Updated July 14, 2023

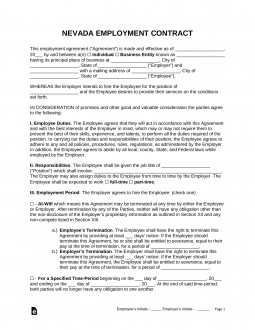

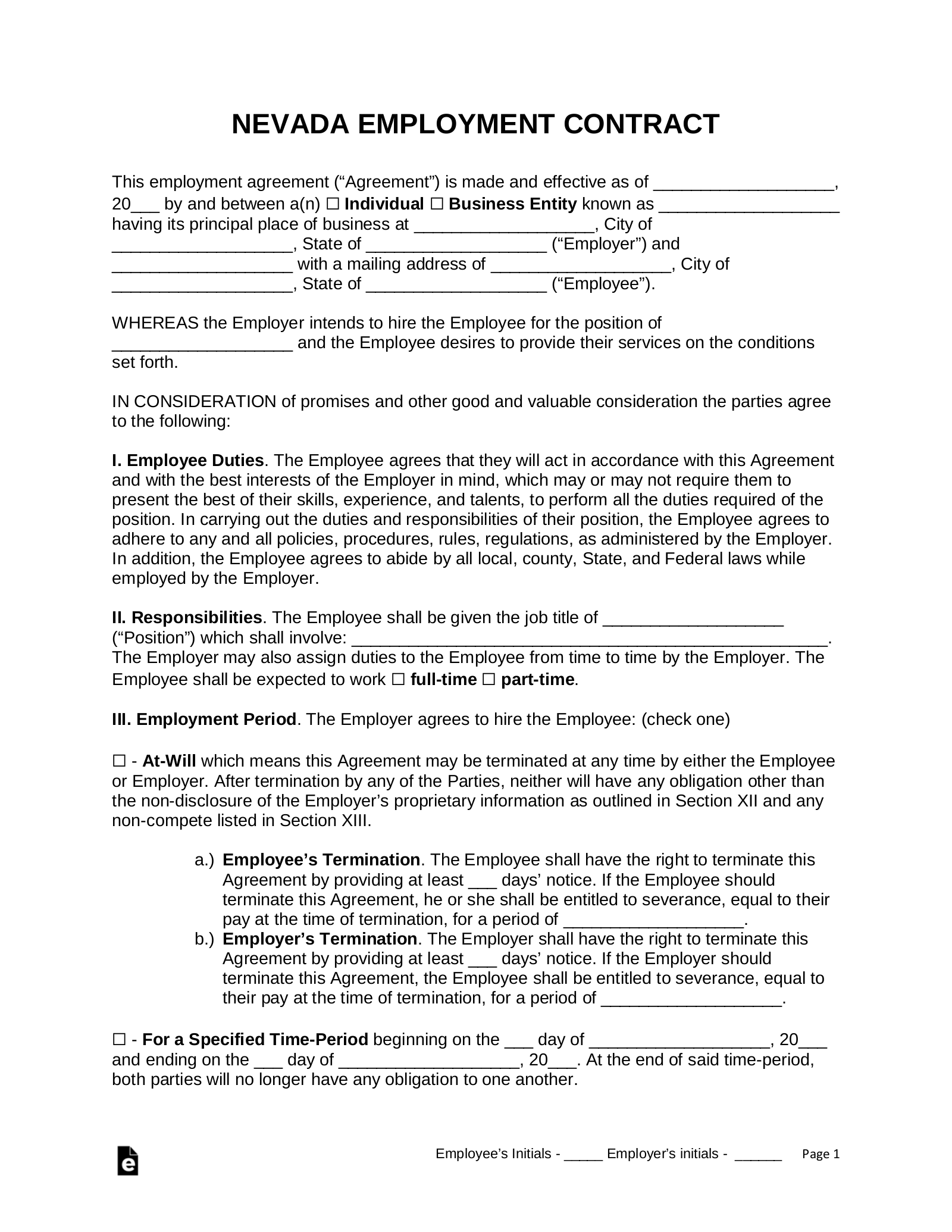

A Nevada employment contract agreement is used by an employer when hiring a new employee to outline the terms of the worker’s employment. The document must describe the specifics of the required work, the duration of time covered by the contract, and the nature of the financial compensation that the employee will receive. The employer may wish to have the employee sign a non-disclosure or non-compete agreement in order to ensure that they will not share confidential information with competing businesses.

By Type (4)

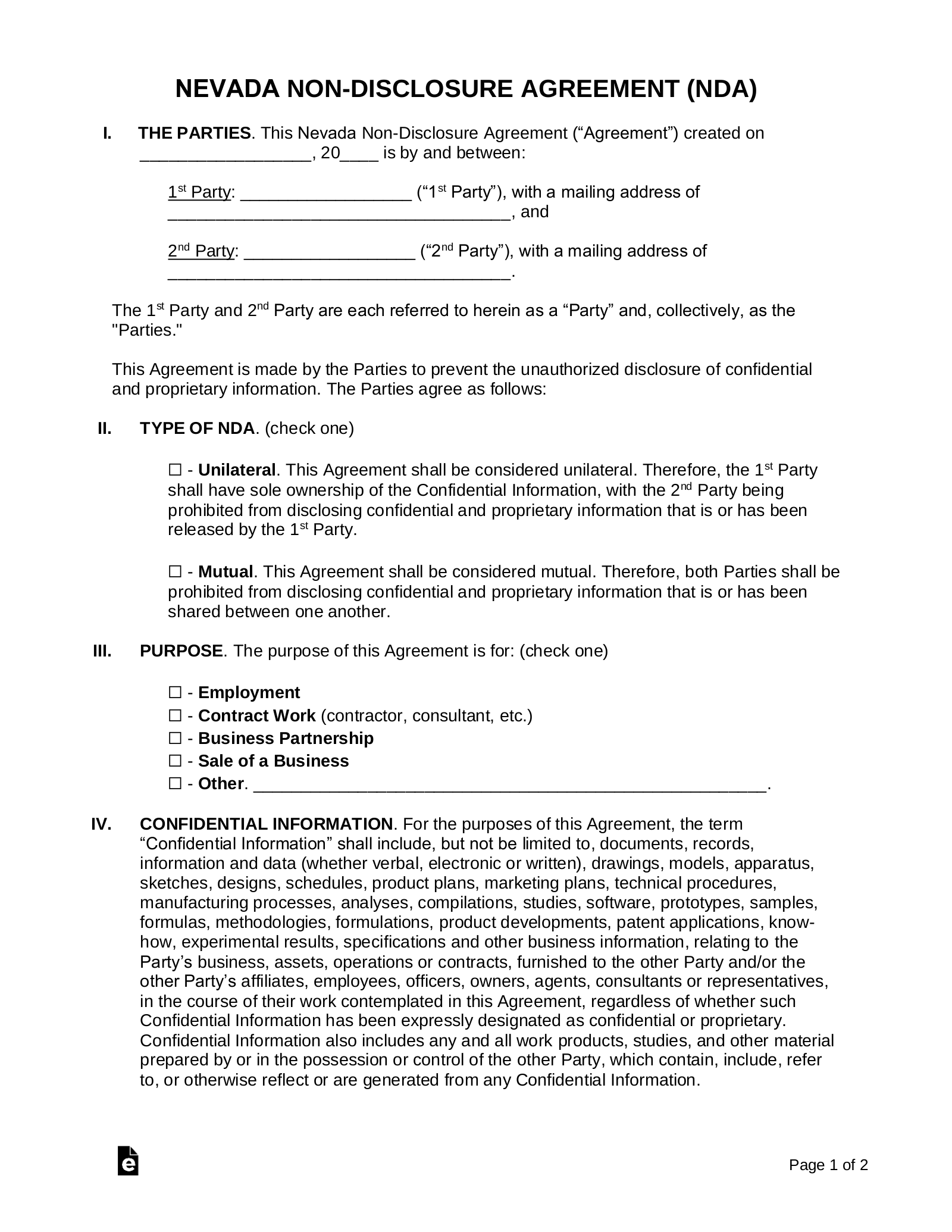

Employee Non-Disclosure Agreement – Employers may have their employees sign this contract to restrict them from sharing confidential information and trade secrets with business competitors.

Download: PDF, MS Word, OpenDocument

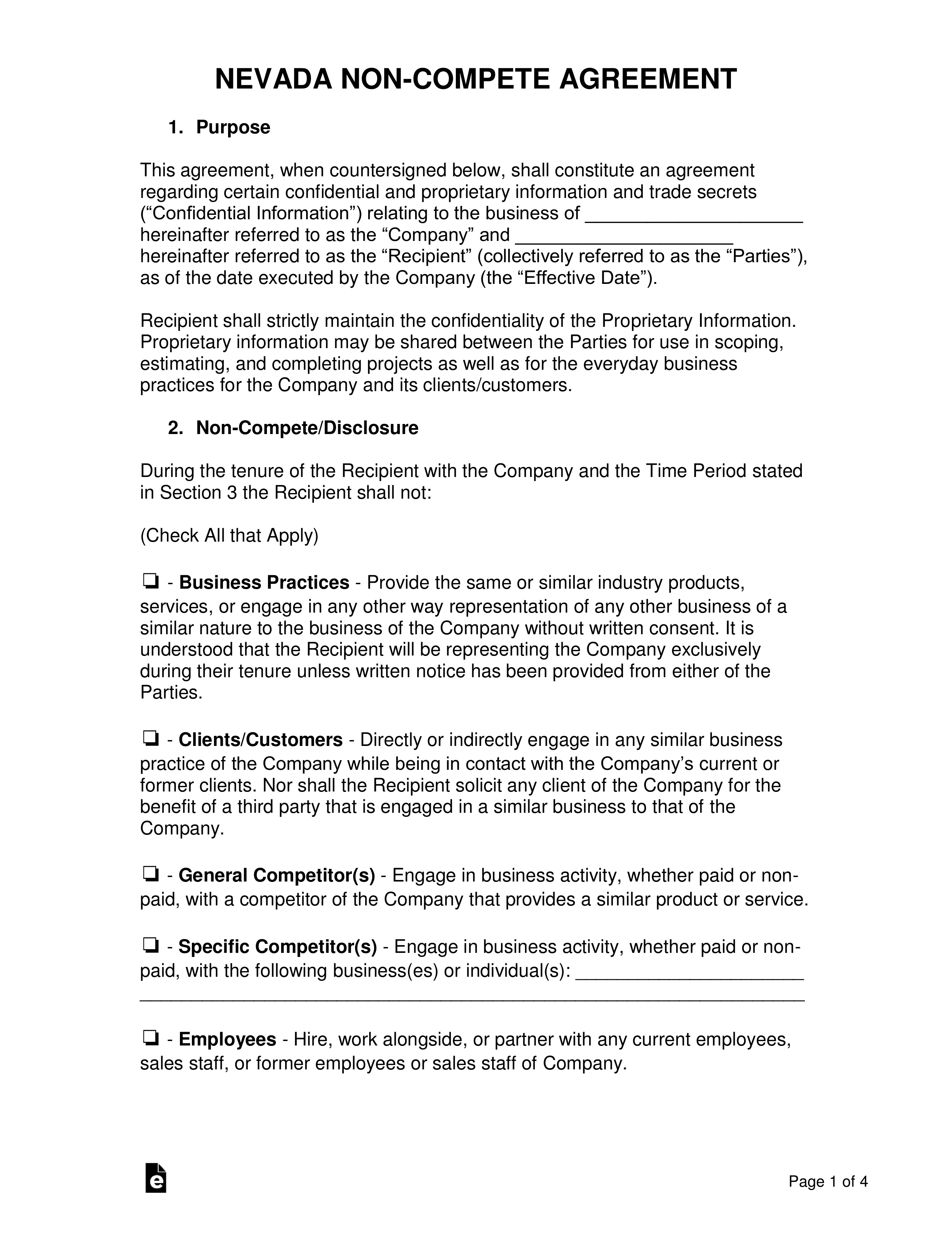

Employee Non-Compete Agreement – This contract protects the employer by prohibiting the employee from working within the same industry for a reasonable amount of time following the termination of their employment or the effective date of the agreement.

Download: PDF, MS Word, OpenDocument

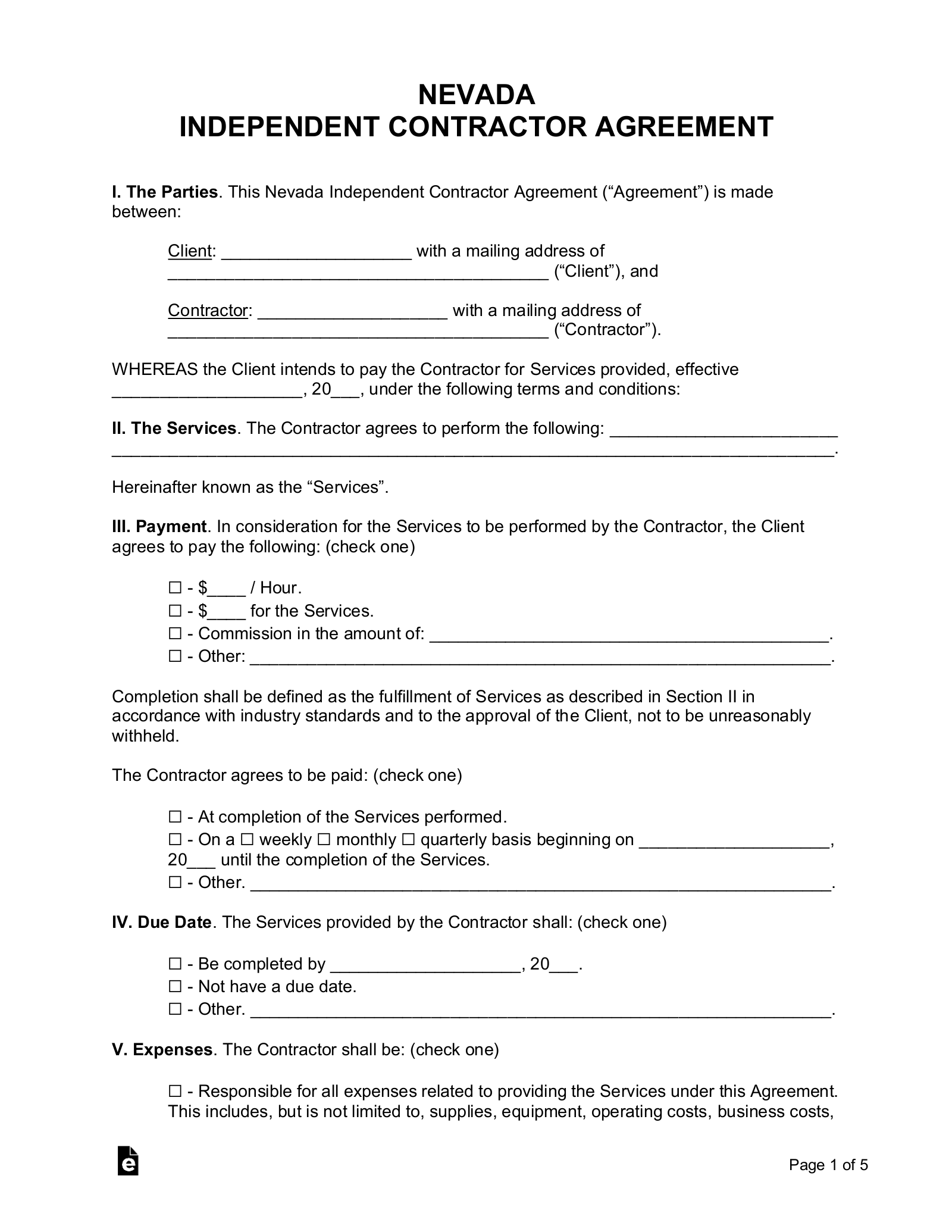

Independent Contractor Agreement – A contract that establishes the terms that a contractor must fulfill in order to receive financial compensation from the client.

Download: PDF, MS Word, OpenDocument

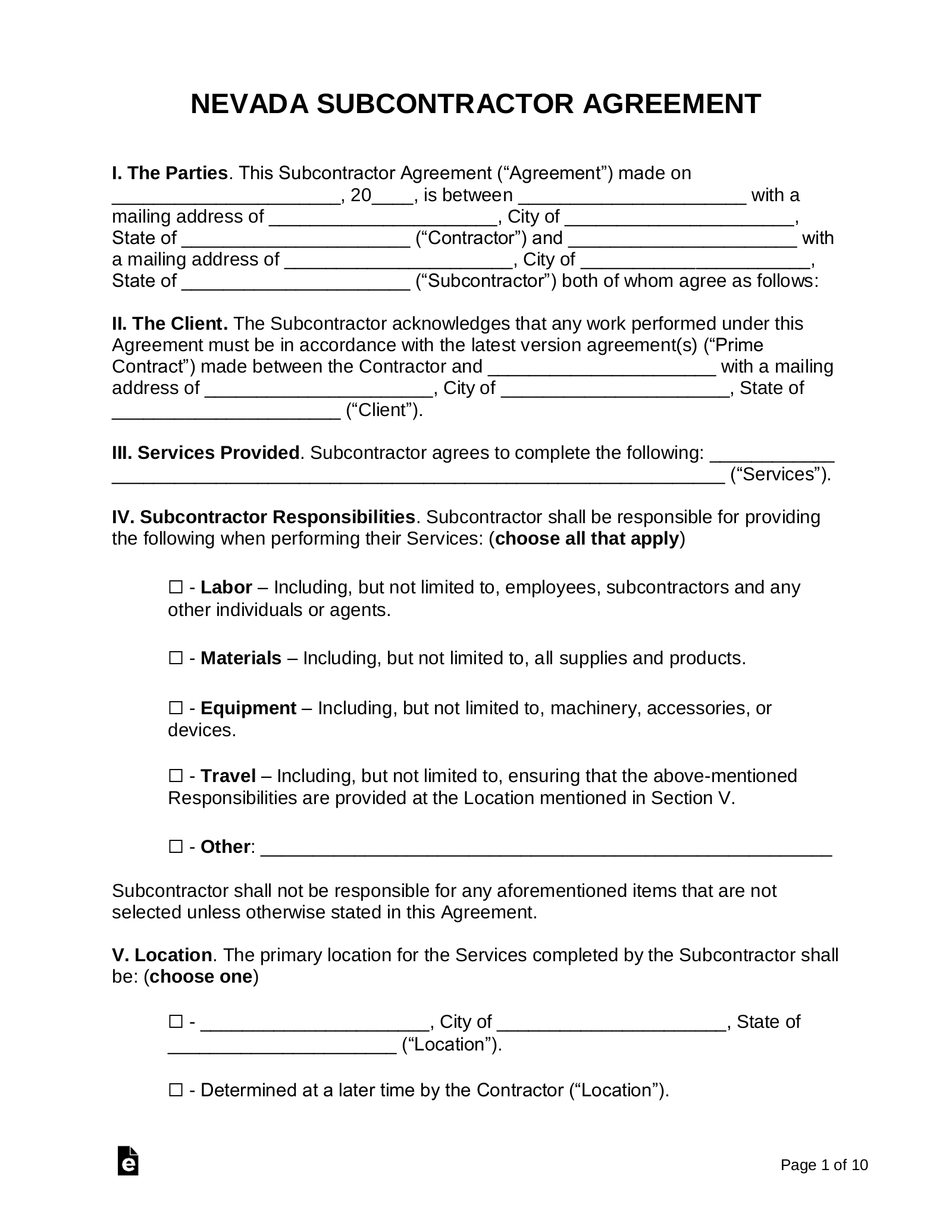

Subcontractor Agreement – When taking on subcontractors to bring a certain task to completion, a contractor uses this document to outline the particulars of their working arrangement.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – § 608.010

“. . . includes both male and female persons in the service of an employer under any appointment or contract of hire or apprenticeship, express or implied, oral or written, whether lawfully or unlawfully employed.”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy,” “Implied Contracts” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 0%

Minimum Wage ($/hr)

Minimum Wage – $8.25/$7.25 for employees with qualifying health benefits (see Annual Minimum Wage Bulletin).