Updated September 25, 2023

A Florida employment contract agreement is a document that establishes the framework of an employment relationship between an employer and an employee. Not all jobs/positions require a formal legal agreement, but a contract can be beneficial to both parties by clearly defining the terms of the employee’s position while protecting the employer’s business interests. Provisions such as income, period of employment, duties, benefits, confidentiality, non-compete, and termination may be integral components to a contract, depending on the position in question for which the employer is hiring the employee. It’s crucial that both parties understand and agree to all terms and conditions drafted in the contract as this contract is legally binding once signed.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Legal document created to protect employer’s valuable information from third party disclosure.

Employee Non-Disclosure Agreement (NDA) – Legal document created to protect employer’s valuable information from third party disclosure.

Download: PDF, MS Word (.docx), OpenDocument

Employee Non-Compete Agreement – Legal document implemented to keep employees from directly competing with employers in the same field of business.

Employee Non-Compete Agreement – Legal document implemented to keep employees from directly competing with employers in the same field of business.

Download: PDF, MS Word (.docx), OpenDocument

Independent Contractor Agreement – Document outlining the terms and conditions of a contractor’s job/task for the client.

Independent Contractor Agreement – Document outlining the terms and conditions of a contractor’s job/task for the client.

Download: PDF, MS Word (.docx), OpenDocument

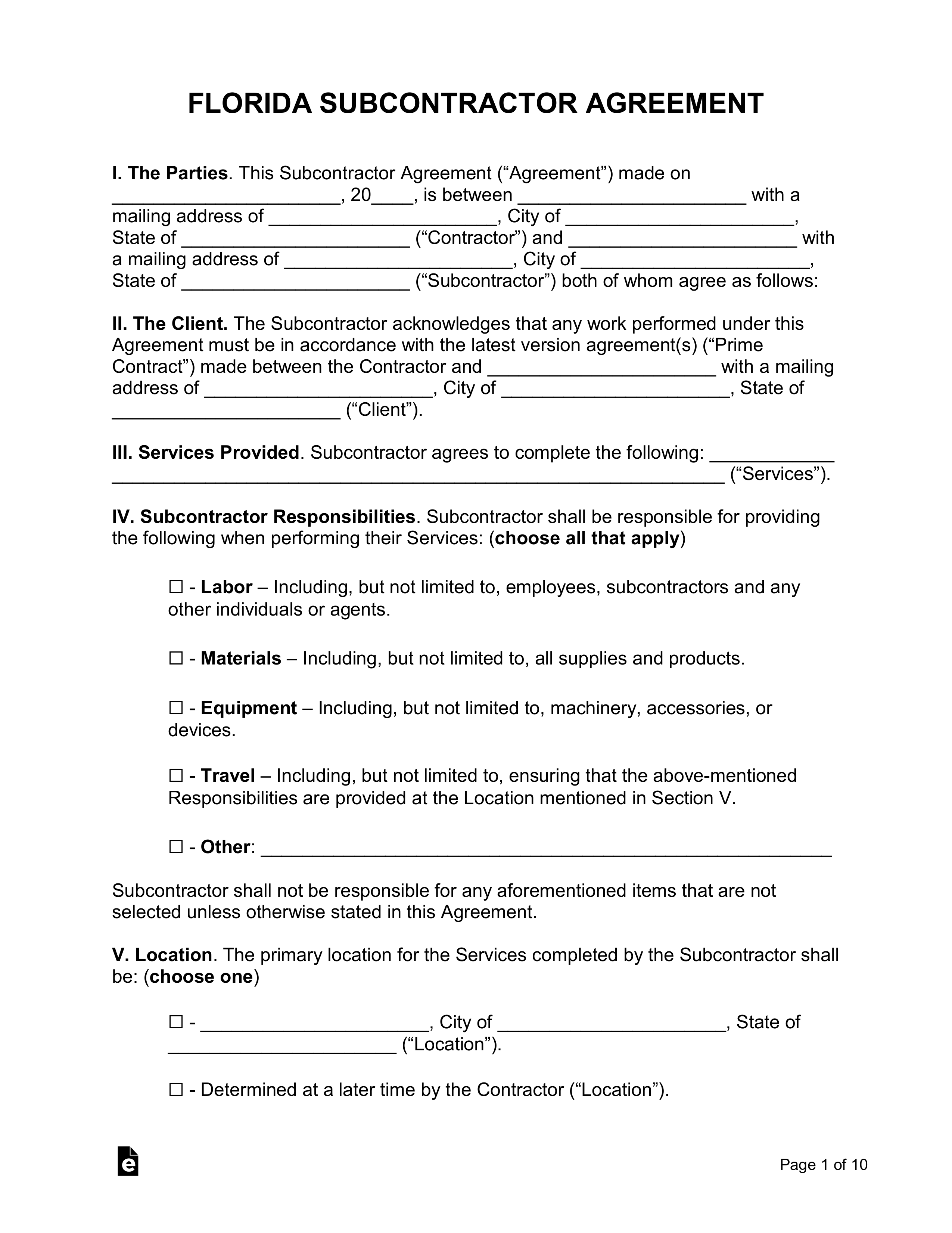

Subcontractor Agreement – Document outlining terms and conditions of a subcontractor’s job/task for the contractor.

Subcontractor Agreement – Document outlining terms and conditions of a subcontractor’s job/task for the contractor.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“. . . means any person who receives remuneration from an employer for the performance of any work or service while engaged in any employment under any appointment or contract for hire or apprenticeship, express or implied, oral or written, whether lawfully or unlawfully employed, and includes, but is not limited to, aliens and minors.”

“. . . includes any person who is an officer of a corporation and who performs services for remuneration for such corporation within this state, whether or not such services are continuous.”

At-Will Employment

At-Will Employment – No state exceptions.

Income Tax Rate (Individual)

Individual Income Tax Rate – 0%

Minimum Wage ($/hr)

Minimum Wage – $8.56[3]