Updated August 24, 2023

A final demand letter is a letter sent in an attempt to collect a debt or repayment. The letter is sent prior to a collector or financial institution filing legal action against a debtor.

What’s Included

- Clear statement advising letter is Final Demand

- Date of Notice

- Name and address of debtor

- Advisement of prior notifications sent

- Advisement of the fees/dues owed (Total to include taxes, interest, penalties, or other fees incurred due to lack of payment).

- Include evidence of previous agreement

- Clear timeframe of when final payment is due

- Action to be taken if payment in full is not received

How to Write a Final Demand Letter (5 steps)

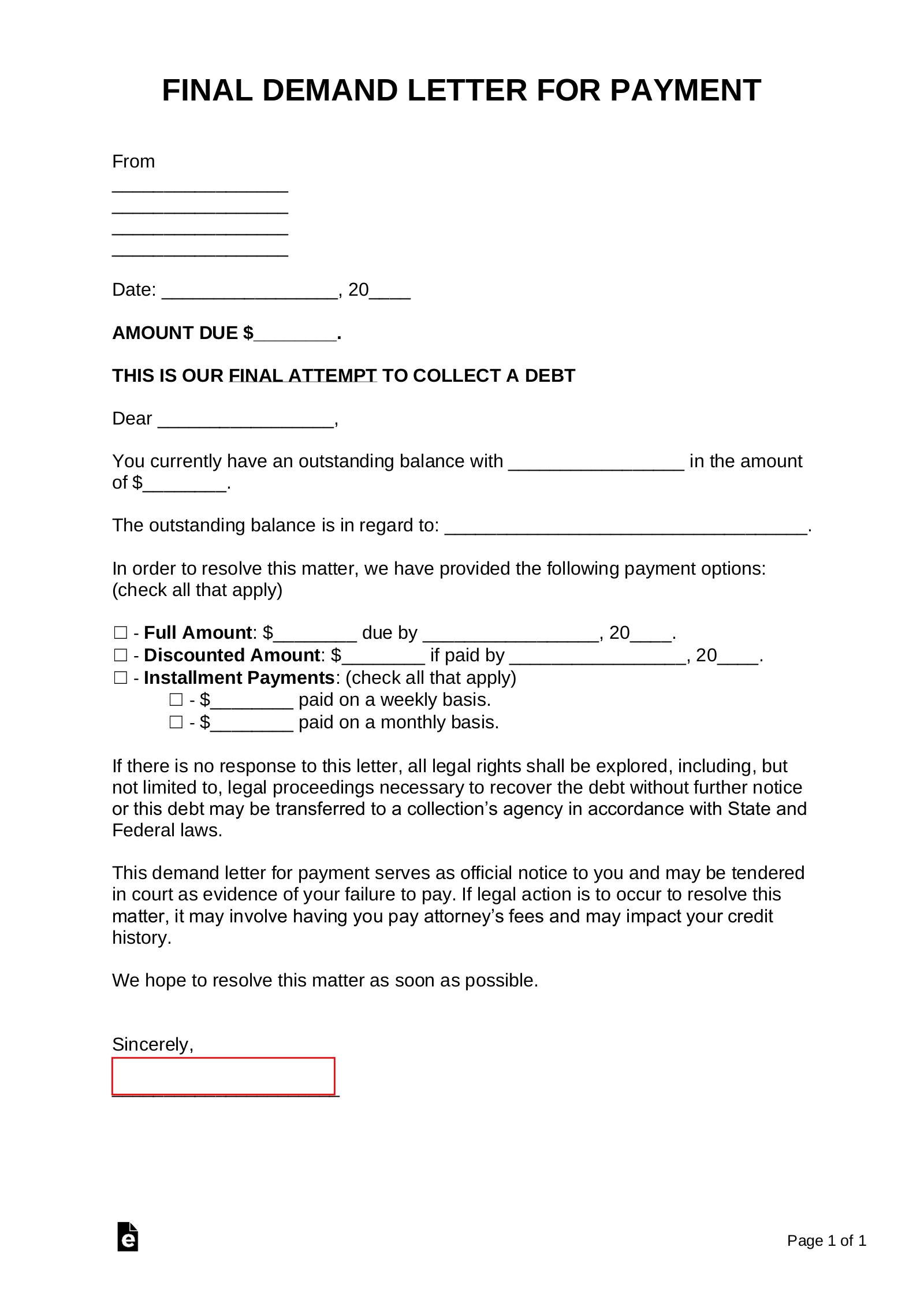

- Enter the Header Information

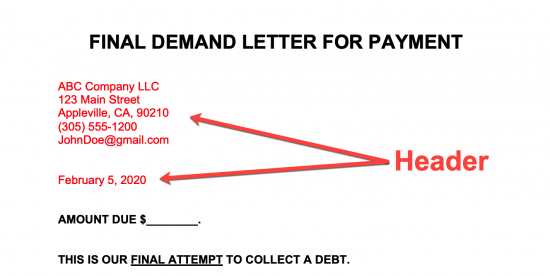

- Enter the Amount Due

- Complete the Debtor’s Details

- Enter the Payment Option

- Detail the Consequences and Sign

2. Enter the Amount Due

The amount due by the debtor should be included in the Final Demand Letter. Note that any taxes, interest or penalties should be totaled into one sum. If there is any evidence of the amount due, such as an invoice, it should be attached.

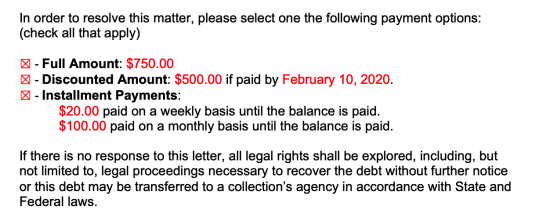

4. Enter the Payment Option

Enter the payment options (select as many as desired). The basic approach is to enter how much is owed followed by a discounted amount if the debtor pays within a specific timeframe. In addition, if the debtor is living paycheck to paycheck, is best to have an installment plan ($/week or $/month).

5. Detail the Consequences and Sign

At this point, the creditor should enter the penalties and terms that should happen if payment is not made. This includes, but not limited to, sending the debt to a collection’s agency and that the balance owed may impact the debtor’s credit report.

All demand letters should always be sent via Certified Mail with Return Receipt to ensure the debtor received it.

Sample Final Demand Letter

4545 West Lakeside Lane

Phoenix, AZ 85029October 4, 2017RE: Outstanding debt of $10,595.00 FINAL DEMAND FOR PAYMENT

Dear Ms. Houston,

This is our last attempt and FINAL WARNING in an attempt to collect your past-due debt. As of the date of this letter, there is an outstanding balance of your account in the amount of $10,595.00 for services rendered on June 1, 2017, by Johnson and Johnson Construction.

Please be aware that this amount has reached over 120 days in aging. Multiple notifications have been made by mail and contact has been attempted by phone with no response. The previous agreement, signed and dated on May 25, 2017, has not been complied with, as payment should have been fully finalized by June 15th, 2017. If payment is not received within 10 days of receipt of this letter to the address below, we will seek legal action to the fullest extent of the law.

Johnson and Johnson Construction

ATTN: General Accounting Department

951 East Village Lake Drive

Lake Pleasant, AZ 85021

To avoid damage to your credit rating and ensure you avoid further legal action, please remit payment immediately. Of note, you may be held liable and be subject to additional fees incurred by Johnson and John Construction in attempt to pursue this debt and take all legal action the extent allowed by local state laws.

We thank you in advance for your prompt and immediate attention to this serious matter.

Regards,

General Accounting Department

Johnson and Johnson Construction