Updated December 22, 2023

An unpaid wages demand letter is submitted to an employer that owes an employee for past wages. This is common when an employee has stopped working and is demanding their last paycheck from the employer. The Fair Labor Standards Act (FLSA) does not cover unpaid wages. Therefore, an employee must lookup their State laws regarding this matter.

Common Types of Unpaid Wages

- Last Payment (after leaving)

- Overtime Pay

- Minimum Wage ($/hr)

Table of Contents |

How to Collect Unpaid Wages

- Contact Your State Labor Office

- Write a Demand Letter

- Contact U.S. Dept of Labor

- File a Complaint and Summons

- Attend Court Hearing

Some states require an employer to pay an employee’s last paycheck immediately. Although, many States have no required time-frames. Therefore, collecting the last paycheck from an employer requires strong language to motivate them to make payment. This motivation should come from a well-written demand letter and threat of court action.

1. Contact Your State Labor Office

2. Write a Demand Letter

3. Contact U.S. Dept of Labor

4. File a Complaint and Summons

In the employee’s State, a proper court filing should be made. This will be completing (most commonly) by submitting a Complaint and Summons along with paying the filing fee. The Complaint and Summons will then be required to be served by the employee on the employer in accordance with court rules.Small Claims Court Limits ($) – Most filings will be with the State’s Small Claims court system.

5. Attend Court Hearing

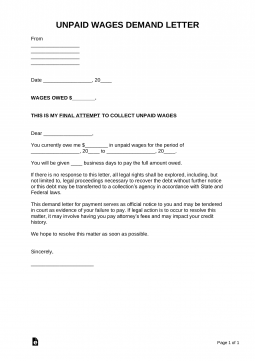

Sample – Unpaid Demand Letter

Enrico Diaz

423 Bearbridge Pass #1-A

80314 Boulder Colorado

enricod@email.com

(720) 555-8097

February 8th, 2020

Ms. Jennifer Coolidge, Senior Supervisor

Preston Research LLC

3 Hildebrand Street, Suite 744

80301 Boulder, CO

Dear Ms. Jennifer Coolidge,

I was recently let go from my position as Call Center Supervisor on January 22nd, 2020. I am writing this letter because I am still owed a total of $989 in unpaid wages for the period of January 15th to January 21st, 2020. I respectfully demand that you pay the full amount owed to me within five business days.

If there is no response to this letter, I will take legal action to recover these unpaid wages. Additionally, this debt may be transferred to a collection’s agency without further notice. You may be held liable for any fees associated with such actions.

This demand letter for payment serves as official notice to you and may be tendered in court as evidence of your failure to pay. If you believe that the amount is different than the one described herein, you must pay this sum and provide a justification for the difference in calculations.

Please send your payment to the following address:

423 Bearbridge Pass #1-A

80314 Boulder Colorado

I hope that this matter can be resolved as soon as possible.

Sincerely,

Enrico Diaz

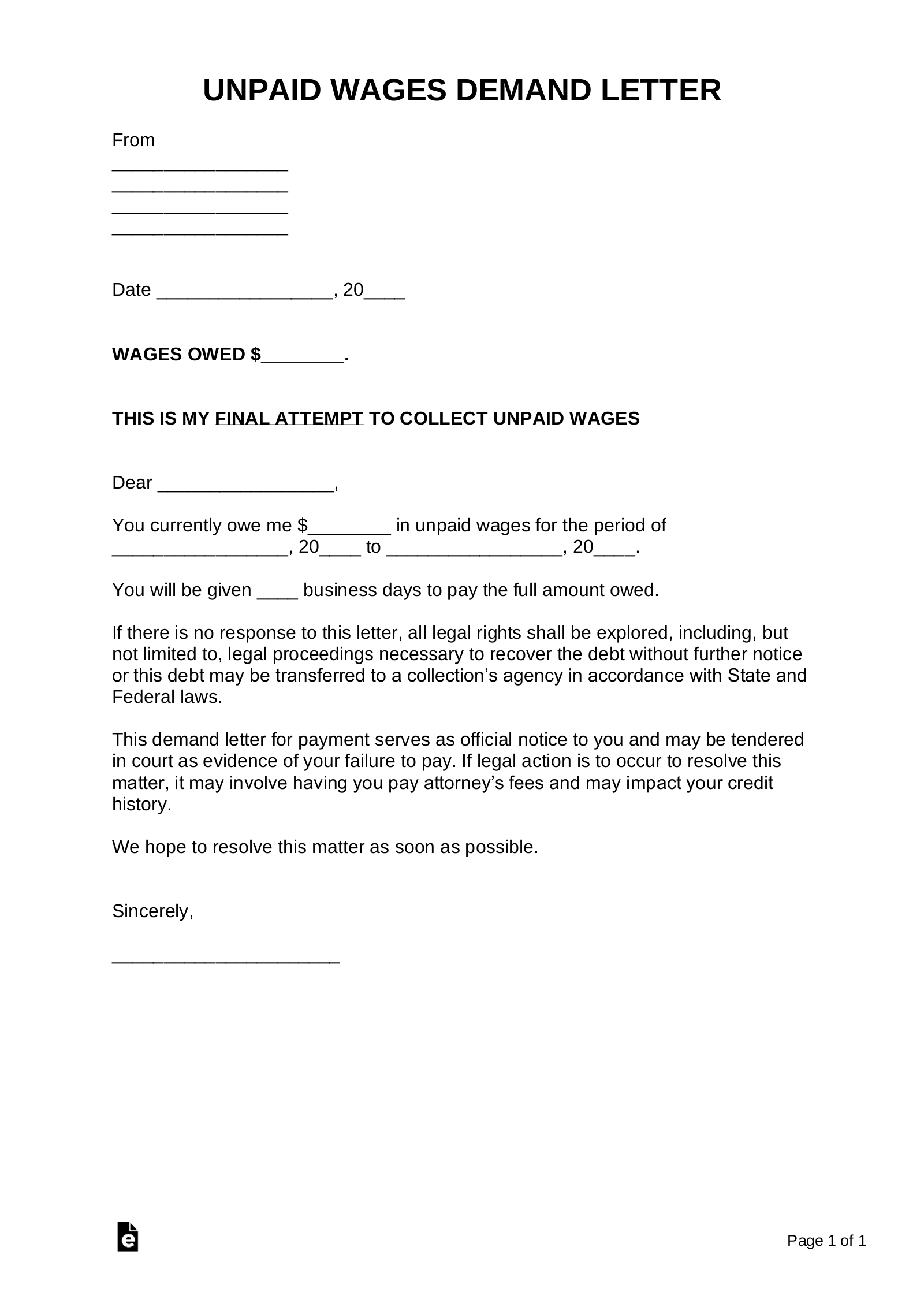

State Required Time-Limits

The table provides State time-limits when employers are required to pay an employee’s back pay or last check.

| State | Employee Fired | Employee Quits | Laws |

|---|---|---|---|

| Alabama | No laws. | No laws. | N/A |

| Alaska | 3 working days. | 3 days or next payday, whichever is sooner. | § 23.05.140(b) |

| Arizona | 7 working days or next payday, whichever is sooner. | Next payday. | § 23-353 |

| Arkansas | Next payday. | Next payday. | § 11-4-405 |

| California | Immediately. | 72 hours. Immediately if employee gives 72 hours’ notice. | § 201, 202, and 227.3 |

| Colorado | Immediately. | Next payday. | § 8-4-109 |

| Connecticut | Next business day after discharge. | Next payday. | § 31-71c |

| Delaware | Next payday. | Next payday. | § 19-1103 |

| Florida | No laws. | No laws. | N/A |

| Georgia | No laws. | No laws. | N/A |

| Hawaii | Immediately. | Next payday. Immediately if employee gives one pay period’s notice. | § 388-3 |

| Idaho | Next payday or 10 days, whichever is sooner. If employee requests earlier payment, 48 hours. | Next payday or 10 days, whichever is sooner. If employee requests earlier payment, 48 hours. | § 45-606 and 45-617 |

| Illinois | No later than next payday. | No later than next payday. | 820 ILCS 115/5 |

| Indiana | Next payday. | Next payday. | § 22-2-9-2 and 22-2-5-1 |

| Iowa | Next payday. | Next payday. | § 91A.4 |

| Kansas | Next payday. | Next payday. | § 44-315 |

| Kentucky | Next payday or within 14 days, whichever is later. | Next payday or 14 days, whichever is later. | § 337.055 |

| Louisiana | Next payday or within 15 days, whichever is earlier. | Next payday or 15 days, whichever is earlier. | § 23:631 |

| Maine | Next payday or within two weeks after demand, whichever is earlier. | Next payday or 2 weeks, whichever is earlier. | § 26-626 |

| Maryland | Next payday. | Next payday. | § 3-505 |

| Massachusetts | day of discharge. | Next payday. | § 149-148 |

| Michigan | Immediately. | When amount is determined. | § 408.474 and 408.475 |

| Minnesota | Immediately. | Next payday. If payday is less than 5 days after last day of work, the following payday or 20 days after last day of work, whichever is earlier. | § 181.13 and 181.14 |

| Mississippi | No laws. | No laws. | N/A |

| Missouri | Immediately. | Immediately. | § 290.110 |

| Montana | Immediately (unless there is a written policy). | Next payday or 15 days, whichever is earlier. | § 39-3-205 |

| Nebraska | Next payday or 2 weeks, whichever is earlier. | Next payday or 2 weeks, whichever is earlier. | § 48-1230 |

| Nevada | Immediately. | Next payday or 7 days, whichever is earlier. | § 608.020 and 608.030 |

| New Hampshire | 72 hours (next payday if employee is laid off). | Next payday (72 hours if employee gives one pay period’s notice). | § 275:44 |

| New Jersey | Next payday. | Next payday. | § 34:11-4.3 |

| New Mexico | 5 days. | Next payday. | § 50-4-4 and 50-4-5 |

| New York | Next payday. | Next payday. | § 191 |

| North Carolina | Next payday. | Next payday. | § 95.25.7 |

| North Dakota | Next payday. | Next payday. | § 34-14-03 |

| Ohio | Next payday. | Next payday. | § 4113.15 |

| Oklahoma | Next payday. | Next payday. | § 40-165.3 |

| Oregon | End of the business day after termination. | Immediately. Without 48 hours’ notice, 5 days or next payday, whichever is earlier. | § 652.140 |

| Pennsylvania | Next payday. | Next payday. | § 260.5 |

| Rhode Island | Next payday. If termination is due to merger, relocation, or liquidation of business, 24 hours. | Next payday. | § 28-14-4 |

| South Carolina | 48 hours or next payday. | 48 hours or next payday. | § 41-10-50 |

| South Dakota | Next payday or when employee returns employer’s property. | Next payday or when employee returns employer’s property. | § 60-11-10 and 60-11-14 |

| Tennessee | Next payday or 21 days, whichever is later. | Next payday or 21 days, whichever is later. | § 50-2-103 |

| Texas | 6 days. | Next payday. | § 61.014 |

| Utah | 24 hours. | Next payday. | § 34-28-5 |

| Vermont | 72 hours. | Next payday. | § 342 |

| Virginia | Next payday. | Next payday. | § 40.1-29 |

| Washington | End of next pay period. | End of next pay period. | § 49.48.010 |

| West Virginia | Next payday. | Next payday. | § 21-5-4 |

| Wisconsin | Next payday or 1 month, whichever is earlier. If termination is due to merger, relocation, or liquidation of business, 24 hours. | Next payday. | § 109.03 |

| Wyoming | Next payday. | Next payday. | § 27-4-104 |