Updated September 25, 2023

The bookkeeping services agreement is between a client and a bookkeeper to provide accounting services for a one-time or monthly basis. The bookkeeper will most likely have access to banking records, receipts, revenue details, and other financial information. Therefore, it’s imperative that the bookkeeper that is selected is someone who can be trusted.

Retainer – Advance payment to the accountant to begin their services. Common for larger accounting tasks or before tax filing and reporting.

Table of Contents |

What Does a Bookkeeper Do?

A bookkeeper, who is most likely an accountant, is someone that is hired to create a process for managing the records of a business or individual for internal financial reports and tax returns. The management tasks of a professional bookkeeper vary depending on the client; however, they may be asked to oversee any of the following:

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Bill Payment

- Budget Preparation

- Customized Reports

- Detailed General Ledgers

- Financial Statements

- General Bookkeeping

- Payroll and Check Registers

How Much do Bookkeepers Make?

Factors impacting a bookkeeper’s salary include overall experience, certification, part-time/full-time status, location, and whether they are a work-from-home or standard bookkeeper.[1][2] A work-from-home bookkeeper is often an independent contractor who is able to take on multiple jobs at once.

Video

How to Write

Download: PDF, Microsoft Word (.docx) or Open Document Text (.odt)

1 – Access The Services Agreement Template On This Page

The paperwork previewed in the image will provide the structure and language for an Accountant/Bookkeeper to solidify a Client job. It may be downloaded by clicking any of the buttons in the preview image’s caption area or through the links above. Make sure your software is up-to-date before working on your copy. If you do not have the appropriate PDF editor or word processing software then, use your browser to view, save, and print a copy to fill out manually.

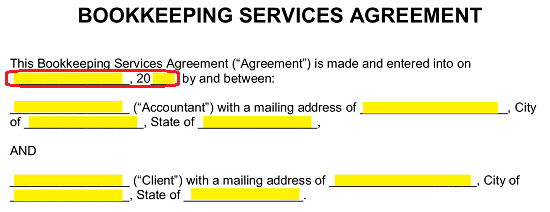

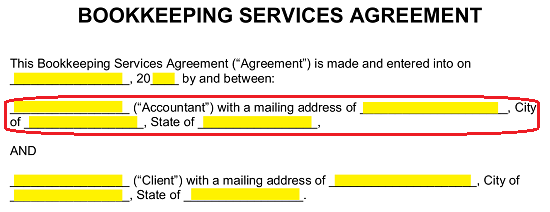

2 – The Accountant And Client Must Be Fully Identified

The first statement will begin by documenting the date when both parties enter this agreement. This will require you to record this calendar month and calendar day on the first blank line and the year on the second blank line.  The Accountant must be named in this statement. Thus, locate the space labeled “Accountant” and produce the legal name of the Accountant being commissioned. You must solidify this entity’s identity by producing his or her mailing address across the next three empty lines.

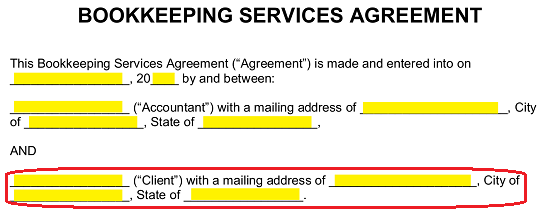

The Accountant must be named in this statement. Thus, locate the space labeled “Accountant” and produce the legal name of the Accountant being commissioned. You must solidify this entity’s identity by producing his or her mailing address across the next three empty lines.  The Client who intends to hire the Accountant named above through this paperwork must have his or her full name supplied on the blank line labeled “Client.” His or her mailing address should also be supplied here. Use the last three blank lines to present the street address, city, and state of the Client’s mailing address.

The Client who intends to hire the Accountant named above through this paperwork must have his or her full name supplied on the blank line labeled “Client.” His or her mailing address should also be supplied here. Use the last three blank lines to present the street address, city, and state of the Client’s mailing address.

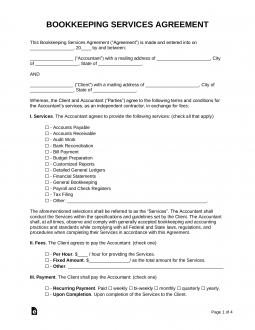

3 – Define The Accounting Services That Will Be Provided

Now that both concerned entities have been identified, we must provide an accurate description of the job at hand. A checklist has been supplied to the first article (“I. Services”) allowing you to define the services the Accountant must supply to fulfill this agreement. In this way you name services such as “Accounts Payable,” “Accounts Receivable,” “Bank Reconciliation,” “Bill Payment,” “Budget Preparation,” “Customized Reports,” “Detailed General Ledgers,” “Financial Statements,” “General Bookkeeping,” “Payroll And Check Registers,” and/or “Other” services by simply marking the corresponding checkbox. Notice the last item on this list. If none of the previous items adequately define what the Accountant is being hired to do or part of what the Accountant will be responsible for, then mark the last box and describe the services required.

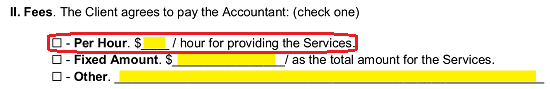

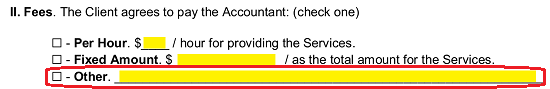

4 – Record The Agreed Upon Compensation For The Accountant’s Services

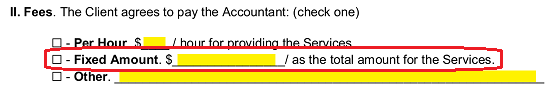

The next couple of articles will deal with the pay of the Accountant. We will begin with this report in the second article (“II. Fees”). You must mark one of the checkboxes in this section to describe the pay rate of the Accountant. If the Client will pay an hourly rate, then mark the first checkbox and fill in the dollar amount the Client must pay the Accountant for each hour of work on the blank line between the dollar sign and “Hour For Providing The Services.”  If the Accountant will be paid one lump sum for the services, he or she is providing then mark the second checkbox and report the full amount of money the Accountant will be paid on the blank line after the words “Fixed Amount.”

If the Accountant will be paid one lump sum for the services, he or she is providing then mark the second checkbox and report the full amount of money the Accountant will be paid on the blank line after the words “Fixed Amount.”  If neither of these choices adequately describe the Accountant’s pay rate for this agreement, then mark the third checkbox (“Other”). Use the blank line that is provided to report precisely ow the Accountant’s pay will be calculated.

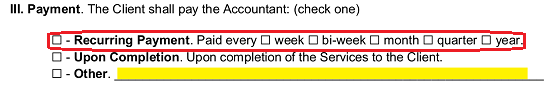

If neither of these choices adequately describe the Accountant’s pay rate for this agreement, then mark the third checkbox (“Other”). Use the blank line that is provided to report precisely ow the Accountant’s pay will be calculated.  The third article “III. Payment” requires an account of how often the Client will pay the Accountant. If the Client will pay on a regular basis over a period of time, then mark the box labeled “Recurring Payment.” You must check one of the items in this selection to indicate the exact frequency of the Accountant’s paycheck (“Week,” “Bi-Week,” “Month, “Quarter,” or “Year”).

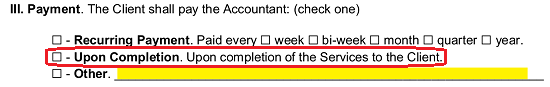

The third article “III. Payment” requires an account of how often the Client will pay the Accountant. If the Client will pay on a regular basis over a period of time, then mark the box labeled “Recurring Payment.” You must check one of the items in this selection to indicate the exact frequency of the Accountant’s paycheck (“Week,” “Bi-Week,” “Month, “Quarter,” or “Year”).  If the Accountant will be paid only “Upon Completion” of the job then, mark the second checkbox.

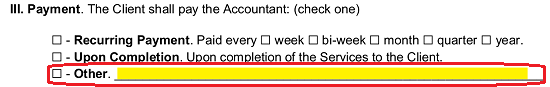

If the Accountant will be paid only “Upon Completion” of the job then, mark the second checkbox.  You may supply a more specific report or define a different schedule of pay altogether by marking the third checkbox and supplying the details on the blank line provided.

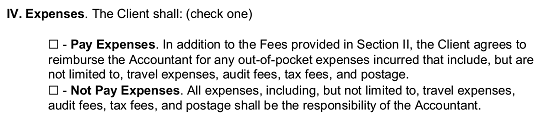

You may supply a more specific report or define a different schedule of pay altogether by marking the third checkbox and supplying the details on the blank line provided.  The next article shall discuss how the Client will treat money the Accountant pays out of pocket in order to successfully complete the tasks he or she is being commissioned to perform. Mark the first checkbox in the “IV. Expenses” section to indicate the Client will “Reimburse The Accountant For Any Out-Of-Pocket Expenses Incurred…” that was necessary for the completion of the Client’s project or mark the second checkbox (“Not Pay Expenses”) if the Client will not pay for any expenses incurred in relation to the job.

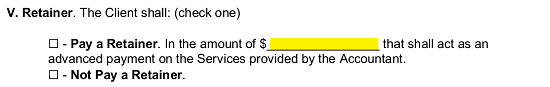

The next article shall discuss how the Client will treat money the Accountant pays out of pocket in order to successfully complete the tasks he or she is being commissioned to perform. Mark the first checkbox in the “IV. Expenses” section to indicate the Client will “Reimburse The Accountant For Any Out-Of-Pocket Expenses Incurred…” that was necessary for the completion of the Client’s project or mark the second checkbox (“Not Pay Expenses”) if the Client will not pay for any expenses incurred in relation to the job.  The fifth article, “V. Retainer,” should be used to solidify whether the Accountant will be paid a retainer (for his or her availability). If so, then mark the first checkbox and present the dollar amount the Client will pay the Accountant to reserve his or her services. If the Client will not be obligated to pay a retainer, then mark the second checkbox.

The fifth article, “V. Retainer,” should be used to solidify whether the Accountant will be paid a retainer (for his or her availability). If so, then mark the first checkbox and present the dollar amount the Client will pay the Accountant to reserve his or her services. If the Client will not be obligated to pay a retainer, then mark the second checkbox.

5 – Report The When And Where This Agreement Is Effective

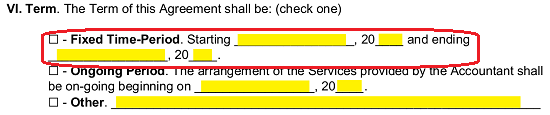

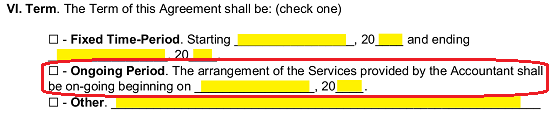

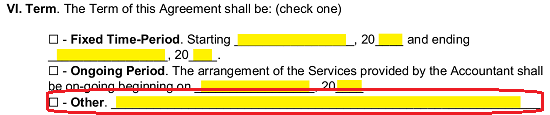

We must include a report on when the terms of this agreement will be active. In “VI. Term” you must select one of the three checkbox statements to define when the Accountant is expected to work for the Client. If the Accountant is supposed to work during a pre-determined time period, then mark the “Fixed Time-Period” checkbox. If this is the case, you should enter the first calendar date the Accountant is expected to work across the first two blank lines then the final calendar date of his or her employment on the last two blank lines.  If this employment arrangement will begin on a specific date and continue until further notice, then mark the second checkbox (“Ongoing Period”). The two blank lines in this selection have been supplied so that you can report the first calendar date when the Accountant will begin working.

If this employment arrangement will begin on a specific date and continue until further notice, then mark the second checkbox (“Ongoing Period”). The two blank lines in this selection have been supplied so that you can report the first calendar date when the Accountant will begin working.  If preferred, you may select the third checkbox (“Other”) then give a description of how the Accountant’s first and last calendar days of work will be determined.

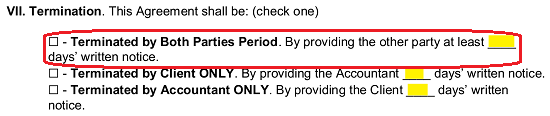

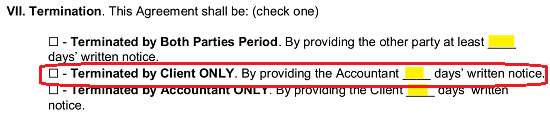

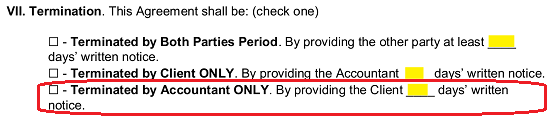

If preferred, you may select the third checkbox (“Other”) then give a description of how the Accountant’s first and last calendar days of work will be determined.  In the seventh section, “VII. Termination,” we will report on how this agreement, and thus the employment of the Accountant/Client relationship discussed here, will end. If this agreement will continue until it is “Terminated By Both Parties” then mark the first checkbox and record how many days’ notice the party terminating the agreement must give to the other party on the blank line after the words “…At Least.”

In the seventh section, “VII. Termination,” we will report on how this agreement, and thus the employment of the Accountant/Client relationship discussed here, will end. If this agreement will continue until it is “Terminated By Both Parties” then mark the first checkbox and record how many days’ notice the party terminating the agreement must give to the other party on the blank line after the words “…At Least.”  If only the Client can terminate this relationship, then mark the second checkbox. Once you have done this, fill in the number of days’ notice the Client must give the Accountant when doing so.

If only the Client can terminate this relationship, then mark the second checkbox. Once you have done this, fill in the number of days’ notice the Client must give the Accountant when doing so.  If the only the Accountant can terminate this relationship, then mark the third checkbox. Make sure to report the number of days before the intended termination date the Accountant must give to the Client on the blank line after the words “…Providing The Client.”

If the only the Accountant can terminate this relationship, then mark the third checkbox. Make sure to report the number of days before the intended termination date the Accountant must give to the Client on the blank line after the words “…Providing The Client.”  The state responsible for overseeing this agreement should be recorded on the blank line after the term “…Located In The State Of” in the article labeled “XIII. Governing Law.”

The state responsible for overseeing this agreement should be recorded on the blank line after the term “…Located In The State Of” in the article labeled “XIII. Governing Law.” ![]()

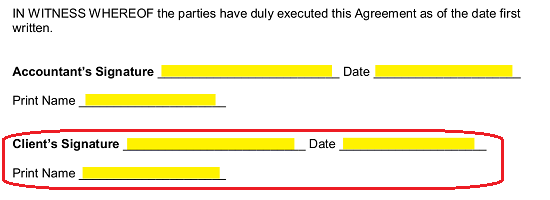

6 – The Accountant And Client Must Enter This Agreement Through A Binding Signature

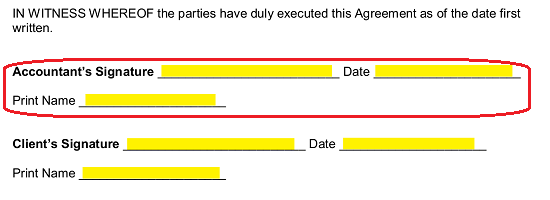

The signature area below the statement (“In Witness Whereof…”) will contain enough room for both the Accountant and the Client to formally enter this agreement. The Accountant will have to sign the blank line labeled “Accountant’s Signature” then producing the signature date on the blank line labeled “Date.” Additionally, the Accountant must print his or her name on the “Print Name” line.  The Client must also supply an executing signature. He or she must sign the line “Client’s Signature” then supply his or her date of signature on the adjacent line. Once done the Client must present his or her printed name on the line “Print Name.”

The Client must also supply an executing signature. He or she must sign the line “Client’s Signature” then supply his or her date of signature on the adjacent line. Once done the Client must present his or her printed name on the line “Print Name.”