Updated January 18, 2024

An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. Also known as a “1099 agreement” due to the contractor not being an employee of the client. A contractor is commonly hired on a short-term or intermittent basis, unlike an employee.

Paying Taxes

Contractors are responsible for paying their own withholding tax to local, state, and federal authorities (per IRS Rules).

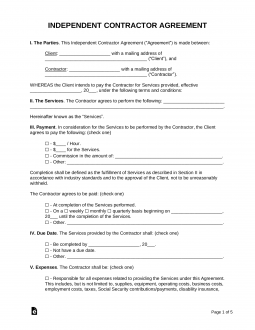

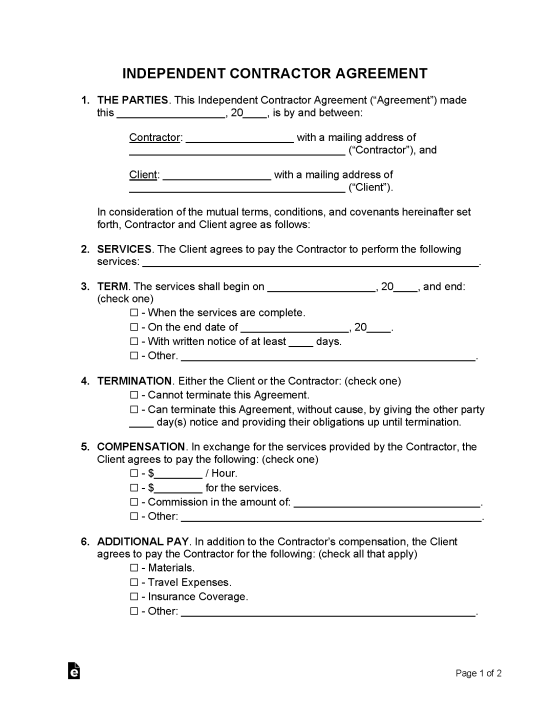

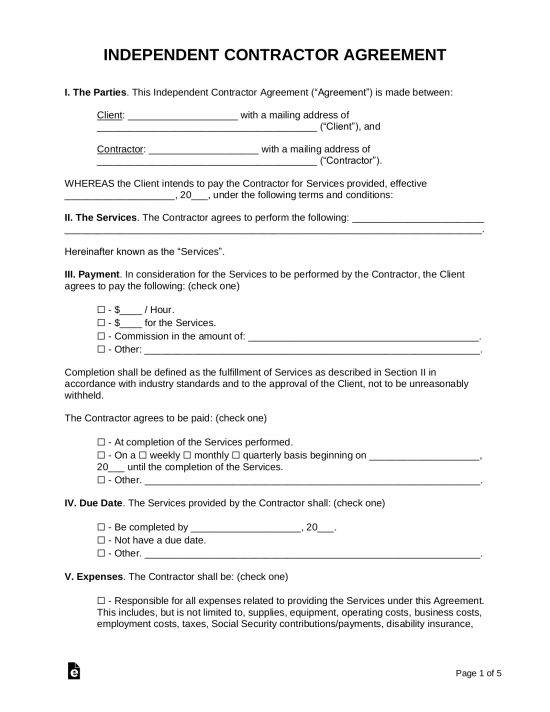

Basic Versions (2)

Download: PDF, MS Word (.docx), OpenDocument

Download: PDF, MS Word (.docx), OpenDocument

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

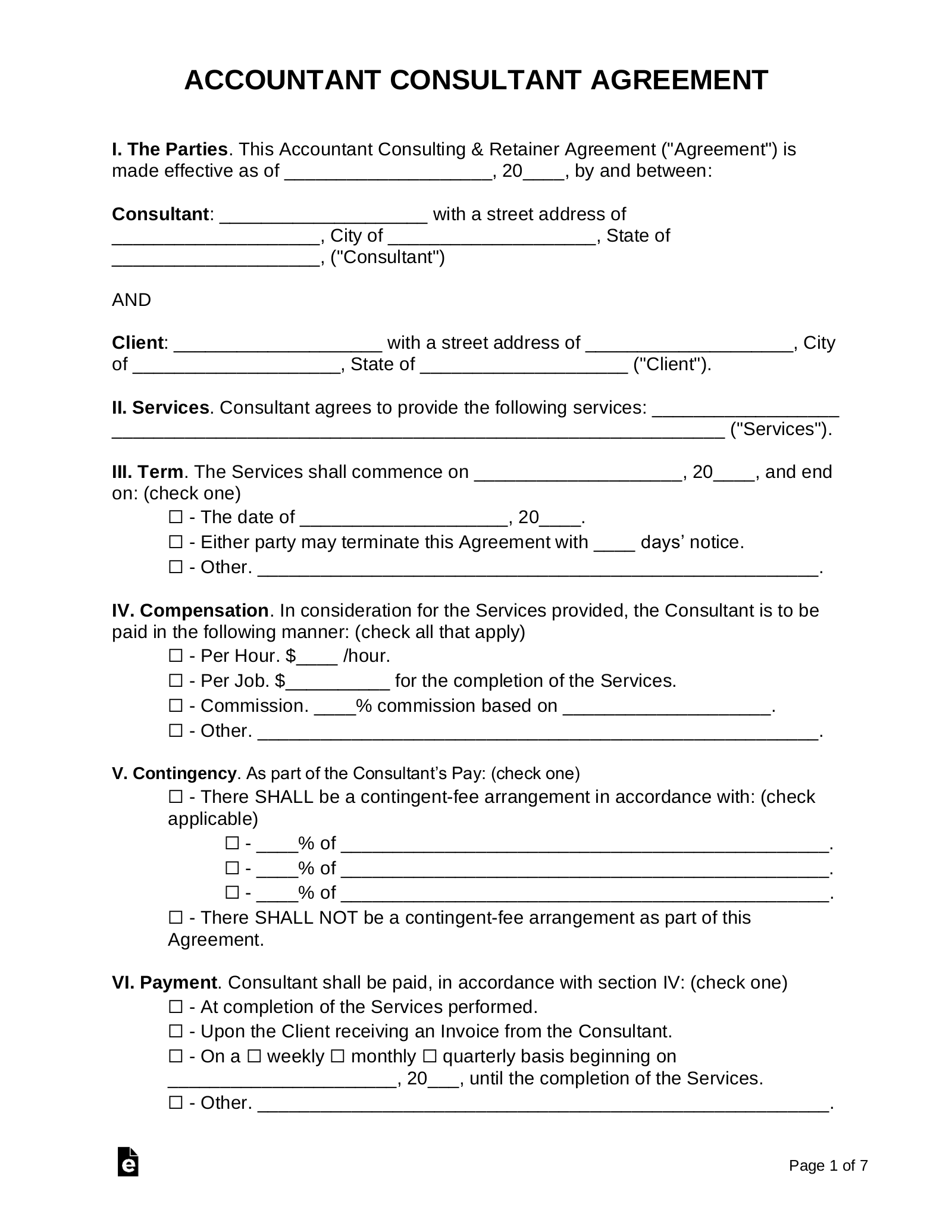

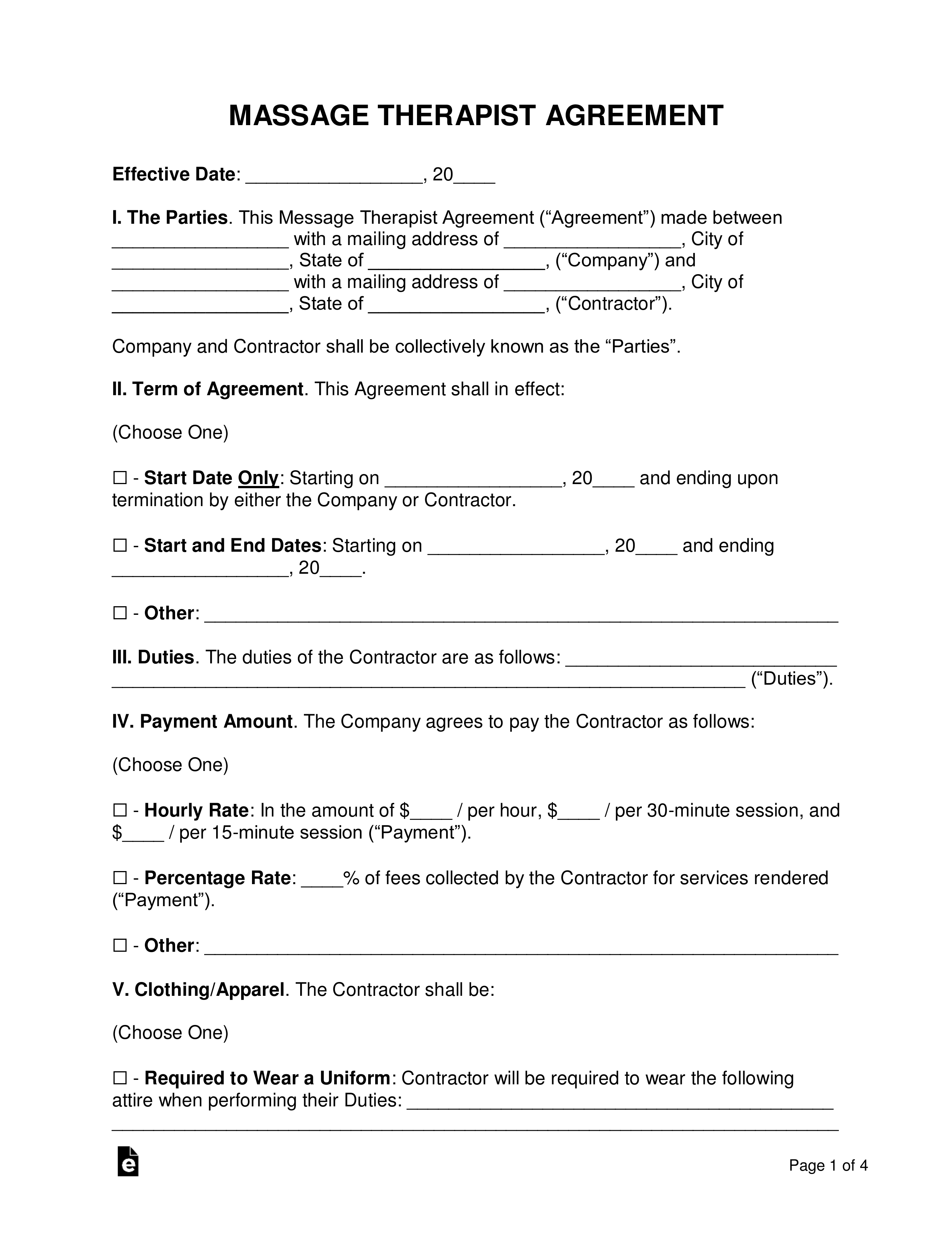

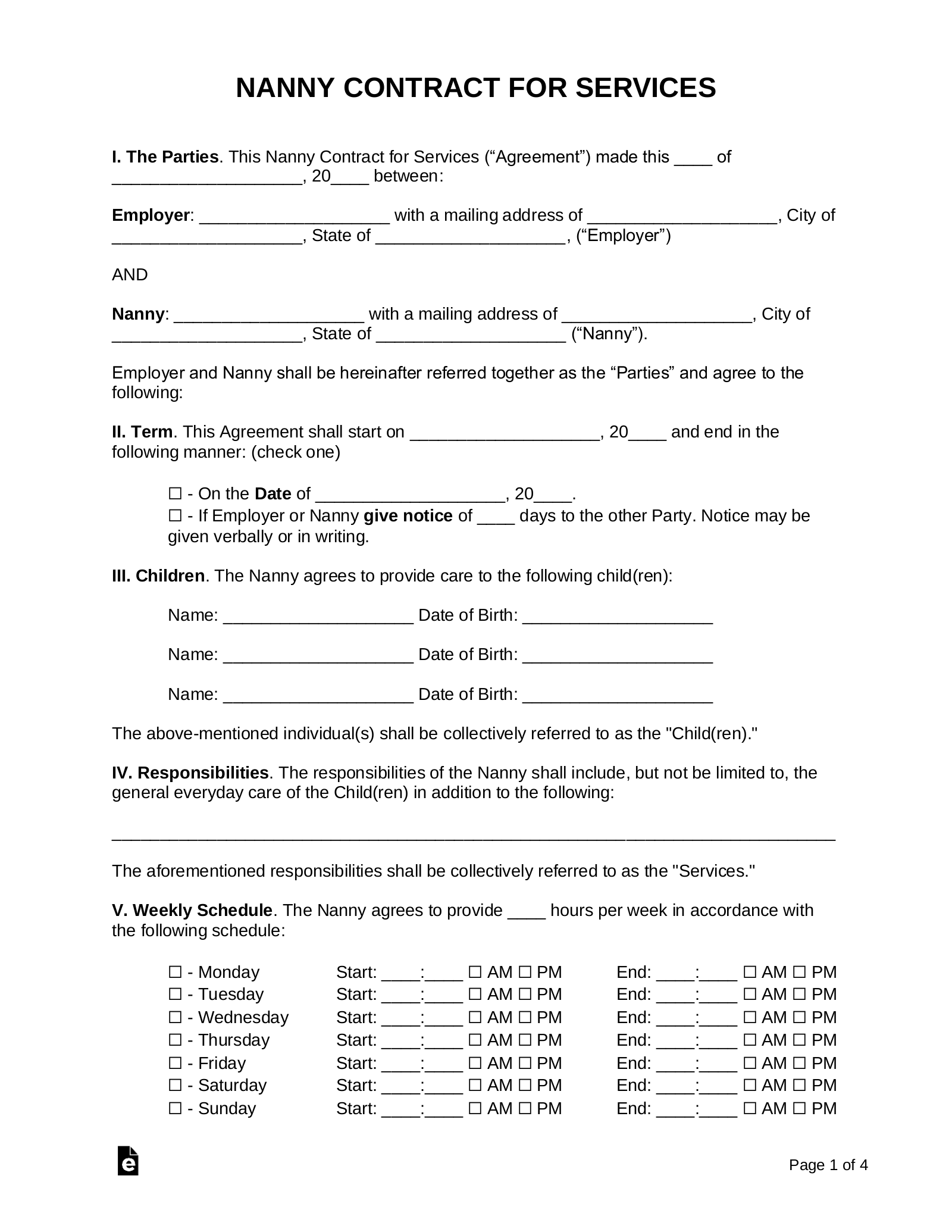

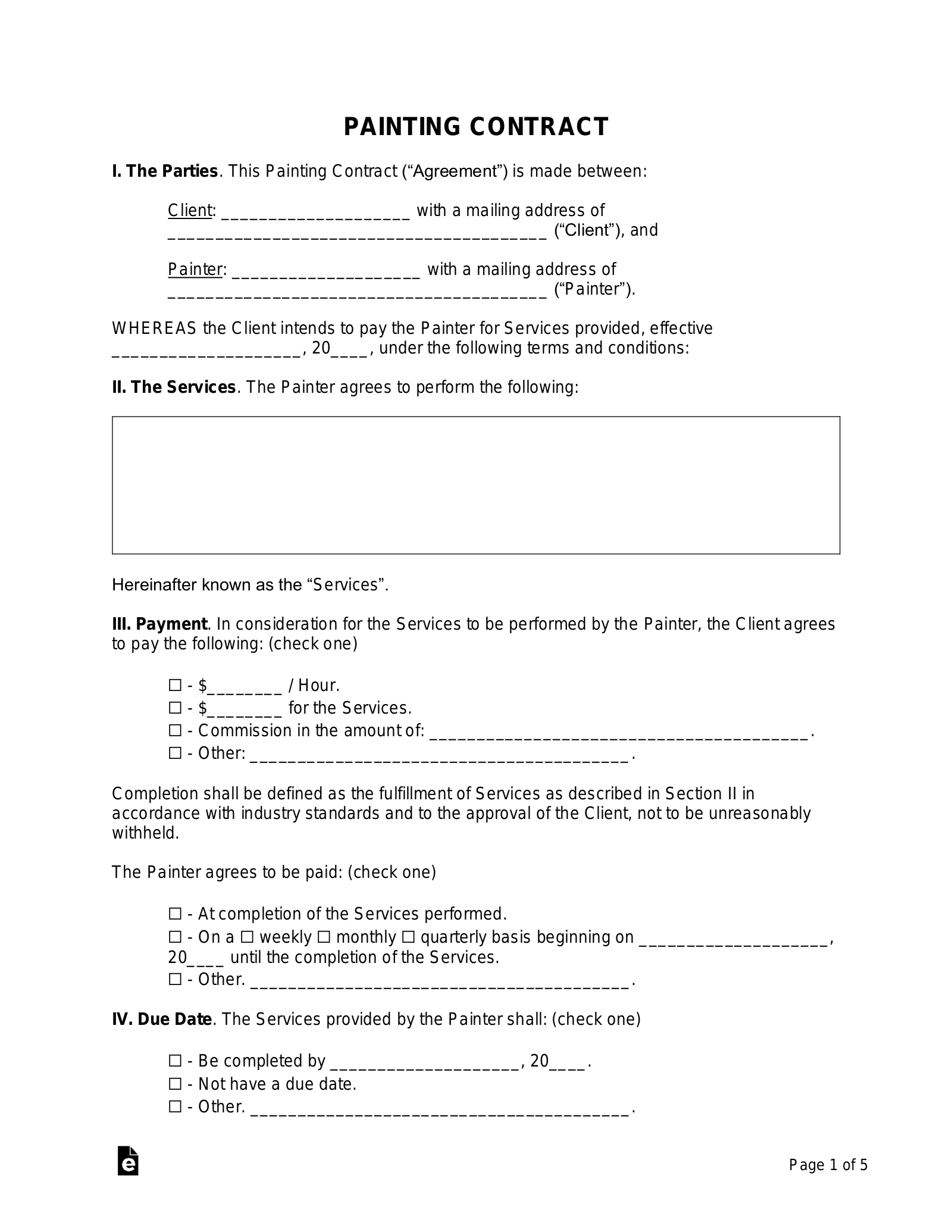

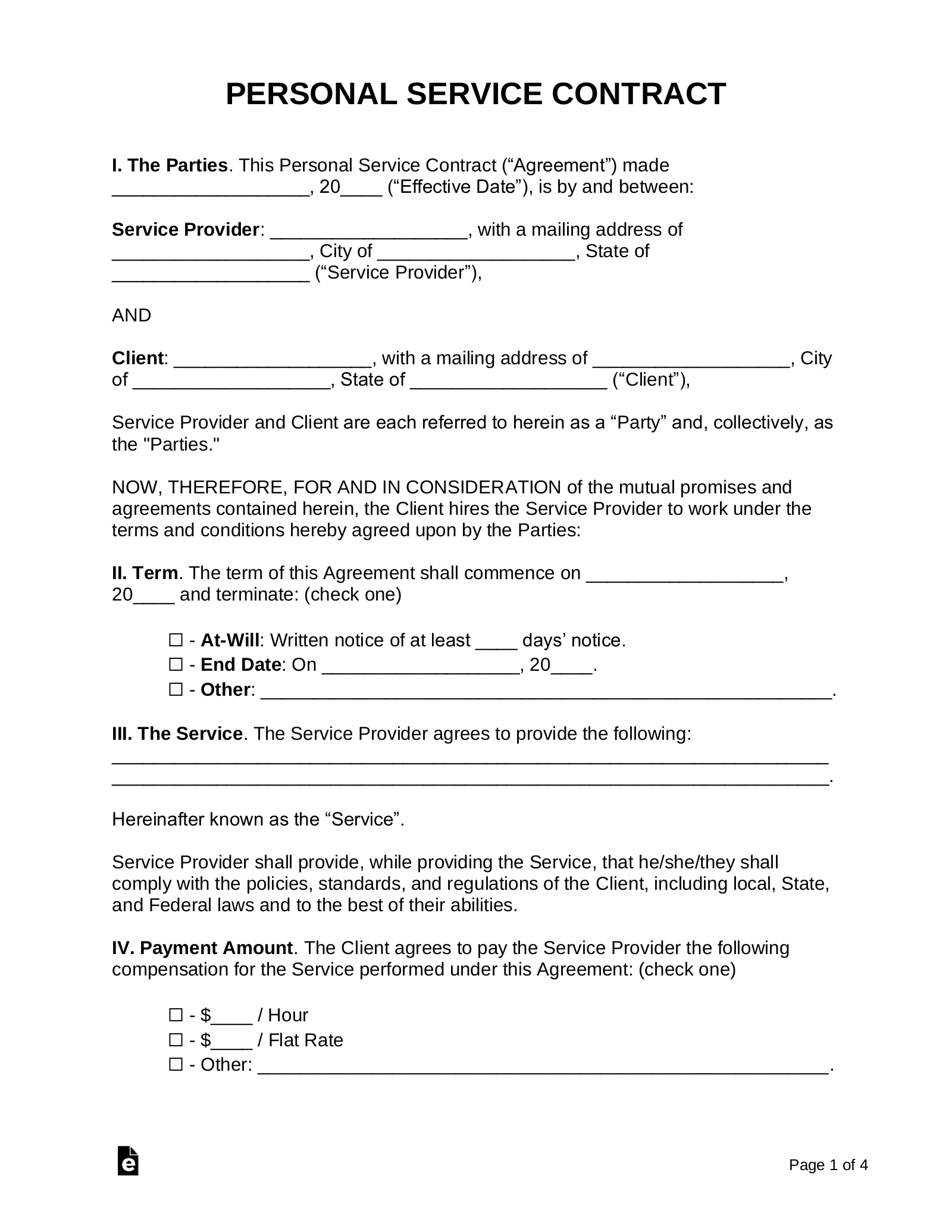

By Profession (35)

By Type (10)

What is an Independent Contractor?

An independent contractor is classified by the IRS as someone who conducts the following activities:[1]

- Able to control how their services are completed;

- Able to work their own schedule and hours;

- May control their work attire;

- Salespersons paid solely on commission (except insurance salespersons);

- Uses their own tools and equipment when performing services; and

- Part-time corporate officers.

Ultimately, an independent contractor is an individual who has their own boss and sets their own rules to justify how they work and their output. Generally speaking, if an individual is paid on a per-project or task manner, they will most likely be considered an independent contractor. If the individual is paid a salary, must adhere to a specific schedule, and is dictated what to do in every facet of their workday, they will most likely be considered an employee.

Independent Contractors: By Right (IRS)

Specifically, the following professions are independent contractors by right under IRS Rules:[2]

- Physicians

- Lawyers

- Dentists

- Veterinarians

- Construction contractors

- Public stenographers

- Auctioneers

How to File Taxes

Independent contractors must use IRS Form 1099 – MISC and file at the end of the year to file their taxes with the Internal Revenue Service (IRS).

How to Hire an Independent Contractor (6 steps)

- Independent Contractor Completes IRS Form W-9

- Verify Contractor

- Negotiate with the Contractor

- Complete the Form

- Sign the Agreement

- File IRS Form 1099

Once an individual or company has decided that services are needed, they will need to determine which independent contractor works best for them. Once a contractor is found, it is time to write an agreement.

1. Independent Contractor Completes IRS Form W-9

IRS Form W-9 should be given to the independent contractor and completed before signing any agreement. This will identify themselves and require them to give their Employer Identification Number (EIN) or Social Security Number (SSN) before performing any work.

IRS Form W-9 should be given to the independent contractor and completed before signing any agreement. This will identify themselves and require them to give their Employer Identification Number (EIN) or Social Security Number (SSN) before performing any work.

This form is required to be stored by the client for a period of four years although is not required to be filed with the IRS.

2. Verify Contractor

Before hiring the services of a third party, it’s best to verify the credentials of the individual or business by looking up all reviews, and past work, along with conducting necessary background checks.

Before hiring the services of a third party, it’s best to verify the credentials of the individual or business by looking up all reviews, and past work, along with conducting necessary background checks.

- Business Entity

For entities, it’s a bit harder to perform a background check. The best way is to simply conduct a search on Google and try to view any negative results. To ensure the entity is valid to do business in the state where the services are being performed a check on the Secretary of State (search by state).

Websites like Yelp, RipOffReport, Facebook, BBB.org, and TrustPilot are great resources for viewing customer testimonials.

- Individual

It’s best to conduct a criminal background check and check with past references to verify the character of the person. For past employment, use LinkedIn as a means of viewing past employers. If agreed by the contractor, the past employers should be contacted in an effort to get to know their integrity and work ethic.

3. Negotiate with the Contractor

Once the contractor has been vetted and qualified, it’s not time to discuss the terms of service. This should include:

Once the contractor has been vetted and qualified, it’s not time to discuss the terms of service. This should include:

- Payment

- Term

- Scope of Work

- Responsibilities

- Confidentiality

- Non-Compete

- Liability

- Insurance

After a verbal agreement has been reached, the parties can decide to authorize a work order or move straight to a binding written independent contractor agreement.

4. Complete the Form

Download: PDF, Microsoft Word (.docx), or Open Document Text (.odt)

Download: PDF, Microsoft Word (.docx), or Open Document Text (.odt)

Use the template and write yourself or seek legal counsel. After the parties have filled in the document and completed it is now ready to be signed.

5. Sign the Agreement

The agreement should be signed by all the parties in the presence of a witness or notary public (or both). In addition, the form should be initialized on the bottom of every page to mark that each item of the contract has been agreed upon by all of the parties.

The agreement should be signed by all the parties in the presence of a witness or notary public (or both). In addition, the form should be initialized on the bottom of every page to mark that each item of the contract has been agreed upon by all of the parties.

At this time, the contract is finalized and legally binding to both parties.

6. File IRS Form 1099

Sample

Download: PDF, MS Word, OpenDocument

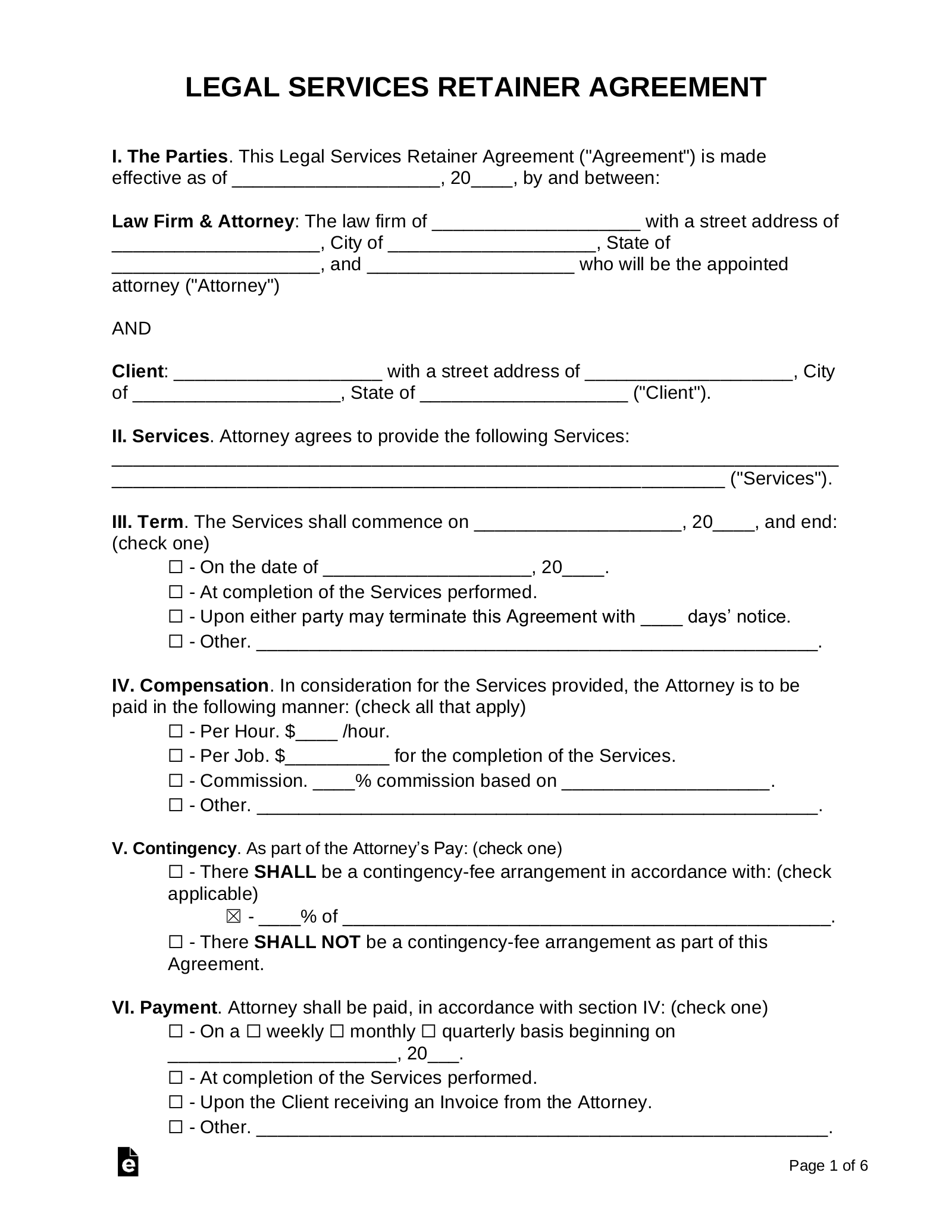

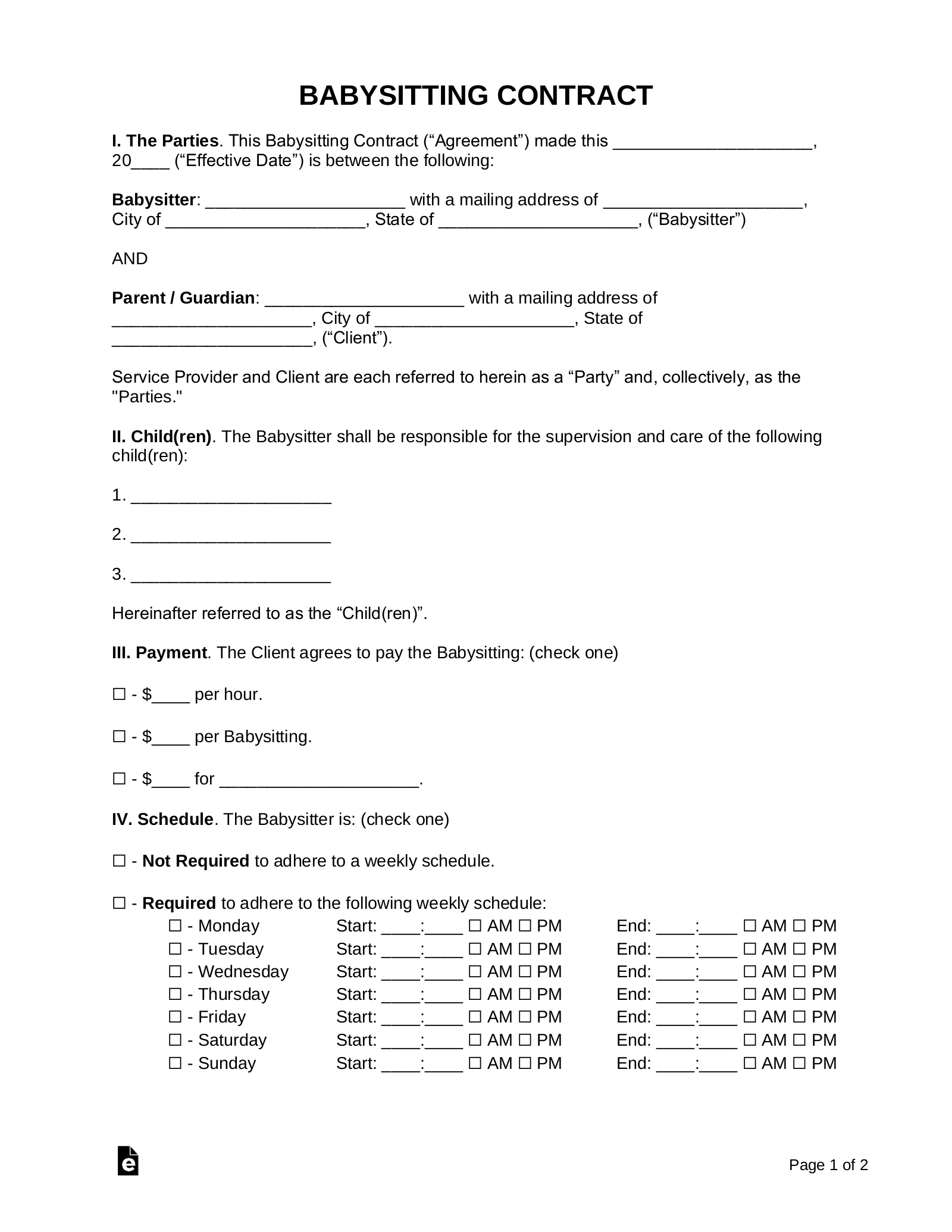

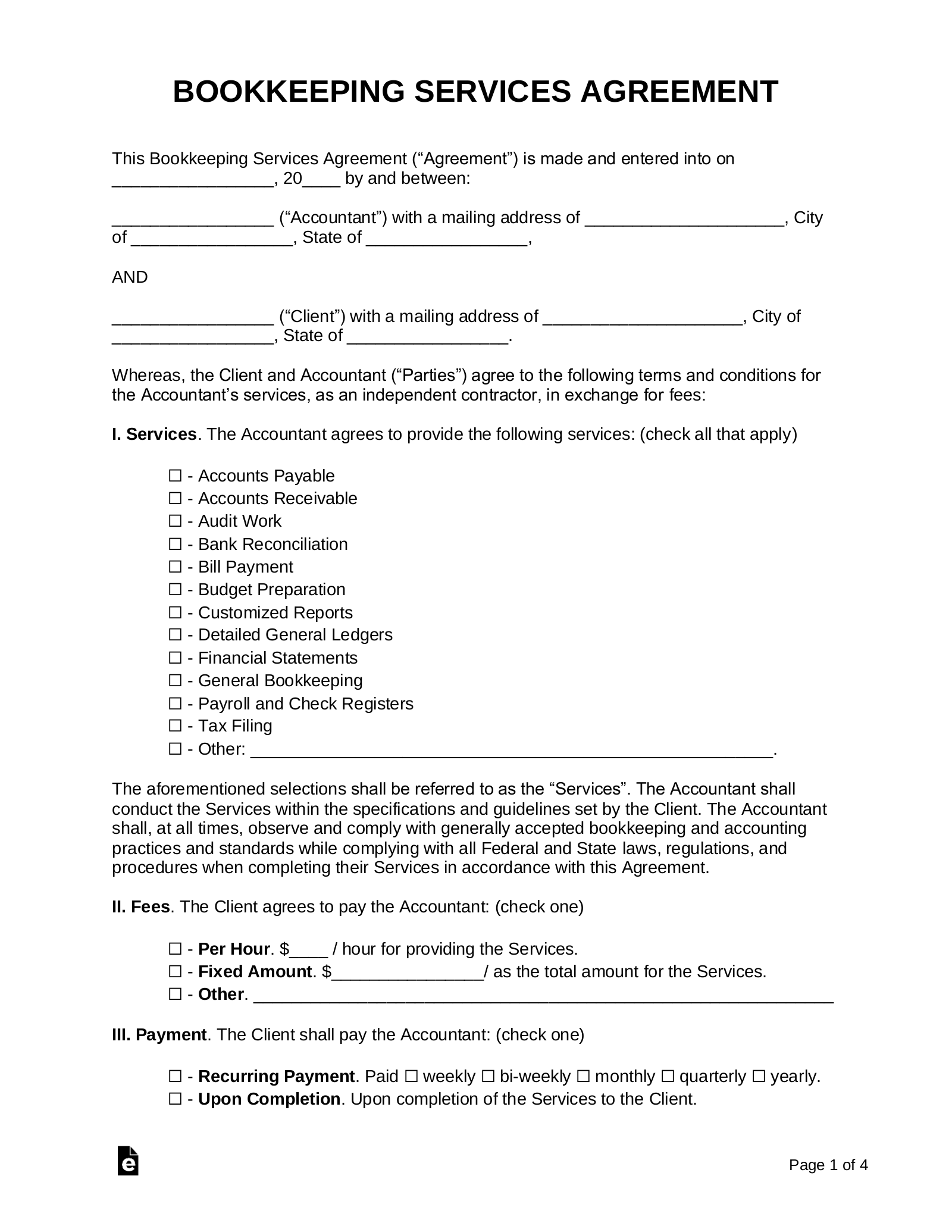

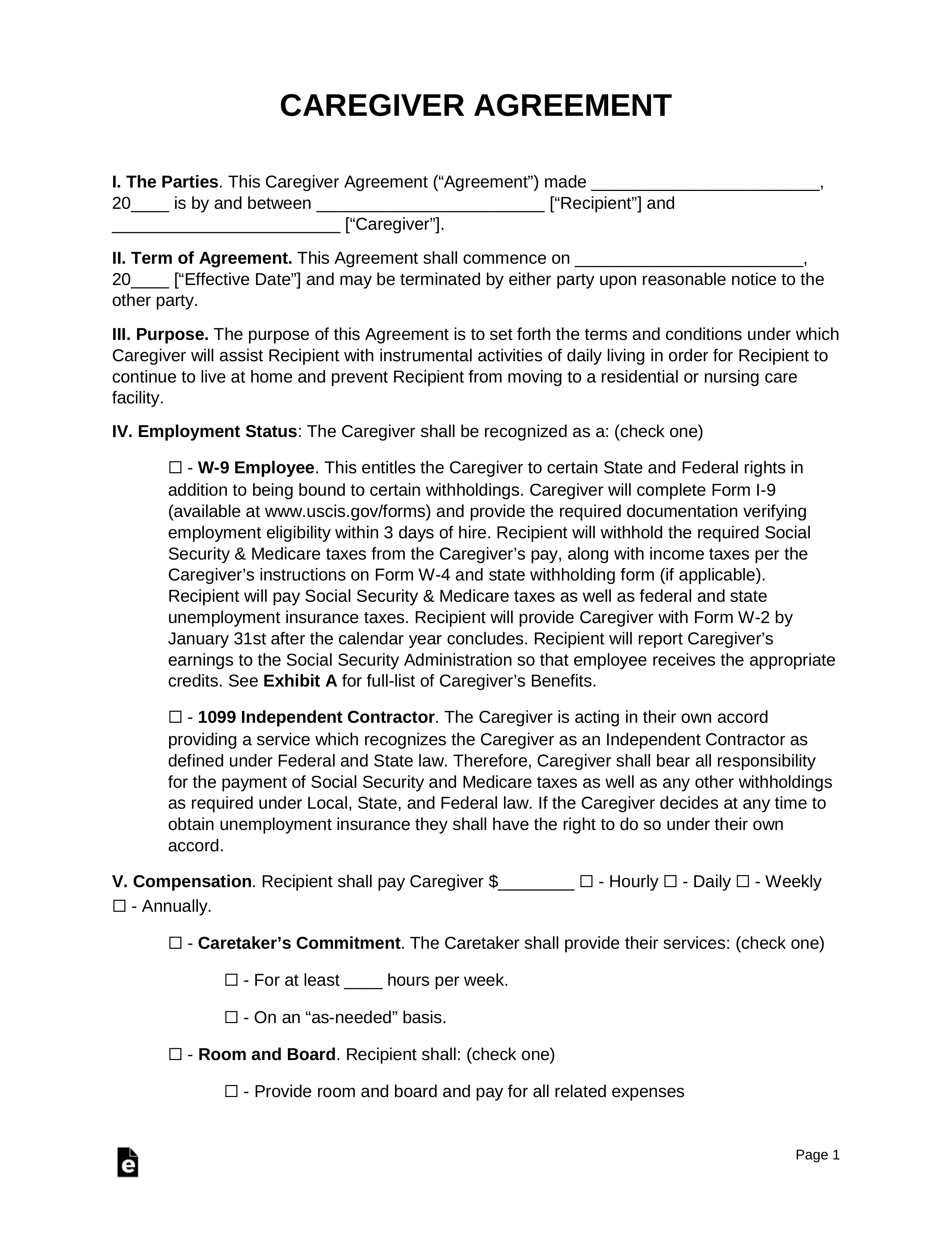

INDEPENDENT CONTRACTOR AGREEMENT

I. THE PARTIES. This Independent Contractor Agreement (“Agreement”) made this [DATE] is by and between:

Contractor: [CONTRACTOR’S NAME] with a mailing address of [ADDRESS] (“Contractor”), and

Client: [CLIENT’S NAME] with a mailing address of [ADDRESS] (“Client”).

In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Contractor and Client agree as follows:

II. SERVICES. The Client shall pay, and the Client shall provide the following services: [DESCRIBE THE SERVICES]

III. TERM. The services shall begin on [DATE] and end: (check one)

☐ – When the services are complete.

☐ – On the date of [DATE].

☐ – Other. [OTHER]

IV. TERMINATION. Either the Client or the Contractor:

☐ – Cannot terminate this Agreement unless either party breaks its terms.

☐ – Can terminate this Agreement, without cause, by giving the other Party [#] days’ notice while providing their obligations up until termination.

V. COMPENSATION. In exchange for the services provided by the Contractor, the Client agrees to pay the following: (check one)

☐ – $[AMOUNT] / Hour.

☐ – $[AMOUNT] for the services.

☐ – Commission in the amount of: [COMMISSION AMOUNT].

☐ – Other: [OTHER].

VI. OTHER EXPENSES. In addition to the Contractor’s compensation, the Client agrees to pay the Contractor for the following: (check all that apply)

☐ – Materials. The Contractor’s materials used for providing the services.

☐ – Travel Expenses. The Contractor’s travel expenses to and from the location of where the services are being provided in addition to any other needs the services require.

☐ – Insurance. Any insurance required by the Contractor that is needed specifically for the services provided.

☐ – Other: [OTHER].

VII. INDEMNIFICATION. The Contractor shall indemnify and hold the Client harmless from any loss or liability from performing the Services under this Agreement.

VIII. INSURANCE REQUIRED. The Contractor is required to have liability insurance and workers’ compensation insurance in accordance with industry standards and state law. The Client has the right to review such insurance policies prior to the commencement of the services.

IX. OTHER BUSINESS ACTIVITY. The Contractor may engage in other business activities provided, however, that Contractor shall not during the term of this Agreement solicit the Client’s employees, clients, accounts, or other related business endeavors of the Client.

X. ASSIGNMENT. Neither the Client nor the Contractor may assign this Agreement without the express written consent of the other party.

XI. RELATIONSHIP DEFINED. Nothing in this Agreement shall indicate the Contractor is a partner, agent, or employee of the Client. The Client employs the Contractor as an independent contractor, and the Contractor hereby accepts.

XII. OTHER AGREEMENTS. It is agreed between the parties that there are no other agreements or understandings between them relating to the subject matter of this Agreement. This Agreement supersedes all prior agreements, oral or written, between the parties and is intended as a complete and exclusive statement of the agreement between the parties. No change or modification of this Agreement shall be valid unless the same be in writing and signed by the parties.

XIII. LEGAL NOTICE. All notices or required or permitted to be given hereunder shall be in writing and may be delivered personally or by Certified Mail – Return Receipt Requested, postage prepaid, addressed those mentioned in Section I.

XIV. GOVERNING LAW. This Agreement shall be construed in accordance with and governed by the laws under the state of [STATE].

IN WITNESS WHEREOF, the Parties have indicated their acceptance of the terms of this Agreement by their signatures below on the dates indicated.

Contractor’s Signature: _____________________________ Date: __________

Print Name: _____________________________

Client’s Signature: _____________________________ Date: __________

Print Name: _____________________________