Updated February 15, 2022

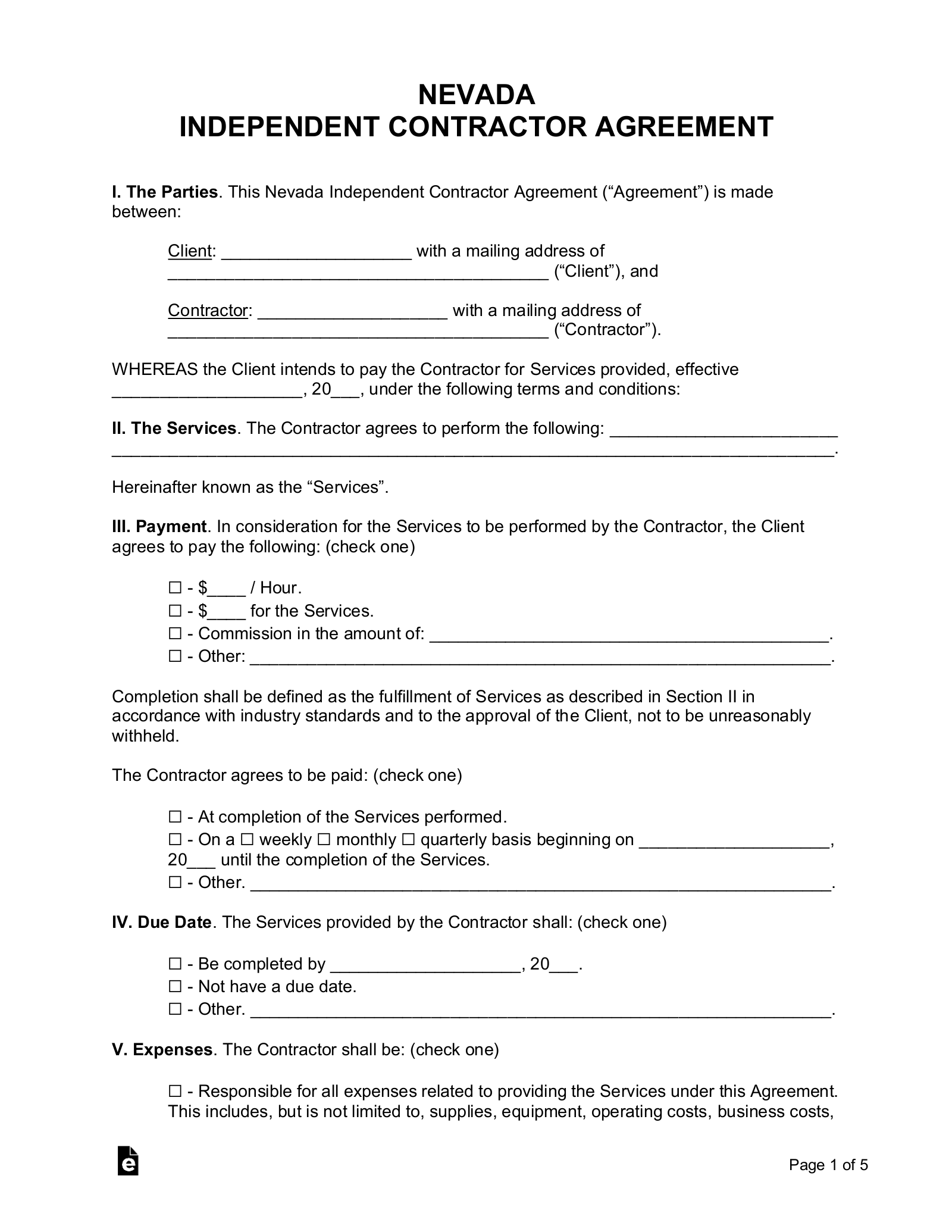

A Nevada independent contractor agreement is a document that a client can use to lay out the terms and conditions of hired contractor work. In addition to stipulating the client’s expectations, the contract will specify the amount of financial compensation that the contractor will receive, as well the due date and/or date that the agreement will be terminated. If the client will be paying for any of the contractor’s expenses or if they expect them to obtain liability insurance, this information must also be included. Independent contractors are responsible for paying their own taxes, and therefore the client does not need to include any tax deductions in their payment. Furthermore, the contractor will be responsible for any physical liability, and the client may find it pertinent to include a clause that sets a minimum amount of insurance that the contractor is required to procure.