” at the bottom of this letter.