Updated November 13, 2023

A one (1) page independent contractor agreement is a simple version that identifies the services provided and payment while stating the general terms and conditions of a standard agreement. Under this agreement, the parties have to ensure that certain clauses are mentioned in an effort to be recognized under State and federal laws to sustain the contractor’s status.

IRS Forms

- IRS Form W-9 – Completed by the payee and delivered to the payer of the contractor at the start of work.

- IRS Form 1099-NEC – Must be filed to the IRS at the end of the year (before January 31) by the payer of the contractor if the services amount to over $600 over a calendar year.

Sample

INDEPENDENT CONTRACTOR AGREEMENT

1. PARTIES. This Independent Contractor Agreement (“Agreement”) made on [DATE] is by and between:

Client: [CLIENT’S NAME] (“Client”), and

Contractor: [CONTRACTOR’S NAME] (“Contractor”).

In consideration of the mutual terms, the Client hereby employs the Contractor as an independent contractor under the following terms and conditions:

2. TERM. The term of this Agreement shall commence on [DATE] and will cancel upon: [SPECIFY].

3. SERVICES PROVIDED. The Contractor agrees to provide the Client the following services: [LIST SERVICES].

4. PAY. The Client agrees to pay the Contractor the following for the services mentioned in Section 3 of this Agreement: [PAY AMOUNT].

5. EXPENSES. The Contractor shall be responsible for the payment of all their own expenses during the term of this Agreement.

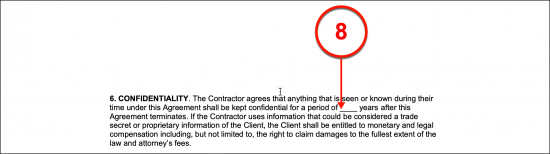

6. CONFIDENTIALITY. The Contractor agrees that anything that is seen or known during their time under this Agreement shall be kept confidential for a period of [#] years after this Agreement terminates. If the Contractor uses information that could be considered a trade secret or proprietary information of the Client, the Client shall be entitled to monetary and legal compensation including, but not limited to, the right to claim damages to the fullest extent of the law and attorney’s fees.

7. FAILURE TO PROVIDE SERVICES. If the Contractor becomes unable to perform the services under this Agreement by reason of illness, disability or death, compensation shall cease upon the happening of the event. Such event must be verified by a licensed physician within the State.

8. ASSIGNMENT. Neither party may assign this Agreement without the express written consent of the other party.

9. SEVERABILITY. If any term, covenant, condition, or provision of this Agreement is held by a court of competent jurisdiction to be invalid, void, or unenforceable, the remainder of the provisions shall remain in full force and effect and shall in no way be affected, impaired, or invalidated.

10. ENTIRE AGREEMENT. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all other prior agreements and understandings, both written and oral, between the parties with respect to the subject matter hereof.

11. GOVERNING LAW. This Agreement shall be construed in accordance with and governed by the laws of the State of [STATE].

Client Signature: ______________ Contractor Signature: ____________

Print Name: __________________ Print Name: __________________

How to Write

Download in PDF, MS Word, or OpenDocument.

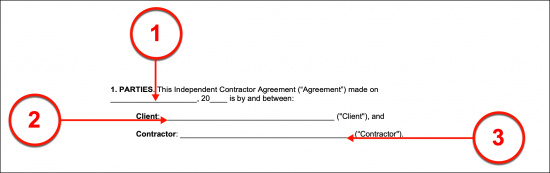

Article 1. Parties

(1) Contractor Agreement Date. The date this agreement is set into motion and becomes effective should be listed at the top of this page. Note that this date may not be prior to the signature date of this document.

(2) Client. Record the full name of the Client who shall hire the Contractor.

(3) Contractor. Furnish the name of the Contractor’s Business or the full name of the Contractor.

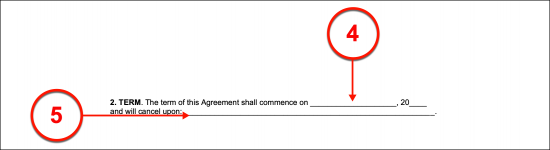

Article 2. Term

(4) Commencement. The first date of effect for this agreement must be recorded in the second article. This may be the same calendar date as that reported in the first article or it may be a calendar date that follows.

(5) Termination. The final calendar date when the Contractor and Client will terminate this agreement should be solidified. 3. Services Provided.

(6) Contractor Requirements. The agreement being developed must include a detail of all the services, and if applicable, all products that the Contractor must supply to the Client in order to receive payment. The third article has been reserved for a presentation of this information or the title of an attachment containing the specifics of the job(s) the agreement focuses on.

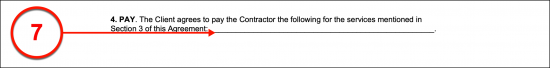

Article 5. Pay

(7) Contractor Payment. The payment required of the Client as compensation for the work detail defined in the previous article is the next topic of discussion. In the third article, supply the payment amount, any payment schedule involved, and any additional earnings (i.e. a commission or contingency payment) the Contractor will expect and should receive in exchange for providing the services and any products listed.

Article 6. Confidentiality

(8) Protecting The Clients Information. The may be times when the Contractor is privy to confidential information or even trade secrets controlled exclusively by the Client. A compromise of such information (such as accidentally speaking about it with the Client’s Competitor) can have devastating results on a business. To prevent the Contractor from divulging such information once the agreement is terminated, a period may be assigned to restrict him or her from discussing or dispersing the Client’s information in any way. Document the number of years after this agreement’s termination where the Contractor will agree to hold the Client’s confidentiality by not disseminating any confidential information regarding the Client’s business.

Article 11. Governing Law

(9) Ruling State. Locate the eleventh article then document the state where the Contractor and Client will obey this agreement and bring any grievances resulting from it for enforcement or a ruling.

Party Execution

(10) Client Signature. The signature and the Client’s printed name must be submitted by the Client upon a successful review of the completed agreement.

(11) Contractor Signature. The Contractor must sign this agreement to show compliance with its terms then must print his or her name to support the signature provided.