Updated December 06, 2023

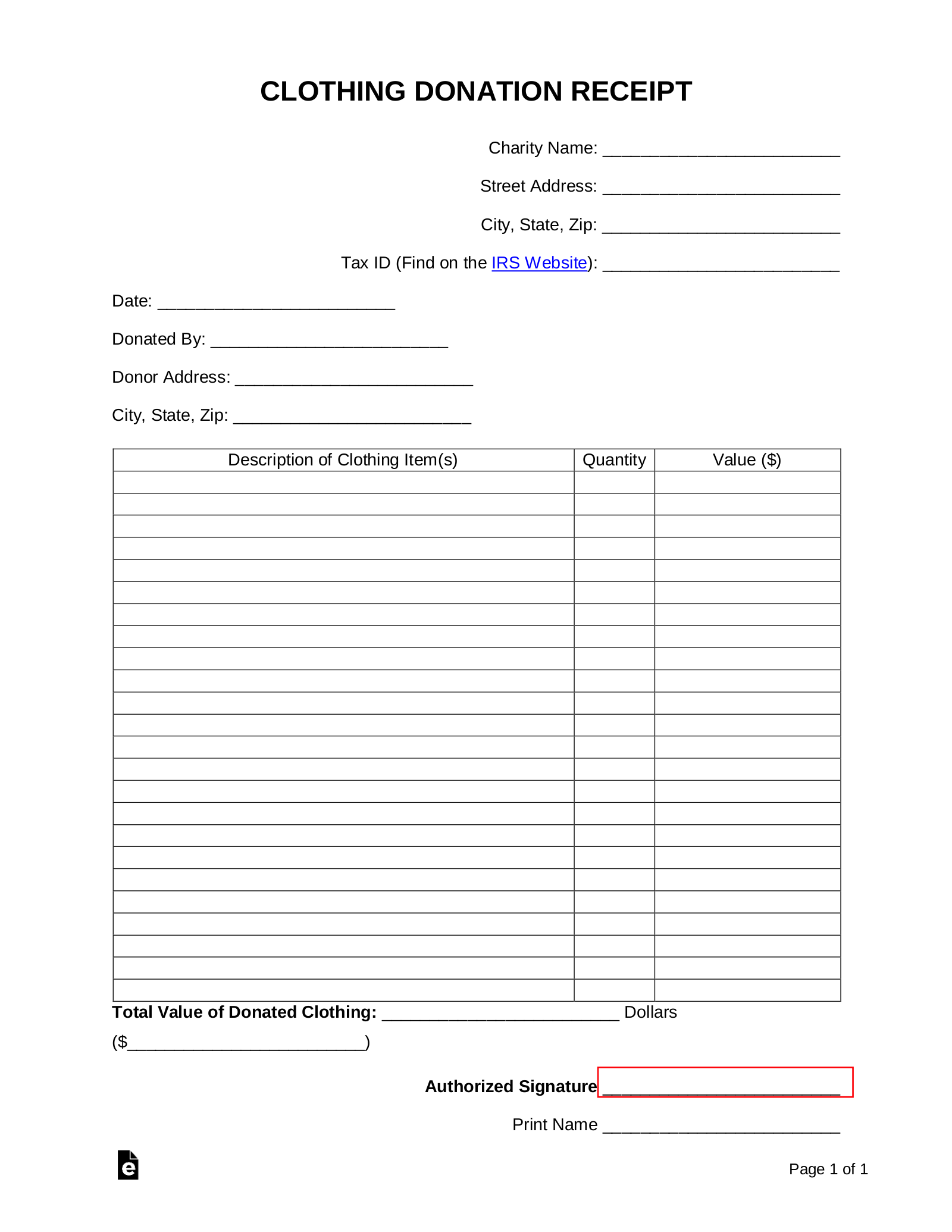

A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their State and/or Federal taxes. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing’s values. Standard guidelines, such as a fixed percentage of an item’s original value, can help to ensure that these figures are accurate and do not raise suspicions when filing one’s tax returns.

Table of Contents |

What to Include?

The donation receipt should include an itemized list of clothing with an estimated value for each item. It should also include a signature from a representative of the charitable organization to affirm that the receipt is accurate.

How to Donate Clothes (4 steps)

- Gather Usable Clothes

- Search for a Donation Center

- Drop-off in Exchange for a Receipt

- Save the Receipt for Tax Deductions

Donating clothes can be a great tax write-off for any individual that pays income tax at the end of the year. It may not be much but commonly an organization that does take used clothing will “round up” or estimate the clothes to be at a higher price than they may actually be sold.

2. Search for a Donation Center

Many organizations accept clothing donations. Some options for donations include nationwide nonprofits such as Goodwill Industries and The Salvation Army, and smaller local charities. Search online, ask at a local church, food pantry, or other assistance centers, or be on the lookout for thrift or secondhand stores that might be affiliated with charitable causes.

Many organizations accept clothing donations. Some options for donations include nationwide nonprofits such as Goodwill Industries and The Salvation Army, and smaller local charities. Search online, ask at a local church, food pantry, or other assistance centers, or be on the lookout for thrift or secondhand stores that might be affiliated with charitable causes.

- Goodwill – 501(c)(3) non-profit

- Salvation Army – 501(c)(3) non-profit

- Burlington Coat Factory – Warm Coats & Warm Hearts Drive

- Vietnam Veterans of America – 501(c)(3) non-profit

3. Drop-off in Exchange for a Receipt

While clothing donations are generally tax-deductible, it is critical to make donations in person to obtain a receipt. Deductions made without documentation are at the taxpayer’s risk, as the IRS can always audit and ask for receipts. Therefore, do not drop off donations in a bin, as you will not receive a receipt.

While clothing donations are generally tax-deductible, it is critical to make donations in person to obtain a receipt. Deductions made without documentation are at the taxpayer’s risk, as the IRS can always audit and ask for receipts. Therefore, do not drop off donations in a bin, as you will not receive a receipt.

4. Save the Receipt for Tax Deductions

Make sure to follow federal and state tax laws when claiming deductions. In general, filers can claim up to 50 percent of adjusted gross income in deductions for charitable contributions. If the value of a contribution exceeds $500, the IRS requires submission of the separate IRS Form 8283.

Make sure to follow federal and state tax laws when claiming deductions. In general, filers can claim up to 50 percent of adjusted gross income in deductions for charitable contributions. If the value of a contribution exceeds $500, the IRS requires submission of the separate IRS Form 8283.

Only usable clothes should be donated. While it might be tempting to give away more ragged garments, charitable organizations will likely discard these. Donors should not gift anything that they would not personally consider to be wearable.

Only usable clothes should be donated. While it might be tempting to give away more ragged garments, charitable organizations will likely discard these. Donors should not gift anything that they would not personally consider to be wearable.