Updated August 25, 2023

A security deposit demand letter is a request made by a tenant reminding a landlord to repay the deposit paid at the beginning of a lease term. Typically, this letter is written after the landlord has not paid the tenant back within the State required timeframe, which ranges from 14 to 60 days.

By State

The State-by-State demand letters are used when the landlord does not return the deposit after the tenancy has ended. The landlord must adhere to their State Required Return Period when the funds must be returned to the tenant.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

Security Deposit Demand Types

After Tenancy – Sent to the landlord if the tenant has not received their security deposit back after the State Required Time-Period.

Did Not Place in a Separate Account – All security deposits must be placed in a separate account in the following States:

Failed to Transfer to New Owner – If the property is sold and the security deposit does not transfer to the new owner.

No Receipt – If the landlord does not furnish a security deposit receipt in the following States:

No Checklist – The landlord is required to furnish the tenant an inventory checklist in the following States:

Sample

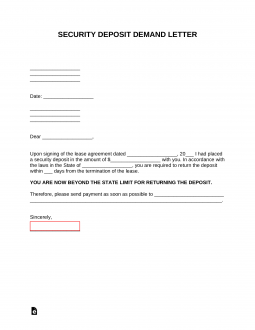

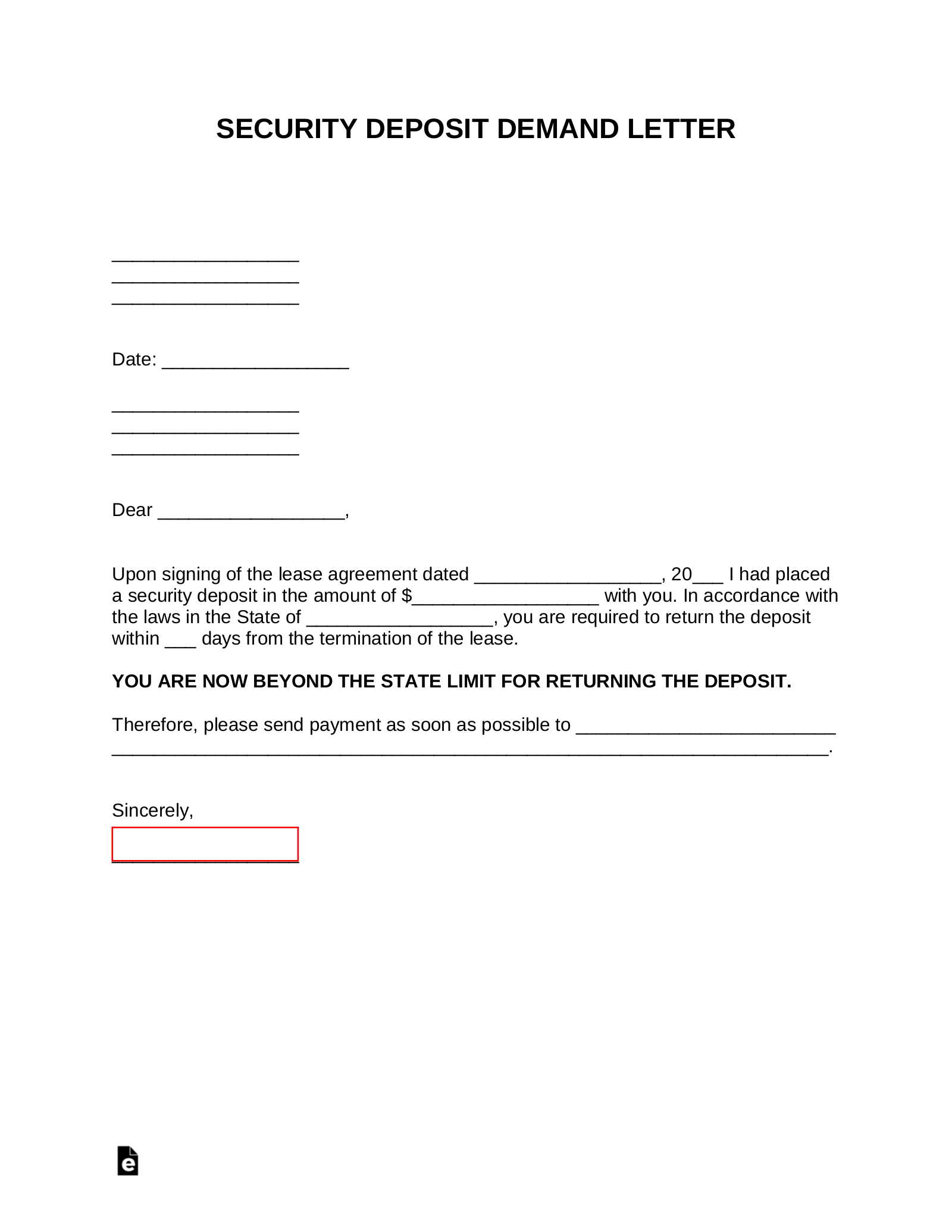

SECURITY DEPOSIT DEMAND LETTER

John Escobar

123 Green Village Lane

Madison, New Jersey

07940

Date: May 3, 2018

Enterprise Properties

100 Main Street

Orange, New Jersey

07050

Dear Enterprise Properties,

On March 1st, 2017 we entered into an agreement to lease property located at 350 Jefferson Street #11A Madison, New Jersey. I placed a security deposit with you in the amount of one-thousand four hundred dollars ($1,400).

Under § 46:8-21.1 of the New Jersey Code you are required to return the deposit within thirty (30) days after the termination of the lease.

YOU ARE NOW BEYOND THE STATE LIMIT FOR RETURNING THE DEPOSIT

Therefore, please send payment as soon as possible to my new address of 123 Green Village Lane Madison, New Jersey 07940.

Sincerely,

John Escobar

How to Send a Security Deposit Letter (5 steps)

- Verify the Laws in Your State

- Download and Complete

- Send via Certified Mail

- Wait for the Landlord’s Response

- Small Claims Court

1. Verify the Laws in Your State

Despite what is written in the lease agreement, the landlord may have more time given the laws in your State. Therefore, it’s best to check the Security Deposit Return Laws and make sure that, in fact, the landlord is late.

Unless the tenant is requesting the security deposit back for Other Reasons.

3. Send via Certified Mail

It is time to send a letter. Even if you have the landlord’s email it is best to send via certified mail with return receipt. This ensures that the landlord has received the notice.

Any landlord will treat this as a major warning for payment. As by signing the return receipt (which gets returned to the tenant) they will know that you have legally notified them of this debt.

5. Small Claims Court

Unless your jurisdiction has a housing court, you will most likely have to make a filing in a small claims court. If the landlord decides to avoid paying, it is the most cost-effective to represent yourself (State-by-State Small Claims Limits ($)).